Read Understanding Business Accounting For Dummies, 2nd Edition Online

Authors: Colin Barrow,John A. Tracy

Tags: #Finance, #Business

Understanding Business Accounting For Dummies, 2nd Edition (10 page)

Its

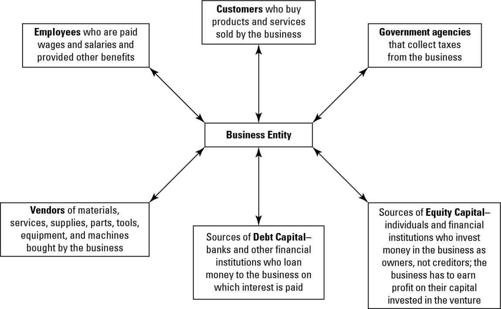

employees,

who provide services to the business and are paid wages and salaries and provided with a broad range of benefits such as a pension plan and paid holidays.

Its

suppliers

and

vendors,

who sell a wide range of things to the business, such as legal advice, electricity and gas, telephone service, computers, vehicles, tools and equipment, furniture, and even audits.

Its

debt sources of capital,

who loan money to the business, charge interest on the amount loaned, and have to be repaid at definite dates in the future.

Its

equity sources of capital,

the individuals and financial institutions who invest money in the business and expect the business to earn profit on the capital they invest.

The

government

agencies

that collect income taxes, payroll taxes, value-added tax, and excise duties from the business.

Figure 1-1 illustrates the interactions between the business and the other parties in the economic exchange.

Even a relatively small business generates a surprisingly large number of transactions, and all transactions have to be recorded. Certain other events that have a financial impact on the business have to be recorded as well. These are called

events

because they're not based on give-and-take bargaining - unlike the something-given-for-something-received nature of economic exchanges. Events such as the following have an economic impact on a business and have to be recorded:

A business may lose a lawsuit and be ordered to pay damages. The liability to pay the damages should be recorded.

A business may suffer a flood loss that is uninsured. The water-logged assets may have to be written off, meaning that the recorded values of the assets are reduced to nil if they no longer have any value to the business.

A business may decide to abandon a major product line and downsize its workforce, requiring that severance be paid to laid-off employees.

Figure 1-1:

The six-spoke wheel of transactions between a business and the parties with which it engages in economic exchanges.

Taking a Closer Look at Financial Statements

As we mention in the preceding sections, accountants prepare certain basic financial statements for a business. The three basic financial statements are the following:

Balance Sheet:

A summary of the financial position of the business at the end of the period.