The Buying Brain: Secrets for Selling to the Subconscious Mind (14 page)

Read The Buying Brain: Secrets for Selling to the Subconscious Mind Online

Authors: A. K. Pradeep

Tags: #Non-Fiction, #Psychology

Four thoughts on that very common occurrence:

1.

You’re not alone

2.

It’s completely normal

3.

You get a broader attention span and a more positive attitude in trade

4.

There’s a fix

To help your customers remember the name of your product or brand, try tying it in with a mnemonic trigger. When you see the star of the movie, Brad, think of cherry. Now you’ll find it easier to retrieve the last name—Pitt.

Taglines should work in the same fashion. What’s the real thing? Whose good hands are you in? Are you lovin’ it?

Familiarity Breeds

. . .

Belief

Another memory deficit that comes with aging is the tendency to consider

familiar

information to be

true

information. The way the brain interprets familiar information is, “I’ve heard that before; so it’s likely to be true.” This can be an obvious pitfall, of course, when the aging brain repeatedly translates what is untrue into true. That’s one way a rumor can become a fact. Interestingly, warning older people about false claims can backfire: They hear the false version often enough and file it under

true

. David Richardson cautions against this tactic, in which addressing a false claim can inadvertently become

“a recommendation.” A much better strategy is to present the material you want remembered simply. Repeatedly, in a variety of formats: TV, radio, print, and banner ads. It’s the frequency of exposure that matters in the aging brain.

However, the

repetition reinforces belief

paradigm can be very useful to a brand that wants to keep a consistent story in front of its customers. If the story is repeated, the older brain will tend to see it as true. So keep your story out there, support it with messaging that lets older consumers feel good about themselves, and keep it positive to align the older brain with your brand.

P1: OTA/XYZ

P2: ABC

c06

JWBT296-Pradeep

June 5, 2010

14:9

Printer Name: Courier Westford, Westford, MA

The Boomer Brain Is Buying

63

The Boomer Brain: Aging Power to the

Nth Degree

As I mentioned at the beginning of this chapter, the fact that these natural brain changes are occurring in aging brains is only half of our story. The other half is the tremendous buying power of the generational cohort that is happening within. I cannot overstate the importance of maximizing your impact among

this game-changing group.

Perform neurological tests to assure that your message is on target. Listen to Boomer brains as they interact with your product. Find out how to make your brand a trusted advisor, an intimate friend and your in-store experience a positive, self-validating one.

Conduct Brand Essence Framework studies to determine how your brand is perceived by the Boomer brain. Use Total Consumer Experience tests to identify the Neurological Iconic signatures that your product evokes in the older brain. Rely on Deep Subconscious Response measurements to isolate and quantify the key attributes that your brand or product is associated with in the mature mind. You’ll learn much more about all these neuromarketing methodologies in Part 2.

The Boomer brain is waiting to hear you and demanding to be addressed in a new and unique way.

P1: OTA/XYZ

P2: ABC

c06

JWBT296-Pradeep

June 5, 2010

14:9

Printer Name: Courier Westford, Westford, MA

P1: OTA/XYZ

P2: ABC

c07

JWBT296-Pradeep

June 7, 2010

6:39

Printer Name: Courier Westford, Westford, MA

The Female Brain Is Buying

At the end of this chapter, you’ll know and be able to use the

following:

r The how’s and why’s of gender brain differences r How to effectively address the female brain’s special, hard-wired preferences

r The messaging elements the female brain loves r Tactics the female brain rejects out of hand One thing we can say with certainty is that, barring some kind of injury or abnormality, most human brains are very much alike. This was represented by the brain you met in Chapter 4, with the same functions, same speed of processing, and universal hard-wired reactions to primal stimuli available to any other, except for two important exceptions to the rule. First, the brain changes as it ages, as we learned in the previous chapter. Second, the brain of a woman is wired differently from the brain of a man. Let’s look at this fascinating variation on the One Brain theme.

Learning about the Female Brain

Trust me; it’s not chivalry that prompts me to provide the female brain with a chapter devoted entirely to her marvelous complexity. She’s here because, in terms of consumer buying power and influence, she deserves to be.

For the first time in history

, more women than men are working full-time. That’s because the number of women working has remained fairly constant, while a full 82 percent of the layoffs from the recession of 2009 fell to men in depressed industries like manufacturing and construction, according to the

New York Times.

In addition, single women now head almost a third of all households in the United States. In many cases women are the sole breadwinners and the 65

P1: OTA/XYZ

P2: ABC

c07

JWBT296-Pradeep

June 7, 2010

6:39

Printer Name: Courier Westford, Westford, MA

66

The Buying Brain

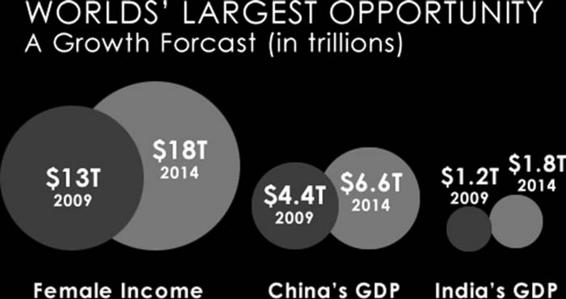

Figure 7.1

Female income worldwide is greater than China and India’s

GDPs combined.

World’s Largest Opportunity

A Growth Forecast (in trillions)

Female Income

China’s GDP

India’s GDP

Source: The Harvard Business Review

, September 2009

decision makers for the products they buy. A recent study shows that

women

worldwide have greater spending power than China and India combined

(see Figure 7.1), even though women on average are still earning only about 80 cents to a man’s dollar.

Today’s woman is, in fact, very different from her pre-recession predecessors.

Like the rest of us, women have been hit hard by the country’s economic crisis. As we’ll see, women’s brains are hard-wired to feel that anxiety more and to carry it with them longer, with deleterious effects to a woman’s body, her psyche, her work, and her home life. Her world has changed, and the strategies she employs and the way she searches for and chooses her products and services will be changing for a long time.

Women control upwards of 80 percent of all of the discretionary income in the United States—and the decisions that surround them are as far-reaching as homes and cars, as indispensable as phone services and appliances, and as commonplace as food and clothing.

My company has for years conducted research on men and women and how their brains react to very specific elements across every category of consumer products and services you can imagine.

We performed literally thousands

P1: OTA/XYZ

P2: ABC

c07

JWBT296-Pradeep

June 7, 2010

6:39

Printer Name: Courier Westford, Westford, MA

The Female Brain Is Buying

67

of tests and noticed distinct gender differences across 90 percent of

the studies.

In neurological testing for insurance, for example, we found that women reacted much more strongly than men to the character of the spokesperson, while men reacted to the price. In lighthearted ads for snack foods, men reacted to slapstick humor, while women ignored it. In automotive ads, men were all about the performance and women were interested in storage capacity and safety factors. In fact, after a time, our analysts became able to determine the gender of test subjects simply by their responses. So naturally, we followed the trail: Do male and female brains have different preferences, encode memory uniquely, and retain information in new ways?

Case Study: The Battle in the

Beauty Aisle

Private-label brands have more than come into their own in recent years. This has been driven by a number of factors, ranging from heightened competitiveness between retailers and consumer products manufacturers to

changing

consumer perceptions about a narrowed or nonexistent quality gap

to macroeconomic conditions compelling shoppers to search for better values across many categories. At any rate, store brand has gained in stature and is, in some cases, viewed on a par with national brands.

So it came as little surprise when a global retailer that has been making major pushes into revamping, upgrading, and marketing its private-label brands approached us about a category the company wanted to leverage: beauty aids—specifically, its brand of moisturizer.

The retailer presented us with a very interesting series of questions: r How can we best determine the consumer’s perceived points of difference between the leading brand of moisturizer and our private-label brand?

r Does our packaging convey the same attributes as the branded product?

r Can we identify how much the lower price point for our brand affects the consumer’s beliefs about the quality and efficacy of the product?

Asking for women’s articulated responses had created confusion in the product development and marketing ranks. The price issue had proved especially puzzling for them. It was unclear how far the price point could be moved before significant consumer reaction would be triggered.

The tools we used to discover the answers to these questions will be explained in detail in the chapters in Part 2, but I’ll touch upon them here.

P1: OTA/XYZ

P2: ABC

c07

JWBT296-Pradeep

June 7, 2010

6:39

Printer Name: Courier Westford, Westford, MA

68

The Buying Brain

We ran two Total Consumer Experience (TCE) tests to tease out consumers’

subconscious responses about the points of difference between the store brand and the leading brand. One test focused on women’s actual use of the private-label product, and one concentrated on the competitor’s product. The TCE

examined the entire consumption process, segmented into individual steps, so it allowed our client to see a side-by-side comparison of exactly how consumers experienced the two products, across multiple senses, second by second.

Deep Subconscious Response (DSR)

tests on both products evoked detailed data about how consumers perceived specific brand attributes. Coupled with the brainwave measurements and eye-tracking data obtained through the TCE, these tests provided clear and differentiated metrics for both products.

We also used the DSR methodology to determine price elasticity in the consumer’s mind. The client came away with the exact parameters within which the company had some flexibility to adjust pricing without risking consumer perceptions about the private-label product and Purchase Intent levels for it.

The client was able to gain an in-depth understanding not only of how its own product was perceived—

the neurological high points

of the consumption process, the specific attributes of the package triggered in test subjects’

subconscious, and the precise range of price points that formed the sweet spot in consumers’ minds—

but also the same information for the leading (competitive)

brand.

Performing tests like the TCE between the two genders gave us plenty of electroencephalographic proof that the two genders did differ in their responses, but we needed to scan the medical literature to validate our assumptions. To our surprise, we found that the female brain was vastly understudied in the medical brain-related literature.

In fact, until the Right for Inclusion of Women in Clinical Research Act was passed in 1995, only 17 percent of medical research was conducted on women. The reason was that women’s bodies cycle each month. They are never static, so it is difficult to establish a baseline. Because of this oversight, the female brain is now a prime area for new study and real advancements in marketing effectiveness. This area represents entirely new territory for companies with brands, products, or messages targeted to women. You can get ahead of this curve with the information you find here and in Part 2.