Purple Cow (5 page)

I don’t think there’s a shortage of remarkable ideas. I think your business has plenty of great opportunities to do great things. Nope, what’s missing isn’t the ideas. It’s the will to execute them.

My goal in

Purple Cow

is to make it clear that it’s safer to be risky—to fortify your desire to do truly amazing things. Once you see that the old ways have nowhere to go but down, it becomes even more imperative to create things worth talking about.

Purple Cow

is to make it clear that it’s safer to be risky—to fortify your desire to do truly amazing things. Once you see that the old ways have nowhere to go but down, it becomes even more imperative to create things worth talking about.

One of the best excuses your colleagues will come up with, though, is that they

don’t

have the ability to find the great idea, or if they do, they don’t know how to distinguish the great idea from the lousy ideas. This book isn’t long enough for me to outline all of the spectacularly successful brainstorming, ideation, and creativity techniques that are used by companies around the world. What I can do, though, is highlight the takeaway ideas, the specific things you can do tomorrow to start on your way to the Purple Cow. If you’ve got the will, you’ll find the way.

don’t

have the ability to find the great idea, or if they do, they don’t know how to distinguish the great idea from the lousy ideas. This book isn’t long enough for me to outline all of the spectacularly successful brainstorming, ideation, and creativity techniques that are used by companies around the world. What I can do, though, is highlight the takeaway ideas, the specific things you can do tomorrow to start on your way to the Purple Cow. If you’ve got the will, you’ll find the way.

The symbolwill mark my top takeaway points, spread throughout the book.

Case Study: Going Up?

Elevators certainly aren’t a typical consumer product. They can easily cost more than a million dollars, they generally get installed when a building is first constructed, and they’re not much use unless the building is more than three or four stories tall.

How, then, does an elevator company compete? Until recently, selling involved a lot of golf, dinners, and long-term relationships with key purchasing agents at major real estate developers. No doubt this continues, but Schindler Elevator Corporation has radically changed the game by developing a Purple Cow.

Walk into the offices of Cap Gemini in Times Square, and you’re faced with a fascinating solution. The problem? Every elevator ride is basically a local. The elevator stops five, ten, fifteen times on the way to your floor. This is a hassle for you, but it’s a huge, expensive problem for the building. While your elevator is busy stopping at every floor, the folks in the lobby are getting more and more frustrated. The building needs more elevators, but there’s no money to buy them and nowhere to put them.

The insight? When you approach the elevators, you key in your floor on a centralized control panel. In return, the panel tells you which elevator will take you to your floor.

With this simple presort, Otis has managed to turn every elevator into an express. Your elevator takes you immediately to the twelfth floor and races back to the lobby This means that buildings can be taller, they need fewer elevators for a given number of people, the wait is shorter, and the building can use precious space for people, not for elevators. A huge win, implemented at remarkably low cost.

Is there a significant real estate developer in the world who is unaware of this breakthrough? Not likely. And it doesn’t really matter how many ads or how many lunches the competition sponsors; they now gets the benefit of the doubt.

Instead of trying to use your technology and expertise to make a better product for your users’ standard behavior, experiment with inviting the users to change their behavior to make the product work dramatically better.

Case Study: What Should Tide Do?

Tide is arguably the best laundry detergent in history. Every year, Procter & Gamble invests millions of dollars and pays a top-flight team of chemists to push the performance of Tide further and further.

Is that the right thing to do?

Tide succeeded early on because of a mixture of good TV ads, very good distribution, and a great product. As the TV-industrial complex crumbled, though, the ads mattered less and less. Now, with the ascension of Wal-Mart, the distribution is more crucial than ever. One chain of stores accounts for a third of Tide’s sales. Without Wal-Mart, Tide is dead.

So what should P&G do? Are they likely to come up with a true innovation, a remarkable breakthrough that even casual detergent buyers notice? Or are the incremental improvements largely a carryover from a different time, a time when people actually cared about their laundry?

Orthodox Purple Cow thinking would have P&G take the profits while they’re still there. Cut research spending, raise the price as much as is practical, and put the incremental profits into the creation of ever more radical and interesting new products. If the current R&D isn’t likely to generate a noteworthy payoff, what’s the point?

If a product’s future is unlikely to be remarkable—if you can’t imagine a future in which people are once again fascinated by your product—it’s time to realize that the game has changed. Instead of investing in a dying product, take profits and reinvest them in building something new.

Getting In

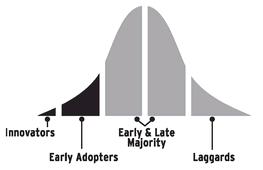

Only the risk-taking, idea-spreading people on the left part of the curve are willing to listen to you.

If we look at the idea diffusion curve, we see that the bulk of product sales come

after

a product has been adopted by the consumers willing to take a chance on something new. Those early adopters create an environment where the early and late majority feel safe buying the new item. The sales that matter don’t come until the left part of the curve is completely sold.

after

a product has been adopted by the consumers willing to take a chance on something new. Those early adopters create an environment where the early and late majority feel safe buying the new item. The sales that matter don’t come until the left part of the curve is completely sold.

The big insight here, though, is that the vast majority of the curve ignores you. Every time. People in the early and late majority listen to their experienced peers but are going to ignore you. It is so tempting to skip the left and go for the juicy center. But that doesn’t work anymore.

Regardless of industry, successful new products and services follow this familiar pattern after they are introduced. First they are purchased by the innovators. These are the people in a given market who like having something first. They may not even need the product; they just want it. Innovators are the folks who sit in the front row at a fashion show in Paris, go to Internet World, and read edgy trade journals.

Right next to innovators on Moore’s curve are the early adopters. (No, they’re not early

adapters

—that would be just about the opposite, wouldn’t it?) Early adopters are the folks who can actually benefit from using a new product and who are eager to maintain their edge over the rest of the population by seeking out new products and services. It might be a new investment device (zero-coupon bonds, say) or even a new TV show, but in any meaningful market, this audience is both sizable and willing to spend money.

adapters

—that would be just about the opposite, wouldn’t it?) Early adopters are the folks who can actually benefit from using a new product and who are eager to maintain their edge over the rest of the population by seeking out new products and services. It might be a new investment device (zero-coupon bonds, say) or even a new TV show, but in any meaningful market, this audience is both sizable and willing to spend money.

Trailing after the early adopters are the early and late majority. These consumers don’t necessarily yearn for a new product or service that can benefit them, but if enough of their peers try it and talk about it, these followers are likely to come along as well.

It’s essential to realize two things about this big and profitable group. First, these people are really good at ignoring you. They have problems that they find far more significant than the ones your product solves, and they’re just not willing to invest the time to listen to you.

Second, they often don’t even listen to the innovators on the left part of the curve. The early and late majority want protocols and systems and safety that new products rarely offer. Countless products never manage to get far enough along the curve to reach these folks. And if they’re not even going to listen to their friends, why should they listen to you?

Finally, the laggards complete the curve, getting around to buying a cassette deck when the rest of us have moved on to CDs. If anything, these people are the adapters. They don’t use something new until it’s so old that what they used to use is obsolete, impractical, or not even available any longer.

No one is going to eagerly adapt to your product.

The vast majority of consumers are happy. Stuck. Sold on what they’ve got. They’re not looking for a replacement, and they don’t like adapting to anything new. You don’t have the power to force them to. The only chance you have is to sell to people who like change, who like new stuff, who are actively looking for what it is you sell. Then you hope that the idea spreads, moving from the early adopters to the rest of the curve. After the early adopters embrace what you’re selling,

they

are the ones who will sell it to the early majority—not you. And they will sell it poorly. (Moore talks at length about moving through the rest of the curve. I highly recommend his book.)

The vast majority of consumers are happy. Stuck. Sold on what they’ve got. They’re not looking for a replacement, and they don’t like adapting to anything new. You don’t have the power to force them to. The only chance you have is to sell to people who like change, who like new stuff, who are actively looking for what it is you sell. Then you hope that the idea spreads, moving from the early adopters to the rest of the curve. After the early adopters embrace what you’re selling,

they

are the ones who will sell it to the early majority—not you. And they will sell it poorly. (Moore talks at length about moving through the rest of the curve. I highly recommend his book.)

You must design a product that is remarkable enough to attract the early adopters—but is flexible enough and attractive enough that those adopters will have an easy time spreading the idea to the rest of the curve.

Digital cameras have been attractively priced for about five years. At the beginning, only gadget-heads and computer geeks bought them. Digital cameras were a little tricky to use, and the quality wasn’t great. Over time, the camera manufacturers obsessed about fixing both problems and were rewarded with dramatically increased sales. Digital cameras are well on their way to replacing film cameras. This shift was not caused by great ad campaigns from the camera companies. Instead, it is the direct result of early adopters successfully selling the cameras to their friends.

Digital cameras spread because they offer convenience and price advantages over film cameras. Better still, these advantages are obvious, easy to talk about, easy to demonstrate, and just begging to be brought up every time an early adopter sees a laggard pull out a film camera.

Other books

Katherine by Anya Seton

BoldLust by Sky Robinson

Phantom Limb by Dennis Palumbo

The Amazing Harvey by Don Passman

Blitz by Claire Rayner

The Dark Messenger by Milo Spires

The Rightful Heir by Angel Moore

From the Earth to the Moon by Jules Verne

Agatha Christie and the Eleven Missing Days by Jared Cade

Undercover Alice by Shears, KT