Financial Markets Operations Management (49 page)

Read Financial Markets Operations Management Online

Authors: Keith Dickinson

The settlement of repo transactions can occur in three forms:

- Specified delivery.

- Tri-party repo.

- Hold-in-custody repo.

Most securities transactions are normally settled on a delivery versus payment (DVP) basis. This mode should be adopted wherever possible in repo and sell/buy-backs where specific securities have been identified as collateral.

Securities can also be delivered on a free of payment (FoP) basis but extra care is required to ensure that both halves of any transaction are delivered/received on the same intended settlement date.

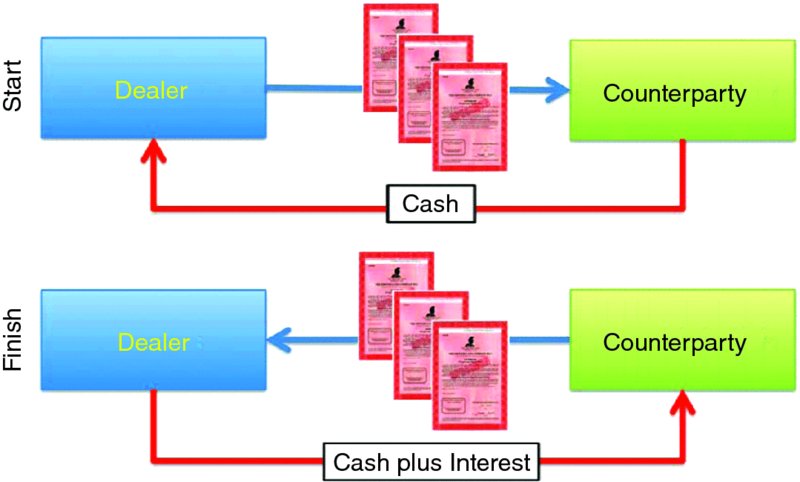

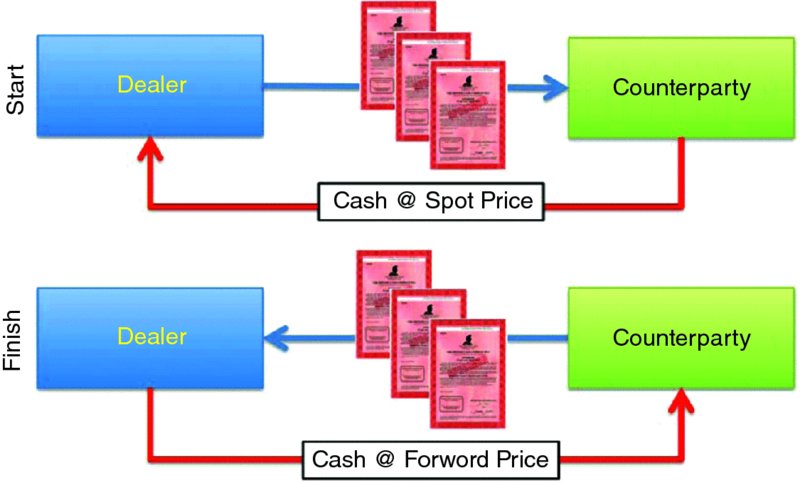

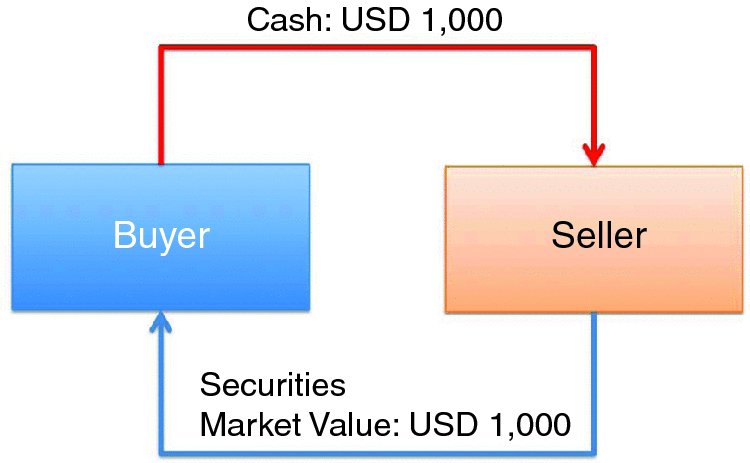

Figures 12.5

and

12.6

summarise the asset flows in a repo and sell/buy-back respectively.

FIGURE 12.5

Repurchase agreement

FIGURE 12.6

Sell/buy-back

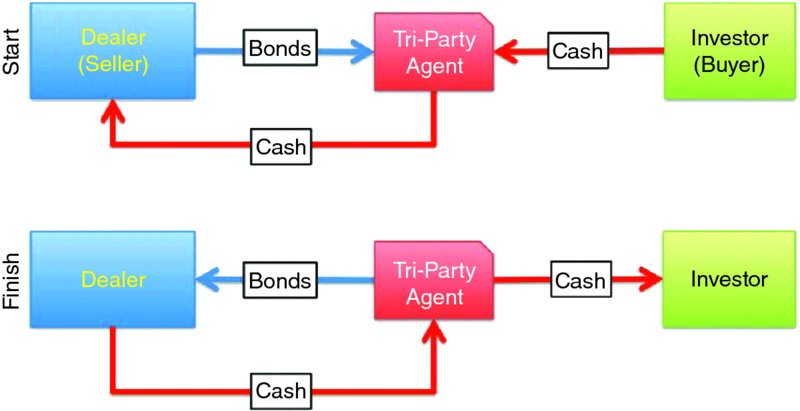

Dealers might wish to outsource the post-trading processing to a third-party custodian. The custodian will enter into a tri-party agreement with its two counterparties â the buyer and seller.

The third-party agents in Europe are typically the two international central securities depositories (Euroclear Bank and Clearstream Banking Luxembourg), SIX Securities Services, JP Morgan Chase and Bank of New York Mellon. In the USA, the repo market is dominated by JP Morgan Chase and Bank of New York Mellon.

The tri-party agent does not assume any of the risk involved with each transaction; that remains between the buyer and seller. Furthermore, the tri-party agent does not provide the trading venue; the counterparties continue to negotiate either directly with each other or utilise one of the ATMs.

A tri-party agent will process and maintain repo transactions, as shown in

Table 12.33

and

Figure 12.7

.

TABLE 12.33

Tri-party agent's processing

| Process | Comments |

| Â |

| Collateral has to satisfy the credit and liquidity criteria, concentration limits and initial margins pre-set by the buyer. |

| Seller credited with cash and debited with collateral. |

| Agent holds collateral as per the section on Hold-in-Custody Repo below. |

| Collateral substitution can occur if:

|

FIGURE 12.7

Tri-party repo

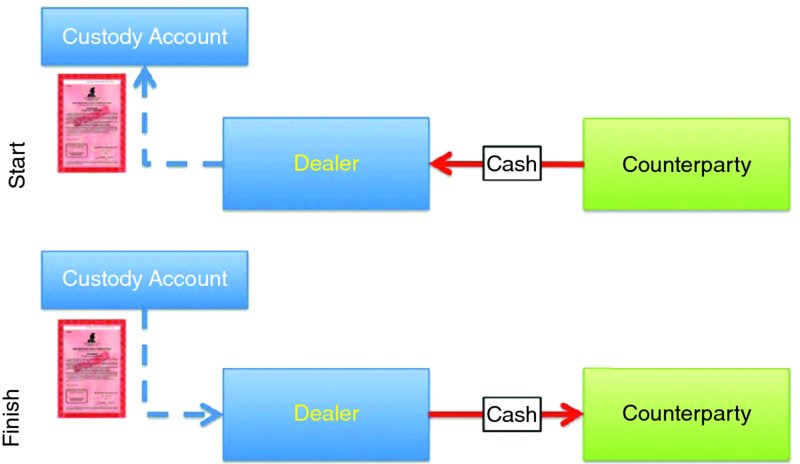

We have seen that the more secure types of repo involve either the actual delivery of collateral by the giver to the taker or the use of a third party as in tri-party repo. There is a third type of repo known as

hold-in-custody repo

(HIC repo), and this is especially attractive in the USA for repo transactions against general collateral (see

Figure 12.8

).

FIGURE 12.8

HIC repo

The similarity with tri-party repo is that the seller does not deliver collateral to the buyer. Instead, the seller holds the collateral, enabling it to reduce settlement costs and provide flexible collateral substitution whenever appropriate. The buyers do not need to directly manage the collateral. The disadvantage for the buyers is that they run the risk that the sellers do not hold collateral of sufficient quantity or quality and/or have perhaps pledged the same collateral to other HIC transactions.

The use of the words “collateral” and “margin” is informal and, in concept, both words mean the same thing. Repo originated from the bond markets and securities lending out of equities markets. Today, there is equity repo and securities lending includes bonds.

As we have seen, the market associations are different, with the ICMA for repo and the ISLA for securities lending.

The Associations' Master Agreements for repo (GMRA) and securities lending (GMSLA) use the terminology in the ways shown in

Table 12.34

.

TABLE 12.34

Master Agreement terminology

| Activity/Agreement | Terminology | Description |

| Repo/GMRA | Margin (securities) | Refers to the underlying purchased securities |

| Repo/GMRA | Collateral | Term often used when referring to margin |

| Repo/GMRA | General collateral (GC) | The buyer is not concerned with the exact purchased securities (only that they meet pre-specified quality criteria) |

| Repo/GMRA | Special (collateral) | Used when specific collateral is being purchased/delivered |

| Securities lending/GMSLA | Collateral | Refers to assets that the borrower provides to the lender in order to collateralise the loan |

| Securities lending/GMSLA | Margin | Difference between the value of the collateral and the value of the loan (e.g. by 5%) |

| Repo and securities lending | Haircut | This is a discount to the market value of the securities and acts as a risk cushion. For example, if a 3% haircut is applied to a security worth USD 100, the collateral value is USD 97. |

Whilst there are differences between the GMRA (2011) and the GMSLA (2010), many of the core provisions are similar from a contractual perspective (e.g. with default events and close-out netting provisions).

The ideal type of collateral should have no credit exposure and should be highly liquid. Price discovery for this collateral should be certain, it should be easy to sell and quick to obtain the cash proceeds.

The most commonly used types of collateral are securities issued by creditworthy central governments, government-guaranteed agency debt and bonds issued by the supranational institutions (e.g. the World Bank). In securities-driven repo, cash is the collateral.

Other types of collateral can include the following:

- Delivery by value (DBV) (see below for more details);

- Corporate bonds (typically senior unsecured debt);

- Covered bonds (e.g. German

pfandbrief

); - Equities (especially shares that are major index constituents, e.g. S&P 500);

- Convertible bonds;

- Money market securities (e.g. treasury bills, certificates of deposit and commercial paper);

- Bank loans (these should be transferable);

- Asset-backed securities (ABS);

- Structured securities such as collateralised debt obligations (CDOs), collateralised loan obligations (CLOs), credit-linked notes (CLNs), etc.;

- Residential and commercial mortgage-backed securities (RMBS and CMBS);

- Gold.

Remember that collateral in the context of repo is divided into general collateral and specials.

Eligible collateral that is acceptable includes many of the types listed above:

- Cash;

- Government securities;

- Corporate bonds;

- Convertible bonds;

- Equities (especially constituents of major indices);

- Letters of credit;

- Money market instruments (e.g. certificates of deposit);

- Warrants;

- Delivery by value (DBV).

Remember that collateral in the context of securities lending is divided into cash collateral and non-cash collateral.

We noted above that one particular type of eligible collateral for all three versions of securities financing was

delivery by value

. DBV was designed as an alternative form of collateral to cash; in other words, in the form of non-cash collateral.

Without DBV, the collateral giver would have to select securities from its securities portfolio and have them delivered to the collateral taker. This involves submitting delivery instructions to the appropriate clearing house. With DBV, however, the collateral giver instructs its clearing house to assemble a package of securities up to a specified value and quality. The DBV package is then delivered by the clearing house to the collateral taker.

In terms of the quality of the securities contained within the DBV package, there are 29 securities categories with a wide range of credit quality and geographical breadth. Some examples are shown in

Table 12.35

.

TABLE 12.35

DBV class list â selection

| DBV Class List | Description |

| F10 | Equities in the FTSE100 index |

| GIL | All UK gilts |

| E30 | Equities in the Eurotop 300 index |

| INT | All international securities |

| USS | US securities |

The full list can be found in Appendix 12.2 at the end of this chapter.

8

Collateral givers can request the clearing house to pass a diversified portfolio of collateral by applying a concentration limit; this limit ensures that the value of any single security does not exceed 10% of the total value of the package of securities being transferred. Margin can be added to the amount of securities delivered.

There are two versions of DBV:

- Overnight DBV:

Collateral is issued at the end of the day and returned the next morning. This version is suitable for overnight repo, for example. - Term DBV:

These have maturities ranging from one day to two years. This version is suitable for term financing and removes the daily requirement to reissue overnight DBVs throughout the duration of the term financing.

Repo exposure refers to the counterparty risk between the buyer and the seller and is measured by calculating the difference between each counterparty's exposure to its counterparty. By way of an illustration, a buyer and a seller enter into a single repo transaction without any haircut.

- The buyer purchases USD 1,000 securities (e.g. a bond) with a market value of USD 1,000 (see

Figure 12.9

). - On the purchase date there is no exposure as the value of the securities equals the value of cash (see

Figure 12.10

). - A period of time has elapsed and the securities are now worth USD 1,300. In the meantime, repo interest of USD 50 has accrued. We now have a situation where one party is exposed to the other, as shown in

Figure 12.11

. - The buyer's exposure to the seller is the difference between what the seller owes the buyer and what the buyer owes the seller. In this case, the buyer has no exposure.

- The seller's exposure to the buyer is the difference between what the buyer owes the seller and what the seller owes the buyer. In this case, the seller has an exposure that is covered through a margin call on the buyer. If the buyer defaults, the seller has insufficient cash with which to replace the securities.

- The seller therefore calls margin from the buyer and reduces its exposure to zero (as shown in

Figure 12.12

).

FIGURE 12.9

Initial purchase

FIGURE 12.10

Exposure on purchase date

FIGURE 12.11

Exposure on a forward date

FIGURE 12.12

Exposure after margin call

In the example above, we considered just the one transaction.

In order to calculate your net exposure you would need to take into account the following:

- All cash paid to or by the counterparty plus any accrued interest on that cash,

plus - The value of all securities transferred to or by the counterparty,

and - Any coupons that have been paid by the issuer but have not yet been repaid by or to the counterparty (i.e. manufactured coupons due).