Understanding Business Accounting For Dummies, 2nd Edition (63 page)

Read Understanding Business Accounting For Dummies, 2nd Edition Online

Authors: Colin Barrow,John A. Tracy

Tags: #Finance, #Business

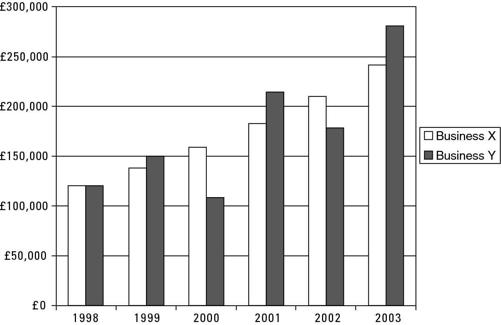

For the first year in the series, 1998, no profit smoothing occurred. Actual profit is on target. For each of the next five years, the two profit numbers differ. The under-gap or over-gap of actual profit compared with smoothed profit for the year is the amount of revenue or expenses manipulation that was done in the year. For example, in 1999, actual profit would have been too high, so the company moved some expenses that normally would be recorded the following year into 1999. In contrast, in 2000, actual profit was running too low, so the business took action to put off recording some expenses until 2001.

If a business has a particularly bad year, all the profit-smoothing tricks in the world won't close the gap. But several smoothing techniques are available for filling the potholes and straightening the curves on the profit highway.

Figure 8-2:

Comparison of two annual profit histories.

Profit-smoothing techniques

One common technique for profit smoothing is

deferred maintenance.

Many routine and recurring maintenance costs required for vehicles, machines, equipment, and buildings can be put off, or deferred until later. These costs are not recorded to expense until the actual maintenance is done, so putting off the work means that no expense is recorded. Or a company can cut back on its current year's outlays for market research and product development. Keep in mind that most of these costs will be incurred next year, so the effect is to rob Peter (make next year absorb the cost) to pay Paul (let this year escape the cost).

A business can ease up on its rules regarding when slow-paying customers are decided to be bad debts (uncollectable debtors). A business can put off recording some of its bad debts expense until next year. A fixed asset out of active use may have very little or no future value to a business. Instead of writing off the non-depreciated cost of the

impaired asset

as a loss this year, the business may delay the write-off until next year.

So, managers have control over the timing of many expenses, and they can use this discretion for profit smoothing. Some amount of expenses can be accelerated into this year or deferred to next year in order to make for a smoother profit trend. Of course, in its external financial report a business does not divulge the extent to which it has engaged in profit smoothing. Nor does the independent auditor comment on the use of profit-smoothing techniques by the business - unless the auditor thinks that the company has gone too far in massaging the numbers and that its financial statements are misleading.

Browsing versus Reading Financial Reports

Very few people have the time to carefully read all the information in an annual financial report - even if the report is relatively short.

Annual financial reports are long and dense documents - like lengthy legal contracts in many ways. Pick up a typical annual financial report of a public corporation: You would need many hours (perhaps the whole day) to thoroughly read everything in the report. You would need at least an hour or two just to read and absorb the main points in the report. How do investors in a business deal with the

information overload

of annual financial reports put out by businesses?

An annual financial report is like the Sunday edition of

The Times

or

The Telegraph.

Hardly anyone reads every sentence on every page of these Sunday papers - most people pick and choose what they want to read. Investors read annual financial reports like they read Sunday newspapers. The information is there if you really want to read it, but most readers pick and choose which information they have time to read.

Annual financial reports are designed for archival purposes, not for a quick read. Instead of addressing the needs of investors and others who want to know about the profit performance and financial condition of the business - but have only a very limited amount of time to do so - accountants produce an annual financial report that is a voluminous financial history of the business. Accountants leave it to the users of annual reports to extract the main points from an annual report. So, financial statement readers use relatively few ratios and other tests to get a feel for the financial performance and position of the business. (Chapters 14 and 17 explain how readers of financial reports get a fix on the financial performance and position of a business.)

Some businesses (and non-profit organisations in reporting to their members and other constituencies) don't furnish an annual financial report. They know that few people have the time or the technical background to read through their annual financial reports. Instead, they provide relatively brief summaries that are boiled-down versions of their official financial statements. Typically these summaries do not provide footnotes or the other disclosures that are included in annual financial reports. These

condensed financial statements

, without footnotes, are provided by several non-profit organisations - credit unions, for instance. If you really want to see the complete financial report of the organisation you can ask its headquarters to send you a copy.

You should keep in mind that annual financial reports do not report everything of interest to owners, creditors, and others who have a financial interest in the business.

Annual

reports, of course, come out only once a year - usually two months or so after the end of the company's fiscal (accounting) year. You have to keep abreast of developments during the year by reading financial newspapers or through other means. Also, annual financial reports present the ‘sanitised' version of events; they don't divulge scandals or other negative news about the business.

Finally, not everything you may like to know as an investor is included in the annual financial report. For example, for US companies, information about salaries and incentive compensation arrangements with the top-level managers of the business are disclosed in the

proxy statement

, not in the annual financial report of the business. A proxy statement is the means by which the corporation solicits the vote of shareholders on issues that shareholders must give their approval - one of which is compensation packages of top-level managers. Proxy statements are filed with the SEC and are available on its EDGAR database,

http://www.sec.gov/edgar/searchedgar/cik.htm

. In the UK this information would usually appear in the body of the main report under the heading, Report of the Directors on Remuneration.