Financial Markets Operations Management (27 page)

Read Financial Markets Operations Management Online

Authors: Keith Dickinson

At the moment that a transaction is executed, both counterparties enter into a legally-binding contract to either deliver an asset against cash or pay cash against receipt of an asset. It is therefore imperative that both counterparties recognise their transactions not only from their point of view but also from their counterparty's point of view.

How might these points of view differ? Here are some possible examples:

- One or both of the counterparties might make a mistake when entering the transaction details either into their automated systems or onto a manual dealing sheet.

- Both counterparties might assume that they have purchased securities when, of course, one counterparty will purchase and the other will sell.

- The price may have been misheard or miskeyed; this can happen especially when trading takes place by open outcry or over the telephone.

It is therefore quite possible to get any of the transaction details incorrect for one reason or another. For this reason, counterparties will confirm their transaction details with each other at the earliest possible opportunity. Counterparties must ensure that:

- They send a confirmation to their counterparty; and

- Make sure they receive their counterparty's confirmation and check it for accuracy. Where there are inconsistencies, staff should check their own records and contact their counterparty.

Where direct market participants (e.g. market makers, dealers, traders and brokers) have traded with each other, it is normal market practice for both participants to exchange confirmations with each other. Furthermore, it is expected that this process should be completed by close of business on the trade date.

There are two main ways of constructing a confirmation:

- Sending a SWIFT message using a Message Type 517: Trade Confirmation Affirmation (MT517) or Message Type 518: Market-Side Securities Trade Confirmation (MT518). In the settlement simulation we use a slimmed-down version of the MT518 to confirm trades; see

Figure 7.13

for the purchase of 5,000 IAG shares. - Using an electronic trade confirmation system (ETC) as provided by companies such as Omgeo (

www.omgeo.com

), SmartStream (

www.smartstream-stp.com

) and Traiana (

www.traiana.com

).

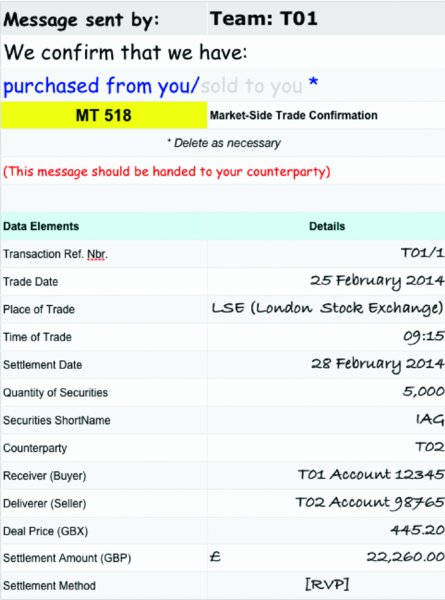

FIGURE 7.13

Outgoing trade confirmation

Once you have sent the MT518, you can tick the “Yes” box on the [Confirm Out] box loc- ated at the bottom of the trade ticket (see

Figure 7.11

) or flag the system that this has been done.

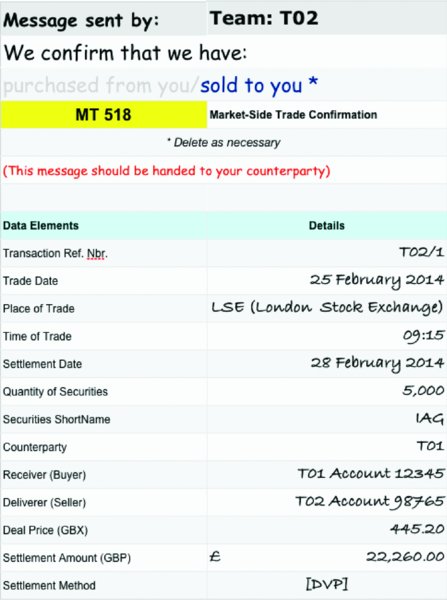

The incoming MT518 from counterparty T02 for its sale of 5,000 IAG shares is shown in

Figure 7.14

.

FIGURE 7.14

Incoming trade confirmation

Once you have received and checked the incoming MT518, you can tick the “Yes” box on the [Confirm In] box on the trade ticket (see

Figure 7.11

) or flag the system that this has been done.

Until 1992 the only way to legally agree trade details was by using paper confirmations. On many occasions these paper confirmations either arrived late or not at all. A group of brokers and buy-side institutional investors came together to develop a system that would enable firms to accurately agree confirmation details on the trade date. This system was called

electronic trade confirmation

(ETC).

As we saw above, confirmations are exchanged for trades executed between two market participants. The situation is slightly different where a market participant (e.g. a broker) has dealt on behalf of a buy-side financial institution such as an investment management company.

As the investment management company is regarded as a client, it is not appropriate for it to generate a trade confirmation. This results in a one-way situation where the broker sends a confirmation note to the investment management company.

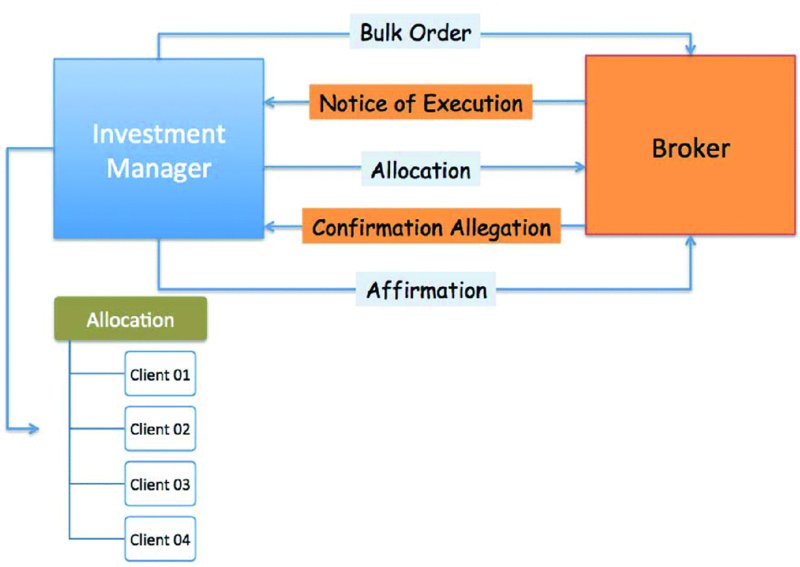

The principles of trade affirmation are straightforward and involve the following steps:

- The broker alleges transaction details electronically using an ETC system;

- The investment management company's system automatically compares the affirmation details with its own records; and

- Either agrees (i.e. affirms) electronically with the broker or rejects the message and both parties investigate the discrepancy.

The target date for affirmation completion is typically by T+1 at the latest; this extra day is to enable the investment management company to calculate trade allocation numbers and to advise its broker accordingly. Best practice encourages affirmation on T+0, i.e. on the trade date itself. This is known as

same-day affirmation

(SDA).

Trade allocation is required when an investment management company places a bulk order with a broker on behalf of several underlying clients. The broker will execute the bulk order and advise the investment management company of the transaction details. The investment manager (IM) must then let its broker (B) have a breakdown of the bulk order into its component parts client by client. In the example shown in

Table 7.5

, a bulk order for 5 million ABC shares is sent to the broker.

TABLE 7.5

Bulk order and trade allocation

| ABC Shares | Client | From | To | |

| Bulk order | 5,000,000 | â | IM | B |

| Execution | Purchase 5,000,000 | â | B | IM |

| Allocation | 500,000 | Client 01 | IM | B |

| Allocation | 1,000,000 | Client 02 | IM | B |

| Allocation | 1,500,000 | Client 03 | IM | B |

| Allocation | 2,000,000 | Client 04 | IM | B |

We can see that a bulk order of 5 million shares is allocated to four clients in the proportions noted in the table. There are two points to note here:

- If the broker is not able to execute the bulk order at one price, it might need to make a series of transactions at different prices. From this, an average price will be calculated.

- In our example, there are four clients; in reality there could be many clients to whom the bulk order will be allocated.

In

Figure 7.15

, we can see a graphical representation of the trade confirmation/affirmation process.

FIGURE 7.15

Trade affirmation/confirmation

In summary, the bulk order is executed in the market and transformed through the allocation process into four separate transactions, each with its own clearing and settlement processes.

In markets where there is a short settlement cycle (e.g.

T

+2), the idea of trade affirmation happening on

T

+1 potentially becomes unworkable, as this leaves very little time for the remaining clearing and settlement processes to take place. SDA has been defined

3

as: “The agreement of all trade details on the trade date between a broker/dealer and an investment manager (or their agent)”. Omgeo also stated that there was a direct correlation between high SDA rates and high settlement rates.

As the markets, and Europe in particular, move towards shorter settlement cycles, SDA will become a necessity.

Not only does SDA enable shorter settlement cycles to occur but there are also direct benefits including risk reduction (e.g. reduced settlement fails) and cost efficiencies

(e.g. reduced operating costs). In addition, SDA can be seen as an enabler in the move to harmonise settlement practices, straight-through processing and information flows.

We have now reached the stage where trades have been executed and either confirmed or affirmed so that both buyer and seller are legally aware of the contract details.

At this stage, a clearing house or central counterparty (CCP) becomes involved. Both the buyer and seller (or their respective agents) must prepare settlement instructions that are sent to the clearing house/CCP for matching.

There are four types of settlement instruction (see

Table 7.6

).

TABLE 7.6

Settlement instruction types

| Instruction | Description | SWIFT Message Type |

| Receive versus payment (RVP) | Buyer's instruction to settle its purchase of securities against simultaneous payment of cash. | MT541 |

| Delivery versus payment (DVP) | Seller's instruction to settle its sale of securities against simultaneous receipt of cash. | MT543 |

| Receive free of payment (FoP) | Buyer's instruction to settle its purchase of securities or inbound transfer of securities. Cash paid separately. | MT540 |

| Deliver free of payment (FoP) | Seller's instruction to settle its sale of securities or outbound transfer of securities. Cash received separately. | MT542 |

Most purchases and sales require RVP and DVP instructions. Free of payment instructions are used in situations such as:

- When the movement of securities occurs separately from the movement of cash. An example would be an investor who buys securities and arranges for them to be delivered to his custodian but makes a payment from another bank.

- When the movement of securities is not associated with a cash counter-value. An example would be where an investor requests his custodian to transfer securities from one of his portfolios to another (where both portfolios are held by the same custodian).

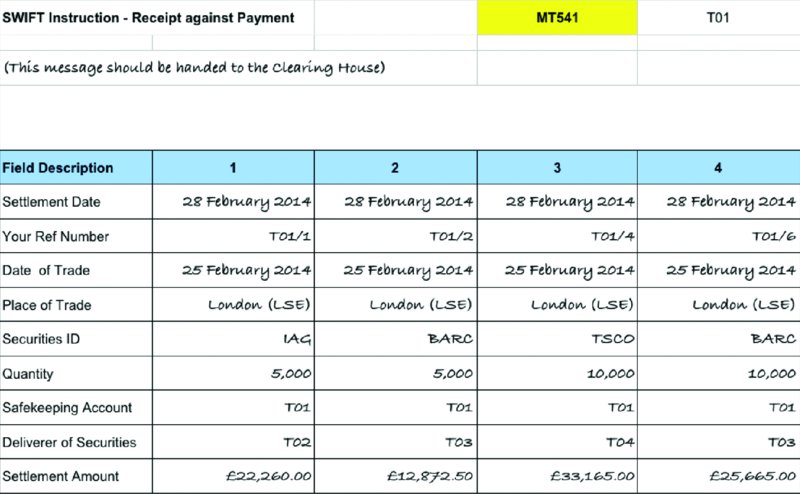

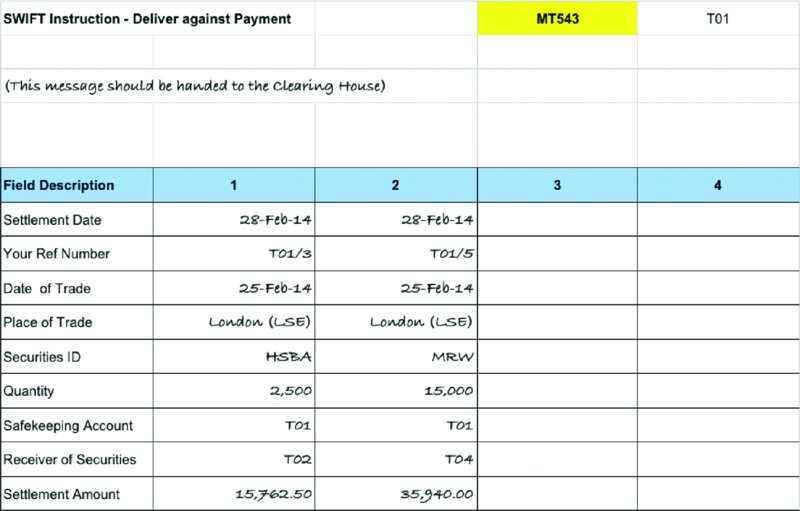

Returning to our settlement simulation example, trading company T01 had executed six transactions, of which four were purchases and two were sales. We should therefore prepare four MT541s and two MT543s. As before, we have prepared basic versions of these two SWIFT message types and entered them on to separate spreadsheets (see

Figures 7.16

and

7.17

).

FIGURE 7.16

Receive versus payment

FIGURE 7.17

Delivery versus payment

The six instructions noted above will be submitted by T01 to the appropriate clearing house. For their part, the three counterparties alleged in T01's instructions will submit their instructions.

The object of instruction matching by the clearing house is to ensure that any one transaction is represented by two instructions â one for delivery and one for receipt.

On receipt of any instruction, the clearing house will validate the instruction message to ensure that the information is potentially correct. Validation might include:

- Checking that the quantity meets the board lot size characteristics for that particular security. For example, an instruction for USD 1,000 of a bond will be rejected if the board lot size is USD 10,000.

- Checking that the settlement amount looks reasonable. If not, there is the possibility that an incorrect price has been used in the calculation. For example, if the settlement amount for the purchase of 5,000 IAG shares (reference T01/1 above) was GBP 24,000.00, that would suggest a price of GBX 480.00 was used. As the market was GBX 445.20 at the time of the trade, the difference of GBX 34.80 is 7.82% above the market price and above an acceptable tolerance of, say, ±3.00%.

The clearing house will attempt to match receipt instructions with delivery instructions either in real time or on a batch process. The matching process will result in two outcomes:

- Instructions that match, i.e. the clearing house identifies RVP and DVP instructions that relate to the same transaction.

- Instructions that do not match, i.e. the clearing house is unable to match an RVP with a corresponding DVP.

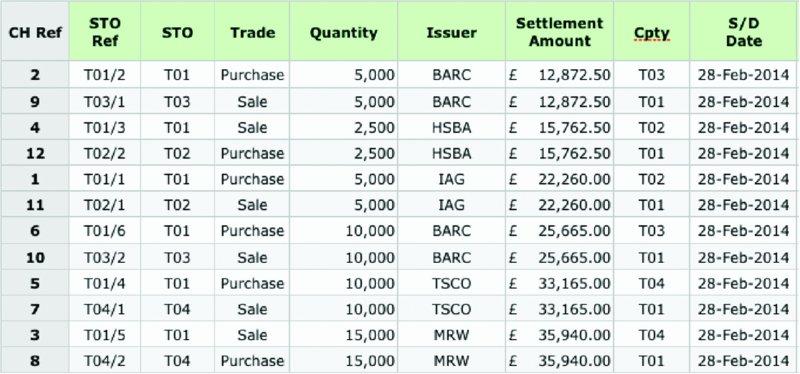

In

Figure 7.18

you will see that all the counterparties have submitted their instructions and the clearing house has attempted to match these instructions one against another.

FIGURE 7.18

Clearing house instructions v1

As all the instructions for the six transactions match, the clearing house will be in a position to allow the transactions to settle subject to there being sufficient cash for the purchases and availability of the securities for the sales.

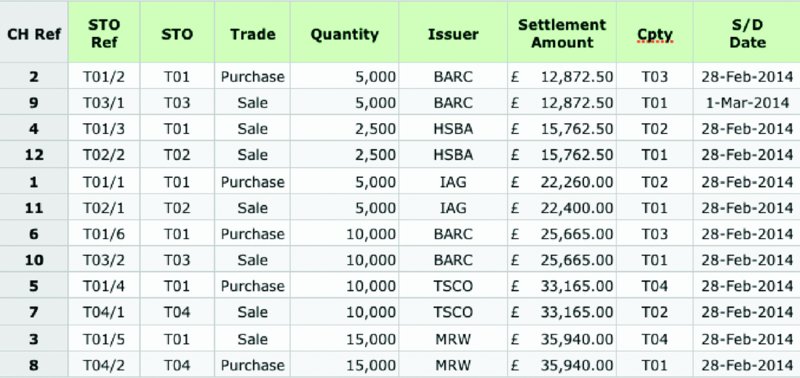

In

Figure 7.19

, you will find a second version of the clearing house's instruction capture system.

FIGURE 7.19

Clearing house instructions v2

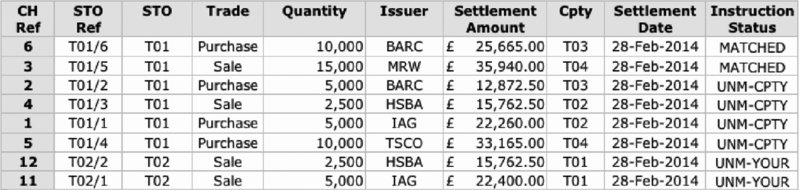

For each of the four unmatched instructions, the clearing house is not able to choose which instruction is actually correct. In fact, they all appear feasible! To resolve the problems, the clearing house will send a report to each counterparty listing both the matched and the unmatched instructions.

In addition, with the unmatched instructions, the clearing house will report to both the instructing counterparty and the alleged counterparty. Examples for counterparties T01 and T02 are shown in

Figures 7.20

and

7.21

.

FIGURE 7.20

Clearing house matched report to T01

FIGURE 7.21

Clearing house matched report to T02

Please note that there are three possible outcomes under instruction status:

- MATCHED: Both halves of the transaction have been matched by the clearing house.

- UNM-CPTY: This is your instruction that has not been matched by your counterparty.

- UNM-YOUR: This is your counterparty's instruction that you have not matched.

The counterparties concerned will need to investigate the unmatched items and contact their counterparties. Whoever was at fault will need to correct their instruction(s) so that we end up with the situation in

Figure 7.18

“Clearing house instructions

v1”.

In an ideal situation, all counterparties should be able to submit their instructions to the clearing house on T+1 at the latest, especially if this is via an automated STP system. Otherwise, instructions that are manually re-keyed might struggle to be submitted by T+1, with T+2 being more realistic. Manual re-keying on this basis will be impractical when settlement cycles contract to T+2.

Unmatched instructions can never settle, and in circumstances where instructions are unmatched on the settlement date, the party at fault can expect to receive an interest claim from their counterparty.

Let us assume that the clearing house has received and matched all the instructions. The clearing house now makes a judgement as to which transactions will settle or fail to settle. We will cover the topic of settlements in the next chapter, but in the meantime, the clearing house needs to verify that there are sufficient cash funds and securities balances to enable the transactions to settle.