Understanding Business Accounting For Dummies, 2nd Edition (57 page)

Read Understanding Business Accounting For Dummies, 2nd Edition Online

Authors: Colin Barrow,John A. Tracy

Tags: #Finance, #Business

In discussing the third step later in the chapter, we walk on thin ice. Some topics are, shall we say, rather delicate. The manager has to strike a balance between the interests of the business on the one hand and the interests of the owners (investors) and creditors of the business on the other. The best analogy we can think of is the advertising done by a business. Advertising should be truthful but, as we're sure you know, businesses have a lot of leeway in how to advertise their products and they have been known to engage in hyperbole. Managers exercise the same freedoms in putting together their financial reports.

Reviewing Vital Connections

Business managers and investors read financial reports because these reports provide information regarding how the business is doing. The top managers of a business, in reviewing the annual financial report before releasing it outside the business, should keep in mind that a financial report is designed to answer certain basic financial questions:

Is the business making a profit or suffering a loss, and how much?

How do assets stack up against liabilities?

Where did the business get its capital, and is it making good use of the money?

Is profit generating cash flow?

Did the business reinvest all its profit or distribute some of the profit to owners?

Does the business have enough capital for future growth?

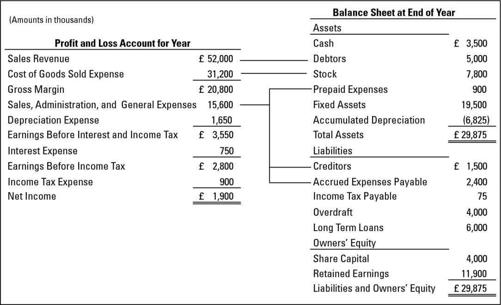

As a hypothetical but realistic business example, Figure 8-1 highlights some of the vital connections - the lines connect one or more balance sheet accounts with sales revenue or an expense in the profit and loss account. The savvy manager or investor checks these links to see whether everything is in order or whether some danger signals point to problems. (We should make clear that these lines of connection do not appear in actual financial reports.)

In the following list, we briefly explain these five connections, mainly from the manager's point of view. Chapters 14 and 17 explain how investors and lenders read a financial report and compute certain ratios. (Investors and lenders are on the outside looking in; managers are on the inside looking out.)

Figure 8-1:

Vital connections between the profit and loss account and the balance sheet.

Note:

We cut right to the chase in the following brief comments and we do not illustrate the calculations behind the comments. The purpose here is to emphasise why managers should pay attention to these important ratios. (Chapters 5 and 6 provide fuller explanations of these and other connections of operating assets and liabilities with sales revenue and expenses.)

1.

Sales Revenue and Debtors:

This business's ending balance of debtors is five weeks of its annual sales revenue. The manager should compare this ratio to the normal credit terms offered to the business's customers. If the ending balance is too high, the manager should identify which customers' accounts are past due and take actions to collect these amounts, or perhaps shut off future credit to these customers. An abnormally high balance of debtors may signal that some of these customers' amounts owed to the business should be written off as uncollectable bad debts.

2.

Cost of Goods Sold Expense and Stock:

This business's ending stock is 13 weeks of its annual cost of goods sold expense. The manager should compare this ratio to the company's stock policies and objectives regarding how long stock should be held awaiting sale. If stock is too large the manager should identify which products have been in stock too long; further purchases (or manufacturing) should be curtailed. Also, the manager may want to consider sales promotions or cutting sales prices to move these products out of stock faster.