Read Eat the Rich: A Treatise on Economics Online

Authors: P.J. O'Rourke

Tags: #Non-Fiction, #Business, #Humour, #Philosophy, #Politics, #History

Eat the Rich: A Treatise on Economics (6 page)

“The work hours are horrible,” explained the Irish specialist broker.

“Tons of hours. It takes speed, concentration. There’s a big burnout factor. A lot of ‘I want a life.’”

But the same can be said of delivering Domino’s pizzas. The professionals in the world of money seem to make so much of that money themselves. How can anybody justify the size of the paychecks?

“I don’t,” said the $2 billion money manager.

“I can’t defend it,” said David the floor broker.

“They shouldn’t be making it,” said the specialist.

Why do we put up with this? The whole business of international finance is dumbfounding. These damn business cycles—we don’t know whether to lie around the Riviera, clipping the coupons on bonds, or sit around the kitchen table, clipping the coupons in newspapers. Investments cause us to act silly. One minute we’re loading our possessions on top of the Ford and fleeing the dust bowl. The next minute we’re buying dust futures on the Chicago Commodity Exchange.

This shit-shower of money flying around the world…This fiscal El Niño blowing certificate-of-deposit droughts to one place and no-load mutual fund floods to someplace else…These cash storms lofting

Hindenburg

high-techs into the sky…These speculatory lightning strikes sending transportation and utilities down in flames. What’s in it for us?

We ordinary toilers at the cubicle farm: Why don’t we rise up? Why don’t we get rid of the capitalist system and replace it with something that’s nicer and more predictable, and gives everybody an even break? “What,” I asked all the Wall Street people I interviewed, “does the investment industry give to society?”

But this time they had an answer.

“Liquidity,” said the $2 billion money manager.

“Liquidity,” said the investment banker who’d described how men’s thoughts were on pecuniary B-girls.

“Liquidity,” said the other investment banker who’d told me things could move stupidly.

“Liquidity,” said the Irish specialist broker.

“It provides liquidity,” said David.

Liquidity

is the Wall Street word for having things you can do with your money and being able to do them. Liquidity is the essence of the free market. Men with more time to explain themselves might have said something like, “We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty, and Ka-ching!, Ka-ching!, Ka-ching!”

If we’re going to have freedom and the money to enjoy it, we have to put up with the stuff in this chapter. At least that’s what the people who run the stuff in this chapter say. Which brings me to the only reason anybody ever reads a chapter like this: What should

you

do with

your

money?

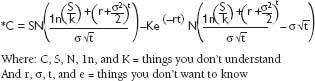

And I actually happen to know. In the course of researching the investment industry, I had drinks with Myron S. Scholes and Robert C. Merton, who had just won the 1997 Nobel Prize in economics. They won the Nobel by creating a mathematical formula for pricing derivatives.* They’ve made a pile of money Sir Edmund Hillary couldn’t climb. And they are two of the smartest people in the world—the Nobel committee says so. I asked them what you should do with your money. (Actually, I asked them, “What

I

should do with

my

money” but…) They said the same thing: “Asymmetrical information.”

You should trade on asymmetrical information. The commodities-selling ranchers counting their calves, the Burger King executives calculating their burgers—these are examples of asymmetrical information. When somebody in a market has (or thinks he has) information that the rest of the people in the market don’t have, that’s asymmetrical.

There wouldn’t be much of a market otherwise. If everybody believed what everybody else believed, everybody would set the same price on everything. The middle-aged men on the stock-exchange floor could quit hollering and go have lunch.

The Wall Street Journal

would become

The Wall Street Shopping Mall Giveaway.

Asymmetrical information shouldn’t be confused with “inside information” because it’s exactly the same thing. Inside information is just the part of asymmetrical information that it happens to be illegal to use. If you’re a highly placed executive at Seagram and know about the upcoming Disney takeover and the new Scotch-and-Water Park, you can’t buy Disney stock in anticipation of the premium that Seagram is going to pay for Disney shares. But if you’re the janitor who empties the highly placed executive’s wastepaper basket, and you know that scotch tastes terrible with inner tubes in it and that drunk people in mouse suits are not to be trusted, you can do anything you want.

The problem is, you aren’t either of those people. And neither am I. This is why we shouldn’t be investing in stocks. We should invest in mutual funds. Mutual funds have multitudes of ex-indie-filmmaker M.B.A.s searching out asymmetrical information.

The problem is, there are too many M.B.A.s discovering the same asymmetrical information, which makes the information all symmetrical again. This is why we should invest in index funds.

The problem is, index funds contain the same stocks that make up the Dow Jones Industrial Average or the like. Index funds will go where the stock market goes. And where the hell is that?

This information is so asymmetrical, nobody knows it.

(What you should really do with your money is watch me. That is, watch what the baby boom does. We baby boomers have caused everything since 1946. We’ll keep buying stocks until we retire. But when we hit sixty-five, we’re going to sell stocks. And the stock market is going to go down. And we’re going to wet ourselves. The math is simple: 1946 + 65 = 2011. Buy stocks until 2011, and then buy Depends.)

There are alternatives to the free market. Congress could pass stricter investment-industry regulations, more orders and directives like the New York Stock Exchange’s rule against running. Investment-industry professionals probably hate all those limitations. Except they don’t. “I think the mix is perfect,” said David. “The rules are rigid and strict.”

“There are things you take for granted in our market—rule of law,” said the B-girl investment banker.

“It’s mostly disclosure rather than regulation per se,” said the move-stupidly investment banker.

SEC requirements and NYSE bylaws are there to make sure that investment trading is fast and confident and the O. J. jury doesn’t have to be brought in every time somebody says “at” instead of “for.” These kinds of restrictions aren’t concerned with how much money goes to which place, just with how it gets there.

On the other hand, we could have the government take over the investment industry. The government would consider what’s best for us all. If Americans wanted to buy stock, the government might, for example, look at the Coca-Cola Company. Coca-Cola was selling for $1.54 a share in 1982, and, as of mid-1998, it went for $78. That would have been a good buy. But Coca-Cola is not a product that provides social benefits. It causes cavities, is a factor in the increasingly dangerous nationwide obesity health threat, and contains caffeine, which harms fetal development in unwed mothers. The government would buy shares in the Studebaker corporation instead.

Studebaker is heavy industry. Heavy industry provides high-paying jobs to semiskilled workers. Studebaker made important contributions to America’s defense efforts during World War II. And Studebaker automobiles produce very little air pollution, because there are only about 200 of them left on the streets. True, Studebaker is out of business, but the government could leave a box of investment money in the empty lot where the Studebaker factory used to be, and semiskilled workers could come by and take what they need.

Plus, if the government controlled the investment industry, those pirates in neckties would be replaced by civil servants on modest salaries. Your investment decisions would be made by government employees, people like, in Arkansas for instance, Paula Jones. You could have your whole retirement fund tied up in a failed lawsuit about the president’s dick.

Maybe we should leave government out of it. Maybe we should select a committee of wise and principled individuals to guide the global investment markets—Mario Cuomo, Toni Morrison, Václav Havel, Oprah, the Dalai Lama, Alec Baldwin, and Kim Basinger. The committee would consider such matters as product safety, environmental impact, social justice between rich and poor nations, and whether a corporation has a “glass ceiling” for women executives. Then the committee would allocate capital accordingly. Kim can be very persuasive on the subject of animal rights. Now your retirement fund consists of a thousand bunny rabbits that have been rescued from medical testing.

Or we could leave the investment industry pretty much alone and just divide its profits evenly. Bill Gates heads an enormous corporation in Redmond, Washington. You teach data processing at a community college in Akron, Ohio. At the end of the year, Bill and you—and everybody else—divvy up. Once. After that, Bill may decide that running Microsoft is an awful lot of work. For the same money, he might as well swipe your job teaching data processing. He certainly has the clothes for it.

Or we could all just move to North Korea and eat tree bark.

Wall Street’s free-market capitalism is doubtless a wonderful thing and a boon to humanity, but it scared me. The free market scared me even when I watched it function under the rule of law. Capitalism scared me despite the fact that I was seeing it operate within a well-defined set of rules understood by all the players. And I liked the players. Capitalists are at least as honest and nice as the people I know who don’t have capital. But I was still scared.

Free-market capitalism was terrifying under the best circumstances. What it was like under the worst circumstance, I couldn’t imagine. And because I couldn’t imagine it, I needed to go someplace that had no rules and was full of crooks. I considered Washington, D.C., but Albania looked like more fun.

ALBANIA

Albania shows what happens to a free market when there is no legal, political, or traditional framework to define freedoms or protect marketplaces. Of course there’s lots of violence—as you’d expect in a situation where the shopkeepers and the shoplifters have the same status under law. And, of course, there’s lots of poverty. Theft is the opposite of creating wealth. Instead of moving assets from lower- to higher-valued uses, theft moves assets from higher-valued uses to a fence who pays ten cents on the dollar for them. But capitalism conducted in a condition of anarchy also produces some less-predictable phenomena. Albania has the distinction of being the only country ever destroyed by a chain letter—a nation devastated by a Ponzi racket, a land ruined by the pyramid scheme.

A pyramid is any financial deal in which investors make their money not from investing but from money put into the deal by other investors, and those investors make money from the investors after that, and so on. It’s the old “send five dollars to the name at the top of the list, put your own name at the bottom of the list, and mail copies to future ex-friends.” If I want to make fifty dollars from my five dollars, ten new dupes must be recruited. If each of them hopes to make fifty dollars, a hundred suckers will be needed, then a thousand, and hence the “pyramid” name. If a pyramid scheme grows in a simple exponential manner—10

1

, 10

2

, 10

3

, etc.—it takes only ten layers of that pyramid to include nearly twice the population of the earth. And 9,999,999,999 of these people are going to get screwed because the guy who started the pyramid has run away with all the five-dollar bills.

When communist rule ended in Albania, in 1992, the nation was broke and was kept from starving only by foreign aid and remittances from Albanians in Italy, the U.S., and elsewhere. But the people of Albania still managed to scratch together some cash. Like American baby boomers, they were worried about the future. So, like baby boomers, they invested. The Albanians invested in pyramid schemes. The pyramids grew. People were getting rich, at least on paper. And then, in 1997, the pyramids collapsed.

Albanian reaction to the financial disaster was philosophical—if your philosophy is nihilism. Violent protests occurred all over the country. The Albanian government banned public meetings. The protests became more violent. The government reacted to this by authorizing the military to shoot at crowds. The military responded to that by deserting in droves. Soldiers had money in the pyramid schemes, too, and were just as mad as anyone else. The violent protests turned into armed rebellions. The government lost control of every military base in the country. By spring the Albanian army was reduced to perhaps one intact unit, numbering a hundred soldiers. The entire defense arsenal was looted.

There’d been plenty to loot. Albania’s Communists had required every man, woman, boy, and girl to undergo military training. Estimates of the number of weapons loose in the country ranged as high as 1.5 million. And the Albanian defense ministry admitted that a whopping 10.5 billion rounds of ammunition had been stolen—more than 3,000 bullets for every person in the nation. Heavy weapons were also pilfered—artillery, missile launchers, and high explosives. Some of these were taken by local Committees for Public Salvation, but most wound up in less-responsible hands. The National Commercial Bank in the city of Gjirokaster was robbed with a tank.

Korce, near the border with Greece, was terrorized by gangs of masked men. Outside Fier, on the seacoast plain, twenty people died in a shoot-out between criminals and armed villagers. The southern port of Vlore was taken over by a gangster chief named Ramazan Causchi, who preferred to be called “the Sultan.”

At least 14,000 Albanians tried to escape to Italy by commandeering boats. One thousand two hundred people squashed into a single purloined freighter. The president of the country himself, Sali Berisha, stole a ferry to send his son and daughter to Brindisi, Italy. Prison guards deserted and 600 inmates broke out of Tirana’s central prison. Among the escapees was the head of Albania’s Communist Party, the splendidly named Fatos Nano. (Nano exhibited the pattern of recidivism common to ex-convicts by campaigning hard during Albania’s elections in June 1997. He is now prime minister.) U.S. Marines and Italian commandos evacuated foreign nationals by helicopter. Humanitarian aid ceased. The International Committee of the Red Cross threw up its hands. “This is almost like Somalia,” said an ICRC official. In four months more than 1,500 people died and tens of thousands were injured. Theft slipped into pillage. The railroad to Montenegro was stolen—the track torn up and sold for scrap. Pillage degenerated into vandalism. Schools, museums, and hospitals were wrecked. And vandalism reached heroic scale. Bridges were demolished, water-supply pumping stations were blown apart, power lines and telephone wires were pulled down. Albania came to bits.

I went to Albania in July 1997, and I know a country is screwed up when I can tell something is wrong with its history and social organization from 20,000 feet in the air. Flying over the Albanian Alps on the trip from Rome to Tirana, I noticed that the villages are not tucked into the fertile, sheltered valleys the way the villages of Austria, Switzerland, or even Bosnia are. The villages of Albania are right up on the treeless, soilless, inconvenient mountaintops. Before ski lifts were invented, there was only one reason to build homes in such places. A mountaintop is easy to defend.

The Tirana airport had one runway and a small, shabby, whitewashed concrete terminal building with a random planting of flowers outside. There were no visa or immigration formalities. Presumably, few people were trying to sneak into Albania to glom welfare benefits. Customs agents did run my bag through an X ray, however. With all the ordnance available in Albania, it’s hard to imagine what they were looking for. Pro-gun-control literature, maybe.

I’d found a translator and driver by calling the Hotel Tirana and hiring the front-desk clerk’s boyfriend. I’ll call him Elmaz. He met me in the airport parking lot in his uncle’s worn-out Mercedes. Elmaz said Tirana was thirty minutes away. We drove toward town on a four-lane turnpike that—“Five kilometers long,” said Elmaz—promptly ended. “Is only highway in country,” said Elmaz. The buckled, pitted two-lane road that followed was full of cars, trucks, and horse carts—an amazing number of them for such a supposedly obliterated economy. Scores of wrecked trucks and cars lined the road. Albania has so many wrecks that all the horse carts are fitted with automobile seats, some with center consoles and luxurious upholstery.

The landscape was the Mediterranean usual, a little too sunbaked and scenery-filled for its own good. But the fields were only half-sown in midsummer, and out in those fields and up along the hillsides were hundreds of cement hemispheres. Each dome was about eight feet across and had a slit along the base. All the slits faced the road. It seemed to be a collection of unimaginative giant penny banks.

These are self-defense bunkers. Elmaz said there are 150,000 of them in the country. They’re everywhere you look. They are Albania’s salient visual feature. The shop at the Hotel Tirana sells alabaster miniatures as souvenirs—model igloos, though the gun slots seem to indicate flounder-shaped Eskimos. In the cities, some of the bunkers have cement flower planters molded onto their tops, a rare conjunction of war and gardening. Larger bunkers appear along the beaches and at other strategic spots. The mountains are riddled with fortified tunnels, and even the stakes in Albania’s vineyards are topped with metal spikes so that paratroopers will be impaled if they try to land among the grapevines.

Albania’s longtime communist leader, Enver Hoxha (pronounced Howard Johnsonish: “Hoja”), ordered all this after the Soviet Union’s 1968 invasion of Czechoslovakia. He was sure Albania was going to be invaded next. Hoxha called for “…war against imperialism, against the bourgeoisie, social democrats, national chauvinists, and modern revisionists…. They hurl all sorts of foul invectives on us. This gladdens us and we say: Let them go to it! Our mountains soar up higher and higher!”

But who’d want to invade Albania? Or so I was thinking as Elmaz and I drove past Albania’s Coca-Cola bottling plant. There, peeking out from behind a ten-foot fiberglass Coke bottle on the roof, was a sandbagged machine-gun nest. Maybe Hoxha wasn’t crazy.

In the event, the pillboxes were no use against the force that actually invaded Albania, which was the force of ideas—though not exactly the same ideas that sparked the Declaration of Independence, to judge by what Elmaz showed me over the next week. Elmaz was studying to be a veterinarian. Everything had been stolen from his school: books, drugs, lab equipment, even parts of the buildings themselves. “We are without windows, without doors,” said Elmaz. “We study with only desks and walls.” The desks had been stolen, too, but the faculty had found them in local flea markets and bought them back. “All the horses we have were shot,” said Elmaz.

Across the road from the veterinary school was a collective farm that once had 5,000 cattle. “They stole five thousand cows!” I said, amazed at the sheer get-along-little-doggy virtuosity needed to rustle a herd that size in Albanian traffic.

“No, no, no,” said Elmaz. “They could never steal so many cows in 1997.”

“How come?”

“Because they were all stolen in 1992 when communism ended.”

How could mere confidence games lead to total havoc? And why did pyramid schemes run completely out of control in Albania? It took about an hour to find out. Elmaz drove me to see Ilir Nishku, editor of the country’s only English language newspaper,

The Albanian Daily News.

“Why were the pyramids so popular in Albania?” I asked Nishku.

“Were people just unsophisticated about money after all those years of communist isolation?”

“No,” said Nishku, “there had been pyramid schemes already elsewhere in Eastern Europe, and they had collapsed before the Albanian ones were started. People in Albania knew about such things as the failure of the MMM scheme in Russia.”

“Then how did so many Albanians get suckered in?” I asked.

And the answer was simple. “People did not believe these were real pyramid schemes,” Nishku said. “They knew so much money could not be made honestly. They thought there was smuggling and money laundering involved to make these great profits.”

The Albanians didn’t believe they were the victims of a scam. They believed they were the perpetrators—this being so different from the beliefs of certain Wall Street bull-market investors in the United States.

“My family had two thousand dollars in the pyramid schemes,” said Elmaz. It was their entire savings.

Nishku told me the first Albanian pyramid scheme was started in 1991 by Hadjim Sijdia. Sijdia Holdings offered 5 percent or 6 percent interest per month, 60 percent to 72 percent a year—way too much, especially considering that Albania was then in a period of low inflation. But Sijdia Holdings had some real investments, and although Hadjim Sijdia was jailed in Switzerland for fraud, he managed to get out and somehow repay his debts.

Following Sijdia Holdings, however, came schemes with a primary business of scheming. There were about nine large pyramids in Albania. Three of them—Sude, Xhaferri, and Populli—had no real assets at all. By 1993 small-business owners had gotten the idea and began creating minipyramids all over the country. Free enterprise can be free of all sorts of things, including ethics, and competition drove the promised rates of return high and higher. At one point the Sude pyramid was offering interest of 50 percent a month.

“The pyramid schemes,” said Ilir Nishku, “created the idea that this is the free market and just four years after communism, we could get rich. They created the wrong idea that

this

is capitalism.”

“Everyone was sitting in cafés,” said Elmaz.

Albania’s economic statistics looked great: 9.6 percent growth in 1993, 8.3 percent in ’94, 13.3 percent in ’95, 9.1 percent in ’96.

“Albania’s economy chalks up the fastest growth rate on the continent,” chirped the slightly clueless

Bradt

travel guide.

The very clueless

United Nations 1996 Human Development Report

for Albania declared, “The progress in widespread economic well-being reported in the

1995 Human Development Report for Albania

has continued, forming a social basis for [here’s where our UN dues really go to work] human development.”

Something called the

Eurobarometer Survey

said the Albanians were the most optimistic people of Eastern and Central Europe.

Even Enver Hoxha’s ancient widow, Nexhmije (pronounced…oh, who cares), waxed positive on capitalism. Released from prison in December 1996, she had a new bathroom installed in her apartment. Jane Perlez of

The New York Times

interviewed the communist crone: “‘This is the good thing about the consumer society,’ [Nexhmije] said, showing off some pink Italian tiles. ‘Though it’s very expensive, you can find everything.’”

The glory days lasted until February 1997. Then five of the big pyramids collapsed, and all the little ones did. Four other major pyramid schemes quit paying interest and froze most accounts, which is to say they went kerflooey, too. An estimated $1.2 billion disappeared, more than half the Albanian gross domestic product; that is, more than half the value of all the goods and services produced in Albania that year.

“Where did all that money

go

?” I asked Nishku.

He began ticking off possibilities: Swiss banks? The Albanian government? Money-laundering operations in Cyprus? Turkish Mafia? Russian Mafia? Mafia Mafia? “We don’t know,” he said.

I asked Nishku if there was any possibility that people would get their money back.

He said, “No.”