History Buff's Guide to the Presidents (14 page)

Read History Buff's Guide to the Presidents Online

Authors: Thomas R. Flagel

Tags: #Biographies & Memoirs, #Historical, #United States, #Leaders & Notable People, #Presidents & Heads of State, #U.S. Presidents, #History, #Americas, #Historical Study & Educational Resources, #Reference, #Politics & Social Sciences, #Politics & Government, #Political Science, #History & Theory, #Executive Branch, #Encyclopedias & Subject Guides, #Historical Study, #Federal Government

During the Bill Clinton and George W. Bush years, major private lenders were getting worse and worse at studying history, specifically the credit history of their borrowers. Enriched by a booming housing market, banks and borrowers created a critical mass of bad investments. A chain reaction of loan defaults in 2007 soon expanded out of control, and major financiers began to fear that doomsday had come. Among those prognosticating Armageddon were Treasury Secretary Henry Paulson and Federal Reserve Chairman Ben Bernanke.

123

Striking fear in Congress and the general public, Bush’s economic advisers claimed that several financial institutions had become “too big to fail” and promptly advocated making them bigger. When investment bank Bear Stearns collapsed in March 2008, the Federal Reserve gave J.P. Morgan Chase $26 billion in loans to buy it.

124

Later in the year, Bank of America was allowed to absorb the failing financial management firm Merrill Lynch. Goldman Sachs, a multinational investment and securities company once run by Paulson, received $10 billion in governmental assistance. In September, the government took 80 percent ownership in the massive insurance conglomerate AIG with $85 billion in stock purchases.

125

In October 2008, Congress had passed the Emergency Economic Stabilization Act, and the doors to the Treasury flew open. The law created the Troubled Asset Relief Program (TARP), offering up to $700 billion in credit and asset purchases to major lenders. Morgan Stanley, a financial services corporation, received $10 billion, J.P. Morgan Chase received $25 billion, Wells Fargo $25 billion, Bank of America $35 billion, and Citigroup $45 billion. AIG allowed the Treasury to purchase $40 billion more of its troubled stock, plus $30 billion in guaranteed loans.

126

Weeks after Obama’s entry into office, another $780 billion in offerings appeared through the American Recover and Reinvestment Act, a third of which involved tax breaks, plus an eventual commitment to AIG that neared $200 billion. The prevailing philosophy “too big to fail” was also applied to the auto industry. General Motors and Chrysler, two out of the three remaining American car manufacturers, were declaring impending bankruptcy. In response, the Bush and Obama administrations pledged $55 billion to their assistance.

127

Altogether, the loans, tax breaks, stock purchases, mortgage assistance, and other stimuli from the Bush and Obama presidencies totaled some three to four trillion dollars in government help by the end of 2009.

128

Taken altogether, the Bush and Obama bailouts were more than the entire yearly Gross Domestic Product of Canada, the 15th largest economy in the world.

6

. BOTH OVERSAW RECORD INCREASES IN FOOD STAMPS

In a failed bid for the 2012 Republican presidential nomination, former Speaker of the House Newt Gingrich assailed President Obama as the “Food Stamp President,” claiming “more people have been put on food stamps by Barack Obama than any president in American history.” In reality, by the end of the twentieth century, the two main parties had settled their long-winded debate over “guns or butter.” Democrats and Republicans were committed to providing both.

129

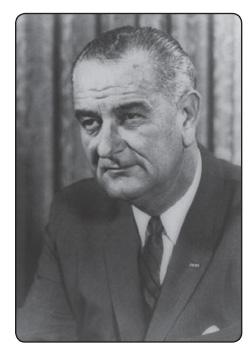

Congress passed the Food Stamp Act during LBJ’s Great Society experiment. By Johnson’s last full year in office, over 3.6 million Americans were taking part. But the largest enrollment surge occurred during the Nixon and Ford administrations. A fragile economy and national implementation boosted participation to nearly 20 million by 1975, a rise of more than 450 percent. One of the major proponents was Nixon himself, who in late 1971 hosted the first-ever White House Conference on Food, Nutrition, and Health and vowed to “put an end to hunger in America.”

130

During the George W. Bush years, a natural rise of population and bouts of economic downturn added more than 14 million Americans to food stamp rolls. In addition, the program transferred over to a debit card format during his first term, reducing the stigma of stamps and increasing convenience. During Bush’s last year in office, the entire initiative was redubbed the Supplemental Nutrition Assistance Program (SNAP), complete with an expansion of benefits.

131

When President Lyndon Johnson established the Food Stamp program in 1964, only 13 percent of U.S. adults were obese. When the program neared its fiftieth anniversary, the national obesity rate stood at 36 percent.

The White House

The continuing recession lasted well into Obama’s administration, and by 2012 an additional 14 million citizens drew on their eligibility. By that point, over 46 million Americans, one in seven, were on SNAP, at a cost of $80 billion per year. Yet both Bush and Obama had marginal influence. During both of their tenures, most of the administration and determination of SNAP eligibility was conducted at the state level.

132

In 2012, the number of Americans receiving food stamps was roughly equal to the entire combined populations of Texas and New York state.

7

. BOTH INCREASED THE DEFENSE BUDGET TO RECORD LEVELS

Traditionally, Republicans label Democrats as soft on defense. Yet in terms of dollars spent, first-, second-, third-, and fourth-highest yearly Pentagon budgets occurred during the Barack Obama presidency. The next eight highest transpired during George W. Bush’s administration. Bush’s peak was in his last year, with a Pentagon budget of $595 billion. The current record was set in 2011 during Obama’s third year, when outlays reached $739.6 billion, an 81 percent increase since 2001.

133

Causes of such high costs were multifarious—two lingering wars, increased salaries and benefits, rising healthcare costs, inflation, high-tech weaponry development,

etc.

From 2001 to 2011, the military remained at generally the same capability, at around 1.5 million active service members. But both presidents committed themselves and the nation to remain the number-one military superpower in the world, outspending the next fifteen nations combined. The second largest defense belonged to China with an estimated 2010 budget of $119 billion; the last time the U.S. had a Pentagon budget that low was 1979.

134

Due to an ongoing recession and the growing national debt, the Obama administration did aim to reduce defense expenditures. In 2011, through executive pressure, Congress passed the Budget Control Act, which dictated a reduction in defense spending by more than $400 billion over the following decade. Yet over that same period, the executive branch still planned to develop a new long-range bomber, ten new warships, a new Air Force tanker, and a new supercarrier (the USS

Gerald R. Ford

) to add to the ten-carrier fleet already in place.

135

The godfather of strong defense (and the namesake of one of the U.S. carriers) was Ronald Reagan. But comparatively, the largest year for the Pentagon under his leadership was $282 billion in 1988, when the United States was battling the military superpower Soviet Union for global hegemony. During the Bush-Obama years, the greatest threat to American international security was al-Qaeda, a polyglot terrorist organization consisting of no more than five thousand members and no central government. By 2011, their leader was dead, their numbers were dwindling, and Reagan’s yearly budget would not have covered five months of the Pentagon’s operational costs.

136

In percentage of GDP, Democrat Bill Clinton had the lowest post-World War II military budget at 3.7 percent of GDP. Democrat Harry Truman had the highest at 15 percent.

8

. BOTH ENDORSED TAX BREAKS TO THE POOR, MIDDLE CLASS, AND WEALTHY

In essence, supply-side economics contends that individuals who are taxed at a low rate will be more willing to work hard and spend more than someone taxed at a higher rate. The traditional argument goes that a higher tax rate may even reduce revenues, as individuals would be less willing to work or more inclined to find ways to avoid taxation altogether. The philosophy has its advocates and critics. In their respective rhetoric, Bush was a devout supply-side believer and Obama was an occasional skeptic. In practice, both men enacted lower taxes across the board.

137

Bush’s push came early in his presidency. The very names of his bills preached the faith of inevitable ascensions—the Economic Growth and Tax Relief Reconciliation Act of 2001 and the Jobs and Growth Reconciliation Act of 2003, after the downturn from the 9/11 attacks. Set to last ten years, the acts meant a loss of at least $1 trillion in federal revenues, but the long-term hope was that the extra cash in pockets would lead to more consumption, more employment, more production, and thus more governmental profit through improved personal earnings.

138

The key components of the measures were the invention of a 10 percent income tax rate for the lower classes; a three-point reduction for each of the 28 percent, 31 percent, and 36 percent rates among the middle classes; and a cut from 39.6 percent down to 35 percent for the wealthiest. Also part of the mix were large cuts on long-term capital gains, dependent child tax breaks, and education incentives. To what extent the efforts helped the economy was difficult to measure, especially when the country began to fall into a severe recession in December 2007. Three months later, Bush endorsed the Economic Stimulus Act of 2008, which gave businesses larger tax breaks for recent purchases and cash rebates to lower-and middle-income families. The cost was $152 billion. Yet less than a year later, by the time of Obama’s inauguration, the unemployment rate had doubled, and the GDP had fallen by more than 4 percent.

139

To try and leverage the country out of the hole, the new president proposed, among other plans, tax cuts. Among the most conspicuous, his 2009 stimulus plan included $288 billion in tax breaks, mostly to the lower-and middle-income brackets. In 2010, when the Bush cuts were set to expire, Obama signed a law that extended them. By 2012, when the recession was still showing signs of remaining in place, Obama offered to reduce the highest corporate income taxes, from 35 percent to 28 percent, and successfully lobbied for an extension of a payroll tax cut of $143 billion (an amount twice the yearly budget of Ireland).

140

According to a Government Accountability Office report in 2008, 55 percent of American companies paid no income tax during at least one of the previous seven years.

9

. BOTH OVERSAW RECORD NATIONAL DEBTS

Repeating tax breaks, extensive social programs, frequent military engagements, and the maintenance of superpower status for a country of hundreds of millions of people can be pricey. Thus, when George W. Bush entered the White House, the national debt stood at $5.8 trillion. After his eight years in office, it more than doubled to nearly $12 trillion. After four years of the Obama presidency, the debt surpassed $17 trillion. At least they were in good company.

After the heady days of the Roaring Twenties, when there was no Medicare, Medicaid, Social Security, interstate highways, or GI Bill and only a modest military, the national debt has expanded under every presidency. Only four chief executives have seen one or more years of budget surplus. Nixon essentially inherited his 1969 surplus of $3 billion from the tax-heavy Johnson administration. Truman had two years in the black, Eisenhower saw three, and Clinton enjoyed four. Yet none of the profits could outpace the momentum of growing federal expenditures.

141

From its inception, the United States federal government had been saddled with debt, over $75 million worth, and one person in particular embraced it. The first secretary of the treasury, Alexander Hamilton, believed that running a negative balance was a good thing. Debt meant that people at home and abroad were willing to invest in the country and thus had a deeply vested interest in its survival and success. Debt meant loans and capital to repair, build, and innovate. To make payments on these obligations meant the establishment of strong credit, good faith, and the ability to find loans in the future. And debt was part of being a strong, involved, and responsive central government, the very entity Hamilton helped create in the Philadelphia Constitutional Convention of 1789.

142