India (Frommer's, 4th Edition) (26 page)

Frommer’s lists exact prices in the local currency. The currency conversions quoted above were correct at press time. However, exchange rates fluctuate dramatically. At press time, US$1 bought you around Rs 49, and 1 euro equaled almost Rs 70, while £1 was worth around Rs 80. Bear in mind that in spite of the falling dollar/euro, a few dollars, pounds, or euros go a long way in India. For up-to-the-minute

currency conversions,

log on to

www.xe.com/ucc

or

www.oanda.com/convert/classic

to check the latest rates.

You cannot obtain Indian currency anywhere outside India, and you may not carry rupees beyond India’s borders. You may have to exchange at least some money at the airport upon your arrival; change just enough to cover airport incidentals and transportation to your hotel, since the rate will be quite unfavorable.

It’s always advisable to bring money in a variety of forms on a vacation: a mix of cash, credit cards, and traveler’s checks—although the latter can really prove to be a nuisance and should really only be used as a backup. Be sure to bring more than one kind of credit card since certain cards may not work in smaller towns or at certain ATMs.

In many international destinations, ATMs offer the best exchange rates. Avoid exchanging money at commercial exchange bureaus and hotels, which often have the highest transaction fees.

CURRENCY

Indian currency cannot be obtained before you enter India. The Indian rupee (Rs) is available in denominations of Rs 1,000, Rs 500, Rs 100, Rs 50, Rs 20, Rs 10, and Rs 5 notes. You will occasionally come across Rs 1 or Rs 2 notes—treat them as souvenirs. Minted coins come in denominations of Rs 5, Rs 2, and Rs 1, as well as 50 and 25 paise (rarely seen now). There are 100 paise in a rupee.

Note:

Badly damaged or torn rupee notes (of which there are many) may be refused, particularly in larger cities, but less fuss is made over them in small towns. Check the change you are given and avoid accepting these.

Banks offer good exchange rates, but they tend to be inefficient and the staff lethargic about tending to foreigners’ needs. You run the risk of being ripped off by using

unauthorized money-changers;

the most convenient option is to use ATMs while you’re in the big cities. Always ask for an encashment receipt when you change cash—you will need this when you use local currency to pay for major expenses (such as lodging and transport, though you should use a credit card wherever possible). You will also be asked to produce this receipt when you re-exchange your rupees before you leave India.

A Transfer Will Save You Time

A Transfer Will Save You Time

India is one destination where it is really worthwhile to arrange an airport transfer with your hotel so that you can avoid waiting in long lines at the airport money-changer, dealing with prepaid booths, or negotiating fees with drivers and touts. After a good night’s rest, head to the nearest bank or ATM for a cash infusion.

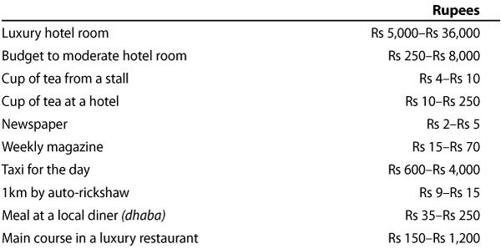

What Things Cost in India

This is a sampling of

average

prices you’re likely to pay in India. Bear in mind that big cities generally have much higher prices than smaller towns, and that any place that attracts tourists inevitably attracts rip-off artists.

The Battle of the Haggle

The Battle of the Haggle

Sure, things are cheap to begin with and you may feel silly haggling over a few rupees, but keep in mind that if you’re given a verbal quote for an unmarked item, it’s probably (but not always) twice the realistic asking price. Use discretion though, because items that are priced ridiculously low to begin with are hardly worth reducing further—either you’re being conned or you’re being cruel. To haggle effectively, make a counteroffer under half price, and don’t get emotional. Protests and adamant assertions (“This is less than it cost me to buy!”) will follow. Stick to your guns and see what transpires; stop once you’ve reached a price you can live with. Remember that once the haggle is on, a challenge has been initiated, and it’s fun to regard your opponent’s act of salesmanship as an artistic endeavor. Let your guard slip, and he will empty your wallet. Take into account the disposition and situation of the merchant; you don’t want to haggle a genuinely poor man into deeper poverty! And if you’ve been taken (and we all have), see it as a small contribution to a family that lives on a great deal less than you do.

Small Change

Small Change

When you change money, ask for some small bills (a wad of Rs 10s and Rs 20s) for tipping or baksheesh (see “Tipping” in chapter 16, “Fast Facts: India”). At smaller outlets and vendors, you’ll also frequently be told that there is no change for your Rs 500 note. Keep your smaller bills separate from the larger ones, so that they’re readily accessible.

ATMS (AUTOMATED TELLER MACHINES)

Getting cash from your checking account (or cash advances on your credit card) at an ATM is by far the easiest way to get money. These 24-hour machines are readily available in all Indian cities and larger towns and at large commercial banks such as Citibank, Standard Chartered, ABN Amro, and Hong Kong & Shanghai Bank; in fact, these days, there are ATMs even in relatively small towns, although some of them may run out of cash or have limits on the amount that can be withdrawn at any one time.

Cirrus

( 800/424-7747;

800/424-7747;

www.mastercard.com

) and

PLUS

( 800/843-7587;

800/843-7587;

www.visa.com

) networks span the globe; call or check online for ATM locations at your destination.

Be sure to find out your daily withdrawal limit before you depart. You should have no problem withdrawing Rs 10,000 at a time from an ATM (which goes a long way in India), although some ATMs may have slightly lower limits.

Also keep in mind that many banks impose a fee every time a card is used at a different bank’s ATM, and that fee can be higher for international transactions (up to $5 or more).

CREDIT CARDS

Credit cards are another safe way to carry money. They also provide a convenient record of all your expenses, and they generally offer relatively good exchange rates. You can withdraw cash advances from your credit cards at banks or ATMs, but high fees make credit card cash advances a pricey way to get cash. Keep in mind that you’ll pay interest from the moment of your withdrawal, even if you pay your monthly bills on time. Also, note that many banks now assess a 1% to 3% “transaction fee” on all charges you incur abroad (whether you’re using the local currency or your native currency).

MasterCard and Visa are commonly accepted throughout India. American Express is accepted by most major hotels and restaurants; Diners Club has a much smaller following.

If You Lose Your Plastic

If You Lose Your Plastic