Soldier of Finance (14 page)

Read Soldier of Finance Online

Authors: Jeff Rose

Be prepared for emergencies, but once that is covered, project into the future and establish a plan for building wealth. Your lifetime campaign is not about mere survival; it's about winning in the end. Stay on top of all your investments and be sure they're producing, including your savings account.

Hopefully by now you are feeling more confident. By faithfully following the Soldier of Finance procedures, you have positioned yourself for the final phase of your campaign to take control of your financial life. Take a moment to reflect on the progress you've made.

Most important, you've gotten the upper hand over the strongest opponents to your success. You've identified your weaknesses and your strengths. You've put your credit cards in their place and have gotten your debt under control. By establishing clearly defined goals, you've provided for emergencies and given yourself the means to adjust your plans when necessary.

These are not small accomplishments. You are now in a secure place to begin making investments that can move you into wealth. Too many people try to invest without securing their foundation. Their bad financial habits and accumulated debt undermine their future. But you have not gone that route. You took the time to get ready for the fun part of being a Soldier of Finance: conquering prosperity. Congratulations.

Go / No Go

Preparation for Emergencies

Do you have a FRAGO Fund?

_______ Go     ________ No Go

How much money is in your FRAGO Fund? How long could you last if your income completely stopped?

_______ Go     ________ No Go

Where is your FRAGO Fund?

_______ Go     ________ No Go

How much interest are you getting on the money when you are not using it?

_______ Go     ________ No Go

How long would it take you to access your FRAGO Fund if you needed it?

_______ Go     ________ No Go

- You cannot predict emergencies, but you can prepare for the impact they will have on your financial situation. Preparation allows you to be flexible enough to meet whatever situation comes along.

- Create a FRAGO Fund (Financial Reserve and Goal Fund), and set aside enough money to use during unexpected emergencies, such as loss of a job or a car breakdown.

- Your FRAGO Fund should have, as a minimum, the amount of money you would need to cover your expenses for a month. Three months is better, and you should work toward that goal.

- A simple formula for knowing how much to put in your FRAGO Fund is to add your basic allowance for housing (BAH) to your monthly expenses (ME). The resulting number is the minimum you should have on hand.

- Do not use any form of credit as an emergency fund, such as credit cards, HELOCs (Home Equity Lines of Credit), or payday loans. Adding to your debt will only make matters worse. Your goal is to get out of debt.

- A FRAGO Fund should be kept in a savings account so that it is readily accessible on short notice. By leaving it there, you will collect at least a small amount of interest while the money is waiting.

- Don't put too much in a savings account. You will be losing money on interest.

MANUALS AND ORDERSâGETTING STARTED IN INVESTING

One constant in the military was that we were provided with as much information as could be accumulated. In Basic Training, we had the

Soldier's Handbook.

In Iraq, every time we launched an operation, it began with comprehensive Operation Orders spelling out the mission and our objective, covering every conceivable scenario. No matter what happened, no matter what might go wrong, we would be prepared to react quickly and decisively. The platoon sergeant was responsible for passing information down to us. As a squad leader, my job was to make sure my team leaders understood everything they needed to know for the mission. We ran battle drills until it all worked like a well-oiled machine. Ignorance was no excuse.

Yet ignorance is one of the biggest reasons people don't start investing. They either don't know how to start or they harbor misconceptions about how investments work that lead them to believe it's not worth the effort.

Several years ago, I met with a guy who needed some help with his pension. The plant where he worked had shut down and the employees had to make decisions about their pensions and their 401(k) plans. He had a pension because participation was required. When I asked about his 401(k), however, I discovered that he had turned it down ten years earlier.

“I didn't want to mess with that,” he told me, “because it involved the stock market.”

Based on that one factor, he decided not to take advantage of a great opportunity to put some money aside for his retirement. His employer had a great matching plan. And the sad part is that a 401(k) does not require you to invest in stocks. You can choose bonds or money market options. A 401(k) is not the stock market. His ignorance left him near retirement with very little saved or invested.

I recently e-mailed my newsletter group and asked the question, “Why haven't you started investing yet?” It was a loaded question, of course, because the majority of my readers are 40 or older and already are investing, but I do have many younger subscribers and I was curious to know what holds people back.

Responses varied, but I noticed that most fell into two basic areas: some didn't have the patience to wait out an investment; others didn't think they had enough money to get started. One guy told me, “I feel like I need $100,000 to get started.”

You will need patience. There is no way to get around that. Investments that provide security and wealth will not fill your bank account in a month. They take time. At the start of my career, I met with an older couple who were in their mid-seventies. They had purchased a bond through my office, a transaction done over the phone, and I wanted to meet them face-to-face and work with their investments. I drove forty-five minutes to the next town to sit down with them in their home.

As they filled in some background information for me, I discovered that they didn't really know how wealthy they were. The husband had spent his whole life as a line worker at a car factory. His wife was a retired teacher.

They had not done anything spectacular. In the beginning, every time they got a paycheck, they bought some savings bonds. As time went on, they branched out into a few stocks, bonds, and mutual funds. Now they lived comfortably off their pensions and never pulled money from their investments. Totaling their assets, we discovered they had accumulated over $1 million.

In the case of this couple, they had almost too much patience. They put money away steadily and paid no attention to it. They retired and didn't even know how rich they were!

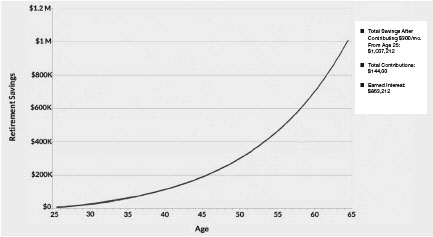

Investments pay off over time. The nature of this multiplication process is that for a long time it doesn't seem like you're making much progress. You feel like you're running on a treadmill, but at some point, the numbers increase rapidly and dramatically. (See

Figure 12-1

for an example.)

If you don't start, however, you will never see that kind of return. If you don't have the patience to let it grow, you will never get started.

I began investing with $50 a month. I had a job with an investment firm, making $18,500 base salary. That was not back in the 1970s, either, when you could live on that; it was in 2002! My budget was tight. After deductions, my take-home pay was less than $850 each month.

Figure 12-1 Example of retirement savings growth.

Example of retirement savings growth.

Nevertheless, I understood the value of getting started early. I opened a Roth IRA and set aside $50 every month to invest. At the same time, I opened a 401(k) and put 5 percent of my income before tax into it. In two years, that $50 initial monthly investment grew to $1,200 plus accumulated interest. That might not seem like much, but by the time I retire, it will be in the millions.

Eliminate the excuses that have kept you from investing. You don't need much to get started, and it's not difficult to learn the basics. Understand the importance of taking action. I've never met anybody who decided, after looking at their financial profile, that they had saved too much.

Like any good military operation, you have to make a plan, think it through, and execute it patiently and consistently. Many people have the idea that they will acquire enough for retirement by winning the lottery. The truth is, they have a better chance of going on a date with Kim Kardashian or Justin Bieber. Building wealth for your future is not a dramatic spin of the roulette wheel, but a methodical process that takes time.

Ten percent is a number that appears throughout history as a standard for a variety of financial applications. Church people are familiar with tithing, the practice of giving 10 percent of their income to support their ministry.

A pastor I know speculates that 10 percent is often used because we have ten fingers, which makes it simple for anyone to calculate, including those who don't understand math. It is a convenient number to work with, and it provides a simple way to calculate how you can allocate money for investments.

As a first step in the investment process, consider what you can do with 10 percent of your income. Develop the habit of disciplining yourself, setting aside a portion of each paycheck for something other than bills and living expenses. Starting with 10 percent is a simple way to do that.

You should always pay yourself first, before you pay your creditors. And by that, I don't mean taking 10 percent and going to the mall. I mean putting 10 percent into your future. Twenty percent would be better, but if you're just getting started, 10 percent will be less intimidating. Once you get into the habit of paying yourself, you will be able to expand the amount you put into investments, but for now, reference 10 percent as a bare minimum.

Before describing the types of investment vehicles available to you, however, I want to address a subject that I believe is an important aspect of financial stabilityâgiving. I have made it a practice to always give 10 percent of my income to my church. If you are not religious, develop the habit of making charitable contributions to a cause close to your heart.

There are many benefits to giving. First is the basic concept that you get what you give. This idea has been expressed in numerous ways; “You reap what you sow” and “What goes around comes around” are two common ones. I don't know that I can really explain it, but good things come to generous people. When you develop an overall attitude of generosity, other aspects of how you interact with people are affected. You become friendlier, meaning people are more likely to want to be around you, more likely to be generous toward you, and more likely to share opportunities with you that they otherwise wouldn't.

It's no accident that people who are successful in business are also good at building strong personal relationships with people. They establish trust through their approachability and integrity. Trust leads to more business opportunities and greater success. By this obscure route, generosity is a link to financial success.

The key is that you have to mean it. People can tell when you just put on a friendly face to make a sale. Generosity, when you don't get anything back, indicates a lot about you and is a character trait well worth developing. Where you give is not as important as the fact that you do. If your motive is getting a tax deduction, you have missed the point entirely, and the charitable contribution will probably not help you much.

Consider setting aside 10 percent of your paycheck to give away; mathematically, it might not make much sense to you, but the benefits reach far beyond the dollars and cents involved.

Next, set aside another 10 percent for investments. A Brightwork Partners survey of 3,300 working Americans found that workers who were best prepared for retirementâthat is, those on track to replace 100 percent of their current incomeâdiffered from those likely to replace 45 percent or less of their current income, not in how much they earned but in how much they utilized savings plans. The former saved 10 percent of their income and invested it where it would gain interest.

The point is that you don't need much to start investing, and if you don't know where to begin, look right under your nose. You get a paycheck. Before you do anything with it, before you pay a single bill, before you go out to dinner or go to a movie, take one-tenth of it and put it somewhere that will let it work for you.

Another aspect of investing is getting good advice. Friends and family will try to tell you the best way to invest, based on their own experience, but ultimately, they probably only know what they've been involved in. Take the time to learn as much as you can about how money works, and trust your own judgment. That does not mean you should not consult financial professionals. Full-time advisors spend a lot of time keeping up with current investment vehicles, trends, and changing tax laws. The more complex your investments become, the more advice you probably will need.

How do you choose a good advisor? How do you know if the advisor is trustworthy? Here are three considerations:

1. Don't sign with the first person you talk to.

Take the time to interview at least two or three advisors. Listen to what they offer. Chat with each one long enough to be sure you are comfortable with the advisor's background, education, and personality. If you ask a question and do not get a direct answer, or what you hear doesn't make sense to you, that person may not be a good fit.

2. Ask how the advisor gets paid.

Many advisors are paid by commission, which translates to a predisposition to recommend investment vehicles that yield the best commissions for them. That will likely be the best investment for the advisor, but not necessarily for you. Look for fee-based or fee-only advisors. They are paid with a percentage of your account, which means the more money you make, the more they make, providing the incentive to find the best investments they can for you. That doesn't mean you should never talk to someone who takes commissions, but be sure you understand the advisor's methods and motivation.

3. See if there are any complaints filed against the advisor.

There are a couple of places you can check to see if an advisor has negative reviews from past clients. One is

www.CFP.net

, the Certified Financial Planner Board of Standards. Do a local search to check on certified financial planners in your area. Another site that deals with fee-only advisors is

www.NAPFA.org

, the National Association of Personal Financial Advisors.