Don't Break the Bank: A Student's Guide to Managing Money (17 page)

Read Don't Break the Bank: A Student's Guide to Managing Money Online

Authors: Peterson's

Tags: #Azizex666

Probably the most important thing you need to do when it comes to managing your money is creating a budget. For most people, creating a budget isn’t so hard—but sticking to it can be a challenge.

A budget is where you track what money you have coming in, and then plan where it will go. Having a budget is important because otherwise it’s easy to spend all of your money on non-essentials—and, before you know it, you have no money left and you still haven’t paid your bills or taken care of important expenses.

How to Set Up a Budget

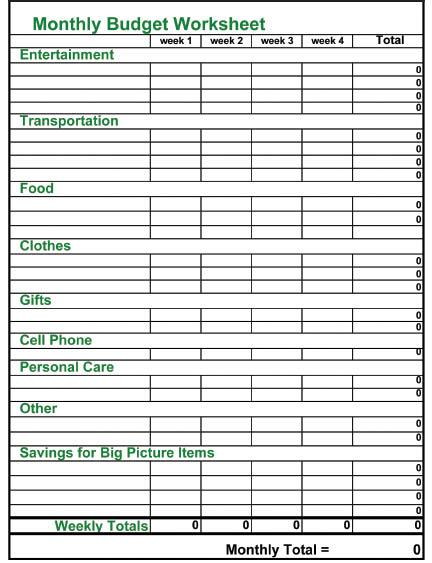

There are lots of ways to set up a budget. You can use a site like Mint.com that lets you organize a budget online. You can create a spreadsheet in Excel and keep it on your computer. You can get a fancy budgeting ledger from an office supply store. Or you can just write up a simple chart in a notebook.

It doesn’t really matter so much what your budget looks like. The important thing is that you come up with a system you like and that’s easy for you to keep current. Otherwise, you will quickly give up, and your budget will be long forgotten.

Did You Know?

Only nine states actually require that personal financial education courses be offered to students. No wonder so many teens don’t know as much as they should about managing money!

When setting up your budget, you first list your income for the month. Include all sources of income (job, allowance, and anything else). If your income varies from month to month, it’s usually a smart idea to estimate on the low end, just to be on the safe side. Next, make a list of all of your expenses. Start with the most important ones first—things like your cell phone bill, car insurance (if you have it), any school expenses, and other necessities. After that, you can list “luxuries” like clothes and entertainment. By setting a specific amount for these things in your budget, you might find it easier to decide which purchases are most important. (For example, if you have $50 for clothes in your budget, you may decide that spending $45 on a single shirt isn’t a smart strategy.)

If possible, you should try to include savings in your budget. Even if you can only save a small amount, that’s still better than nothing.

The Best Laid Plans

Expert Advice

“Save more than you spend. Ok, ok, I know what you are thinking, ‘I am a teenager. I am working to play, to shop, and to have fun.’ So true, but think about this: If you pay yourself first (instantly putting money into your savings), that money will grow, and that reward down the road will be greater and you will have something to show for all your hard work.”

~ Bethany Myers, MBA, Owner/Career Consultant at BLM Consulting

To plan your budget, consider your spending habits. Where does your money usually go? Don’t be surprised if you don’t know—at least, not exactly. Many people find themselves struggling to figure out how they spent all of their money without realizing it.

How Far Would $100 Go?

How far can you stretch a buck? (Or $100?) That depends a lot on your spending (or saving) habits—and your shopping savvy.

Let’s look at a few typical spending personalities, and see how far $100 would last them.

The Fashionista

You see a designer pair of boots at the mall. You tend to have no willpower when it comes to shopping (especially when it comes to boots), so you immediately reach for your wallet. The boots cost $125. Unless you can get a special discount or borrow some money from a friend, you only have enough for one boot and half of the other one. No matter, because if you don’t buy the boots, you will surely see something else at one of the other stores that catches your eye. Your money won’t even last an hour because it will be gone before you leave the mall.

The “Hey, Where Did All My Money Go?” Spender

This past week, you stopped for a caramel latte (cost: $4 each) every morning. You took a cab across town twice, at a cost of $5 each time. Yesterday, you grabbed a copy of People magazine ($4.99) and a container of Orbit gum ($2.50). You’ve downloaded twelve songs from iTunes® this week, at $0.99 each. You went to the movies with friends, where you had popcorn, a soda, and a box of Milk Duds (total cost, including the ticket: $23). One night, you had a craving for some junk food, and since the supermarket was already closed, you had to go to the convenience store, where they charged you $5 for a bag of Combos, $3 for a soda, and $2 for a candy bar. Now your cell phone bill is due, but you realize you›ve got less than $20 left, and you can›t figure out where your money went because you really have nothing to show for it.

The Thrifty Saver

You like to put as much of you cash into your savings fund as you can. You try to stick to a strict $20 weekly budget for “spending money.” You buy snacks at the grocery store, and you pick store brands whenever possible. You also aren’t embarrassed to use coupons. You take the bus, walk, or carpool with friends. Instead of expensive nights out, you host get-togethers with friends at your house. You watch movies online or rent them through Netflix. For you, $100 would be more than enough for the week, and you’d have some to stash in your savings.

Keep a Money Diary

To really get a handle on how you spend your money, you may need to keep a “money diary” for several weeks. During this period, write down everything you spend—that means every single penny. Keep a tiny notebook with you, and jot down every purchase you make. Don’t skip anything—even the 50 cents you spend on bus fare should be recorded.

At the end of the month, add up everything you recorded in your money diary. You can separate it by categories (or specific stores or bills). To get a really clear picture of your spending, put your list on an Excel spreadsheet, and create a pie chart or other colorful graphic in which you break down your spending by categories. You may be shocked to see what your biggest “money grabbers” are.

Pinpoint Your Priorities

Expert Advice

“Write down EVERYTHING you spend money on for an entire month, from a $1 coke to a $25 haircut. This is an eye opener when it comes to wasting money! Just one Starbucks per day can add up to $100 a month! A better alternative might be to use the coffee pot! Maybe you will realize that you’d rather pack a lunch instead of buying lunch each day.”

~

Kristl Story of TheBudgetDiet.com

An important part of planning your budget is determining your priorities and identifying your commitments. If you have payments, such as for a cell phone or other utilities, credit cards, or a loan, that should be an important priority. These are important commitments and should be at the top of your budget. If you have a tendency to want to splurge on shopping sprees, make sure you pay these bills immediately as soon as you get paid, before you have a chance to get distracted by the big sale at the mall. (Consider setting up an automatic payment arrangement via online banking, so the bills will be paid before you ever get the money in your hands.)

Make It a Family Affair

Expert Advice

“Budgeting is always a sensitive subject and requires a lot of conviction to successfully execute. An easier alternative is to pull out the same amount of money from an ATM each week, say $50, and allow that amount for your discretionary spending for the week. This way, you can physically see how much remains in your wallet, which makes it easier to plan your daily activities according to how much money you still have.”

~

Gabe Albarian, President, Financial Swagger, Inc.

Teens aren’t the only ones who often find budgeting to be a challenge. Many adults have trouble tracking their spending and managing their budgets. So this may be a good opportunity to do a family activity together. Recruit your parents and siblings to join in, and together you can work on creating a family budget. You may even be able to teach your parents a few tricks, such as how to organize and track their expenses online.

Needs vs. Wants

One of the toughest parts about budgeting your money and cutting back on expenses is determining your necessities—what you truly need. The basic rule of smart money management, especially when you need to live on a tight budget, is that you need to focus on what you need, not necessarily what you want. Again, this comes back to priorities. But it also requires you to be really honest with yourself about what you really need. Let’s face it, that new iPhone case probably isn’t something you really need. On the other hand, food is a necessity. Likewise, bus fare or a subway card may be a necessity if you need transportation to get to work.

Yes, it’s not always fun to separate needs from wants. Almost always, the “wants” are more fun, while the needs tend to be the boring, practical stuff like food and shelter. Ideally, you will be able to squeeze room in your budget for a few fun things. (Later in this chapter, the tips in the section on saving money may help you stretch your budget.) But if not, you need to make sure you take care of the necessities first.

Common Expenses—The Stuff We All Want

There are some common areas where many teens spend a lot of their money. Again, how high these should be on your priority list depends on what other expenses you have and how much room you have in your budget.

Go Go Gadgets!

This is an increasingly big expense for teens. While most teens today don’t spend a lot of money on CDs, they do spend a lot on gadgets like gaming systems, phone, MP3 players, and other electronics and accessories.

According to a survey by

Seventeen

magazine, 75 percent of teens would choose a new pair of shoes over 50 new MP3 downloads, and 63 percent would choose a new pair of jeans over tickets to a concert.

This is the kind of thing you may want to start a savings fund for, putting away a certain amount each week until you can afford to buy it. It’s also important to take good care of your electronics, so they can last as long as possible. Consider buying a replacement plan, especially if you tend to be rough on electronics.

Fun Fact:

In 2009, 76 percent of all 8- to 18-year-olds owned an iPod or an MP3 Player.

Can You Hear Me Now? Cell Phone Expenses

Is a cell phone a necessity or a luxury? This is one thing you can probably debate, but you could make a decent case for listing it as a necessity. For safety reasons, it’s a good idea to have a cell phone in case of emergencies, such as if your car breaks down or you have a problem while walking home late at night.

Shocking Stat

In 2009, a 13-year-old from California racked up a whopping cell phone bill of more than $21,000 after downloading 1.5 kilobytes of data with his phone. That same year, a 13-year-old girl from Wyoming got a cell phone bill for nearly $5,000 after sending more than 10,000 text messages in one month.

Most teens today do have a cell phone—which means they not only have to pay for the phone, they also have a monthly bill. If you’re lucky, your parents can add you to their family plan, which may make your individual bill lower than if you had an individual plan. Do your parents insist that you pay for your share of the bill? If so, you need to educate yourself about your phone plan, including rates and charges. Pay particular attention to monthly limits on minutes and text messages. Also find out about downloading rates and limits, especially if you access the Web a lot on your phone.

To keep your cell expenses under control and to make it easier to budget, consider going the prepaid route. There are several different carriers that offer prepaid plans, and you can choose from a bunch of different types of phones, including the PDA and flip phone varieties. Some prepaid plans offer unlimited text and data options.