Unfair Advantage -The Power of Financial Education (20 page)

Read Unfair Advantage -The Power of Financial Education Online

Authors: Robert T. Kiyosaki

Tags: #Personal Finance, #unfair advantage, #financial education, #rich dad, #robert kiyosaki

But a person doesn’t need to be a multi-multimillionaire to take advantage of hedging. With a little bit of education, anyone can learn how to use an option contract to protect themselves against loss.

The irony of this idea is that many people label the options market as too risky. In reality, many of the people who purchase options are doing so to reduce their risk. They use the option as a hedge, rather than for speculation. I purchase many options with the idea that I will lose 100 percent of the money I’ve spent on the option. To me, the context is not much different than the money I spend on insuring my rental property. The income from the rental property pays for the insurance, just as the income from a paper asset will pay for the option that protects it.

Printing Money with Paper Assets

FAQ

Can you print your own money with paper assets? Can I achieve an infinite return on my investment?

Short Answer

Yes.

Explanation

I will let Andy explain, since this is his area of expertise.

Andy Tanner explains:

We know that it is impossible for a stock to actually reach the theoretical number of infinity. However, in the stock market, we can place transactions that can put us at risk for an infinite loss. One example of that is shorting a stock. When we short a stock, we lose money as the stock price goes up. Since there’s no limit to how high a stock price can go, shorting a stock is considered to be a transaction that carries infinite risk. So while the stock price will never actually reach infinity, infinity is a concept we must understand for both gain and loss.

Another way to look at infinity is this: As the amount of our own money that we place in an investment approaches zero, the return we receive on that investment approaches infinity. So if we can find a real estate investment that doesn’t require any of our own money, we are applying the concept of infinite return. That’s one of the reasons why debt, in the real estate world, can make you rich.

With paper assets, we can do this without using any debt at all. That’s right: zero debt. And because one of the things that paper assets brings to the table is the ability to scale, this type of investing is available to almost anyone who is willing to obtain the necessary financial education. Again, I want to emphasize that a person does not need to be a multi-multimillionaire to learn about these types of investments.

When Robert asked me to contribute to this chapter and show how to “print money,” I thought the easiest way to do it might be to make a very small trade (1,000 shares) and use it as an example that earns between $500 and $600 or so in cash flow. Even though this is the same process my hedge-fund friends apply to millions, we can actually scale it down to someone who just wants to generate their first few hundred dollars from somewhere other than a job. I will use some pictures to illustrate and also use the simple concept of hedging we discussed earlier in the chapter.

In the world of paper assets, an investor can choose to be a buyer of a contract and spend money, or be the seller of a contract and receive money. It’s actually a very straightforward concept. Buyers spend money. Sellers receive money.

Robert often mentions the importance of taking a class to learn basic technical analysis. It’s the term we use to look at the ups and downs of markets. It’s one of the things we can get somewhat familiar with by playing the

CASHFLOW 202

game.

Here is an illustration of the ups and downs of the S&P 500:

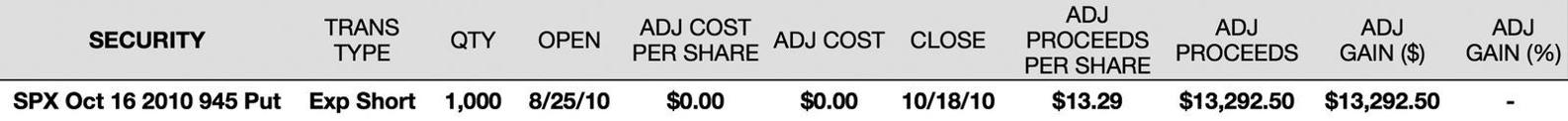

Since there is a strong level of support just above the 1,000 level, an investor might seek to “print some money” by selling a put option contract at, say, the 945 level. But we don’t actually call it “printing money.” We call it “writing an option.”

That simply means that the buyer of the contract would now have “insurance” on the S&P 500 if it were to fall below 945 before the contract expires.

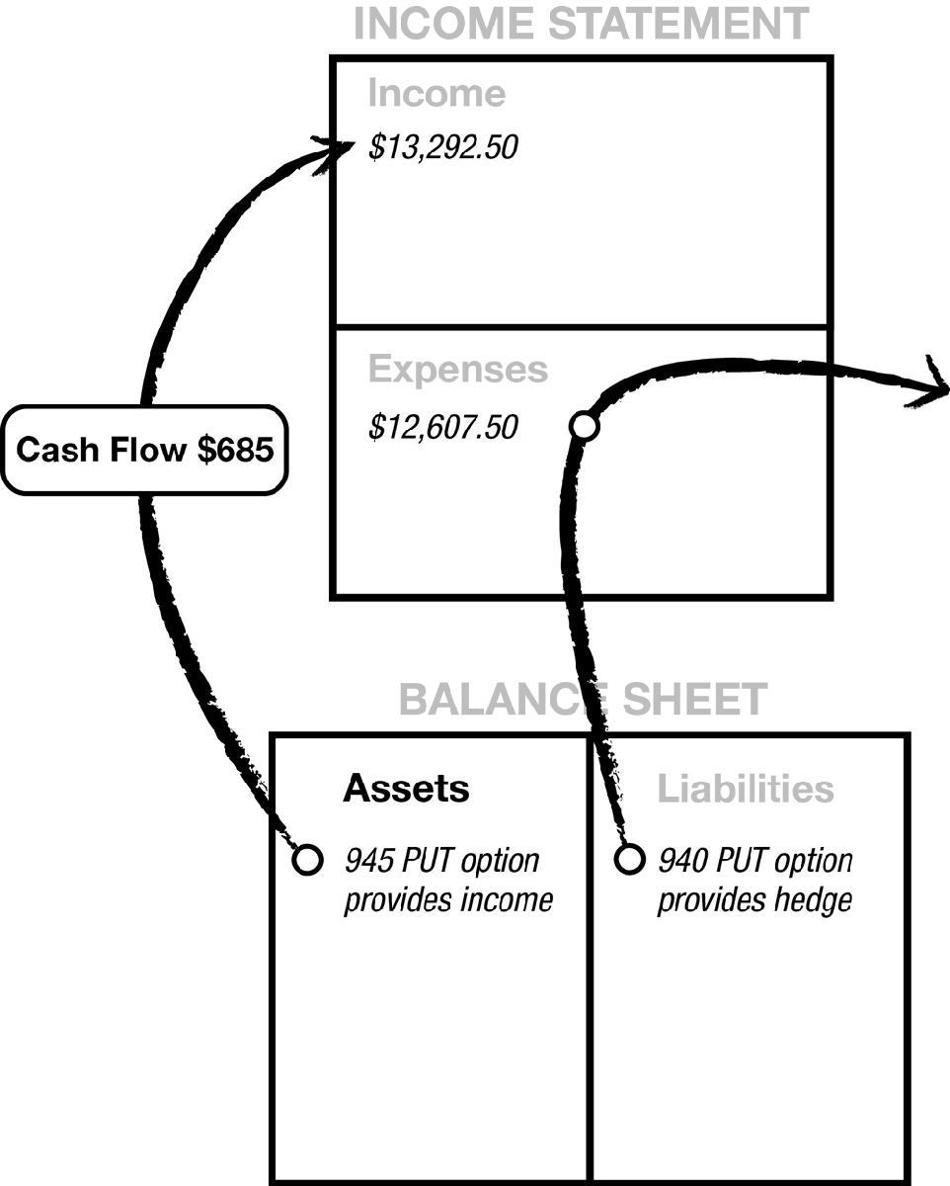

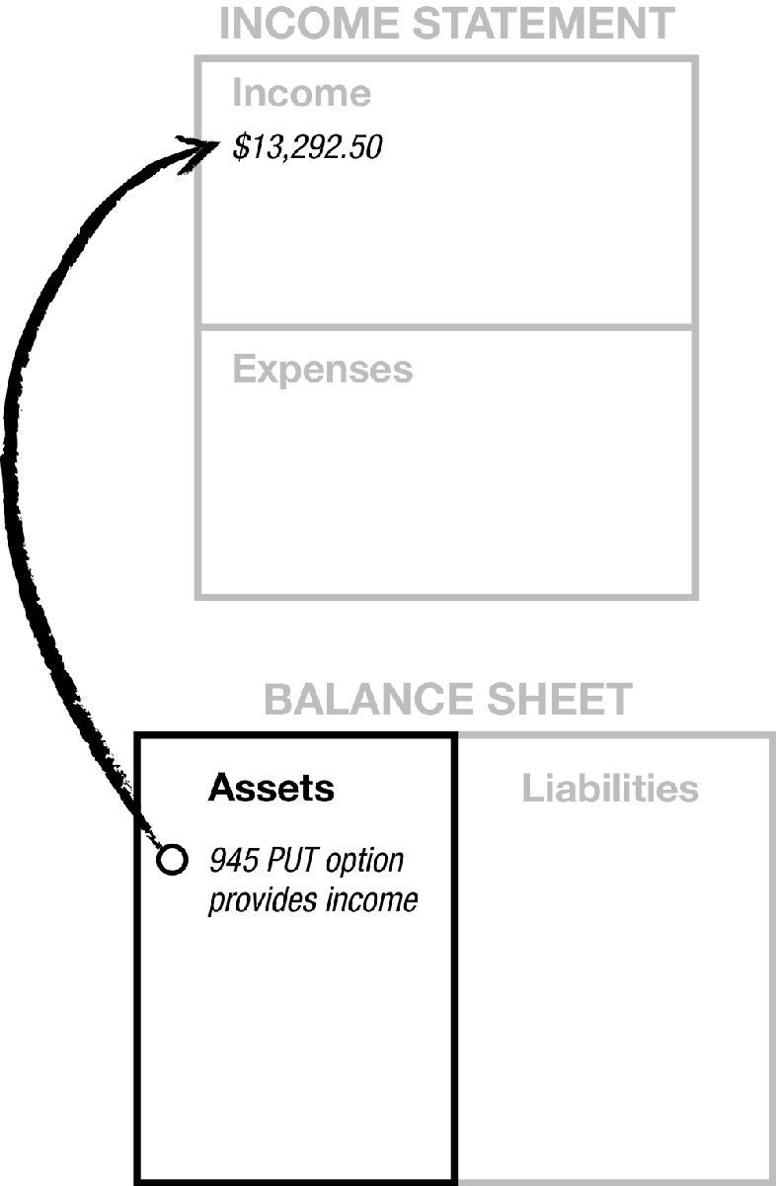

On a financial statement, we can draw a picture of that sale “that puts money in our pocket.” It would look something like this:

It’s interesting to note at this point that a lot of people criticized Robert for saying that “your house is not an asset” because it doesn’t put money in your pocket. I could see myself drawing similar criticism for placing a short stock, or a short option, in an asset column. So be it. The fact is, they produce income. On your brokerage statement, it might look something like the picture below. Notice that the adjusted cost is zero, so the adjusted return is infinite (or undefined) when the option expires.

While it can be difficult to predict the direction the market will go, finding a range in which it is likely to reside for a short time—be it up, down, or sideways—is much easier, in my opinion.

Here we see how the market actually moved until expiration.

Of course, when we are the buyer of insurance, it is an expense, and it brings the buyer no money unless our house burns down. The same is true with this put option example. So being the seller of an option is a common way that sophisticated investors make money.

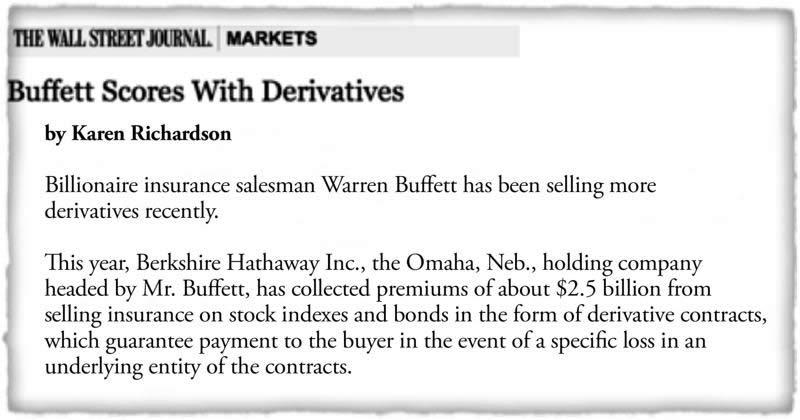

This is actually very similar to one of the ways Warren Buffett has been making money in the market for a long time. As the

Wall Street Journal

reported:

Some people mistakenly think that Warren Buffett is against the use of these contracts because he has referred to certain kinds of them as “financial weapons of mass destruction.” And, for the uneducated, they probably are. But Buffett actually makes billions and billions from selling them himself. Because there is so little control with paper assets, they carry more risk. So investors will pay lots of money to hedge.

In fact, we can actually use the money we receive for selling put options to buy puts to use as a hedge to control our risk, and still receive a positive cash flow.

That would look like this: