When Computers Were Human (34 page)

Read When Computers Were Human Online

Authors: David Alan Grier

By nature, Davis should have been among the critics of the National Youth Administration. He was a political conservative and once described President Franklin Roosevelt as a “violent man, who showed the nature of his spots immediately after his election.” Yet, when Indiana University announced that it would start a National Youth Administration program, he put his political objections aside and moved “with a boldness that verged on rashness” to secure NYA funds for his computers. He suspected that “the University administration, caught without definite plans for the employment of these young people, would set them to menial tasks about the campus.” With a clear program in hand, he was able to acquire a substantial amount of the National Youth Administration

funds allocated to Indiana University, though he confessed he gained “few friends by his boldness.”

35

In all, the National Youth Administration funds helped him produce two more volumes of tables.

The quality of Davis's calculations was tested when

Tables of Higher Mathematical Functions

reached the British Nautical Almanac Office and the desk of L. J. Comrie.

36

“With an unknown author,” wrote Comrie, “it is desirable to check considerable parts of the tables, to see if he has the reliability of Andoyer and Peters, the proneness to error of Steinhauser, Gifford and Hayashi, or the plagiaristic tendencies of Duffield, Benson and Ives.”

37

These other human computers had been the targets of pointed reviews by Comrie; and Davis was to join their number. Comrie worked through the book, table by table and value by value. By recomputing 2,000 entries, he reconstructed Davis's original computing plan, uncovered a substantial number of errors in the book, and identified the source of each mistake. Comrie noted that the pattern of errors indicated that the computers had verified their results by repeating the calculations a second time, “the poorest possible check” in his eyes. They had made mistakes in rounding the numbers and had introduced errors when they transcribed the values. Even the design of the book did not escape his attention. “The general lay-out of the tables,” Comrie wrote, “shows a lack of acquaintance with many elementary principles of tabulation, lack of consistency and lack of consideration for the user.” The review was not entirely negative, though its conclusion, that “table-lovers are assured that they should possess this work,” seemed faint praise.

38

Davis apparently paid due attention to Comrie's criticism, for the second set of tables, those produced with NYA funds, had considerably fewer errors than the first.

39

During the first years of the Great Depression, H. T. Davis spent summers at the family home in Colorado Springs. It was a time to get away from the demands of university life, a chance to see old friends, and an opportunity to meet those who had come to southern Colorado in search of a better life. Town society included wealthy miners and poverty-stricken farmers. There were ministers hoping to find a land more spiritual and patients who hoped that the dry air might free them from tuberculosis. Among this group was a businessman named Alfred H. Cowles (1891â1984), who had survived the stock market crash with most of his fortune intact and had come to think that he might use his resources to improve the national economy.

Cowles was not formally trained in economics or in the methods of research, but he came from a successful newspaper family. The Cowles family owned the Cleveland

Leader

, had a substantial share of the Chicago

Tribune

, and also published farm papers in Washington, Oregon,

and Idaho which were similar to

Wallace's Practical Farmer

. Alfred Cowles had begun his career at the family paper in Spokane before deciding that he wanted to form his own business. He established an investment firm in Chicago and specialized in acquiring and restructuring small railroads. For a time, he ran a small conglomeration of southern lines that was known as the Alfred Cowles Railroad,

40

but he never entirely broke his ties with the world of journalism. His firm published a stock market newsletter that analyzed the state of the market and recommended stocks to buy or sell.

In the late 1920s, Cowles was diagnosed with tuberculosis, and as others had done before him, he moved west in search of better health.

41

He withdrew from business shortly before the stock market crash of 1929, an event that caused him to think about the health of the economy as well as his own physical well-being. The initial prognoses for the market were optimistic and forecast a quick return to prosperity, but stock prices continued to fall. With time to ponder the situation, Cowles “began to feel that most of the forecasters were just guessing, himself included.”

42

Living a life of enforced leisure, he began to sketch ideas for studying the stock market. His financial work had taught him something about correlation and statistical least squares. His first analysis was a regression model, one that simultaneously compared the predictions of twenty-four different market newsletters with the actual stock market prices. The equations required him to use least squares and demanded a substantial amount of calculation, calculation that Cowles did not know how to do.

With the resources at his command, Alfred Cowles could have easily found university researchers willing to study stock market predictions. He had connections at Yale University, where he had gone to college, and at the University of Chicago. Yet it seems that Cowles wanted to do the work himself, that he wanted to be the gentleman researcher, the amateur scholar working in semiretirement. Believing that he could do the work if he had assistance with the computations, he went in search of calculating help. He was led to H. T. Davis through a mutual friend, the director at a local tuberculosis foundation. In many ways, Davis was a good match for Cowles, for he never questioned the businessman's approach to research. Had he been more active in the economics community, Davis might have tried to push Cowles toward a certain type of research, or he might have tried to make Cowles a silent partner in his own research. Instead, he tried to be the best help he could. “As far as I know, such a regression equation has never been made,” Davis replied, apparently unaware that Myrrick Doolittle had solved such equations by hand at the Coast and Geodetic Survey, that Howard Tolley had done similar work at the Department of Agriculture, and that George Snedecor was doing the same at Iowa State College.

43

“It happens, however,” Davis continued,

“that a new machine is now available, a Hollerith Calculator, by means of which such a problem can be solved.”

44

In fact, Davis had little, if any, experience with “Hollerith Calculators,” as tabulating equipment from International Business Machines was sometimes called. His opinion was deduced from what others had told him or from what he read about the machines in the scholarly literature. While card tabulators could ease the labor of computing a large regression problem, they were unable to do some of the most difficult and time-consuming work, as the workers at the Iowa State Statistical Laboratory had learned. The Iowa State computers were able to use the machines only to calculate correlations and do the preliminary work for a regression problem. The final solution had to be calculated with an adding machine. To solve a regression problem with twenty-four elements could require eight or ten months of labor.

Though he knew little about tabulating equipment, Davis agreed to help Cowles build a computing laboratory in Colorado Springs. Later that summer, the two of them took the train north to Denver and visited a company that used punched card tabulators in its business. Cowles was satisfied with what he saw and leased a full set of equipment for his office.

45

Only after the tabulators arrived in Colorado Springs, perhaps as late as August, did Davis realized that the tabulating equipment could not compute a correlation or solve a regression equation. To compensate for this deficiency, he pressed Cowles to hire some of the computers that had prepared the

Tables of Mathematical Functions

in Indiana.

46

Cowles eventually adjusted his research plans, replacing the massive twenty-four-term regression with a series of twenty-four smaller calculations. Much of the work for these smaller calculations could be handled by the punched card equipment, leaving only a little arithmetic for the computers to do by hand. As he gathered data, he also developed a simpler way of analyzing the stock market forecasts, a method that compared the forecasts to random guesses. The calculations for this method were easily handled by the punched card machines. It was not the work that Cowles had planned to do, but it allowed him to answer the question “Can stock market forecasters forecast?” with the quick summary “Not very well.” He elaborated that “the best individual records failed to demonstrate that they exhibited skill and indicated that they more probably were the results of chance.”

47

Cowles must have known that he would never be a major economic researcher, but he wanted to be a part of the economics community and guide its research. He incorporated his office into a private research foundation, the Cowles Commission for Economic Research, and he actively reached out to scientists who were interested in economic research and organized computation. Using H. T. Davis as an intermediary, he met

with James Glover, who taught actuarial mathematics and computation at the University of Michigan, and Thornton Fry of Bell Telephone Laboratories.

48

He also approached the Econometric Society, a new professional society devoted to the mathematical study of the economy, and offered to collaborate with them, to provide them with computing services, and to fund their publications. Initially, his proposal produced hesitation among the economists. One member reported that a few “became alarmed lest the Society's good name be harmed by its implication in a venture with a man who was willing to spend a considerable sum of money in order to accomplish they knew not what purposes of his own.” The group debated the proposal among themselves before sending one of their number to meet with Cowles and to inquire about his intentions. The emissary spent a week with the businessman and concluded “that Cowles was sincerely interested in econometric research.” He urged the society to take Cowles's money, work with his research organization, and utilize his computing staff without fearing that he would attempt to influence them or their work.

49

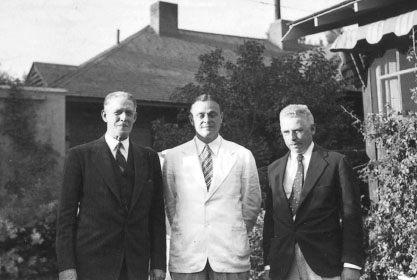

28. Alfred Cowles (center) with H. T. Davis (right) at Cowles's home in Colorado Springs. Photo taken by Elizabeth Webb Wilson

At the Econometric Society, Cowles crossed paths with Elizabeth Webb Wilson, the ballistics computer of the First World War.

50

Wilson was living in Cambridge, Massachusetts, and pursuing a doctorate in economics at Radcliffe College. She was the only woman among the First World War computers to find some kind of scientific role, but her success had

been shaped more by her wealth than by her wartime accomplishments. She had taught high school after the war until an inheritance from her parents left her a substantial income. Freed of the need to work, she had pursued graduate study, first at the University of Michigan and later at Radcliffe. Like Cowles, she tried to move beyond the role that wealth had brought her, though she was limited by her gender in a way that Cowles was not. Instead of financing industry, she had done calculations for the Michigan Teachers' Annuity. Instead of commanding the Econometric Society, she had represented Michigan professor James Glover at actuarial congresses. Though she might yearn to be the leader, she would accept the role of observer and commentator.

51

If “business principles were quite free to work out their logical consequences, the outcome should be to put the pursuit of knowledge definitely in abeyance,” quipped the economist Thorsten Veblen.

52

Veblen's nephew, the mathematician Oswald Veblen, rarely agreed with his uncle's pronouncements, but he might have conceded the idea that commercial businesses rarely supported unfettered scientific research. The younger Veblen had spent part of the 1920s in a frustrating attempt to convince industries that supporting mathematical research was in their interest, a campaign that he called “our Debt to Mathematics.”

53

It proved to be a much harder task than organizing the computing staff at Aberdeen. Few industries, save those involved in power generation or aircraft production, saw any value in pure mathematics. Mathematicians found it easier to raise money for computation, as computation could support a corporate goal. Both Westinghouse and General Electric expanded their computing staffs during the 1930s, as they were involved in the construction of the large New Deal electrical projects: the Rural Electrical Association, the Tennessee Valley Authority, and the dams on the Columbia River. The two companies investigated Vannevar Bush's new computing machine, the differential analyzer, in order to handle their engineering calculations. One of the few examples of a company funding an independent computing lab, a lab with little direct connection to company production, was the scientific computing facility at Columbia University, which was financed by International Business Machines.