Don't Break the Bank: A Student's Guide to Managing Money (24 page)

Read Don't Break the Bank: A Student's Guide to Managing Money Online

Authors: Peterson's

Tags: #Azizex666

When you find an apartment you like, you will probably have to complete a rental application. This may ask about your income, because the landlord wants to be sure you’ll be able to afford the rent every month. The landlord may also do a background check to see if you have good credit and make sure you haven’t been evicted from an apartment in the past. (See Chapter 8 for more about credit checks.)

If you don’t have a job or other source if income, or if the landlord is nervous about renting to you because of your age, you may get asked to get a co-signer. Your parents may be willing to do this, but it’s important that you remember that it is your responsibility to pay this bill. Don’t leave your parents holding the bag.

A

co-signer

is someone who signs a loan or rental application with you. This person agrees to be responsible for that debt, should you fail to pay it.

If you decide you want the apartment (and the landlord approves you as a tenant), you will need to sign a lease or rental agreement. This is a contract that states how much you will pay—monthly rent, security deposits, and any other charges you may be required to pay. It usually also spells out all of the rules you must follow, from how you must maintain the property to whether you are allowed to have overnight guests.

Be sure to read this document carefully. It’s a good idea to have your parents look it over, too. Watch for any fine print, especially any charges or fees the landlord can impose (say, a late fee if your rent isn’t on time or a “cleaning fee” if the landlords feels the place is messy when you move out).

The lease is a legal document, and you will be obligated to abide by its terms. It can be difficult to break a lease, and if you move out of the apartment before your lease is up, you will often be held responsible for any rent due for the remaining term of the lease.

Are You Ready for Roommates?

Most likely, you won’t be able to afford a place of your own, so you will probably need to live with roommates. In addition to all of the normal roommate issues you would encounter if you lived in the dorms (getting used to each other’s bad habits, coordinating schedules so you can each study, sleep, or do other daily activities in peace, etc.), you will also have financial matters to sort out.

If you don’t know your roommates well (or at all), you have no idea how they manage their money. They may be shopaholics who have trouble paying their bills, or they may be obsessive about splitting the bills equally right down to the penny.

It’s important to iron out the financial details in advance of move-in day. Discuss them in as much detail as possible, to try to prevent problems later. Make a list of every expense—including things like groceries and cleaning supplies, if you will be sharing these items. Then discuss how you want to divide up the bills.

Think about how you want to handle things you may not use equally. For example, if there’s a charge for a parking spot and only one of you has a car, this may not be a cost you need to split.

Try to go through every possible scenario you can think of, so you’ll be prepared to handle any money situations that may crop up. Even if you’ll be sharing a place with friends, that’s no guarantee that you won’t run into money issues and financial disagreements.

Ideally, your landlord or property management company allows for individual leases. That means you each enter into a separate rental agreement with the landlord and are only responsible for your own rent. That way, if your roommate flakes out or disappears, you aren’t on the hook for his or her part of the rent.

Roommate Money Questions to Consider

• What happens if one person drops out of school or otherwise needs to vacate early?

• If one roommate loses his job or can’t pay the rent, what happens?

• Do you share groceries and household supplies? If not, how will you make sure one person doesn’t use stuff the other person bought?

• What about guests? What if a guest damages something or uses some household supplies?

Keep Credit Cards Under Control

Once they escape their parents’ watchful eye, many college students become more reckless with their spending, especially if they want to buy cool clothes or enjoy lots of social activities with their friends. This is when it gets very tempting to rely on plastic to pay for all your splurges. It’s important to be self-disciplined enough to resist racking up big credit card bills. To make things easier, avoid getting a lot of credit cards in the first place. You really only need one credit card, just for emergencies.

Credit card companies traditionally put a lot of effort into marketing to college students. They would host big promotions on campus and give away free swag to students who signed up. They would usually gladly give you a credit card even if you had no job and no apparent means of paying the bill.

According to one study, the average college student has a credit card balance of $3,173. Around 21 percent of undergraduates have balances between $3,000 and $7,000.

Recent laws have had a major impact on how credit card companies can market—and provide credit cards—to students [see Chapter 9: Charge It! (Paying with Plastic)]. It’s now tougher to get a credit card if you’re under 21, and that’s a good thing, as it helps protect you from getting buried in sky-high credit card bills.

Be Smart with Student Loan Debt

If you’re like many college students, you may have no choice but to take out some student loans in order to help pay for college. But if you get a tax refund because you have excess financial aid (and some of that consists of loans), it’s a smart idea to contact the financial aid office and tell them you want to decrease the amount of your loans. Remember, this isn’t “free money.” Loans are a debt that you will need to repay, so you shouldn’t take more than you absolutely need.

Your Income May Affect Your Financial Aid

If you receive financial aid for school, keep in mind that your income may affect how much aid you can receive. (It can seem like an unfair Catch-22: You are trying to improve your financial situation by working, but then the government or your school may turn around and cut the amount of money they’ll give you in aid.)

Check with your school’s financial aid office for advice and information on how an increase in income may affect your aid. Some forms of income (such as pay from a work-study job) do not affect your aid. If your income will affect your aid, you need to weigh the different scenarios and see how you would come out better.

Save Money on Textbooks

Expert Advice

“Save on Textbooks: Don’t purchase textbooks at the school bookstore. I saved $300 last year by buying used textbooks and renting textbooks. Use the free textbook search engine at helpsavemydollars.com to find the cheapest textbook retailers. “

~ Scott Gamm, 19, student at NYU’s Stern School of Business and founder of helpsavemydollars.com

Even if your tuition costs are covered by financial aid (or paid by your parents), you may still need to pay for your textbooks out of your own pocket. If you’ve never bought a textbook before, prepare for sticker shock. Even a relatively thin paperback book can be shockingly expensive.

You can usually save lots of money by buying used textbooks. Check out the bulletin boards on campus—or the local CraigsList or other online classifieds—to see if anyone is selling the books you need. Better yet, rent your books. You can use sites like Chegg.com to rent books online.

The average costs for books and materials for a four-year public university in 2010–11 was $1,137.

Beware the Unpaid Internship

Internships are popular with college students because you can gain work experience and possibly earn college credit while also making some extra money. But many companies are now offering internships that don’t pay at all. In many cases, these companies are actually ignoring the law. The government has rules about internships, and there are only limited situations when it’s okay for a company not to pay an intern. Most of the time, companies are required to pay interns, even though many of them try to get away without doing so.

The U.S. Department of Labor specifies the rules regarding unpaid internships on its Web site at www.dol.gov.

The Jump$tart Coalition Reality Check interactive tool at

http://jumpstart.org/reality-check-page1.html

lets you enter some information about your lifestyle habits and future plans, and then it gives you an estimate of how much money you will need. This can definitely be a wake-up call!

Some major companies offer unpaid internships—and, as one college intern ship counselor noted, it often follows that the more popular the company is with college students (think sports and media companies), the less likely they are to pay interns. That’s because many college students are so eager to work for these companies, they are willing to do it for free just for the “prestige” of working there and adding it to their resume.

If you are tempted to take an internship that doesn’t come with a paycheck, think carefully and weigh the pros and cons. The internship may actually end up costing you money, especially if you need to find housing in whatever city the internship is located.

Maintain Your Money Habits

Hopefully, at this point, you have already developed some money management skills and feel comfortable with the budgeting basics. (If not, it’s not too late—just go back and review some of the earlier chapters in this book for tips.) But mastering your money isn’t just a one-time thing. You need to keep up these good habits for life. Some tips for staying in the groove:

• Do a basic review of your budget every month, especially if your situation changes (say, you start a new job) or you have trouble making ends meet.

• Be diligent about checking your online bank activity regularly to keep track of your balances and watch for any signs of trouble. Make this a part of your daily routine (it only takes a few minutes).

• Review a copy of your credit report every few months, and look at it closely to check for mistakes or outdated information.

Part VII

Taking Stock of Your Financial Future: Investing

Investing is a great way to help plan for your future. It can also be really cool to watch your money grow, if you invest it wisely. You don’t need to be a millionaire to invest—taking a little bit from each paycheck is a great way to start. Anything you can stash away now will help you create a nest egg for your future. We know the thought of investing can be intimidating, so we’ve broken it down into simple terms to make things easier.

Chapter 13

Investing: How to Make Your Money Grow

Investing is when you take a certain amount of money and use it to try to make more money. You can do this in several different ways, which will be explained later in this chapter.

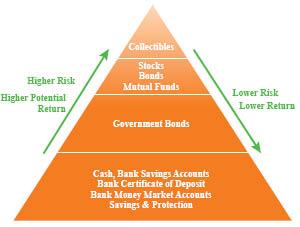

The Game of Risk

One important aspect of investing is the element of risk. There is sometimes the possibility that you won’t make any profit, or that you could lose some or all of the money you invested. The risk varies depending on the type of investment. Some investments (like bonds) are said to be no-risk or low-risk. The downside is that you won’t earn as much potential profit from these low-risk choices. In order to possibly earn really big profits, you need to take some risks. (Of course, most people who choose risky investments always think they’ve found a “sure thing” that will definitely pay off. The lure of a big payday is very tempting and can cause people to ignore the risk of losses.)

The chart below (courtesy of TheMint.org) shows the risk levels of the most common types of investments.