Financial Markets Operations Management (20 page)

Read Financial Markets Operations Management Online

Authors: Keith Dickinson

With the markets becoming more globalised, it has become necessary to regulate and supervise financial institutions of all types and sizes by means of certain requirements, restrictions and guidelines.

You will have noticed that, in recent years, there have been many examples of problems in the industry. Examples include the mis-selling of financial products, dealers exceeding their internal limits, and a decreasing confidence in the banking industry as a whole, to name but a few.

The financial regulators, usually either a government or non-government organisation, have a difficult task in ensuring that problems like these do not re-occur.

Listed in

Table 4.20

are some of the more usual objectives of the regulators.

TABLE 4.20

Regulatory objectives

| Regulatory Objectives | |

| Market confidence | Maintaining confidence in the financial system. |

| Financial stability | Contributing to the protection and enhancement of stability in the financial system. |

| Consumer protection | Securing an appropriate degree of protection for consumers. |

| Financial crime reduction | Reducing the possibilities for a regulated business to be used for financial criminal purposes. |

Supervision of the financial markets tends to cover the initial authorisation of firms to conduct business and the ongoing monitoring of their activities. Failure to comply with any rules and regulations can lead to substantial fines and even loss of authorisation. Added to this, details of fines and censures will almost certainly be reported in the press and this adds to the reputational risk for firms.

Regulation tends to be enforced on a country-by-country basis; however, regions such as Europe are becoming more regulated from the centre (i.e. Brussels). Whether local or regional, the following organisation types are supervised:

- Stock exchanges;

- Listed companies;

- Investment managers;

- Banks and other financial service providers.

There are many regulatory authorities located across the world, but listed below is just a small selection of these:

- United States

- Securities and Exchange Commission (SEC);

- Federal Reserve System (the “Fed”);

- Office of the Comptroller of the Currency (OCC).

- Securities and Exchange Commission (SEC);

- United Kingdom

- Financial Conduct Authority (FCA).

- Financial Conduct Authority (FCA).

- Continental Europe

- Federal Financial Supervisory Authority (BaFin), Germany;

- Autorité des Marchés Financiers (AMF), France;

- Autoriteit Financiële Markten (AFM), Netherlands;

- Commissione Nazionale per le Società e la Borsa (CONSOB), Italy;

- Swiss Financial Market Supervisory Authority (FINMA), Switzerland.

- Federal Financial Supervisory Authority (BaFin), Germany;

- China

- China Securities Regulatory Commission (CSRC).

- China Securities Regulatory Commission (CSRC).

- Japan

- Financial Services Agency (FSA).

- Financial Services Agency (FSA).

- Singapore

- Monetary Authority of Singapore (MAS).

- Monetary Authority of Singapore (MAS).

For a complete list of regulators, please go to the website of The International Organization of Securities Commissions (IOSCO) at

www.iosco.org/lists

. IOSCO was established in 1983 and: “⦠is the acknowledged international body that brings together the world's securities regulators and is recognised as the global standard setter for the security sector”.

20

There are various agencies that have been established for a particular product or products and that span a more global point of view. Indeed, products such as Eurobonds and OTC derivatives have no domicile. In these cases, whilst individual firms are authorised and monitored by their local regulator, the products themselves are regulated by a third-party organisation. Examples of these and other associations are noted in

Table 4.21

together with the headline product type they have responsibility for. For more details, you can visit the websites listed in the table.

TABLE 4.21

Regulators' and trade associations' websites

| Regulator/Association | Product(s)/Industry | Website |

| International Capital Market Association (ICMA) | International securities (e.g. Eurobonds) and repo agreements | www.icmagroup.org |

| International Swaps and Derivatives Association (ISDA) | OTC derivatives | www2.isda.org |

| The Financial Markets Association (ACI) | Foreign exchange, interest rate products and other securities, banknotes and bullion, precious metals and commodities and their various derivatives | www.aciforex.org |

| Various central securities depositories associations (CSDAs) | World Forum of CSDs European CSDA Asia-Pacific CSD Group Association of Eurasian CSDs Americas' CSDA Africa and Middle East Depositories Association | www.worldcsds.wordpress.com www.ecsda.eu www.acgcsd.org www.aecsd.com www.acsda.org www.ameda.org.eg |

| International Securities Lending Association (ISLA) | Securities lending and borrowing | www.isla.co.uk |

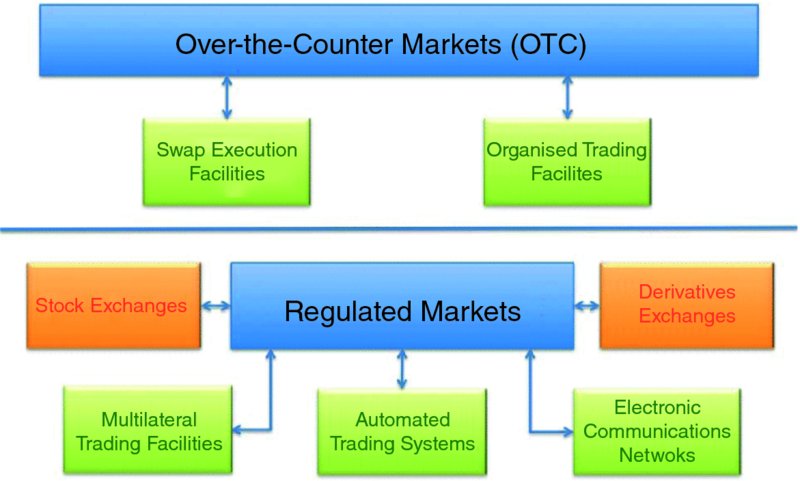

This section on market infrastructure considers the organisation types that take responsibility for the trading, clearing, settlement and custody of securities. In terms of the trading of securities, these can either be traded on a regulated market (e.g. a recognised stock exchange) or between two trading counterparties away from a market (i.e. “off exchange”) in what we refer to as the

over-the-counter market

(OTC).

Figure 4.2

distinguishes between the regulated and OTC market structures.

FIGURE 4.2

Market structure

It is difficult to judge when the first stock exchange was formed. In fact there is little consensus on this point; however, it is true to say that stock exchanges have been around for many centuries. Some say they originated in ancient Rome; others will disagree. What is true, however, is that stock exchanges provide services for certain market participants (e.g. market makers, brokers and traders) that enable securities such as equities and bonds

to be issued and subsequently traded. Traditionally, the stock exchange would have been a physical building and the trading would have taken place on the floor of the stock exchange. Furthermore, trading would not have been allowed anywhere other than the floor of the stock exchange.

Companies that wish to issue shares and raise debt through bond issues will have the securities listed on the stock exchange. Again, traditionally a security would have been listed on one particular stock exchange, more often than not in the country of the issuer. Once the securities had been issued in the so-called primary markets, then subsequent trading, known as secondary market trading, would also take place on the exchange. In today's world, there is sometimes no compulsion to have to trade listed securities on the exchange. Instead, buyers and sellers can come together away from the exchange; we refer to this as being “off exchange” (otherwise known as “over-the-counter” or OTC).

In recent times, many of the traditional stock exchanges have moved away from being a physical location to becoming computer or telephone-based. Indeed, more recently established exchanges have tended to dispense with a floor and have gone straight into trading using computers, telephones, etc.

Whilst there is no reason why any trading in today's environment should be on the floor of an exchange, there are still a few exchanges where trading continues to take place on the floor. One example where floor trading still takes place is the New York Stock Exchange. Here, specialist brokers execute trades on behalf of buyers and sellers through a process of

open outcry

. Floor trading takes place alongside computerised trading, which was introduced in the early 1970s. The exchanges system was known as the

Designated order turnaround

system (DOT).

Derivatives exchanges can either be part of a stock exchange (e.g. Singapore Exchange) or a separate entity in their own right (e.g. Shanghai Futures Exchange). A selection of derivatives exchanges is listed in

Table 4.23

.

TABLE 4.23

Selection of derivatives exchanges

| Exchange/URL | Derivatives Products | Securities Products |

| ASX (Australia) ( www.asx.com.au ) | Equity options Index Interest rates Agricultural Energy | Yes |

| Shanghai Futures Exchange (China) ( www.shfe.com.cn/en ) | Commodity futures: Non-ferrous metals Precious metals Ferrous metals Energy Natural rubber | No |

| SGX (Singapore) ( www.sgx.com ) | Equity index Foreign exchange Interest rates Dividend index | Yes |

| EUREX (Germany) ( www.eurexchange.com ) | Interest rate derivatives Equity derivatives Equity index derivatives Dividend derivatives Volatility index derivatives Exchange-traded funds Derivatives Inflation derivatives Commodity derivatives Weather derivatives Property derivatives | No |

| ICE (USA) ( www.theice.com ) | Futures and options: Energy Agriculture Financials Ferrous metals Freight Environmental OTC: ICE swap trade Physical energy Credit default swaps | No |

| Osaka Exchange (Japan) ( www.ose.or.jp ) | Index futures JGB futures Options on JGB futures TOPIX options Single stock options | Yes |

| NYSE LIFFE (part of the NYSE Euronext Group, USA) ( globalderivatives.nyx.com ) | Interest rates Equity derivatives Commodity derivatives | No |

| CME Group (USA) ( www.cmegroup.com ) | Agriculture Energy Equity index FX Interest rates Metals Options OTC Real estate | No |

Unlike securities, which are issued by the organisation that raises equity and/or debt capital, derivative products that are traded on an exchange are created by the exchange. The derivative products have nothing to do with the underlying asset (e.g. equities, bonds, commodities), although they are priced according to the price movements of the underlying assets.

These derivative products are standardised by the exchange in terms of the criteria (referred to as contract specifications) shown in

Table 4.24

.

TABLE 4.24

Contract specifications

| Contract Specification | Description | Example |

| Underlying | The asset that the contract is deliverable into/exercised into. | A government security or single shares or an index, etc. |

| Contract currency | The currency that the contract is traded and delivered in. | USD, EUR, JPY, etc. |

| Unit of trading | The size of each contract. | 100,000 nominal value, 1,000 shares in ABC, etc. |

| Quotation | The way the contract is priced. | per GBP 100 nominal, per share, etc. |

| Minimum price movement | The minimum amount that the price can move. | (Also known as tick size ) 0.01, 0.25, etc. |

| Expiry or delivery month | The month in which the contract is deliverable/exercisable. | Quarterly â March, June, September and December. |

| Trading details | Trading dates and times. | Last trading date: two business days prior to the last business day in the delivery month. Trading hours: 08:00 to 18:00. |

| Trading platform(s) | The methods for trading the contracts. | Open outcry and/or electronic platform. |

There are several non-exchange trading venues that compete with the traditional stock exchange model.

MTFs provide similar trading services, rules and market surveillance to the regulated markets. However, MTFs do not have a listing process and cannot change the regulatory status of a security.

Under new European rules (MiFID II), investment firms will have to be authorised as an MTF if they wish to operate internal matching or crossing systems in order to execute client orders.

MTFs are also obliged to make prices on existing orders available on market data feeds (pre-trade transparency) and publish trades in real time (post-trade transparency). Furthermore, there must be a consistent application of pricing and charges to all Facility members, a system rulebook and the means by which to apply for membership of the Facility.

In 2011, two pan-European MTFs, BATS Europe and Chi-X Europe, merged to form BATS Chi-X Europe. The merged entity became a Recognised Investment Exchange in 2013. According to its press release dated 4 December 2013, BATS Chi-X Europe had 23% overall market share in Europe.

21

An ATS is the US equivalent of an MTF in Europe. They are similar in concept to MTFs, in that they provide a marketplace for buyers and sellers to trade in securities. There are, however, some differences between an ATS and an MTF, for example:

- They do not perform self-regulation;

- They do not necessarily provide public information on prices;

- They do not set rules governing the conduct of ATS subscribers.

In the USA, ATSs are regulated as broker/dealers and are regulated differently than traditional stock exchanges.

According to a paper prepared by the SEC's Division of Economic and Risk Analysis (DERA),

22

there are 35 broker/dealers operating 44 ATSs, and trading on the systems comprises 10â15% of US equity trading volume. Lists of current ATS operators (including ECNs â see below) can be found on the SEC website at

www.sec.gov/foia/docs/atslist.htm

.

An ECN is a type of ATS that enables traders and institutional investors to deal directly amongst themselves without the need to go through an exchange/OTC market maker.

ECNs include Instinet (Institutional Network), which was established in 1969 and enables US institutions to trade directly with each other. The system was opened to broker/dealers and NASDAQ market makers in 1983.

By contrast to the stock exchange trading system, the over-the-counter (OTC) market is an off-exchange system where trading is carried out directly between the buyer and the seller. There is no stock exchange involvement with this. As with exchange trading, OTC trading occurs with financial instruments such as derivatives and Eurobonds.

In the OTC derivatives market, transactions in financial instruments such as interest rate swaps are tailored by the counterparties themselves rather than a derivatives exchange. Whilst this leads to innovation and bespoke products, there is a high degree of opacity due to the fact that there is no centralisation of the products; in other words, the only counterparties who know about the product, and the transaction, will be the buyer and the seller. This can lead to a variety of risks, including, for example, counterparty risk. In recent years, the global regulators have been concerned with this risk (and other types of risk as well) and have taken steps to introduce what is known as

centralised clearing

into the system. We will come across central counterparties (CCPs) in Chapter 5: Clearing Houses and CCPs.

A second major reform is the formation of new platforms for trading OTC derivatives electronically. In the USA, these new platforms are known as

swap execution facilities

(SEFs), and an SEF is defined as “⦠a facility, trading system or platform in which multiple participants have the ability to execute or trade swaps by accepting bids and offers made by other participants that are open to multiple participants in the facility or system, through any means of interstate commerce”.

23

In Europe, the EU has proposed a similar approach by means of the establishment of

organised trading facilities

(OTFs) defined as “⦠any system or facility, which is not a regulated market or MTF, operated by an investment firm or a market operator, in which multiple third-party buying and selling interests in financial instruments are able to interact in the system”.

24

Whilst there are some key differences in these definitions, the overall objective is to move OTC derivative instruments and trading onto an exchange-type environment (i.e. an SEF or an OTF) with increased transparency and regulatory oversight. Differences include:

- OTFs are designed to trade equities, commodities and other derivatives rather than just swaps (as under SEFs).

- The OTF model includes the ability to use execution models that include voice brokerage as well as electronic trading.

The Eurobond market is a variation on the OTC theme. Whilst many Eurobond issues are listed in Luxembourg and London, none are domiciled in any country. This means that as there are no domestic exchanges on which to trade, trading takes place “off exchange”. The Eurobond industry is regulated by the International Capital Market Association as a Self-Regulated Organisation and its Rule Book covers the trading and settlements of this product type.