I.O.U.S.A. (21 page)

Authors: Addison Wiggin,Kate Incontrera,Dorianne Perrucci

Tags: #Forecasting, #Finance, #Public Finance, #Economic forecasting - United States, #General, #United States, #Personal Finance, #Economic Conditions, #Economic forecasting, #Finance - United States - History, #Debt, #Debt - United States - History, #Business & Economics, #History

In the past, when we ran large budget defi cits, for example, our government turned to Americans to borrow that money.

After World War II, almost all the federal debt was owed to Americans. Today, with our extremely low national savings rate, we have no choice but to turn to foreigners to fi nance our debt.

U.S. debt held by foreigners totaled $ 2.5 trillion as of March 2008, the Concord Coalition recently told the Mankato, Minnesota,

Free Press,

and we borrow $ 711 billion more from the rest of the world than we lend to it. Just as the citizens of Thriftville became wary as their amount of Squanderbonds began to pile up, foreign investors are becoming increasingly concerned with the U.S. debt that they hold — especially as the dollar falls in value.

During World War I, the U.S. government (and, occasionally, celebrities) turned to its citizens to help fi nance the country ’ s debt that had been incurred during the war through the purchase of

war savings bonds.

While popular decades ago, savings bonds have become all but obsolete in recent years, and direct investments in the United States provide only about a tenth of what is needed to fi nance the country ’ s debt. This said, the U.S. government has become increasingly dependent on overseas investment and the foreign purchase of U.S.

Treasury bonds to fi nance their burgeoning debt.

Foreign ownership of U.S. debt and foreign investment in U.S. companies in and of itself is not harmful — it is what the

free market

theory is based on. However, as a larger and larger percentage of U.S. assets are owned abroad, combined with a c04.indd 69

8/26/08 8:59:55 PM

70 The

Mission

low or negative national savings rate, this situation becomes

Free Market

Theory:

A market

problematic.

is governed by the

Former Treasury Secretary Robert Rubin explains that

laws of supply

although this occurrence is a side effect of the United States ’

and demand, and

current fi scal situation, as more and more of these Treasury

not by regulation

or government

bonds pile up in other countries, “ it will create unease abroad

interference.

and in foreign capital markets, which would then translate back into higher interest rates in this country and a lower currency than would be the case if we were dealing only with our own domestic markets. The bottom line is that it creates a somewhat greater risk of adverse interest rate effects and currency effects than if the debt was domestically held. ” (See Figure 4.2a and 4.2b. )

“ There ’ s nothing inherently wrong with this in the short -

term, ” says David Walker, “ and the truth is America lends money to other countries. However, as our reliance on foreign lenders increases every year, one might ask, what are the longer - term consequences? ”

In August 2007, the United States almost found out the answer to that question, when China threatened to liquidate SOURCE: President’s 2009 Budget

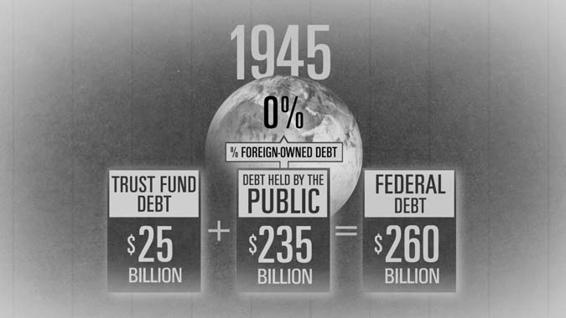

Figure 4.2a

Public, Private Debt: Debt Held by Foreigners — 1945

Source:

President ’ s 2008 budget.

c04.indd 70

8/26/08 8:59:55 PM

Chapter 4 The Trade Defi cit

71

SOURCE: President’s 2009 Budget

Figure 4.2b

Public, Private Debt: Debt Held by Foreigners — 2007

Source:

President ’ s 2008 budget.

its $ 1.3 trillion in U.S. Treasuries if the U.S. government continued to insist on placing tariffs on Chinese exports. Basically, the Chinese were fl exing their economic muscles. Since 2005, when China depegged its currency, the yuan, from the U.S. dollar, the United States has been on China ’ s case to revalue the yuan, or make the dollar value of the yuan higher. “ Instead of a dollar being worth 8 yuan, for example, Washington wants the dollar to be worth only 5.5 yuan, ” explains Paul Craig Roberts in an article called

“ China ’ s Threat to the Dollar is Real,”

published by CounterPunch on August 9, 2007. ” “ Washington thinks that this would cause U.S. exports to China to increase, as they would be cheaper for the Chinese, and for Chinese exports to the United States to decline, as they would be more expensive. This would end, Washington thinks, the large trade defi cit that the United States has with China. ”

In order to force the yuan revaluation, the United States was threatening to impose trade sanctions on Chinese goods.

In response, China threatened to dump its Treasury holdings —

a move that the media coined China ’ s “ nuclear option, ” since this act would destroy the U.S. dollar. This struck a cord with c04.indd 71

8/26/08 8:59:56 PM

72 The

Mission

U.S. offi cials who were well aware that the Chinese had them over a barrel.

Paul Craig Roberts continues: “ Despite China ’ s support of the Treasury bond market, China ’ s large holdings of dollar -

denominated fi nancial instruments have been depreciating for some time as the dollar declines against other traded currencies, because people and central banks in other countries are either reducing their dollar holdings or ceasing to add to them. China ’ s dollar holdings refl ect the creditor status China acquired when U.S. corporations off - shored their production to China. Reportedly, 70 percent of the goods on Wal - Mart ’ s shelves are made in China.

“ China has gained technology and business knowhow from the U.S. fi rms that have moved their plants to China.

China has large coastal cities, choked with economic activity and traffi c, that make America ’ s large cities look like country towns. China has raised about 300 million of its population into higher living standards, and is now focusing on developing a massive internal market some four to fi ve times more populous than America ’ s. ”

In other words: China gets what it wants.

Financial Warfare

Financial warfare similar to what China was threatening in the summer of 2007

isn ’ t unheard of. In fact, it has happened before.

In the fall of 1956, the world was on the brink of a major international confl ict.

America ’ s allies, Britain and France, were engaged in a battle against Egypt over control of the Suez Canal, a large man - made canal in Egypt. Russia was threatening to intervene on the side of Egypt.

America wanted to avoid military action at any cost, and demanded that the British and French allies withdraw from the region. When the United States ’

request was denied, it turned to fi nancial warfare. America, which at that time owned much of England ’ s debt, threatened to sell off a signifi cant part of its

(continued)

c04.indd 72

8/26/08 8:59:57 PM

Chapter 4 The Trade Defi cit

73

(continued)

holdings in the British pound. This would have effectively destroyed England ’ s currency.

As a result, all British and French military forces withdrew from the Suez region within weeks. Some historians consider this the exact moment that the British Empire ceased to exist.

Solutions

Last year, the United States borrowed 65 percent of all the money that was borrowed in the world — 10 times as much as the next biggest borrower.

“ If fi fteen or twenty years from now two or three percent of the GDP, ” says Warren Buffett, “ is being paid abroad merely to service the debts or the ownership of assets that occurred because we ’ re overconsuming, that will be politically unstable. ”

“ It took forty

- two presidents

“ It took forty - two presidents two

two hundred twenty

- four years to

hundred and twenty - four years to

run up a trillion dollars of U.S. debt

run up a trillion dollars of U.S. debt

held abroad, ” pointed out Senator

held abroad, ” pointed out Senator

Conrad. “ This president has more

Conrad. “ This president has more

than doubled that amount in just

than doubled that amount in just

six years. ”

six years. ”

“ We can ’ t pay our bills now — that ’ s why this debt is jumping so dramatically. It just fundamentally threatens our long -

term economic security, ” continued the senator. “ If we don ’ t deal with this, our children and grandchildren are going to have a much different life then we have enjoyed. We ’ ll be in such deep pot to the rest of the world, we ’ ll be dependent on the kindness of strangers, we ’ ll be dependent on other countries continuing to loan us vast amounts of money. ”

David Yepsen posed a question: “ We fi nance these defi -

cits and this debt by borrowing money from other countries, China for example. What implications does this have for our c04.indd 73

8/26/08 8:59:58 PM

74 The

Mission

foreign policy if we ’ re in hock to other governments? Does that give American presidents fl exibility to make foreign policy decisions, or do we have to worry about what our bankers think?

Bob Bixby answered: “ We have to worry about what our bankers think. ”