Mergers and Acquisitions For Dummies (60 page)

Read Mergers and Acquisitions For Dummies Online

Authors: Bill Snow

If Buyer's stock is publically traded, the next thing to remember is that not all stock is equal. Accepting stock traded on a major exchange (NYSE or NASDAQ) is far more desirable than accepting stock traded over-the-counter (OTC) or on the Pink Sheets because the major exchanges have far stricter listing requirements.

What is the average daily volume?

What is the average daily volume?

Average daily volume

(the average number of shares traded per day over a period of time) is an important consideration, too. If a stock is

thinly traded

(has a low average daily volume), the Seller who accepted it may be limited in her ability to sell that stock. For example, say Seller receives 10 million shares of stock as part of the consideration for selling her business. If the stock trades at $1 per share, Seller has $10 million worth of stock.

However, if the average daily trading volume is, say, 10,000 shares, she essentially has an illiquid stock. Putting in a trade for all 10 million shares results in crashing the share price. If only 10,000 shares (on average) trade hands per day, the odds that she can sell 10 million shares in a short period of time are virtually nil. On the other hand, a stock with a higher trading volume is usually easier to sell.

In general, the average daily volume is higher for stocks listed on NYSE and NASDAQ than for stocks listed OTC or on the Pink Sheets.

In general, the average daily volume is higher for stocks listed on NYSE and NASDAQ than for stocks listed OTC or on the Pink Sheets.

Stock (public or nonpublic) received as a result of a business sale is usually

Stock (public or nonpublic) received as a result of a business sale is usually

restricted,

meaning that the owner of that stock can't sell the stock for some period of time. That length of time depends on securities regulations. In order to help prevent a crash of the stock price, Buyer may ask Seller to agree to a restricted period longer than current securities laws.

Even if securities law restrictions no longer restrict a stock, a thinly traded stock is effectively a restricted stock (it's pretty hard to sell a stock that no one's buying).

Even if securities law restrictions no longer restrict a stock, a thinly traded stock is effectively a restricted stock (it's pretty hard to sell a stock that no one's buying).

Selling less than 100 percent of the company

If Buyer and Seller disagree about valuation, another possible solution is for Buyer to acquire less than 100 percent of the business. Selling a piece of the company allows Seller to take some chips off the table and create some liquidity right away while allowing her to participate in the future upside of the company.

Most Buyers want to have a

control stake

in the business, meaning they want to acquire at least 50 percent of the company. In rare situations a

minority stake

(less than 50 percent) may be palatable to Buyer.

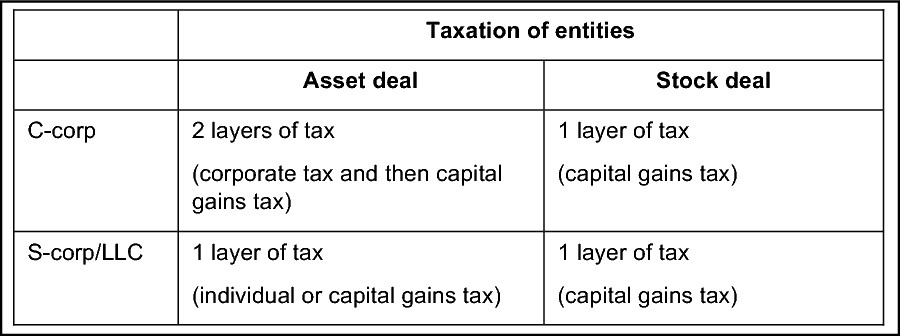

Taxation of entities

Taxing corporations is complicated because you have two basic types of entities (C-corps and S-corps/LLCs), two types of business sales (asset or stock), and three types of taxes (corporate, individual, capital gains). A C-corp's profits are taxed at the corporate tax rate, and then any distributions to ownership are taxed again, this time at either the owner's marginal tax rate or at the capital gains rate.

The S-corp offers the benefit of removing a layer of tax and avoiding double taxation. The profits of the entity flow to the owners. The owners must pay tax on the income, usually at their marginal income tax rate. One of the limitations of S-corps, though, is that they're limited to 100 shareholders while C-corps have no limits to the number of shareholders. LLC's are similar to S-corps (with some different terminology) for taxation purposes; I lump them in with S-corps here, but check with your tax advisor about some subtle differences.

But the tax issues don't stop there; selling a business opens another can of tax worms. The following table helps break down how a business sale affects the business's taxation:

I cannot stress this enough: Sellers need to plan ahead and speak with their tax advisors. Your specific tax situation depends on your company's specific situation.

Warning:

An owner who converts a C-corp to an S-corp shortly before a sales transaction may be in for another nasty little tax surprise: In some cases the conversion from a C-corp to an S-corp may take ten years before the owner is able to realize the full tax benefit. Ideally, conversion to an S-corp should take place years before the owner sells the company.

A Seller agreeing to sell less than 100 percent of the company is wise to include a put option as part of the sale. A

A Seller agreeing to sell less than 100 percent of the company is wise to include a put option as part of the sale. A

put option

allows Seller to sell her remaining shares to Buyer at some future date and at some future price. Most often, that price is an agreed-upon formula based on some sort of financial performance of the company.

Dealing with Renegotiation

Yes, valuation can change during the sale process. In fact, that occurrence even has a name: renegotiation. Or, as disappointed Sellers may call it, the dreaded renegotiation.

Theoretically, when Buyer and Seller negotiate a valuation, both sides want to see the deal close with that valuation. In practice, however, one side or the other may try to change the sale price before the closing.

If Buyer is trying to change the valuation, you can bet that he's trying to lower the valuation.

Buyer may have a case to ask for a lower valuation if the company has experienced some sort of material changes, such as the following:

Decline in profits

Decline in profits

Loss of major customers

Loss of major customers

Loss of key executives

Loss of key executives