Unfair Advantage -The Power of Financial Education (21 page)

Read Unfair Advantage -The Power of Financial Education Online

Authors: Robert T. Kiyosaki

Tags: #Personal Finance, #unfair advantage, #financial education, #rich dad, #robert kiyosaki

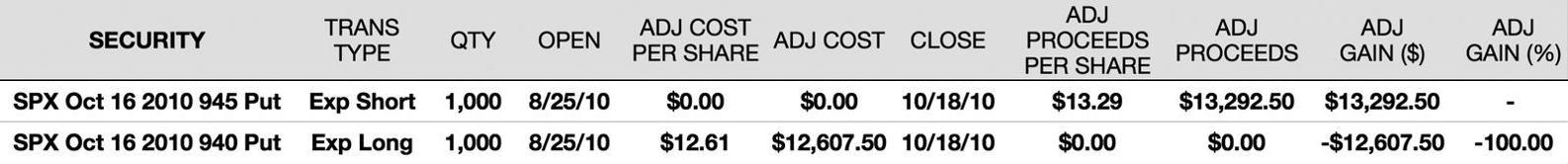

Notice on our statement from the brokerage that we get an infinite return on the options we sold and a 100 percent loss on the put options that we purchased—very similar to the money we might spend for insurance on a house.

To someone who is new to these types of transactions, it may seem like there’s a lot to learn. And there is. But with a constant commitment to their financial education, I believe anyone can learn it.

I am going to now hand it back over to Robert.

Protection from Robin Hood

As a child, I loved the story of Robin Hood. As I grew up, I realized Robin Hood was a thief. He justified his actions by vilifying the royals and saying, “I steal from the rich to give to the poor.”

Today, millions of people believe it is okay to steal from the rich and give to themselves.

As the economy worsens and poverty increases, more people will turn into Robin Hoods. Some will turn into felons: breaking into homes, hijacking cars, kidnapping people, and robbing banks. There are others who will steal from you via the court system.

Recently, I had to go to court. A person I did business with in 2005 claimed that I owed him 60 percent of my wealth. Although he has no case, we still had to go to court.

In 2007, he was flying high. Today he is bankrupt and looking for an innovative way to make money, so he put on his Robin Hood costume and we went to court. After the judge told him he had no case, he is now willing to settle for a hundred thousand dollars. The case is still not settled.

FAQ

How do you protect yourself from Robin Hoods?

Short Answer

Use the laws of the rich.

Explanation

There are many ways to protect your wealth, such as a house alarm, insurance, a gun, or a dog.

For centuries, the wealthy have used legal entities such as corporations. For a better explanation of how legal entities are used to protect the wealth of the wealthy, my legal advisor, Garrett Sutton, will take over.

Garrett Sutton explains:

We don’t have to get too legal to know that investing involves risk. When investing involves unlimited risk, the chance that out of the blue you’ll lose absolutely everything you own, fewer people will invest. But when you can hedge your bets and shield some of your assets, more people will put their money to work.

It started with corporate charters granted by the English Crown in the 1500s. The wealthy and the well-connected were able to take risks that others could not, and the English economy flourished. In time, governments realized that limited-liability entities should offer an equal should offer an equal opportunity for protection.* Of course, the face that tax revenues greatly increased with such an expansion of rights certainly helped governments make the right decision.

Today states such as Nevada, Wyoming, and Delaware provide favorable risk-protection laws and affordable fees, and generate huge sums of money for their treasuries. And, in one of the bigger win-wins out there, they allow investors to legally hedge their bets through state-chartered limited-liability entities which has allowed the economy to grow and more taxes to be collected. Much can be explained by examining self-interest.

Ironically, while providing for the good entity choices, governments also offer bad entity choices and don’t tell you which ones to use. The paternalistic nanny state so many complain of certainly had not come to entity selection. The government doesn’t teach it or warn about it,** and they’ll let you make the wrong decision.

The bad entity choices, and the ones that offer no protection from claims and thus no minimization of risk, are sole proprietorships and general partnerships. You will not enter into businesses or protect your wealth with these entities. The rich learned this a long time a go. If your advisor advocates using a sole proprietorship or general partnership do what the rich do: Move up to the next level. Get a new advisor who knows how to protect you.

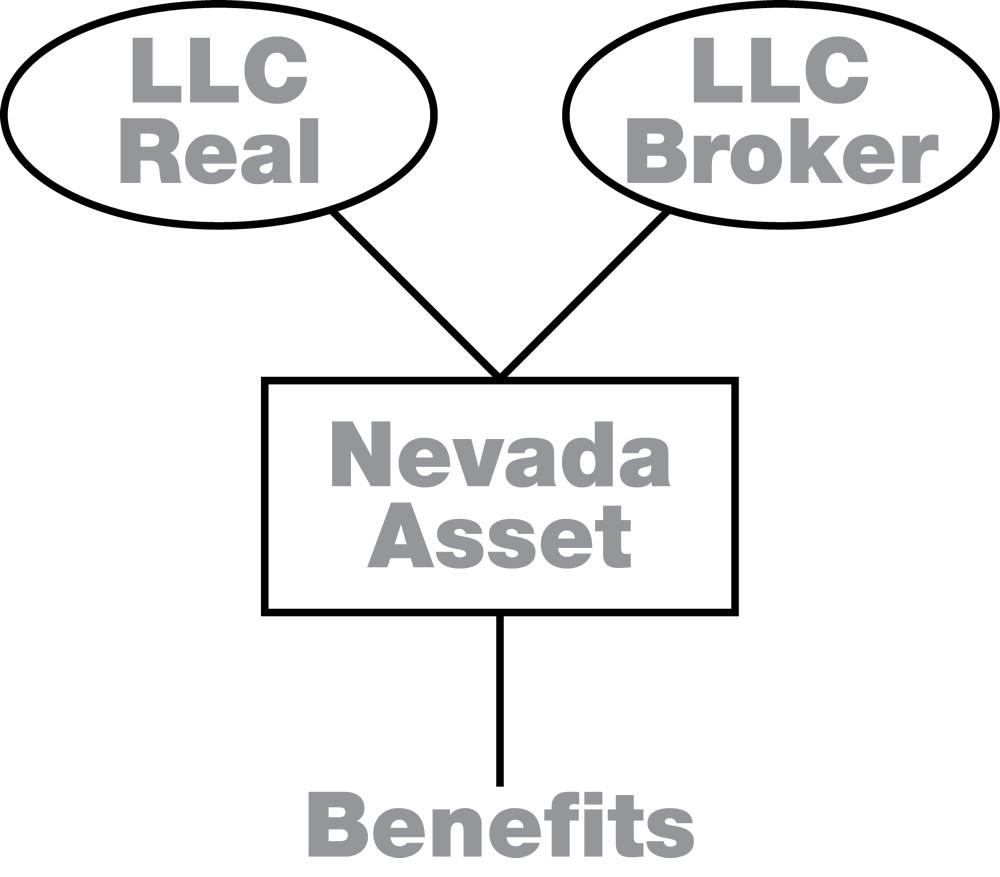

Nevada has the best law on asset-protection trusts. Assets that have been in the trust for over two years cannot be reached by creditors, even with a court order. An example of this structure is as follows:

The LLC allows you to manage and protect the property. The asset-protection trust puts up an even bigger wall, protecting you as the beneficiary from creditors.

In setting up an asset-protection plan for clients, I am sometimes asked the question: Won’t the government or the IRS be suspicious

of this?

My answer involves the history we discussed at the start. Governments encourage asset-protection planning. They allow for the charters, the

laws, and the taxation. They want the rich and everyone else to invest and take risks. In turn, they gain significant tax revenue. So do what the government wants: Protect your assets.

In Conclusion

Thank you, Garrett. This has been a long chapter because risk is a massive subject.

The best way to minimize risk is not by avoiding risk and using oxy morons that actually increase risk. The best way to reduce risk is by taking control. And that starts with your financial education. The more you know, the greater control you have over your life and finances.

Risk is real. Accidents, mistakes, and crimes happen every day. One of the reasons the rich get richer is that they take control of their financial education, rather than avoiding risk and believing in job security, saving money, safe investments, fair share, mutual funds, diversified portfolios, and being debt-free—oxymorons that actually increase risk.

Risk is increasing, and it’s tied to uncertainty. With terrorism, economic uncertainty, the rise of China, and the decline of the West, risk will increase because uncertainty is increasing.

True financial education gives you more control over risk.

And that control over risk is an unfair advantage.

* Petitioning the Crown for a corporate charter was time-consuming and unseemly, and more than a few monarchs cared nothing for “business.” But their regents saw it clearly.

** Perhaps we are not ready to see the following:

Government Warning: (1) According to the Department of Justice, use of a sole proprietorship may expose all of your assets to the risk of immediate loss. (2) Use of a sole proprietorship impairs your ability to build business credit and may stunt any future economic opportunities.

Chapter Five - UNFAIR ADVANTAGE #5: COMPENSATION

The Rich Don’t Work for Money

In

Rich Dad Poor Dad,

rich dad’s #1 lesson is, “The rich don’t work for money.”

This statement bothered many people in 1997 when

Rich Dad Poor Dad

was published and still does today—especially people who believe the rich are money-hungry people. Granted, a few are.

Yet, it is people who work for money who become the money-hungry people, especially in a financial crisis.

FAQ

Why not work for money?

Short Answer

Because money is no longer money.

Explanation

In the old economy, it was possible to work hard and save enough money to enjoy a good life. Once a person retired, they would earn enough interest from their savings to live a comfortable life.

In this new post-crisis economy, not only are interest rates at record-low rates, but the government continues to print trillions in counterfeit money, an action that destroys the purchasing power of your labor and your savings.

Most frightening in the new economy is the compounding interest on trillions of dollars of debt. I do not know how this is sustainable. If interest rates rise, as they did in the 1980s, the world will go bust when U.S. taxpayers say, “Sorry, we can’t make the mortgage payment on the national debt this month.” When that happens, the real economic crisis will surface.

The power that debt wields over an economy has already occurred in Japan, Latin America, Mexico, Russia, Iceland, Greece, Spain, Italy, Portugal, and Ireland. America, England, and Europe are soon to follow. Welcome to the new economy.

The Three-Legged Stool

In the old economy, financial advisors often spoke of the three-legged stool of retirement. One leg was personal savings, one leg was a company pension, and the third leg was Social Security. The three-legged stool supported the World War II generation, but for millions in the baby-boom generation in the United States, their three-legged stool will have no legs.

FAQ

What happens if I work for money?

Short Answer

The more money you make… the more money you lose.

Explanation

Two things happen for people working for money.

They get caught in the cycle of hard work, higher taxes, debt, and inflation. They look like rats in a pet store, running furiously on the wheel to nowhere.

They stop working. Many people simply say, “Why work any harder? If I make more money, the government just takes more. Why work if I can’t get ahead?”

This is why the rich don’t work for money.

In the new economy, a person needs to know how to convert their phony money into real money as quickly and safely as possible.

This takes financial education, education that will prepare you to do what the government wants done: things like owning a business that employs people rather than the employee, providing housing rather than buying a house, producing oil rather than burning oil, and producing food rather than eating food. In countries all over the world, governments reward

producers

and punish

consumers

who work for money.

More Money Does Not Make You Rich

I can remember in the 1950s, when my poor dad earned $300 a month, or $3,600 a year. His income barely covered the living expenses for a family of six. He worked very hard but was always broke, spending more than he earned, and our family struggled. He could not get ahead, so he went back to school for advanced degrees that would enable him to earn more money.

In the 1960s, his career took off, receiving promotion after promotion, climbing the ladder inside the educational system of Hawaii. By 1968, he was earning $65,000 a year as Superintendent of Education for the state, which was a lot of money then. The problem was that even with more money, my dad was still broke. He bought a new house in an expensive neighborhood, a new car, and still had the expenses of kids in college. His income went up, but so did his lifestyle expenses. He had no assets except for a little money in savings.

In the early 1970s, he ran for Lt. Governor and lost. In his mid fifties, he was out of work and even more broke. If not for Social Security and a small pension, he would have been destitute.

When the dollar went off the gold standard in 1971, the biggest financial boom in world history began, but my dad was not a part of it. Although he held a PhD in education, his education had not prepared him for the real world of money. He saw the world from the E and S quadrants and knew nothing of the B or I quadrants.

As his friends grew richer, my dad grew angry and bitter. As his anger grew, so did his belief that rich people were greedy people.

Today, millions of people are in the same shoes as my poor dad. Many are well-educated, hardworking people, but they are falling behind, rather than getting ahead in this crisis. They fall behind because they work for money and save money.

Congratulations! You’re a Trillionaire!

We know the world is printing money. The world prints money in good economies and bad economies. The question is: How much money is being printed?

If the United States is printing trillions of dollars, how much is the rest of the world printing? Perhaps a better question is: What will trillions in printing-press money do to you? Will trillions of dollars make you richer, or poorer?

If the financial turmoil of the past few years leads us into hyperinflation, there will be more millionaires, billionaires, and even trillionaires. You might be one of them.

Ironically, in this brave new world, there are already many trillionaires, but they are broke. For example, if you moved to Zimbabwe today, you could be a trillionaire in Zimbabwe dollars.

In fact, if you want to be a trillionaire, all you have to do is go online and buy a Zimbabwe trillion-dollar bill and you can go around telling your friends, “I’m a trillionaire.”

You would be a trillionaire, but you’d still be broke. Welcome to the new economy.

I carry a

one-hundred-trillion

Zimbabwe note in my wallet. Numerically, that is $100,000,000,000,000. I carry it to remind me that one hundred trillion Zimbabwe dollars may buy me an egg in Zimbabwe, but only if the egg is on sale.

Too

much

money is the trap of the new economy. In spite of trillions of dollars in the U.S. economy, millions of Americans are broke or will soon be broke.

FAQ

If the rich do not work for money, what do they work for?

Short Answer

Assets that produce cash flow in good economies or bad.

Explanation

Rather than save money in a bank or a retirement plan filled with paper assets, it is important to convert those dollars into real assets: assets that retain value, produce cash flow, and offer tax incentives.

FAQ

What makes you so sure your assets are safe assets?

Short Answer

They produce cash flow in good economies and bad economies, with tax incentives.

Explanation

Throughout history, paper money has come and gone. There was the Continental during the Revolutionary War and the Confederate dollar during the Civil War.

Although both currencies collapsed and became worthless, there was still an economy with people working, buying, selling, and trading. In other words, the money became worthless, but the economy kept going.

Many people have become extremely wealthy during financial collapses. Great assets become available for next to nothing. The problem is that people who were trained to look for a job, like my poor dad, cannot tell the difference between assets or liabilities.

I invest in assets that are essential to the economy. I invest in apartment buildings because people need a roof over their head. Most people would rather pay rent than live under a bridge. The government also gives rent subsidies for people without money. If the economy collapses, the government will most likely print money and give money (even if it is worth less and less) to the owners of the apartment houses. With this inflated money from the government, I will pay off my millions in debt with counterfeit money. If the economy collapses, the government will help me pay off my assets simply because the government does not want millions of people on the streets.

I invest in oil because oil keeps the world running, fed, and warm. And I invest in gold and silver because, when governments print money, gold and silver retain their intrinsic value.

There are many different types of assets that are essential to the economy. Find the ones that interest you.

FAQ

How do you know what is important to the economy?

Short Answer

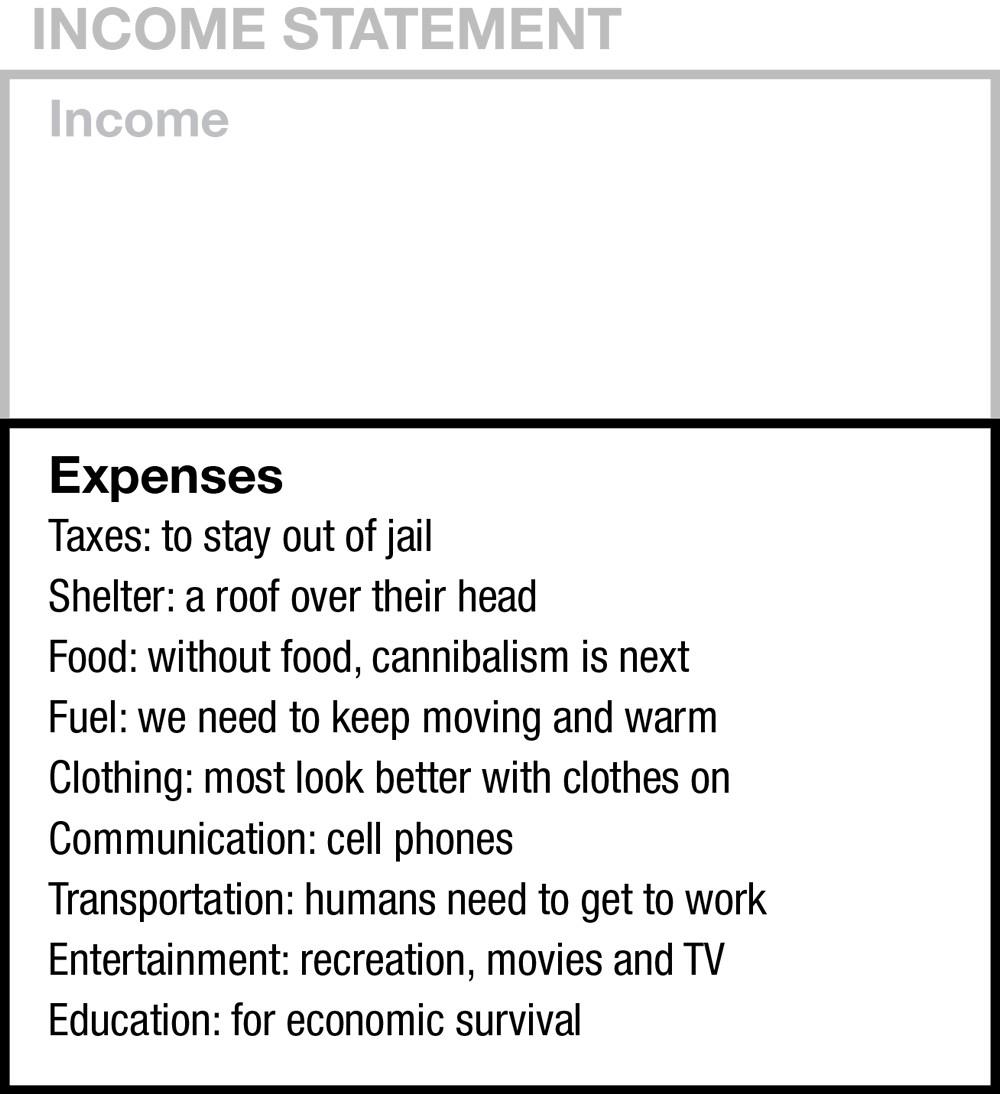

Look at financial statements, especially the expense column.

Explanation

When you look at a person’s financial statement, if they have one, you can see what is important to them and their personal economy. Their personal economy is what they must spend money on. A few examples are:

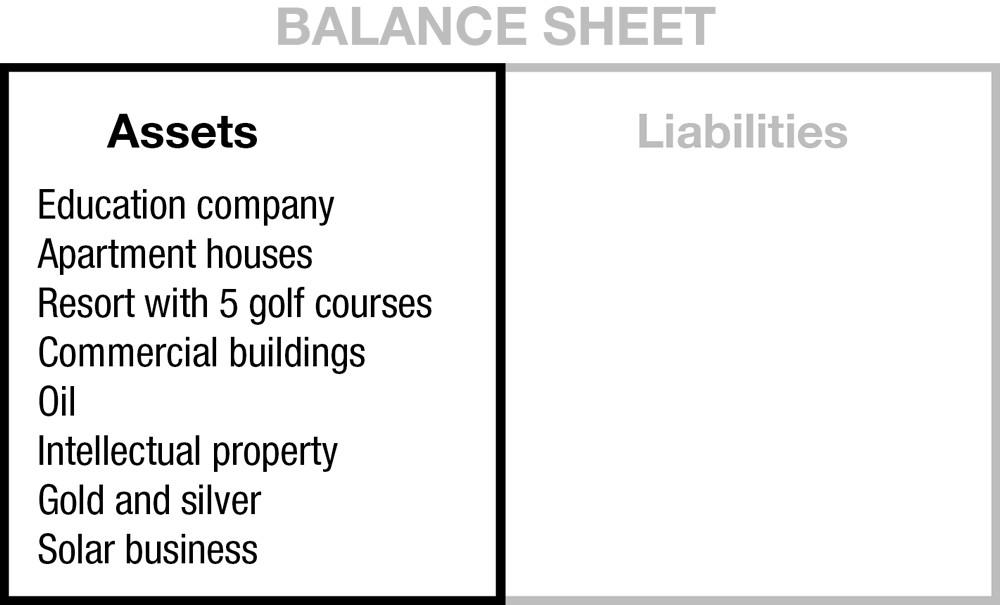

My asset column:

FAQ

Can you tell a rich person from a poor person by looking at their financial statement?

Short Answer

Yes.

Explanation

That is why your banker asks for your financial statement, not your report card. When you look at a person’s financial statement, you can tell what is important to that person. You can also predict the person’s future.

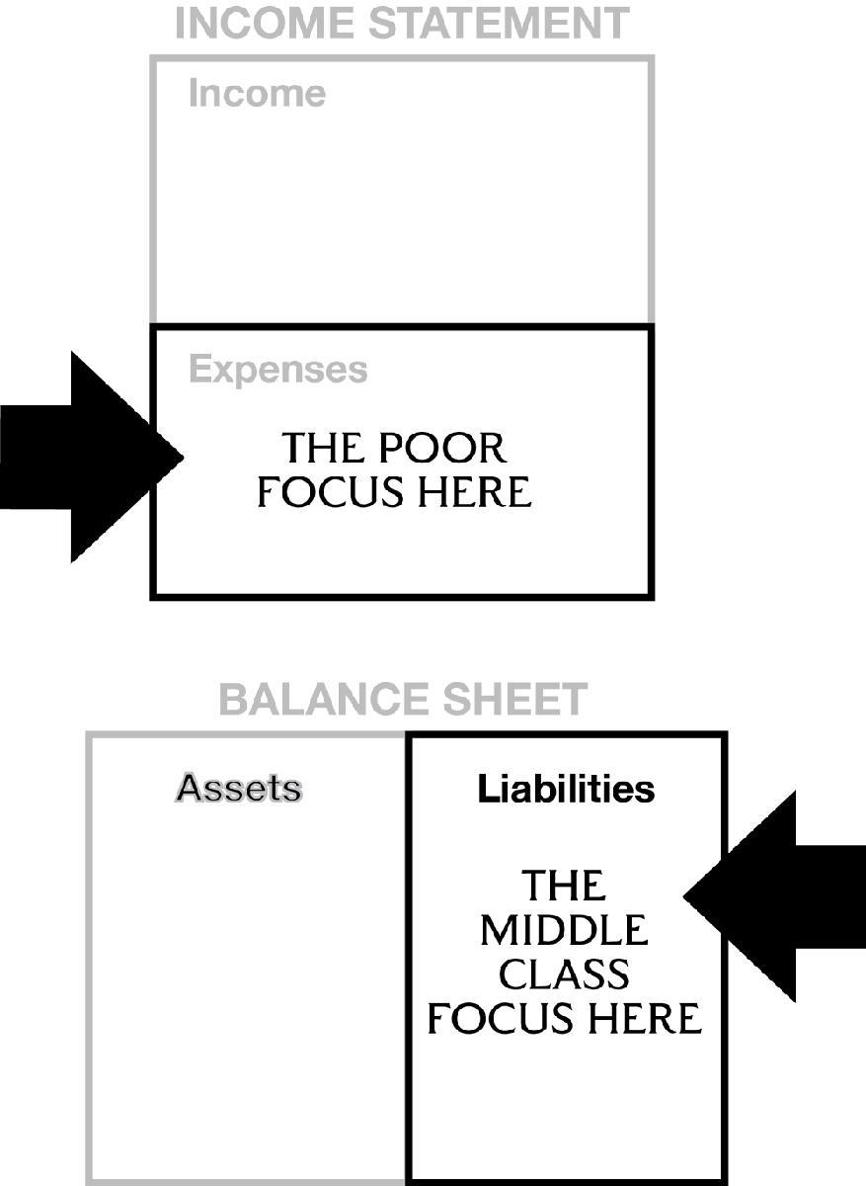

Poor people focus only on the expense column.

They earn enough to survive day to day with a roof over their heads, food on the table, gas in the car, and clothes on their backs. It is not a matter of how much they make. It is what they think is important. There are many people who make a lot of money, but spend it all through the expense column. They live paycheck to paycheck, even if they make a lot of money. They have no future because they live for today.