Understanding Business Accounting For Dummies, 2nd Edition (49 page)

Read Understanding Business Accounting For Dummies, 2nd Edition Online

Authors: Colin Barrow,John A. Tracy

Tags: #Finance, #Business

A business can use alternative accounting methods to determine the cost of stock and the cost of goods sold, and to determine how much of a fixed asset's cost is allocated to depreciation expense each year. A business is free to use very conservative accounting methods - with the result that its stock cost value and the non-depreciated cost of its fixed assets may be much lower than the current replacement cost values of these assets. Chapter 13 explains more about choosing different accounting methods.

Growing Up

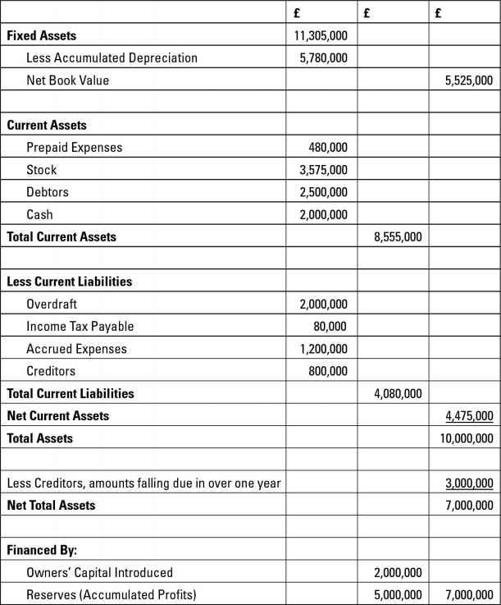

Figure 6-4 sets out the same data as in Figure 6-3 but follows the layout of the UK balance sheet. The conventions, concepts, rules, regulations, resulting ratios, in fact the whole dang thing is exactly the same - it's just that things are in a different order. You'll most probably come across both the UK and US versions in business accounting.

In this layout we start with the fixed assets rather than liquid assets such as cash and work our way down. After the fixed asset sum has been determined to arrive at the residual unwritten down ‘value' of those assets, in this case £5,525,000, we work our way down the current assets in the reverse order of their ability to be turned into cash. The total of the current assets comes to £8,555,000.

Figure 6-4:

UK balance sheet.

Next we get the current liabilities, which come to a total of £4,080,000, and subtract that from the current asset total of £8,555,000 to arrive at a figure of £4,475,000. This is often referred to as the

working capital

, as it represents the money circulating through the business day to day.

By adding the net current assets (working capital) of £4,475,000 to the net book value of the fixed assets, £5,525,000, bingo! We can see we have £10,000,000 tied up in net total assets. Deduct the money we owe long term, the creditors due over one year (a fancy way of describing bank and other debt other than overdraft), and we arrive at the net total assets. Net, by the way, is accountant-speak for deduction of one number from another, often adding a four-figure sum to the bill for doing so.

The net total assets figure of £7,000,000 bears an uncanny similarity to the total of the money put in by the owners of the business when they started out, £2,000,000, and the sum they have left in by way of profits undistributed over the years, £5,000,000. So the balance sheet balances, but with a very different total from that of the US balance sheet.

You can find a blank UK-style balance sheet and profit and loss accounts in Excel format, as well as a tutored exercise and supporting notes, at

www.bized.co.uk/learn/sheets/tasker.xls

.

The Accounting Standards Board provides guidance on how the Companies Act requires balance sheets and profit and loss accounts to be laid out. To access their guidance go to

www.frrp.org.uk

and click on ‘ASB', ‘Technical', and ‘FRSSE'.

Chapter 7

:

Cash Flows and the Cash Flow Statement

In This Chapter

Separating the three types of cash flows

Figuring out how much actual cash increase was generated by profit

Looking at a business's other sources and uses of cash

Being careful about free cash flow

Evaluating managers' decisions by scrutinising the cash flow statement

T

his chapter talks about

cash flows

- which in general refers to cash inflows and outflows over a period of time. Suppose you tell us that last year you had total cash inflows of £145,000 and total cash outflows of £140,000. We know that your cash balance increased £5,000. But we don't know where your £145,000 cash inflows came from. Did you earn this much in salary? Did you receive an inheritance from your rich uncle? Likewise, we don't know what you used your £140,000 cash outflow for. Did you make large payments on your credit cards? Did you lose a lot of money at the races? In short, cash flows have to be sorted into different sources and uses to make much sense.

The Three Types of Cash Flow

Accountants categorise the cash flows of a business into three types:

Cash inflows from making sales and cash outflows for expenses; sales and expense transactions are called the

operating activities

of a business (although they could be called profit activities just as well, because their purpose is to make profit).

Cash outflows for making investments in new assets (buildings, machinery, tools, and so on), and cash inflows from liquidating old investments (assets no longer needed that are sold off); these transactions are called

investment activities.

Cash inflows from borrowing money and from the additional investment of money in the business by its owners, and cash outflows for paying off debt, returning capital that the business no longer needs to owners and making cash distributions of profit to its owners; these transactions are called

financing activities.

The cash flow statement (or

statement of cash flows

) summarises the cash flows of a business for a period according to this three-way classification. Generally accepted accounting principles (GAAP) require that whenever a business reports its income statement, it must also report its cash flow statement for the same period - a business shouldn't report one without the other. A good reason exists for this dual financial statement requirement.

The income statement is based on the

accrual basis of accounting

that records sales when made, whether or not cash is received at that time, and records expenses when incurred, whether or not the expenses are paid at that time. (Chapter 3 explains accrual basis accounting.) Because accrual basis accounting is used to record profit, you can't equate bottom-line profit with an increase in cash. Suppose a business's annual income statement reports that it earned £1.6 million net income for the year. This does not mean that its cash balance increased £1.6 million during the period. You have to look in the cash flow statement to find out how much its cash balance increased (or, possibly, decreased!) from its operating activities (sales revenue and expenses) during the period.

In the chapter, we refer to the net increase (or decrease) in the business's cash balance that results from collecting sales revenue and paying expenses as

cash flow from profit

, as the alternative term for

cash flow from operating activities.

Cash flow from profit seems more user-friendly than cash flow from operating activities, and in fact the term is used widely. In any case, do not confuse cash flow from profit with the other two types of cash flow - from the business's investing activities and financing activities during the period.