Read Start Your Own Business Online

Authors: Inc The Staff of Entrepreneur Media

Start Your Own Business (28 page)

2.

Personality

. Is the accountant’s style compatible with yours? Be sure the people you are meeting with are the same ones who will be handling your business. At many accounting firms, some partners handle sales and new business, then pass the actual account work on to others.THE SIZE OF ITA

re you dithering over the choice between that large, fancy law or accounting firm with offices in every corner of the globe, or that humble, one-person legal or accounting office down the street? Before you bust your budget to retain Squelch, Withers & Ream, know this: When it comes to professional service firms, bigger isn’t always better.A big law or accounting firm may boast impressive credentials on your first meeting with them. The problem is that they usually boast an impressive price to match. What’s more, the hotshot you meet with on your initial conference may not be the person who will actually work on your legal cases or taxes. That task is likely to fall to a less experienced junior partner with limited know-how. This isn’t necessarily bad, but make sure you know who will be working on your file and what their experience is. Also be sure you’re billed correctly and don’t get charged $300 an hour for something a paralegal did.Only you can decide what is right for you, but make sure you’re not being swayed by a big name or a fancy office. While a big law or accounting firm may be right for some small businesses’ needs, the reality is that your company will make up a much smaller share of such a firm’s client list. As such, you may not get the attention they’re devoting to bigger clients. In other words, if Standard Oil has a sudden tax emergency, your file is likely to get put on the back burner. This is one situation where it’s better to be a big fish in a small pond.When evaluating competency and compatibility, ask candidates how they would handle situations relevant to you. For example: How would you handle a change in corporation status from S to C? How would you handle an IRS office audit seeking verification of automobile expenses? Listen to the answers, and decide if that’s how you would like your affairs to be handled.Realize, too, that having an accountant who takes a different approach can be a good thing. If you are superconservative, it’s not a bad thing to have an accountant who exposes you to the aggressive side of life. Likewise, if you are aggressive, it’s often helpful to have someone who can show you the conservative approach. Be sure that the accountant won’t pressure you into doing things you aren’t comfortable with. It’s your money, and you need to be able to sleep at night.

3.

Fees

. Ask about fees upfront. Most accounting firms charge by the hour; fees can range from $100 to $275 per hour. However, there are some accountants who work on a monthly retainer. Figure out what services you are likely to need and which option will be more cost-effective for you.Get a range of quotes from different accountants. Also try to get an estimate of the total annual charges based on the services you have discussed. Don’t base your decision solely on cost, however; an accountant who charges more by the hour is likely to be more experienced and thus able to work faster than a novice who charges less.TIPFind out how well-connected the CPA and his/her firm are before making a final decision. CPAs are often valuable resources for small businesses needing to borrow money or to raise capital from other sources. A well-connected CPA might help you get a foot in the door with a bank or investor.At the end of the interview, ask for references—particularly from clients in the same industry as you. A good accountant should be happy to provide you with references; call and ask how satisfied they were with the accountant’s services, fees and availability.

After you have made your choice, spell out the terms of the agreement in an “engagement letter” that details the returns and statements to be prepared and the fees to be charged. This ensures you and your accountant have the same expectations and helps prevent misunderstandings and hard feelings.

Make the most of the accounting relationship by doing your part. Don’t hand your accountant a shoebox full of receipts. Write down details of all the checks in your check register—whether they are for utilities, supplies and so on. Likewise, identify sources of income on your bank deposit slips. The better you maintain your records, the less time your accountant has to spend—and the lower your fees will be.

TIPIf you are starting a retail or service business involving a lot of cash, make sure the CPA has expertise in providing input on controlling your cash. As you grow, this becomes an increasingly vital issue, and a good CPA should be able to advise you in this area.

It’s a good idea to meet with your accountant every month. Review financial statements and go over any problems so you know where your money is going. This is where your accountant should go beyond number-crunching to suggest alternative ways of cutting costs and act as a sounding board for any ideas or questions you have.

A good accountant can help your business in ways you never dreamed possible. Spending the time to find the right accountant—and taking advantage of the advice he or she has to offer—is one of the best things you can do to help your business soar.

part 3

FUND

chapter 12

ALL IN THE FAMILY

Financing Starts with Yourself and

Friends and Relatives

Friends and Relatives

O

nce you have decided on the type of venture you want to start, the next step on the road to business success is figuring out where the money will come from to fund it. Where do you start?

nce you have decided on the type of venture you want to start, the next step on the road to business success is figuring out where the money will come from to fund it. Where do you start?

The best place to begin is by looking in the mirror. Self-financing is the number-one form of financing used by most business startups. In addition, when you approach other financing sources such as bankers, venture capitalists or the government, they will want to know exactly how much of your own money you are putting into the venture. After all, if you don’t have enough faith in your business to risk your own money, why should anyone else risk theirs?

Do It YourselfBegin by doing a thorough inventory of your assets (the “Personal Balance Sheet” on page 179 can help with this). You are likely to uncover resources you didn’t even know you had. Assets include savings accounts, equity in real estate, retirement accounts, vehicles, recreational equipment and collections. You may decide to sell some assets for cash or to use them as collateral for a loan.

e-FYIIf you want to finance your business with plastic, you can find the best available rates on credit cards at

abcguides.com

.

If you have investments, you may be able to use them as a resource. Low-interestmargin loans against stocks and securities can be arranged through your brokerage accounts.

The downside here is that if the market should fall and your securities are your loan collateral, you’ll get a margin call from your broker, requesting you to supply more collateral. If you can’t do that within a certain time, you’ll be asked to sell some of your securities to shore up the collateral. Also take a look at your personal line of credit. Some businesses have successfully been started on credit cards, although this is one of the most expensive ways to finance yourself (see Chapter 14 for more on credit card financing).

If you own a home, consider getting a home equity loan on the part of the mortgage that you have already paid off. The bank will either provide a lump-sum loan payment or extend a line of credit based on the equity in your home. Depending on the value of your home, a home-equity loan could become a substantial line of credit. If you have $50,000 in equity, you could possibly set up a line of credit of up to $40,000. Home-equity loans carry relatively low interest rates, and all interest paid on a loan of up to $100,000 is tax-deductible. But be sure you can repay the loan—you can lose your home if you do not repay.

Consider borrowing against cash-value life insurance. You can use the value built up in a cash-value life insurance policy as a ready source of cash. The interest rates are reasonable because the insurance companies always get their money back. You don’t even have to make payments if you do not want to. Neither the amount you borrow nor the interest that accrues has to be repaid. The only loss is that if you die and the debt hasn’t been repaid, that money is deducted from the amount your beneficiary will receive.

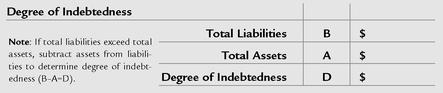

Personal Balance SheetBy filling out a personal balance sheet, you will be able to determine your net worth. Finding out your net worth is an important early step in the process of becoming a business owner because you need to find out what assets are available to you for investment in your business.

Assets Totals Cash and Checking Savings Accounts Real Estate/Home Automobiles Bonds Securities Insurance Cash Values Other Total Assets A $

Liabilities Totals Current Monthly Bills Credit Card/Charge Account Bills Mortgage Auto Loans Finance Company Loans Personal Debts Other Total Liabilities B $ Net Worth (A-B=C) C $

Other books

Big and Aimee: Beautiful Chaos by Charae Lewis

Death Called to the Bar by David Dickinson

Ghosts of Empire by Kwasi Kwarteng

Crimson and Steel by Ric Bern

Step to the Graveyard Easy by Bill Pronzini

Police at the Funeral by Margery Allingham

God Save the Queen by Amanda Dacyczyn

Love Unlocked by Waterford, Libby

Knollig: A Terraneu Novel ( Book 2) by McKnight, Stormy

Mafia Queen (The Manning Sisters #1) by Christina Escue