The Alpha Masters: Unlocking the Genius of the World's Top Hedge Funds (41 page)

Read The Alpha Masters: Unlocking the Genius of the World's Top Hedge Funds Online

Authors: Maneet Ahuja

Gruss Partners

Gurvitch, Howard

Harding, David

Harken Energy Corporation/Harken Andarko Partners

Hewlett-Packard

Hill, J. Tomlinson

Hoine, Andrew

Howard Hughes Corporation

Huyton, David

Jain, Anshu

JCPenney

Jensen, Greg

Johnson, Ron

Jordan, Boris

Klarman, Seth

Kmart

Kohlberg, Jerry

Kozlowski, Dennis

Kuwait Investment Authority

Kynikos Associates LP.

See also

Chanos, James

Ursus Partners fund

Lagrange, Pierre

Lasry, Marc.

See also

Avenue Capital Group

Amroc Investments

Avenue International

Robert M. Bass Group (Keystone, Inc.)

Lebow, Bennett

Leucadia National Corporation

Levy, Leon

Loeb, Daniel.

See also

Third Point

LTV

Lueck, Martin

Man Group/AHL

Marconi Corporation

Marks, Leonard

Marriott Corporation

MBIA

McCormick, David

McDonald’s

Mint Investment Management Co.

Morgan Stanley Investment Management

Murray, Eileen

Nash, Jack

Neumann, Michael

Odyssey Partners

Oxford Man Institute of Quantitative Finance

Paulson, John

address to Committee on Oversight and Government Reform

Advantage funds

Bank of America, investment in

Bear Stearns

Citigroup, investment in

gold share class, creation of

Gruss Partners

merger of Dow Chemical and Rohm & Haas

Odyssey Partners

Paulson Credit Fund

Paulson Partners

Pellegrini, Paolo

Pershing Square Capital Management.

See also

Ackman, William A.

investments

Borders

Canadian Pacific Railway

General Growth Properties (GGP)

JCPenney

Kmart

MBIA

McDonald’s

Sears Roebuck & Company

Target Corporation

Tim Horton’s

Wendy’s

Pershing Square Foundation

Vornado investment in

Post-Modern Portfolio Theory (PMPT)

Price, Michael

Prince, Bob

Principles

(Dalio)

Pure Alpha Fund II

Pure Alpha Major Markets fund

Pure Alpha strategy

Rainwater, Richard

Risk arbitrage

Risk Parity

RMF

Rockefeller Center Properties

Rockefeller, David

Rohm & Haas

Roth, Steve

Rubin, Robert

Saba Capital Management

Schroeder, Alice

Sears Roebuck & Company

Simons, Jim

Renaissance Medallion Fund

Sinoforest

Six Flags

Skilling, Jeffrey

Sopher, Rick

Soros, George

Quantum Endowment Fund

Spiller, Charles

Spitzer, Eliot

Steinberg, Joe

Subprime mortgage securities

Target Corporation

Tepper, David

Appaloosa.

See

Appaloosa Management

Goldman Sachs

Thoroughbred Fund

Third Point

investments

Dade Behring

Yahoo!

Third Point Offshore Investors Limited

Tighe, Mary Ann

Tilson, Whitney

Tim Horton’s

Trian Partners

Troubled Asset Recovery Program (TARP)

Trump, Donald

Tyco

Ullman, Mike

Volcker, Paul

Waldorf, Michael

Walton, Jack

Washington Mutual

Weinstein, Boaz

Wendy’s

Whitehead, John

Whitman, Meg

Williams, James

Wong, Tim

Yahoo!

Yang, Jerry

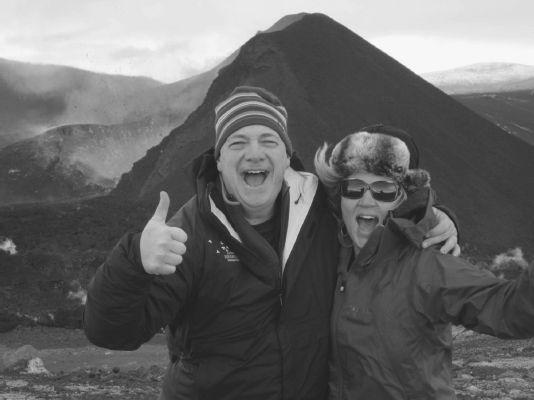

Bridgewater Founder Ray Dalio (

left

) in Iceland, 2011.

Photo credit:

Bridgewater Associates, LP

Bridgewater’s offices in Westport, Connecticut.

Photo credit:

Bridgewater Associates, LP

Tim Wong (

right

) on the trading floor at the Man Group’s London headquarters.

Photo credit:

Michael Austen, Report and Accounts for 2011

Pierre LaGrange in the boardroom at the Man Group’s London Headquarters.

Photo credit:

Michael Austen, Report and Accounts for 2011

During the Committee on Oversight and Government Reform Hearing on “Hedge Funds and the Financial Markets,” George Soros, Soros Fund Management, LLC (

left

), James Simons, President Renaissance Technologies (

center

), and John Paulson, President, Paulson & Co (

right

), testify on Capitol Hill, November 13, 2008.

Photo credit:

(c) Daniel Rosenbaum/

The New York Times

/Redux