The Road to Freedom (20 page)

Read The Road to Freedom Online

Authors: Arthur C. Brooks

â¢

The U.S. government's deficit in 2010 alone was $1.3 trillion (8.9 percent of GDP), and the CBO estimates that the fiscal 2011 deficit will also reach this level.

30

To put this into perspective, in 2011, the U.S. will borrow about $4,152 for every person in America,

31

to pay for a government that 65 percent of Americans already believe is too large

.

32

â¢

Servicing the national debt in 2011 cost an estimated $221 billion.

33

Debt service costs will reach $1 trillion in 2023 under current policies. Considering the level of debt, this is actually a bargain because of historically low interest rates. If the interest rates the U.S. pays on its debt were to rise by just one percentage point, it would cost an extra $1.7 trillion over the coming decade.

34

â¢

Under current policies, federal spending will exceed revenue by 10.1 percent of GDP over the next twenty-five years. Even ignoring the existing debt, closing that gap completely with taxes would require an immediate and permanent 56 percent increase in all federal tax revenues.

35

There are three core principles to keep in mind when addressing the debt crisis.

First

, the debt problem has one fundamental cause that outweighs all others: out-of-control entitlement spending. The U.S.

cannot fix the deficit and debt problems without taking on entitlement reform. Any politician who suggests otherwise is not telling the truth.

Second

, debt crises are more successfully dealt with through spending reductions than with tax increases. This is just common sense. If you took over a private company that was failing because of out-of-control spending, you would focus first on spending, not raising prices. Only governments have the nerve to argue that profligate spending can be fixed with more confiscatory taxation.

Third

, there are no quick fixes. The national debt is a vast and long-term problem. The scope of a consolidation plan must reflect this reality. Any proposal that does not deal with the long runâat least twenty-five yearsâis not serious.

AMERICA IS NOT

the first country to face a debt problem. Many other nations have faced such problems. Some have returned to solid footing and prosperity. Others have failed, leading either to default or years of malaise. We can learn a lot from the paths other countries have taken.

A group of American Enterprise Institute (AEI) economists recently looked closely at twenty-one developed countries' attempts to reduce debt and deficits (economists call this “fiscal consolidation”) from 1970 to 2007.

36

Like America today, all these countries had spent too much money for too long. In response, some countries cut spending radically, while others tried to get more tax money from their citizens. Still others tried a combination of spending cuts and tax increases.

Some of the countries succeeded and escaped their crises. Others defaulted on their debts or limped along in long-term economic recession. Of the nations that succeeded, 85 percent of

their deficit reduction, on average, came from spending cuts. Of those that failed, spending cuts were only 47 percent. In a nutshell, cutters succeeded, and taxers failed.

Again, all this may seem like common sense. Countries that meet spending problems head on with spending cuts inspire confidence among investors. Those that meet their overspending with tax increases are treated in much the same way as financially irresponsible individualsâno one wants to lend to them or go into business with them. But that common sense is often sadly lacking among politicians who have the ability to collect tax money by force.

What sort of spending did the successful countries cut? You guessed it: entitlements. Reducing entitlements is the single most effective step a country can take toward reducing its national debt. The reason is simple: Entitlement programs become more expensive over time. Every dollar of savings from reducing entitlement spending today is accompanied by many more dollars of savings in the future. The lesson for America is that changes to Medicare or Social Security right now will pay big dividends into the future.

37

But all the benefits of entitlement reform are not far off in the futureâsome come right now. Economists at the International Monetary Fund have shown that cutting entitlements can have an immediate, positive impact on the current economy.

38

The reason is that when global investors see a country deal with its long-term spending problems, it bolsters confidence and attracts capital, growth, and jobs. If America deals with entitlements now, foreigners will be more likely to invest their money and establish their businesses in the U.S. That is precisely what the nation needs to emerge from the economic slump.

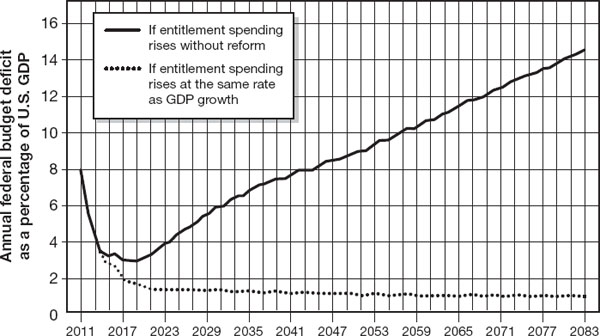

The bottom line when it comes to debt and deficits is this: If the U.S. can get entitlements under control, it can achieve budget balance. For years, irresponsible politicians from both parties have

made promises to the American people about their pensions and their health careâpromises that simply cannot be fulfilled. If the U.S. does not deal with entitlement reform, particularly of Social Security and Medicare, debt will continue to explode, and future generations will pay the price.

Figure 7.2

. Entitlement spending is the real cause of the U.S. government debt explosion. (Source: Author's calculations. Congressional Budget Office

Long-Term Budget Outlook,

June 2011, Alternative Fiscal Scenario

.)

While entitlements are the main problem leading to debt and deficits, discretionary spendingâthe spending that the government approves every yearâcan and should be cut as well. Many good proposals have shown how this can be done. President Obama's Fiscal Commission in 2010âwhich to date he has ignoredârecommended cutting $84 billion from discretionary spending in 2012, $153 billion in 2013, and a total of almost $2 trillion between 2012 and 2020.

39

A number of discretionary programs should be slashed right away. Prime among them are agricultural subsidies, which cost the nation nearly $20 billion each year,

40

drive up food prices, and hurt

farmers in poor countries around the world. Similarly, the U.S. subsidizes both fossil fuel and “clean energy,” distorting markets and putting almost $20 billion in tax money into corporate pockets each year.

41

Examples like this are, sadly, easy to find.

America can also save money by reducing the federal workforce. The government could cut 10 percent of federal workersâ200,000 jobsârelatively painlessly by not replacing those who retire or quit. This would save taxpayers $13.2 billion by 2015.

42

In addition to cutting jobs, a three-year compensation freeze (in wages or benefits) could be imposed on federal workers and Defense Department civilians, which would save $20.4 billion by 2015.

43

Cutting spending on entitlements, discretionary spending, and the federal workforce would go a long way toward reducing the national debt. But shouldn't we also raise taxes to close the gap?

No. In fact, the government should match spending cuts with tax

de

creases, especially on businesses. Taxing companies at very high rates leads some to pay more, but others to lower their production or go overseas. As a result, they pay less in taxes. As I will show, the U.S. could lower corporate taxes and raise

more

money for the Treasury than it does currently.

As any child knows, it is wrong to make promises you cannot keepâand even worse to make promises you have no intention of keeping. That is the essential moral problem with our creaking system of entitlements.

The promises politicians have made to their constituents have created massive unfunded liabilities in pensions and health care. These programs have made millions of Americans dependent on

the government, which has promised them more in benefits than they ever paid into the system.

Without immediate reform, the insolvent system will require that future generations pay in much more than they take out, which is manifestly unfair. If people are unable or unwilling to pay for future benefits and the system goes bankrupt, those most harmed will be the poor, who will lose their safety net. A system that allows people a free ride at the expense of the least powerful members of societyâthe young and the poorâis blatantly unethical.

Here are the facts about the entitlement system that show the urgent need for reform:

â¢

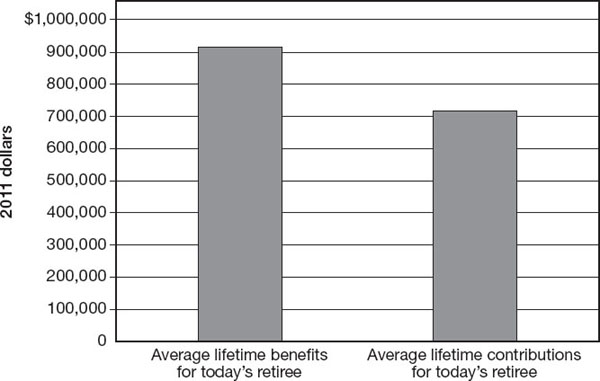

To date, most Americans have withdrawn more from the Social Security and Medicare systems than they ever paid into them.

44

In the coming decades, most people will have to pay in more than they take out, costing tens of trillions of dollars.

â¢

Social Security and Medicare are going broke because benefit payments are exceeding the taxes to pay for them. The fund to pay for Medicare hospital care has been running a deficit since 2008.

45

Without reform, Social Security will be insolvent in 2036.

46

â¢

The U.S. currently spends 9.9 percent of GDP on entitlements ($1.49 trillion). Without reform, by 2030, that number will rise to 14.3 percent ($3.43 billion).

47

â¢

Despite the appalling costs, the system fails many of the neediest citizens. The U.S. currently spends over $725 billion per year on Social Security benefits, yet leaves almost 10 percent of seniors in poverty.

48

Figure 7.3

. Americans retiring today are going to take out more than they have paid in to Medicare and Social Security. (Source: Urban Institute. Steuerle, C. Eugene, and Rennane, Stephanie. “Social Security and Medicare Taxes and Benefits Over a Lifetime,” Urban Institute, June 2011.)

Before I discuss the specific policies needed to enact reform, there are three fundamental principles underlying a fair and stable entitlements system.

First

, entitlements should be a minimum basic safety net for the poor, not a source of retirement benefits for everybody. The government should move away from a system that is effectively for the middle class.

Second

, entitlement policy should not create incentives for people to stop working and saving their money. The system should encourage people to work longer, retire later, and save more, so they can take care of themselves without resorting to the safety net.

Third

, the system must create incentives for people to use public resources in a responsible way. Entitlements should not reward governments or individuals for overspending on programs and services, as they currently do.

â¢

â¢

â¢

BASED ON THESE PRINCIPLES

, we can reform entitlements, and in the process, solve much of our problem with debt.

Let's start with Social Security. The system is going broke, and many politicians would have us believe that the only way to fix this is by raising taxes. The easiest way to do so, they say, is by lifting the cap on taxable earnings. Right now, people pay payroll taxes on their first $106,800 of earnings for Social Security. If people paid payroll taxes on all their income, it would create a flood of new money and a huge tax increase on upper-income Americans.

49

This is nothing more than a sneaky way to make our tax system more progressive, and it is completely unnecessary. There is no reason to do this. The system can be fixed without more taxes, in three steps.