Nolo's Essential Guide to Buying Your First Home (34 page)

Read Nolo's Essential Guide to Buying Your First Home Online

Authors: Ilona Bray,Alayna Schroeder,Marcia Stewart

Tags: #Law, #Business & Economics, #House buying, #Property, #Real Estate

BOOK: Nolo's Essential Guide to Buying Your First Home

7.11Mb size Format: txt, pdf, ePub

You don’t need to go into your discussion with a completely drafted loan agreement—after all, part of your objective will be to negotiate those details with the lender. Still, you can show that you’ve thought carefully about how to structure the loan profitably for both of you, by suggesting a:

• repayment schedule (such as monthly or quarterly)

• mortgage term (length)

• payment amount, and

• plan if things go wrong, such as late payments and fees, what constitutes loan default, and loan restructuring options.

Again, be sure to run these by your institutional lender, if any, before finalizing your loan agreement with a relative or friend, to make sure you won’t be undermining your qualification for institutional financing.

Gracias, Arigato, MerciFind a way to show your thanks for a gift or loan—a card, lunch at your new house, and maybe more. In case you’re stuck for gift ideas, check at

www.redenvelope.com

. But be aware that, depending on your relationship with your relatives, they may also expect frequent stays in your new guest room, want you to follow their decorating advice, or feel that they can comment on your spending habits. Then again, some may act like this without having contributed to your house purchase!

If your relative or friend agrees to lend you money, you’ll need to finalize the loan with the proper legal paperwork. A handshake isn’t good enough for anyone. For one thing, it’s easy to misunderstand something you’ve only talked about. Clarifying and writing your agreement down now avoids disputes, as well as memory lapses down the line. For another, failing to record your lender’s mortgage on the property leaves that person out in the cold if some other lender or creditor forecloses on your house—they wouldn’t be entitled to any of the proceeds, some of which might go to a creditor who came along later (like a contractor who worked on your house, whom you haven’t yet repaid and who files a lien). And finally, written proof that you’re paying mortgage interest allows you to deduct it at tax time.

To make your agreement legally binding, you’ll need these two documents:

•

Promissory note.

You‘ll need to sign a note for the amount of the loan, including the rate of interest, repayment schedule, and other terms, such as penalties for late payments. You can find several promissory notes on Nolo’s website (

www.nolo.com

). If you’re borrowing only a few thousand dollars or less, a promissory note may be all you need. But for most intrafamily loans, it makes legal and financial sense to also prepare a mortgage.

•

Mortgage (or “deed of trust,” in some states).

A mortgage gives your lender an interest in your property to secure repayment of your debt (per the promissory note). It needs to be recorded with a public authority, such as the registry of deeds.

Unless you’re experienced in real estate transactions, we recommend you get an expert’s help with preparing and recording a mortgage and related legal documents. Ask your lender or closing agent for advice, or check out Virgin Money (described below).

How Virgin Money Can HelpVirgin Money is the leader in managing “person-to-person” loans between relatives, friends, and other private parties. The company provides a full range of services for managing interpersonal loans and mortgages, including loan documentation, mortgage recording, repayment management, electronic funds transfer, online accounts, year-end reports, and credit reporting. Virgin Money also offers traditional mortgages. For more information, visit

www.virginmoneyus.com

or call 800-805-2472.

An estimated 10% of home sales involve some sort of seller financing. Surprisingly, the seller can be one of the most flexible sources of financing for your new house. Seem counterintuitive? There are several ways that sellers can help—admittedly not that common, but keep your eyes open for situations where:

Getting a Mortgage From the Seller• The seller’s house has substantially appreciated in value over the years, so that the seller will owe a high amount of capital gains tax when it’s sold. By in effect selling the house to you over time, the seller can reduce the tax hit.

• The seller is having difficulty finding a qualified buyer or is anxious to move a house that’s been on the market a long time.

• The seller would prefer to be paid over time at a favorable interest rate rather than receive all the equity at the time of sale, perhaps to supply a regular income for upcoming retirement.

• The seller can justify a higher price by helping with the financing.Here’s a brief overview of the various forms of seller financing. As with loans from family and friends, be sure to consult with your primary lender to find out how seller financing will affect your eligibility, and get expert help for documenting and recording the mortgage.

A form of seller financing often called a “seller carryback” allows the seller to essentially sell you the house on an installment plan. The seller transfers ownership of the house to you at the closing, but in return receives a promissory note entitling him or her to scheduled payments and a mortgage, providing a lien on the property until the loan is repaid. It’s often structured so that the buyer has a balloon payment after a few years, at which point you’d either refinance or move out of the house. This kind of arrangement works best for a seller who already owns the house free and clear and won’t have to turn around and pay off a bank loan upon sale.

You can also use seller financing to cover a second mortgage, when the amount you’ve saved for a down payment plus your bank loan doesn’t quite add up to the sales price. Adviser Asheesh Advani says, “You could save 1% or 2% by offering to accept a seller-finance arrangement rather than taking out a second bank loan.”

If seller financing looks like an option, approach the seller in an organized way (see our suggestions, above, for approaching family and friends). Be prepared to provide detailed information about your income, credit, and employment history, plus references—more information than you’d need for a close relative. As with other private loans, seller financing can be flexible and creative. You might ask the seller for:

• a competitive interest rate (less than you’d pay for a fixed-rate mortgage)

• low initial payments (unless you can easily afford high ones)

• a mortgage rate buydown (as described below)

• no prepayment penalty

• no large balloon payment for at least five years, plus the right to extend the loan at a reasonable interest rate if market conditions make it impossible to refinance or pay the balloon payment in full, and

• the right to have a creditworthy buyer assume the second mortgage if you sell the house.

This is a hard bargain, so be prepared to give up on the less important terms.

Assuming the Seller’s MortgageAnother option is to assume the seller’s mortgage: Essentially, you take the seller’s place with the seller’s mortgage holder, subject to all the conditions the seller agreed to. This type of financing makes most sense when the interest rate on the seller’s mortgage is lower than the current market rate. It’s all aboveboard, done with the lender’s consent (unlike something called a “wraparound,” where you pay the seller and the seller pays the unwitting bank—not recommended).

One problem with assumable mortgages is that you’ll probably have to pay much more for the property than the seller owes on his or her mortgage and will either need a very large down payment or a second mortgage to cover the difference. Since second mortgages are usually at a higher interest rate, you won’t want to assume a seller’s mortgage if the savings on the assumed mortgage will be cancelled out by the higher rate on the second mortgage.

Another potential problem is that usually, only adjustable rate mortgages (plus FHA and VA loans, with some conditions) are assumable, so the interest rate probably won’t stay where it is. Examine how high it might go using the suggestions in Chapter 6.

Finally, the seller usually wants something out of the deal, too: often, a higher asking price. That’s because the seller is still on the hook for the mortgage if you default.

CAUTIONSeller-funded down payment assistance programs are illegal.

The Housing and Economic Recovery Act of 2008 prohibits the use of down payment assistance programs funded by those who have a financial interest in the sale, such as Nehemia and AmeriDream. This new federal law does not prohibit other assistance programs provided by nonprofits funded by other sources, churches, employers, or family members. And the law does not prohibit the type of seller financing we discuss above. Check with your lender or local government housing agency if you have questions on the legality of a particular program.

If you’re buying a newly constructed home, the developer is likely to offer you some unique financing alternatives. The usual possibilities include closing costs paid by the developer, mortgage subsidies (buydowns), or allowances for upgrades like higher-quality fixtures. All are more common when developers have large numbers of unsold properties and there’s a large supply of new homes on the market. (And in particularly slow markets, developers may offer packages featuring everything from cruises to free fireplaces!)

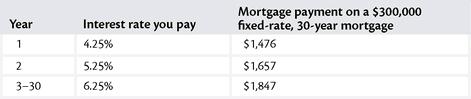

Mortgage Rate BuydownsTo make its houses more affordable, a developer may offer to “buy down” your mortgage. That means subsidizing the interest rate you pay for the first two or three years by prepaying part of the mortgage interest. In a 2-1 buydown, for example, you pay a below-market interest rate (and make reduced mortgage payments) the first year of the loan, and a slightly higher (but still below-market) rate the second year, with the developer filling in the gaps. The two-year period is meant to cover the time when money is usually tightest for first-time homebuyers.

EXAMPLE:

Depending on the particular developer, you may be able to apply a buydown to a mortgage you find yourself or you may be limited to mortgages offered through a developer’s preferred lender. You usually need good credit to qualify for this type of program.

And as with any loan package, make sure the buydown works for you—will you really be able to pay the increased mortgage payments after the initial reduced-rate period? If there are any strings attached, such as high initial points or above-market interest rates after the buydown period ends, also consider how much you’ll end up paying over the life of that loan. If you can afford higher monthly payments from the start, you may find a more competitive mortgage elsewhere. Use one of the mortgage calculators recommended in Chapter 6 to compare mortgage options.

Other books

La berlina de Prim by Ian Gibson

Galaxy's Edge Magazine: Issue 2, May 2013 by Resnick, Mike, et al.

Persuaded by Misty Dawn Pulsipher

Rock Chick 06 Reckoning by Kristen Ashley

Having His Baby by Shyla Colt

CinderEli by Rosie Somers

Pebble in the Sky by Isaac Asimov

Memorias de Adriano by Marguerite Yourcenar

The Very Best of F & SF v1 by Gordon Van Gelder (ed)

Broadchurch: The Letter: A Series Two Original Short Story by Chris Chibnall, Erin Kelly