Unfair Advantage -The Power of Financial Education (23 page)

Read Unfair Advantage -The Power of Financial Education Online

Authors: Robert T. Kiyosaki

Tags: #Personal Finance, #unfair advantage, #financial education, #rich dad, #robert kiyosaki

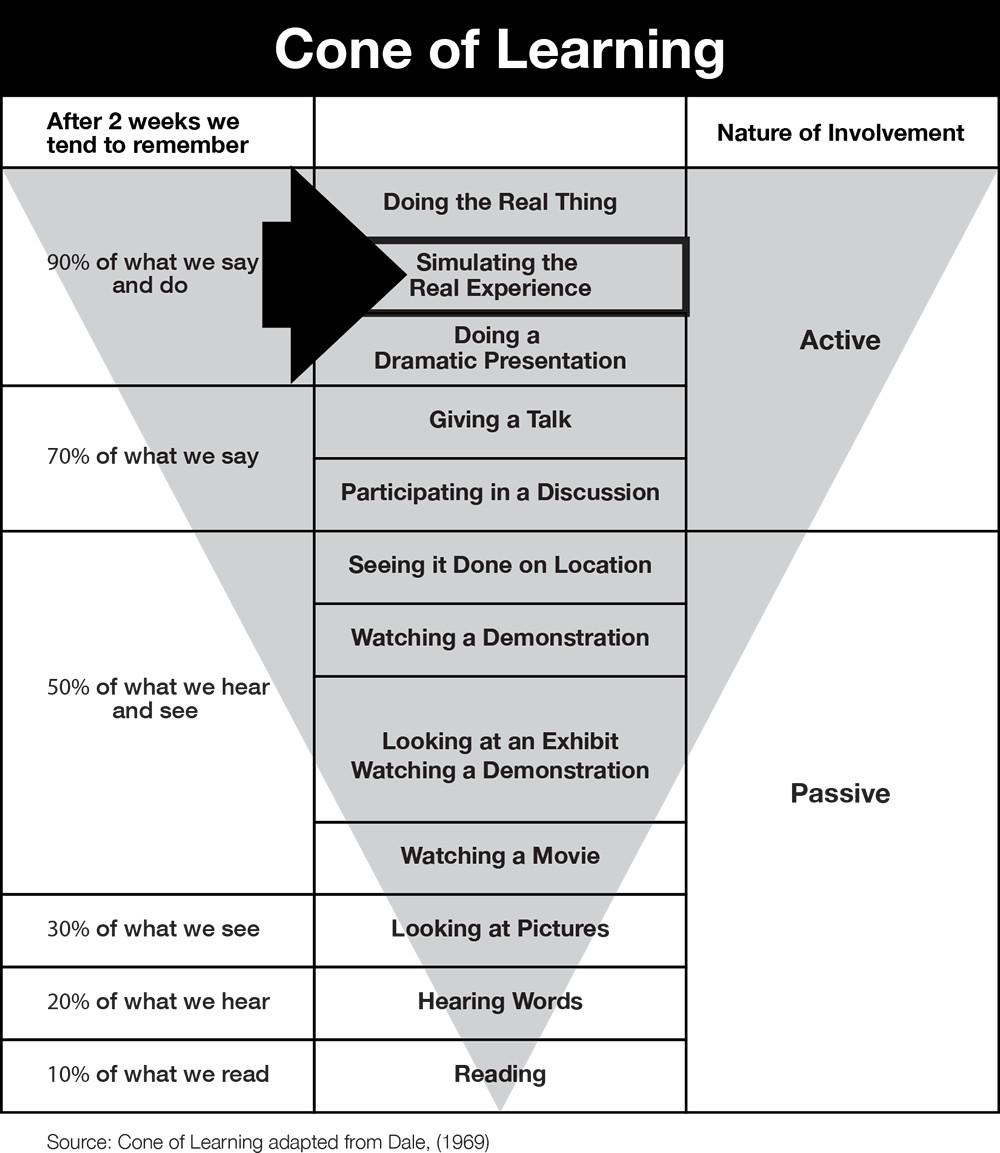

The Cone of Learning illustrates the effectiveness of various methods of learning by measuring retention.

You may notice that the most impactful way to learn is illustrated at the top of the cone: simulation and doing the real thing. The least meaningful way to learn is at the bottom of the cone: reading and lecture.

In flight school, pilots were trained extensively on simulators. Once we were competent on simulators, we flew the real aircraft. Kim and I created the

CASHFLOW

game as a simulator. The game allows players to make as many mistakes as possible with play money, not real money.

There are CASHFLOW clubs all over the world that teach and support people on their path to becoming entrepreneurs and investors, just as the military uses simulators to train military pilots.

A word of caution: Many people play the

CASHFLOW

game once or twice and think they are seasoned investors. Once again, this is arrogance in action.

CASHFLOW clubs will allow you to move on to focus on one of the four asset classes–entrepreneurship and business, real estate, paper assets, or commodities. Then we advise continuing your education, hiring a coach to guide you through your real-life process. The process of investing time to become a better investor or entrepreneur before investing or starting a business with your life savings will help increase your chances of success.

The more important and risky the venture is, the more important games and simulations are in the learning process. That’s why professional athletes practice more than play, actors rehearse more than act, and why doctors and lawyers call their businesses a “practice.”

The power of compounding education is staggering. Most of us have heard about the power of compounding interest rates. Many of us know that mutual funds profit via the power of compounding expenses. And most of us are very aware of America’s compounding national debt.

The Power of Learning

To better explain the power of compounding learning, I will use the game of golf as a metaphor. When a person first takes up the game of golf, the process can be painful, ugly, and frustrating. The new golfer puts in a lot of time and effort for very little in return. Many people quit after the first lesson.

But if they stick with the learning process—take lessons, hire a coach, practice, play eighteen holes three to four days a week, and enter tournaments on weekends—in a few years they are likely to beat most golfers, even golfers with more natural talent.

To truly develop their talents, they would have to increase their dedication to learning. In the world of professional golfers, the difference between the top 20 money winners and the top 125 golfers is less than two strokes. In other words, the top 20 make millions, and the next 100 golfers earn a comfortable living.

The game is the same. And the difference is not just natural talent. The difference is in dedication to learning to become the best. This is an example of the Third Law of Compensation: the power of compounding education.

Education is not a class, a course, or a few lessons. True education is a process. True education can sometimes be a

painful

process, especially at the start when it’s hard work with little in return.

While Tiger Woods may not be a good example of faithfulness in marriage, he is a good example of success in golf. Tiger dropped out of Stanford in 1996 to become a professional golfer at the age of 20. The moment he turned pro, he signed endorsement deals for $40 million with Nike and $20 million with Titleist. Not a bad start for a college dropout.

Some might say he is naturally gifted and an overnight success. He may be naturally gifted, but he was not an overnight success. It took time, dedication, and sacrifice to develop his talents. More important than the age he turned pro is the age at which he started his golf career.

When Tiger was a baby, his dad created a driving range in his garage with a carpet and a net. Before Tiger could walk, he would sit in his high chair and watch his dad hit practice balls into the net.

When he was nine months old, his dad sawed off a golf club so Tiger could hit balls into the same net. When he was 18 months old, Tiger began going to the golf course with his dad and hit buckets of balls on the driving range.

At the age of three, he shot a 48 for nine holes at the Navy Golf Club in California. When he was four, his dad hired a coach for Tiger. At six, he began to play in junior contests. And in1984, at the age of eight, he won the 9-10 boys’ event at the Junior World Golf competition.

You get my point.

Success takes an investment in time, dedication, and sacrifice. This is true education. It is a process. For most successful people, there is no such thing as an “overnight success.”

My rich dad constantly said, “Success requires sacrifice.” He also said, “Most people are not rich because they want money without sacrifice.”

The reason so few people make it over to the B and I side of the CASHFLOW Quadrant is because life is easier on the E/S side, at least it may seem that way in the beginning. For most people on the E/S side, life will get harder in the new economy, especially as they grow older. And long-term success also requires strong legal, ethical and moral character, as Tiger is finding out the hard (and expensive) way.

Infinite Returns

Infinite returns are the result of obeying Law of Compensation #3.

When Kim started out in 1989 with her 2-bedroom/1-bath house, she worked really hard just to make $25 a month in net cash flow. Twenty years later, she works less and makes much more money— often infinite returns, which means

money for nothing.

Even in this economic crisis, her wealth is accelerating, making more money with much less effort, because infinite returns are the result of the 3rd law of compensation.

Smarter and Better Friends

One more aspect of Law of Compensation #3 is smarter and better friends. When financial intelligence increases, you also start to meet smarter people. When you meet smarter people, you are invited into investments that are called “insider” investments. These are investments that never make it to market. The investments are so good that the investment does not need to be advertised or sold. Someone makes a phone call, and the investment is off the market.

The resort and golf-course investment that Kim and I have was an insider investment. The moment the property went into foreclosure, the banker called just four people and the property was gone.

This is another example of the power of compounding financial education. If Kim and I were dishonest, immoral, or illegal, we would never have been invited into the partnership. A good reputation is also an unfair advantage.

The Power of Financial Education

Obeying the laws of compensation allowed Kim to retire at 37. I retired at 47. Obeying the laws granted us our financial freedom, something fewer people will achieve in the brave new world of the new economy.

Kim and I founded The Rich Dad Company only after we achieved our freedom. Before we talked or wrote about our freedom, we had to pressure-test our freedom. We wanted to find out if our financial education was real and could survive the ups and downs of the economy.

I would say our freedom survived because we obeyed the laws of compensation. We remembered to give more if we wanted more in return. We continued to learn how to give more from the B and I quadrants. And we knew we had to keep learning and practicing, improving our skills in the B and I quadrants.

FAQ

But didn’t your rich dad give you a head start? Isn’t that your unfair advantage?

Short Answer

Yes and no.

Explanation

My rich dad did not give me anything. He simply showed me the way. At the age of nine, playing

Monopoly

, I knew the difference between assets and liabilities. But I still had to take classes and learn, turning my education into real assets.

What gave me my unfair advantage was financial education, applied to real life.

The greatest unfair advantage that Kim and I have is that we do not stop learning. We attend classes and apply what we learn. We know that if want more, we need to learn how to give more. The more we give, the more tax breaks and low-interest loans we receive. We know if we give others a better life, we will receive a better life in return.

FAQ

Don’t most people attend financial courses to make money only for themselves?

Short Answer

Yes and no.

Explanation

It is very important to learn to take care of yourself. There are too many people who want to save the world but cannot save themselves. If you cannot save yourself, you are less effective in the world.

When I was young, I learned, “God helps those who help themselves.” Too many students leave school wanting to help people, but cannot help themselves. If you want to save the world, learn to save yourself first. Then go save the world.

Time to Change Careers

In 1981, I had the privilege of studying with Dr. R. Buckminster Fuller at a weekend conference in the mountains of California. For those not familiar with Dr. Fuller’s work, he is often referred to as “The Planet’s Friendly Genius.” He is the inventor of the geodesic dome and hundreds of other inventions, all dedicated to making the world a better place.

During one of his talks, he said something that changed my life. At the time I was flat broke, having lost my first big business, the nylon-and-Velcro wallet business. I knew what to do but I was struggling. Something was wrong. Sitting there, listening to one of our world’s greatest geniuses, I realized what I had forgotten. Listening to him, I realized I was disobeying the Laws of Compensation.

That morning, Dr. Fuller said to the group, “I do not work for money. I have dedicated my life to the service of others.” Speaking on principles that govern the world, he said, “The more people I serve, the more effective I become.”

His simple words hit me like a lightening bolt. It dawned on me that I was struggling, as my business was struggling, because I was only thinking about making money for myself. I knew it was time for me to change careers, again.

A few months later, I began training to become a teacher, a teacher of entrepreneurship who would follow the principles taught by Dr. Fuller, principles that follow the laws of compensation.

I had a hard time deciding to become a teacher because I really did not like school or most of my teachers. Also, all the teachers I knew were poor. Finally, I resolved my decision to teach by committing to follow the Laws of Compensation and focus on serving more and more people rather than just making money.

The unfair advantage I had over most teachers was that I was an entrepreneur. I knew I could build a business as an educational entrepreneur, outside the traditional school system.

Two years later in 1984, after much practice teaching, often holding seminars that no one came to, I sold my wallet business and took a leap of faith. The moment I made my commitment, I met Kim. When I told her what I was up to, she said she wanted to join me on this new adventure.

Although we had no money, we held each other’s hand and took our leap of faith together. I would never have made it without Kim.

In some of our books, I write about the fact that Kim and I were homeless for a time, sleeping in a borrowed car, living in friends’ basements or living rooms, while we learned to be teachers.

For five years, we had our faith tested. For five years, it was extremely difficult selling enough seats to our classes to cover business expenses and our living expenses too. After five years, the business picked up and we expanded with offices throughout Australia, Canada, Singapore, New Zealand and throughout the United States.

In 1994, ten years after taking our leap of faith, Kim and I were financially free.

In 1996, following the Laws of Compensation, Kim and I created our board game

CASHFLOW.

We created the game so we could serve more people, teaching people the same financial lessons my rich dad taught me.