Simply Complexity (20 page)

Authors: Neil Johnson

Thinking more generally, the crashes which occur in real financial markets are actually telling us something interesting about the internal forces present within that market – in particular, the opposing forces due to the crowds and anticrowds. These two forces are usually quite evenly balanced, yielding what looks like fairly random fluctuations in the price. However, crashes are good

examples of moments where these forces become unbalanced, hence producing a large ordered movement in one direction. Such large changes are often called extreme events. There are many other examples of such large changes in Complex Systems: punctuated equilibria in evolution, unexpected changes in physiological and immunological levels within the body, sudden congestion in the Internet or vehicular traffic, etc. This ability to self-generate large changes is a defining characteristic of Complex Systems since it allows for evolution with innovation.

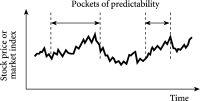

Figure 6.1

Let the bad times roll. The emergence of order from deep within the market means that there is a period of increased predictability prior to the crash.

Interestingly, the fact that order emerges out of disorder and leads to a sustained crash means that there is the possibility that, with the appropriate spectacles, we could look inside the Complex System and see such a large change coming by detecting this emerging pocket of order. It turns out that this is precisely what is suggested by David Smith’s mathematical theory, as discussed at the end of

chapter 4

. The fact that order starts to emerge prior to a large change means that there is something very concrete which can be detected, and a concrete prediction then made. This effect is sketched in

figure 6.1

. In the language of

chapter 4

, what happens as this pocket of order emerges is that the corridors which predict the future movements of the market become narrower and begin to show a definite direction. The upshot is that the market seems to become more predictable before large changes than at other times. And since it is the large changes that investors typically want to know about, because these represent large sources of

risk, David Smith’s research looks set to become a very important tool – not only for markets, but in all the other application areas described at the end of

chapter 4

.

Let’s take a closer look at the whole prediction question, with the focus on financial markets. We have stated above, and in

chapter 4

, that corridors can be constructed in order to help predict the future evolution of a Complex System. If the corridors are wide and don’t seem to indicate a definite direction up or down, this would obviously not be a good moment to make predictions about future price movements. On the other hand, it could be a good time to start trading in market volatility, for example by buying or selling financial derivatives called options. Alternatively, we could just walk into our local betting shop and start spread-betting on the market. By contrast, if the corridors are narrow and seem to indicate a definite direction up or down, this would obviously be a good moment to make predictions about future movements.

But what determines which of these two cases will arise? A financial market walks around in a way which is sometimes disordered and sometimes ordered. On average, this produces a value of our parameter

a

which is between the disordered value of 0.5 and the ordered value of 1. However, at any one moment, the feedback of information to the traders will tend to either act to reinforce the current price trend or to go against it. In the former case, this gives reinforcement of the persistence. The corridors will tend to narrow down and exhibit a definite direction. In the latter case, by contrast, the feedback acts against the current price trend. Hence the market will enter a moment of uncertainty and disorder, in which case the corridors will tend to be wide and have no definite direction.

Building on David Smith’s work, Nachi Gupta has recently used real market data to confirm that this type of corridor construction and hence prediction is indeed possible. This finding shows that financial markets are neither continually predictable

nor unpredictable, but instead show periods where they are predictable (i.e. non-random) and periods where they are not (i.e. random). The basic idea is sketched in

figure 6.2

. In short, markets exhibit pockets of predictability associated with pockets of order – just like any Complex System should.

Figure 6.2

Pockets of predictability. The origin of these is the pockets of order that a Complex System will create as it takes itself between the regimes of order and disorder and back again. It is these pockets of predictability that Nachi Gupta and David Smith’s mathematical techniques can help identify.

In order to produce the corridors and hence identify the pockets of predictability, the research team selects an artificial market model whose price movements closely resemble recent movements in the real market – in technical jargon, they effectively train the artificial market model on real financial data in order to build up a rough picture of the current composition of the trader population within the real market. They then run this artificial market model forward into the future. The range of possible outcomes that are produced then provide the corridors.

Complex systems such as financial markets generate their own forays to order and disorder and back again – like a self-perpetuating machine. They are also typically open to the environment. Financial markets are a perfect example of this, being hit or “kicked” continually by outside news and events, such as companies going bust, earnings reports, unemployment figures, and

the outbreak and progress of wars in oil-producing regions of the world. Recent research suggests that most everyday news items have relatively little effect on market movements – but what about major news?

Teaming up with Stacy Williams of HSBC Bank, Omer Suleman, Mark McDonald and Dan Fenn have used the information from Reuters news agency in order to quantify and classify the impact of different types of news on financial market movements. Their ultimate goal is to be able to understand what

types

of news move markets and in what types of ways. In particular, they are attempting to classify news in terms of its different types of impact. Based on an understanding of possible ripple effects across markets, they are working on building general shock-response and vulnerability indicators for different geographic regions or industry sectors, in response to the different types of events which a news agency could report. Their research has already come up with some fascinating results, focusing on the following particular classes of news:

News that is (1)

unexpected

in terms of the fact that it occurs at all, (2)

surprising

in the sense of when it occurs, (3) is

not

related directly to markets, (4) has

never

happened before, and (5) is

true

. As an example of this, the research team considered the shocking 9/11 terrorist attacks in the U.S. In particular, they analyzed the minute-by-minute response of the world’s currency markets to the sequence of events as the news unfolded throughout the day.

News that is (1) somewhat

expected

in terms of the fact that it occurs at all, (2)

surprising

in the sense of precisely when it occurs, (3) is

not

related directly to markets, (4) has

never

happened before, and (5) is

true

. As an example of this class of news, the research team considered the 7/7 terrorists attacks in London, and similarly monitored the response of the world’s currency markets throughout that day. The fact that the U.K. was a close ally of the U.S. and had hence received terrorist threats since the Iraq invasion meant that such attacks might have been expected at some stage.

News that is (1) somewhat

expected

in terms of the fact that it occurs at all, (2)

surprising

in the sense of precisely when it occurs, (3)

is

related directly to markets, (4) has

never

happened

before, and (5) is

untrue

. As an example of this class of news, the research team considered the

rumor

which suddenly started circulating around the world’s markets on the morning of Wednesday 11 May 2005, that the Chinese currency would be revalued. The rumor was then denied officially by the Chinese government later the same day. Although such a revaluation had been expected for a while, the timing of any official announcement was completely unknown to the markets in advance – hence such a rumor would have initially seemed highly credible to traders.

News that is (1)

not unexpected

in terms of the fact that it occurs at all, (2)

surprising

in the sense of when it occurs, (3)

is

related directly to markets, (4)

has

happened before, and (5)

is

true. As an example of this class of news, the research team considered the

actual

revaluation of the Chinese currency which occurred later that same year in 2005.

For these particular classes of news, the researchers managed to quantify the response of the currency markets using the network study mentioned in

chapter 5

. In just the same way as a car mechanic will push down the edge of a car to test the response of the shock absorbers, the team looked at these particular news events to see how the market responded. Their results suggest that markets tend to respond in a remarkably similar way to particular classes of news event, or “shock”, from the outside. In the case of terrorist attacks, for example, they found that the global response to the London attacks represented a much milder but similar response to the earlier U.S. attacks. For the case of the rumor and actual revaluation of the Chinese currency, they also found a common pattern of response.

Again using the car analogy, this is consistent with the fact that a particular car will respond in the same way if it is pushed down in the same way. For a car this isn’t surprising, since nothing much else is happening to it. But for a market, this is extraordinary. Indeed it represents a huge endorsement of the whole idea that a financial market can be seen as a real entity – a Complex System in its own right, sitting there in the virtual information world. The push isn’t real, it is information – and yet the response is real and measurable.

Tackling traffic networks and climbing the corporate ladder

Traffic can be a real pain, especially when you are stuck in the middle of it. But it creates problems for us even before we have left the house. In particular, anyone who drives to work or does the school-run, is faced with the daily dilemma of “Which route should I take?” Many of us have to deal daily with this dilemma – and many of us try to gain a competitive advantage by making use of our own past experiences and publicly available traffic information. For this reason, these “which route?” problems represent a wonderful example of human Complexity in action: a collection of decision-making objects repeatedly competing for limited resources, armed with some kind of information about the past and present – in particular, drivers repeatedly competing to find the least crowded route from A to B, such that they have the shortest possible trip duration.

Let’s suppose, for one idyllic moment, that there are no other cars on the road. Then all we would need to do to get from A to B as quickly as possible is to work out which of the available routes represents the shortest distance. Since we would presumably travel at the same speed on every available route, the route which represents the shortest distance will also be the route with the shortest trip duration. Simple.

The difficulty comes when we add in other cars, and hence other drivers. The more cars there are on a given road, the slower the traffic will move in general. Even if everyone travels at the speed limit, there are just too many things that could go wrong. People tend to slow down if they sneeze, or change radio stations, or look at something by the side of the road – and this gives rise to a chain of events that can end up with that awful stop-start traffic that we all know and hate. Worse still, there might be an accident or some other hold-up that just brings everything to a grinding halt.