Free Lunch (9 page)

Authors: David Cay Johnston

“What's different today from the sixties is the drug problems and the gang members,” Price said. Back then

the city had money to keep kids busy. Gangs were a much smaller problem, their pool of recruits kept out of trouble by an almost

limitless supply of organized activities from softball games to making sculptures with Popsicle sticks and glue. The city also

provided jobs to college students, who enforced, however inexpertly and unevenly, boundaries on behavior. But as the budgets

were cut, healthy activity faded away, gangs rose to deadly prominence, and drugs became freely available until, Price said, “about

once a month, I have to call the paramedics because someone OD'd.”

Price and other

recreation workers, including part-timers, were told their job duties included maintaining order, which often meant telling drug

users and gang members to leave. Few were courageous, or foolish, enough to confront gang members. But when they called the

police for help the cops often failed to show. When they did, the cops usually came in several cars, each with two officers carrying

guns and wearing Kevlar vests. “It's dangerous here and the city won't even talk about hazard pay,” Price observed

dryly.

At two dozen parks, groups of children gave interviews to a stranger in which they

articulated the boundaries of various gangs. There were few differences of opinion about which streets were safe to cross. Some

boys and girls said they wished they could go swimming on hot days, but they almost never did because between their homes and

the public pools lay territory too risky to cross, even with a grown-up holding their hand. All of these youngsters were familiar with

a chilly entry into the lexicon of urban lifeâthe drive-by gang shooting.

Wise as they were to

nuances of gang culture and geography, few of these children, who were mostly between 7 and 11, had been to Disneyland. Most

had seen images of the Magic Kingdom on television, yet had no idea it was within an hour's drive. In the parks where fee money

was abundant, however, everyone seemed to have a story about one of their visits to Disneyland, some from trips organized at

their neighborhood park recreation center.

Among the youngsters at the dead parks, hardly

any had actually seen the Pacific Ocean beaches, even though they lived within a few miles of the shore. Not one child asked how

he or she might get to the beach or pursued the stranger's suggestion that, since the beaches were free, they could play on the

sand and in the waves all day if their parents took them. Many said they had seen the beaches on television, but that was their only

connection to what most Southern California youths treat as a birthright, the beach culture of sun, surf, and fun music. In park after

park, their answers were a depressing indication of the tight boundaries that life had already imposed on their expectations for

their futures.

The proponents of markets as the solution to all problems want to eliminate

public parks. Some of them attack parks on moral grounds, while others say they are economically inefficient or demonstrate how

socialism pervades American society, threatening freedom.

The Cato Institute, the nation's

leading promoter of libertarian ideals, laid out the case for eliminating public parks in 1981. The second issue of the

Cato Journal

called for “the outright abolition of public ownership and the transfer of the

parks to private parties” because financing parks through tax dollars means “coercion.” Instead, Cato argued, “existing public

parks could either be given away or sold to the highest bidder.”

A key assertion was that

because visitors are not charged, parks are overused. That is the exact reverse of what happened in Los Angeles. Park use was

heaviest where people were affluent enough to pay fees. In poor and working-class neighborhoods, cuts in government spending

and a lack of private resources to replace public funding resulted in woefully underused parks.

Milton Friedman, the intellectual godfather of market-solution prophets, urged the elimination of national

parks when he was Barry Goldwater's economic adviser in the 1964 presidential election. As for city parks, Friedman wrote that

putting up tollbooths to charge everyone entering would be too complicated given the small size and multiple entry points of most

parks. This was presented as a matter of reluctant practicality, not principle.

Ranking not far

below Friedman in the pantheon of market-solution prophets are F. A. Hayek, and Ludwig von Mises, who was Hayek's mentor.

Hayek won a Nobel in economics and his book

The Road to Serfdom

is a key part of

the free market economic gospel.

The Ludwig von Mises Institute denounced public parks in

2007 as “nature socialism.” The institute declared that “the formation of state and national parks must, at some point, use

aggression” because even when parkland is donated to government “from that point on its maintenance and management would

require victimization through further taxation.” Any land owned by the government involves “the violation of rights,” the von Mises

Institute concluded.

Such arguments may seem extreme because they have received little

news coverage. The nutty idea that parks pose a danger to freedom is widely discussed, however, among those who have been

making government economic policy for much of the past three decades. And these ideas, and the journals in which they are

presented, are basic source documents for the influential editorial page of

The Wall Street

Journal

, which champions policies that make the rich richer.

Under even

sharper assault are special-purpose public parks, notably municipal golf courses. In North Carolina, the San Francisco Bay Area,

and other places municipal golf courses are denounced as subsidy schemes because their fees typically do not cover their full

costs, at least not the way the money is accounted for in city budgets.

Whether these golf

courses may save money by, for example, keeping people active and thus holding down Medicare costs is not measured in city

budgets or contemplated by market ideologues. Nor is the aesthetic benefit of greenery in tightly packed cities. What is most

curious, though, is that these attacks ignore using the market to measure the value of parks. Land near urban parks typically sells

for significantly more than land without such amenities. The extra property taxes thus generated have been shown in some places

to more than make up for the untaxed value of parks even when they generate no fees.

Suggestions that municipal golf courses serve a public purpose, that they add a thread to social cohesion

and stability, are rejected out of hand. The market ideologues see only a subsidy for those affluent enough to afford golf clubsâor

children allowed on a swing without paying a fee. People who buy tickets to a movie theater, the argument goes, get no such

subsidy.

Besides, the Friedmanites say, government should not be competing with private golf

courses. The land should be sold to developers, at least in San Francisco, the money used to relieve the burden of taxes. Thomas

Sowell, the economist who holds the Friedman chair at Stanford's Hoover Institution, and the John Locke Society barely give a nod

to the idea of parks as amenities that help sustain a healthy society, the idea of parks championed by John Mullaly.

At the same time that public parks have atrophied in many cities for lack of public funds to maintain them, the

market for commercial ballparks is flourishing, as we shall see in the next chapter.

6

PRIDE AND PROFITS

F

ROM ST. PETERSBURG TO ST. LOUIS AND BEYOND, CITIES THAT

DID

not have a big-league baseball, football, hockey, or basketball team have built

stadiums and arenas in the hope that they would come. Smaller cities, like Rochester, New York, built stadiums for less popular

sports like professional soccer, even when there was no hope the facilities could pay for themselves. Often there was no sign that

team owners had put their own money at risk.

The beneficiaries of this spending pepper the

Forbes 400 list of the wealthiest Americans. At least 27 of these billionaires own major sports teams. Nearly all of them have their

hands out.

Arthur Blank, a founder of the Home Depot, owns the Atlanta Falcons football team.

Mark Cuban, the Internet entrepreneur, owns the Dallas Mavericks basketball team. H. Wayne Huizenga, who made a fortune in

trash hauling and another with Blockbuster, owns the Miami Dolphins football team. Mickey Arison, whose Carnival line carries half

of all cruise passengers, owns the Miami Heat basketball team. They are just a few of the billionaire owners of commercial sports

teams who have stuffed gifts from the taxpayers into their already deep pockets.

The billionaire

team owners seek these payments because commercial sports is not a viable business, at least not as it is operated in America.

Although baseball, basketball, football, and hockey teams are all privately held, they disclose limited information about their

finances. From that data, one crucial fact can be distilled: while some teams are profitable, overall the sports-team industry does

not earn any profit from the market. Industry profits all come from the taxpayers.

In a market

economy, the team owners would have to adjust or cover the losses out of their own deep pockets. Instead they rely on the

kindness of taxpayers to enrich themselves at the expense of the vast majority who never attend these sporting

events.

Subsidies for sports teams have grown steadily. From 1995 through 2006, local, state,

and federal governments spent more than $10 billion subsidizing more than 50 new Major League stadiums and countless minor

league facilities. “This trend is only accelerating: Government spending on sports facilities now soaks up more than $2 billion a

year,” Neil deMause, author of the book and Web site

Field of Schemes

told Congress

in 2007.

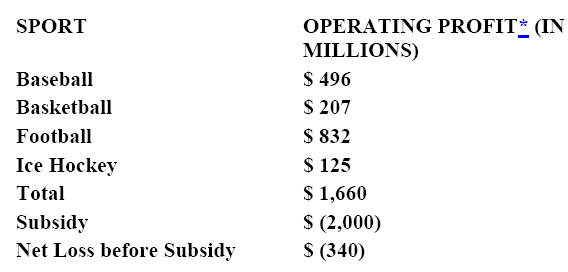

According to

Forbes

magazine, the Big

Four sports had revenues in 2006 of $16.7 billion. They counted a tenth of that, slightly less than $1.7 billion, as operating income,

which is one way to measure profits.

Putting together the estimates by

Forbes

and deMause shows that the entire operating profit of the commercial sports industry

comes from the taxpayers. The subsidies, in fact, cover a third of a billion dollars in operating losses before this boost from the

taxpayers pushes the industry into the black.

COMMERCIAL SPORTS

*

Before interest, taxes, depreciation, and debt repayment

Sources:

Forbes; Field of

Schemes

Another way to look at these figures is to

consider the subsidy a discount on the prices fans pay for tickets. There are about 135 million tickets sold by the Big Four

commercial sports each year, so the subsidy equals about $15 per ticket. As we shall see, however, the subsidies do not actually

flow to the ticket buyers, who instead pay above-market prices.

Also, the figures from

Forbes

cover only operating profits and losses, not all costs. No business or industry can

continue in the long run without covering all of its costs. Not taken into account by

Forbes

were interest paid on borrowed money, taxes, and paying down debt. Add in those

costs and the actual losses for the commercial sports industry, absent subsidies, are far greater than $340 million a

year.

Subsidy economics tends to drive prices up, not down, as recipients chase subsidies

more than customers. Adam Smith figured this out in 1776. He examined the subsidies in his day for commercial fishing. In his era

the word

bounty

referred to gifts the government bestowed on the owners of herring

ships. He concluded that to collect subsidies, people will appear to engage in a commercial activity. Smith wrote:

The bounty [subsidy] to the white-herring fishery is a tonnage bounty; and is

proportioned to the burden [size] of the ship, not to her diligence or success in the fishery; and it has, I am afraid, been too

common for vessels to fit out for the sole purpose of catching, not the fish, but the bounty.

To see how that observation applies to commercial sports, consider the failing Montreal Expos baseball team.

Major League Baseball, which is a corporation jointly controlled by the team owners, bought the Expos in 2002. They kept the team

in Canada for three more years, sustaining losses equal to what they paid for the team. Then Major League Baseball moved the

franchise to the District of Columbia, renaming the team the Washington Nationals. The next year the league sold the team to a

group of politically connected investors led by Theodore N. Lerner, a billionaire Maryland real estate developer. The Lerner group

paid $450 million. Selling to the Lerner group allowed the other owners to recover what they had spent and make a profit of about

$210 million. That is an extraordinary return on investment, nearly doubling the league's money in four years.

What caused the value of the team to more than double in four years? Did the market for baseball suddenly

turn red-hot with fans eager to attend? Not at all. Major League Baseball attendance in 2005 was virtually the same as in 2000, the

league's statistics show. Instead, the billionaires who own Major League Baseball went fishing for a subsidy.

Even before they moved the team, Major League Baseball sought taxpayer money for a new stadium in

Washington. Eventually the city government agreed to spend $611 million on a new stadium. More than anything else, it was that

subsidy that made the value of the team rise. In effect, the billionaire owners of the 30 Major League Baseball teams received a

transfer of wealth from the taxpayers just by moving a failing team to a city willing to lavish more than a half billion taxpayer dollars

on a new stadium.

Lerner's group appeared to pay a lot of money for the team. In reality, they

got the team for free and may even turn out to have been paid to buy the team. How? The purchase price was $450 million while the

subsidy is worth $611 million, or $161 million more than the purchase price.

If Lerner's group

can capture just three-fourths of the subsidy, they will have effectively acquired the team for free. As we shall see in the next

chapter, even a badly managed team was able to capture 80 percent of its subsidy, more than the Lerner group needs to make its

effective purchase price zero. If the Lerner group captures more of the subsidy, then they will in effect have been paid to acquire

the team.

Further, the Lerner group gets to sell the naming rights for the new stadium, a gift

from the taxpayers worth many tens of millions of dollars. Citigroup, the bank and insurance company, is paying $20 million a year

for two decades to have its name on the new Mets stadium in New York. A British bank, Barclays, agreed to pay the same amount

once a new arena is built in Brooklyn for the New Jersey Nets basketball team, which plans to change its name to the Brooklyn

Nets. (While that basketball arena benefits from free land and all sorts of tax breaks, it is mostly privately funded.)

But even that is not the end of it. The Washington Nationals have announced that when they move into their

new stadium in 2008 they will raise ticket prices to almost the highest among the 30 Major League teams. The average price for

season tickets will rise 42 percent, from $21 a game to $30. The most expensive seats will nearly triple to $400 from $140. Baseball

teams moving into subsidized new stadiums and arenas on average raise ticket prices by 41 percent and some have doubled their

average admission price, deMause calculated.

These increases will mean less spending by

consumers on other recreational activities, from nightclubs and movie theaters to video arcades. One proof of this was observed

by economists who study commercial sports subsidies. During the long baseball strike of 1994, business at bars and nightclubs in

league cities boomed, cash registers filling with dollars not spent on expensive baseball tickets and stadium hot

dogs.

What is truly perverse in the case of the Nationals is the reason that this particular team

can charge so much for its best seats. These seats are not, as one might imagine, those closest to the action on the field. Instead,

they are the seats that are in the sight lines of television cameras. Getting on television is valuable to politicians trying to implant a

memory of their faces in the same way that shampoo bottles come in distinctive shapes, as visual clues to encourage purchases

without thinking. Also, being seen with powerful officials has value for the rich and their lobbyists. A leading sports marketing

consultant, Marc S. Ganis, noted that any sports franchise around the nation's capital can command sky's-the-limit prices for seats

that enhance this symbiotic relationship between elected and corporate powers. “There is always a market for those great seats,

especially those that are in the television camera angles,” Ganis said. “With a new stadium in the nation's capital, where visibility

and proximity to power is most important, these seats should sell very easily.”

Less visible are

commercial sports-team finances. In 1997 Paul Allen, cofounder of Microsoft and at the time the fourth-richest man in America, with

a net worth of at least $21 billion, put 18 lobbyists to work engineering $300 million of Washington State taxpayer money for a new

football stadium. The total cost to taxpayers for this gift is far larger than the advertised figure. By some estimates it totals close to

three times the amount advertised. Once this public gift was assured, Allen bought the Seattle Seahawks football

team.

This gift came with a condition, however. The law authorizing the subsidy requires that

“a professional football team that will use the stadium” must disclose its revenues and profits as a condition of its lease to use the

stadium. But Allen makes public only the finances of the shell company that signed the lease, First & Goal, not the team itself.

Christine Gregoire, when she was state attorney general, promised that she would enforce the disclosure clause. But after the

Democrat was elected governor in 2004, she had other priorities. (The Seattle Mariners baseball team, which is subject to a similar

requirement, discloses team profits.)

The huge gifts of money that wealthy owners of sports

teams wheedle out of taxpayers are a free lunch that someone must fund. Often that burden falls on poor children and the

ambitious among the poor. Sports-team subsidies undermine a century of effort to build up the nation's intellectual capacity and,

thus, its wealth. Andrew Carnegie poured money from his nineteenth-century steel fortune into local libraries across America

because he was certain it would build a better and more prosperous nation, which indeed it did. These libraries imposed costs on

taxpayers, but they also returned benefits as the nation's store of knowledge grew. That is, library spending is a prime example of a

subsidy adding value.

Many people born into modest circumstances have risen to great

heights because they could educate themselves for free, and stay out of trouble, at the public library. To cite one example, Tom

Bradley, the son of a sharecropper, learned enough at the local library as a boy to join the Los Angeles Police Department. He rose

to become its highest ranking black officer in 1958 when he made lieutenant. Bradley went on to be mayor for two decades. But

today library hours, as well as budgets to buy books, have been slashed in Los Angeles, Detroit, Baltimore, and other cities, yet

there is plenty of money to give away to sports-team owners.

Art Modell, who pitted Cleveland

and Baltimore against each other in a bidding war for his football team, was asked in 1996 about tax money going into his pocket at

a time when libraries were being closed. It was a well-framed question. His Baltimore Ravens is the only major sports team whose

name is a literary allusion, to the haunting poem by Edgar Allan Poe for his lost love Lenore.