Read 13 Bankers: The Wall Street Takeover and the Next Financial Meltdown Online

Authors: Simon Johnson

13 Bankers: The Wall Street Takeover and the Next Financial Meltdown (20 page)

[T]here is a limited body of evidence suggesting that homeownership creates positive spillovers for near neighbors. Homeowners do appear to be more active citizens. They vote more. They take better care of their homes. Houses that are surrounded by homeowners are worth a little more than houses that are surrounded by renters.

59

However, much of the positive effect of homeownership is due not to ownership itself, but to other factors that differentiate owners and renters. In another paper, Glaeser and Denise DiPasquale found that “almost one-half of the effect of homeownership disappeared when we controlled for the time that the person had lived in the home.”

60

William Rohe and Michael Stegman compared a sample of low-income homebuyers with similar low-income renters over time and found that the homebuyers were less likely to engage in informal neighboring, more likely to participate in block associations, and no more likely to participate in other types of community associations.

61

Alyssa Katz concludes, in

Our Lot,

“scholars found that once they set aside the various traits that tend to determine whether someone chooses to own or rent one’s home, homeowners and tenants really aren’t that different.”

62

The second source of the ideology of homeownership is the idea that owning a home is the best possible investment for a household. Although widely believed, this idea is questionable at best: absent government incentives, betting several times your entire net worth not only on a single type of asset, but on a single building and plot of land, is almost the worst investment you could make after accounting for risk. Many families have made money from housing price appreciation (particularly if they took out mortgages before the inflation of the 1970s), but their high returns are primarily due to the high leverage built into a typical mortgage—leverage that produces massive defaults and foreclosures in a housing downturn such as the one that began in 2006. The things that make housing attractive as an investment are favorable government policies, such as the mortgage interest tax deduction, in which the government subsidizes mortgages for homeowners.

*

In any case, homeownership ranks alongside motherhood and apple pie in the firmament of American values, and helping more people buy houses is almost always seen as a good thing. Lewis Ranieri capitalized on this ideology when he created the market for private mortgage-backed securities beginning in the late 1970s. Mortgage-backed securities would enable lenders to replenish their coffers by tapping the entire world of securities investors, expanding the amount of credit available to homeowners and thereby allowing more people to buy houses at lower interest rates. At a congressional hearing, Katz recounts. “Ranieri promised that putting private bankers and their sales forces in charge of mortgage securities would save borrowers half a percent on every loan.”

63

Congress agreed; in a 1983 report, the Senate Banking, Housing, and Urban Affairs Committee warned that without expanding the market for private mortgage-backed securities, “mortgages would cost more and be more costly to obtain.”

64

Ranieri hitched the mortgage-backed securities market to the cause of expanding homeownership, ensuring its political success.

In the 1990s and 2000s, another financial innovation appeared on the scene with the potential to extend the dream of homeownership to millions more households: subprime mortgage lending. (Subprime lending had been around for decades, but only recently became a major source of money to buy houses, as opposed to refinancing them.)

65

During the housing boom, lenders scrambled to offer mortgages to people who would never have qualified for them before the boom. These were high-cost loans to people with no verified ability to pay them off, which made sense only assuming that continually rising housing prices would leave the lenders with valuable collateral in case of default. These practices looked a lot like predatory lending. But the mortgage lenders and the investment banks that bought and securitized their mortgages justified such activity on the grounds that it promoted homeownership. “Our innovative industry has created a great way to expand homeownership by offering loans to those who can make payments, but who don’t qualify for ‘A’ paper because of poor credit or bankruptcy,” said Ron McCord, former president of the Mortgage Bankers Association, in 1997.

66

And the story stuck. Not only did the federal government make no attempt to regulate subprime lending, but it even became a cheerleader for the subprime boom. The Clinton administration had made an expansion of homeownership a central part of its economic strategy; in 1995, Clinton set a goal of a 67.5 percent homeownership rate

67

at a time when the actual rate was 65 percent (it would peak the next decade at 69 percent).

68

In order to help meet this goal, the Department of Housing and Urban Development mandated that Fannie Mae and Freddie Mac—the giant government-sponsored enterprises that provided funding for the mortgage market—had to devote 42 percent of their money to loans to low- and moderate-income households. That target was increased to 50 percent in 2000 and then to 56 percent in 2004.

69

Growing real household incomes helped a bit in the mid-1990s. But beginning in 1997, the growth of housing prices outstripped income growth; after 1999, real median household income

fell

for five consecutive years as housing prices soared.

70

Under these circumstances, as George W. Bush not only continued his predecessor’s support for increased homeownership but even made the “ownership society” a centerpiece of his political message, the only thing that could keep the homeownership boom going was expanded availability of credit.

Alan Greenspan became an eloquent spokesman for the synergy between financial innovation and homeownership. In a 2005 speech discussing the impact of new financial technology, he said,

Improved access to credit for consumers, and especially these more-recent developments, has had significant benefits. Unquestionably, innovation and deregulation have vastly expanded credit availability to virtually all income classes. Access to credit has enabled families to purchase homes, deal with emergencies, and obtain goods and services. Home ownership is at a record high.

71

The only caveat that Greenspan gave was that the increase in credit availability made it more important to ensure widespread financial education.

For anyone who had doubts about the value of financial innovation and the importance of Wall Street, the ideology of homeownership provided easy assurance. The idea that complex securities could help low- and middle-income families own homes was especially attractive to Democratic congressmen and officials who might ordinarily be distrustful of mortgage lenders and investment bankers, and helped seal off Wall Street’s new money machine from criticism.

The economic and political elites could agree that innovation was good, and that homeownership was good. But the ideology of finance went beyond the idea that Wall Street was good for America. Banking was not only the center of the U.S. economy—it became cool, seductive, and even sexy.

In 1987, Tom Wolfe’s novel

The Bonfire of the Vanities

introduced the term “Master of the Universe” to American culture, in the form of multimillionaire investment banker Sherman McCoy, who lived in “the sort of apartment the mere thought of which ignites flames of greed and covetousness under people all over New York and, for that matter, all over the world.”

72

Although the term was used sarcastically, and McCoy turns out badly in both the human and financial senses, the image of the swashbuckling, super-rich banker engaged in transactions too complex to be understood by ordinary mortals was born.

Also in 1987, Oliver Stone’s movie

Wall Street

was released, with its memorable antihero, corporate raider Gordon Gekko (played by Michael Douglas). Although the movie’s story shows the corruption and ultimate downfall of Gekko, it is remembered for his “Greed is good” speech, which justified the pursuit of money above all else. As screenwriter Stanley Weiser wrote recently, many people would later tell him the movie made them

want

to work on Wall Street: “A typical example would be a business executive or a younger studio development person spouting something that goes like this: ‘The movie changed my life. Once I saw it I knew that I wanted to get into such and such business. I wanted to be like Gordon Gekko.’ ”

73

Liar’s Poker,

Michael Lewis’s 1989 memoir, an ironic antibildungsroman in which the hero is fascinated but ultimately repelled by life at Salomon Brothers, popularized life on Wall Street for a generation of college students. As Lewis wrote much later,

I hoped that some bright kid at, say, Ohio State University who really wanted to be an oceanographer would read my book, spurn the offer from Morgan Stanley, and set out to sea.

Somehow that message failed to come across. Six months after

Liar’s Poker

was published, I was knee-deep in letters from students at Ohio State who wanted to know if I had any other secrets to share about Wall Street. They’d read my book as a how-to manual.

74

Clearly, being a bond trader on Wall Street was different from being a loan officer in the era of 3–6–3 banking. The risk, the testosterone, and the sums of money at stake were all deeply seductive to overachievers from top schools. They

wanted

to order guacamole in five-gallon drums, swear constantly, and place million-dollar bets while eating cheeseburgers.

After

Liar’s Poker,

the financial sector only became more and more exciting in popular culture. From Salomon, the torch of innovation passed to Drexel Burnham Lambert and Michael Milken, who were starring characters in James Stewart’s 1992 bestseller,

Den of Thieves;

the takeover binge they made possible was memorialized by Bryan Burrough and John Helyar in

Barbarians at the Gate,

their 1990 account of the leveraged buyout of RJR Nabisco. After Drexel collapsed, the cutting edge of finance shifted to derivatives desks. In his 1997 memoir,

F.I.A.S.C.O.,

former derivatives trader (and current law school professor) Frank Partnoy chronicled the derivatives culture, where people would describe a trade where they made money at the expense of a client as “ripping his face off.” (The comparatively genteel phrase in

Liar’s Poker

was “blowing up a customer.”) But if Partnoy expected his book to slow the growth of the derivatives industry, he was no doubt disappointed. By this point, the bankers were the heroes of the story, not the villains.

No amount of cautionary tales could change the fact that Wall Street was becoming a deeply seductive place, in a way that traditional banking never was. There were the concrete-steel-and-glass towers crammed full of modern technology. There was the mathematical complexity of modern trading, a game seemingly reserved for the very smart. There was the feeling of being at the center of the financial world, whether raising billions of dollars for multinational corporations or making massive trades that moved the market prices flashing on the Bloomberg screen. There was the lifestyle—eating sushi at Nobu, riding everywhere in a Lincoln Town Car, talking on cell phones (before everyone had one), checking e-mail on BlackBerrys (before everyone had one), and globetrotting in first class (still not available to everyone). To open

Sex and the City,

the 1996 book that launched the eponymous TV show, Candace Bushnell chose an investment banker: “Tim was forty-two, an investment banker who made about $5 million a year.”

75

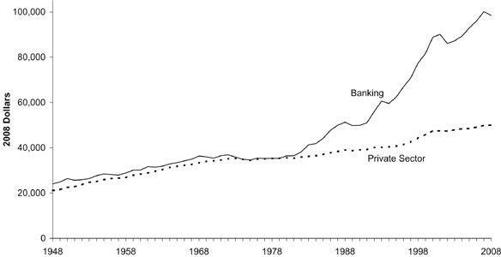

Figure 4-1: Real Average Annual Compensation, Banking vs. Private Sector Overall

Source: Bureau of Economic Analysis,

National Income and Product Accounts

, Tables 1.1.4, 6.3, 6.5; calculation by the authors. Banking includes financial sector less insurance, real estate, and holding companies. Annual compensation is total wage and salary accruals divided by full-time equivalent employees.