MONEY Master the Game: 7 Simple Steps to Financial Freedom (63 page)

Read MONEY Master the Game: 7 Simple Steps to Financial Freedom Online

Authors: Tony Robbins

Today the average life expectancy for a male is 79, while the average female will live to 81. For a married couple, at least one spouse has a 25% chance of reaching age 97.

BUT WAIT, THERE’S MORE!

You could be living

way

longer than even these estimates. Think how far we have come in the past 30 years with technology. From the floppy disk to nanotechnology. Today scientists are using 3-D printing to generate new organs out of thin air. Researchers can use human cells, scraped gently from your skin, to “print” an entirely new ear, bladder, or windpipe!

17

Science fiction has become reality. Later we’ll hear directly from my friend Ray Kurzweil, the Thomas Edison of our age and currently the head of engineering at Google. When asked how advances in life sciences will affect life expectancies, he said:

“During the 2020s, humans will have the means of changing their genes; not just ‘designer babies’ will be feasible, but designer baby boomers through the rejuvenation of all of one’s body’s tissues and organs by transforming one’s skin cells into youthful versions of every other cell type. People will be able to ‘reprogram’ their own biochemistry away from disease and aging, radically extending life expectancy.”

Those are exciting words for us boomers!!! Wrinkles be damned! We may all soon be drinking from the proverbial fountain of youth.

But the implications for our retirement are clear. Our money has to last even longer that we may think.

Can you imagine if Ray is right, and us boomers live until we are 110 or 120? Imagine the type of technology that will alter the lifespan of millennials. What if 110 or 115 is in your future? Nothing will be more important than guaranteed lifetime income. A paycheck that you can’t outlive will be the best asset you own.

When I was young, I thought that money was the most important thing in life; now that I am old, I know that it is.

—OSCAR WILDE

THE 4% RULE IS DEAD

In the early 1990s, a California financial planner came up with what he called

the “4% rule.”

The gist is that if you wanted your money to last your entire life, you could take out 4% per year if you had a “balanced portfolio” invested in 60% stocks and 40% bonds. And you could increase the amount each year to account for inflation.

“Well, it was beautiful while it lasted,” recounts a 2013

Wall Street Journal

article entitled “Say Goodbye to the 4% Rule.” Why the sudden death? Because when the rule came into existence, government bonds were paying over 4%, and stocks were riding the bull! If you retired in January 2000, and you followed the traditional 4% rule, you would have lost 33% of your money by 2010, and, according to T. Rowe Price Group, you would now have only a 29% chance that your money would last your lifetime. Or spoken in a more direct way, you’d have a 71% chance of living beyond your income. Broke and old are not two things that most of us would like to experience together.

Today we are living in a world of globally suppressed interest rates, which is, in effect, a war on savers. And most certainly a war on seniors. How can one retire safely when interest rates are near 0%? They must venture out into unsafe territory to try to find returns for their money. Like the story of the thirst-stricken wildebeest that must venture down to the crocodile-infested waters to seek out a drink. Danger lurks, and those who need positive returns to live, to pay their bills, become increasingly vulnerable.

CRITICAL MASS DESTRUCTION

No matter what anyone tells you, or sells you, there isn’t a single portfolio manager, broker, or financial advisor who can control the primary factor that will determine if our money will last.

It’s the financial world’s dirty little secret that very few professionals know. And of those who do, very few will ever dare bring it up. In my usual direct fashion, I put it smack dab in the middle of the table when I sat down with legend Jack Bogle.

Remember Jack Bogle? He is the founder of the world’s largest mutual fund, Vanguard, and about as straightforward as a man could be. When we spoke for four hours in his Pennsylvania office, I brought up the dirty little

secret, and he certainly didn’t sugarcoat his opinion or thoughts. “Some things don’t make me happy to say, but there is a lottery aspect to all of this: when you were born, when you retire, and when your children go to college. And you have no control over that.”

What lottery is he talking about?

It’s the big luck of the draw: What will the market be doing when

you

retire?

If someone retired in the mid-1990s, he was a “happy camper.” If he retired in the mid-2000s, he was a “homeless camper.”

Bogle himself said in an early 2013 CNBC interview that, over the next decade, we should prepare for

two

declines of up to 50%. Holy sh*t! But maybe we shouldn’t be surprised by his prediction.

In the 2000s, we have already experienced two drawdowns of nearly 50%. And let’s not forget that if you lose 50%, you have to make 100% just to get back to even.

The risk we all face, the dirty little secret, is the devastating concept of

sequence of returns.

Sounds complicated, but it’s not. In essence,

the earliest years of your retirement will define your later years.

If you suffer investment losses in your early years of retirement, which is entirely a matter of luck, your odds of making it the distance have fallen off the cliff.

You can do everything right: find a fiduciary advisor, reduce your fees, invest tax efficiently, and build up a Freedom Fund.

But when it’s time to ski down the backside of the mountain, when it’s time for you to take income from your portfolio, if you have one bad year early on, your plan could easily go into a tailspin. A few bad years, and you will find yourself back at work and selling that vacation home. Sound overly dramatic? Let’s look at a hypothetical example of how the sequence of returns risk plays out over time.

JOHN BIT THE DOG

John bit the dog. The dog bit John. Same four words, but when arranged in a different sequence, they have an entirely different meaning. Especially for John!

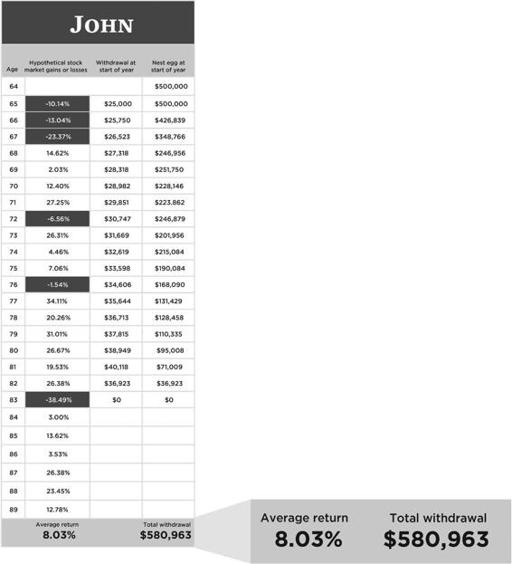

John is now 65 and has accumulated $500,000 (far more than the average American) and is ready to retire. Like most Americans nearing retirement, John is in a “balanced” portfolio (60% stocks, 40% bonds), which, as we learned from Ray Dalio, isn’t balanced at all! Since interest rates are so low,

the 4% rule won’t cut it. John decides that he will need to take out 5%, or $25,000, of his nest egg/Freedom Fund each year to meet his income needs for his most basic standard of living. When added to his Social Security payments, he “should” be just fine. And he must also increase his withdrawal each year (by 3%) to adjust for inflation because each year the same amount of money will buy fewer goods and services.

As John’s luck would have it, he experiences some market losses early on. In fact, three bad years kick off the beginning of his so-called golden years. Not such a shiny start.

In five short years, John’s $500,000 has been cut in half. And withdrawing money when the market is down makes it worse, as there is less in the account to grow if or when the market comes back. But life goes on, and bills must be paid.

From age 70 onward, John has many solid positive/up years in the market, but the damage has already been done. The road to recovery is just too steep. By his late 70s, he sees the writing on the wall and knows that he will run out. By age 83, his account value has collapsed. In the end, he can withdraw just $580,963 from his original $500,000 retirement account. In other words,

after 18 years of continued investing during retirement, he has just an additional $80,000 to show for it.

But here is the crazy thing

:

during John’s tumble down the mountain, the market averaged over 8% annual growth.

That’s a pretty great return, by anyone’s standards!

Here’s the problem: the market doesn’t give you

average

annual returns each year. It gives you

actual

returns that work out to an average.

(Remember our discussions about the difference between real and average returns in chapter 2.3, “Myth 3: ‘Our Returns? What You See Is What You Get’ ”?) And “hoping” you don’t suffer losses in years in which you can’t afford them is

not

an effective strategy for securing your financial future.

FLIP-FLOP

Susan is also age 65, and she too has $500,000. And like John, she will withdraw 5%, or $25,000 per year, for her income, and she too will increase her withdrawal slightly each year to adjust for inflation. And to truly illustrate the concept, we used the exact same investment returns, but we simply

flipped the sequence of those returns.

We reversed the order so that the first year becomes the last year and vice versa.

By merely reversing the order of the returns, Susan has an entirely different retirement experience.

In fact,

by the time she is 89, she has withdrawn over $900,000 in income payments and still has an additional $1,677,975 left in her account! She never had a care in the world.

Two folks, same amount for retirement, same withdrawal strategy: one is destitute, while the other is absolutely free financially.

And what’s even more mind boggling:

they both had the same average return (8.03% annually) over the 25-year period!

How is this possible? Because the “average” is the total returns divided by the number of years.

Nobody can predict what will happen around the next corner. Nobody knows when the market will be up and when it will be down.

Now, imagine if John and Susan both had income insurance. John would have avoided an ulcer, knowing that as his account dwindled, he had a guaranteed income check at the end of the rainbow. Susan would have simply had more money to do with as she pleases. Maybe take an extra vacation, give more to her grandkids, or contribute to her favorite charity. The value of income insurance cannot be overstated! And when coupled with the All Seasons portfolio, you have quite a powerful combination.

6 DEGREES OF SEPARATION

You might recall from earlier in the book when I introduced Wharton professor Dr. David Babbel. He is not only one of the most well-educated men I have ever met but also a gentle and caring soul with a grounding faith. And he prefers David over “Doctor” or “Professor.”

Here is a quick refresher on David’s accomplished background. He has six degrees! A degree in economics, an MBA in international finance, a PhD in finance, a PhD minor in food and resource economics, a PhD certificate on tropical agriculture, and a PhD certificate in Latin American studies. He has taught investment at Berkeley and the Wharton School for over 30 years. He was the director of research in the pension and insurance division for Goldman Sachs. He has worked for the World Bank and consulted for the US Treasury, the Federal Reserve, and the Department of Labor. To say he knows his stuff is to say Michael Jordan knows how to play basketball.

David is also the author of a polarizing report in which he lays out his own personal retirement plan. When it came time for David to retire, he wanted a strategy that would give him peace of mind and a guaranteed

income for life. He remembered that

income is the outcome.

And he also wisely took into consideration other factors such as not wanting to make complex investment decisions in his older years. He considered all his options and drew upon his vast knowledge of risk and markets. He even consulted with his friends and former colleagues on Wall Street to compare strategies. In the end, David decided that the best place for his hard-earned retirement money was

annuities

!

Whoa!

Wait a second.