On the Brink (58 page)

Authors: Henry M. Paulson

Tags: #Global Financial Crisis, #Economics: Professional & General, #Financial crises & disasters, #Political, #General, #United States, #Biography & Autobiography, #Economic Conditions, #Political Science, #Economic Policy, #Public Policy, #2008-2009, #Business & Economics, #Economic History

September 25, 2008, 4:00 p.m.: Bicameral, bipartisan meeting with the presidential candidates, the president, and the vice president to discuss the economic crisis. Left to right: Richard Shelby, Josh Bolten, Vice President Cheney, me, Spencer Bachus, Barney Frank, Steny Hoyer, Republican presidential candidate Sen. John McCain, John Boehner, Nancy Pelosi, President Bush, Harry Reid, Mitch McConnell, and Democratic presidential candidate Sen. Barack Obama.

Pablo Martinez Monsivais/Associated Press

Sunday, September 28, 2008, 12:30 a.m.: Press conference in National Statuary Hall announcing the successful conclusion to TARP negotiations. Left to right: Nancy Pelosi, Sen. Judd Gregg, Spencer Bachus, Chris Dodd, me, House Minority Whip Roy Blunt, and Harry Reid.

Lauren Victoria Burke/Associated Press

October 3, 2008: President Bush visits Treasury’s Markets Room after Congress passes the TARP legislation. Left to right: Matt Rutherford, President Bush, Megan Leary, Tim Dulaney, and Michael Pedroni (shaking hands).

Eric Draper, Courtesy of the George W. Bush Presidential Library

October 10, 2008: Finance ministers and central bank governors of many nations gather on the steps of the Treasury Department after agreeing to a set of coordinated policy efforts to stabilize the global financial system.

Front row, left to right: Canada’s finance minister James Flaherty, France’s finance minister Christine Lagarde, Germany’s minister of finance Peer Steinbrück, me, Italy’s finance minister Giulio Tremonti, Japan’s finance minister Shoichi Nakagawa, Britain’s chancellor of the Exchequer Alistair Darling, and Eurogroup’s president Jean-Claude Juncker. Back row, left to right: Bank of Canada governor Mark Carney, Bank of France governor Christian Noyer, president of Germany’s Bundesbank Axel Weber, Ben Bernanke, Italy’s central bank governor Mario Draghi, Japan’s central bank governor Masaaki Shirakawa, Bank of England governor Mervyn King, president of the European Central Bank Jean-Claude Trichet, International Monetary Fund managing director Dominique Strauss-Kahn, and World Bank president Robert Zoellick.

Chris Taylor, Treasury Department

A page from my log, October 13, 2008, the day we urged the bank CEOs to accept equity capital from the government.

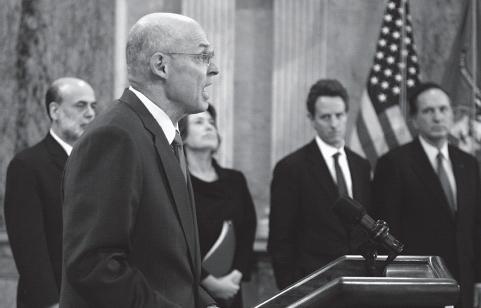

October 14, 2008: Announcing the TARP capital purchase program and the Federal Deposit Insurance Corporation’s temporary liquidity guarantee program in Treasury’s Cash Room. With, left to right, Ben Bernanke, FDIC chairman Sheila Bair, Tim Geithner, and Comptroller of the Currency John Dugan.

Hyungwon Kang/Reuters

My trusted partners Tim Geithner (left) and Ben Bernanke.

Lucas Jackson/Reuters

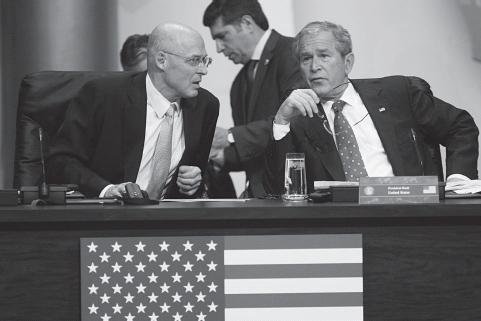

November 15, 2008: With President Bush at the G-20 summit on financial markets and the world economy, in Washington, D.C. Dan Price is in the background.

Eric Draper, Courtesy of the George W. Bush Presidential Library

With Ben Bernanke.

Manuel Balce Ceneta/Associated Press

I

don’t wake up mornings wishing that I were still Treasury secretary. For one thing, I am finally getting a good night’s sleep again. I hope as the markets settle down and the economy begins to recover that that is also true for the millions of people in America—and throughout the world—who have been living through this long nightmare of home foreclosures, job losses, and tight credit since the onset of the financial crisis in 2007.

Certainly I miss my team at the Treasury Department and my other colleagues in government. Even on the worst days, I took comfort from knowing that I was working with some of the sharpest and most creative minds in the country—men and women who had chosen public service over personal enrichment. And I do regret that I am unable either to help with the “exit strategy” to end the emergency programs we put in place to save the financial system or to work within the government for urgently needed regulatory reforms.

When I became Treasury secretary in July 2006, financial crises weren’t new to me, nor were the failures of major financial institutions. I had witnessed serious market disturbances and the collapses, or near collapses, of Continental Illinois Bank, Drexel Burnham Lambert, and Salomon Brothers, among others. With the exception of the savings and loan debacle, these disruptions generally focused on a single financial organization, such as the hedge fund Long-Term Capital Management in 1998.

The crisis that began in 2007 was far more severe, and the risks to the economy and the American people much greater. Between March and September 2008, eight major U.S. financial institutions failed—Bear Stearns, IndyMac, Fannie Mae, Freddie Mac, Lehman Brothers, AIG, Washington Mutual, and Wachovia—six of them in September alone. And the damage was not limited to the U.S. More than 20 European banks, across 10 countries, were rescued from July 2007 through February 2009. This, the most wrenching financial crisis since the Great Depression, caused a terrible recession in the U.S. and severe harm around the world. Yet it could have been so much worse. Had it not been for unprecedented interventions by the U.S. and other governments, many more financial institutions would have gone under—and the economic damage would have been far greater and longer lasting.