The Next Decade (8 page)

THE FINANCIAL CRISIS

AND THE RESURGENT STATE

T

wo global events frame the next decade: President Bush’s response to September 11 and the financial panic of 2008. Understanding what happened and why in both cases amplifies our sense of what it means to be an empire and what its price is, especially when we consider how these interrelated events, which began as domestic American concerns, came to engulf the entire world. Let’s begin with the financial crisis.

Every business cycle ends in a crash, and one sector usually leads the way. The Clinton boom ended in 2000, when the dot-coms crashed; the Reagan boom of the 1980s ended in spectacular fashion with the collapse of the savings-and-loans. From this perspective, there was nothing at all extraordinary about what happened in 2008.

The reason for such booms and busts is fairly simple. As the economy grows, it generates money, more than the economy can readily consume. When there is a surplus of money chasing assets such as homes, stocks, or bonds, prices rise and interest rates fall. Eventually prices reach irrational levels, and then they collapse. Money becomes scarce, and inefficient businesses are forced to shut down. Efficient businesses survive, and the cycle starts again. This has been repeated over and over since modern capitalism arose.

Sometimes the state interferes with this cycle by keeping money cheap in order to avoid the crash and the recession that inevitably follows. Money is, after all, an artifice invented by the state. The Federal Reserve Bank can print as much money as it wants, and it can purchase government debt with it. That’s what the Federal Reserve did in the aftermath of September 11. The Bush administration didn’t want to raise taxes to pay for the war on terror, and the Fed cooperated by financing the war by, essentially, lending money to the government. The result was that no one felt the war’s economic impact—at least, not right away.

Bush’s reasons were derived both from geopolitics and from partisan domestic politics. He was at war with the jihadists, and he did not want to raise taxes to pay for his military interventions. Instead, he wanted the total revenue from taxes to rise by way of a stimulated economy. The theory was that the combination of military spending, tax cuts, and low interest rates would allow the economy to surge, increasing tax revenues enough to pay for the war. If this supply-side gambit didn’t work, Bush reasoned, he would still have the benefit of not undermining political support through tax hikes before the 2004 elections. He also assumed that he could deal with the economic imbalances after the election, as the war wound down. His problem was that the war didn’t wind down, and he grossly underestimated how long and intense it would become. As a result, he and the Fed never got around to cooling off the economy, and the war and this economic policy continue to define his presidency.

Another element that led to the collapse of 2008 was the cheap money pouring into one particular segment of the economy, the residential housing market. In part this was an economic calculation. Housing prices tend to rise over time, which gives real estate the appearance of a conservative investment. Government programs also encouraged individuals to buy homes, and during this era that encouragement extended to a wider segment of the population than ever before. The perception of safety, combined with government policy, brought extraordinary amounts of money into the market, along with speculators and millions of low-income buyers who in ordinary times never would have qualified for the mortgages they took on.

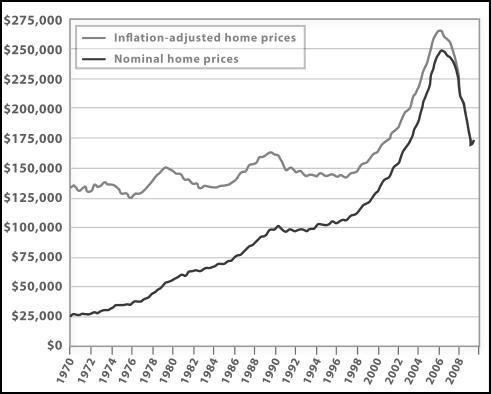

U.S. Home Prices

The price of homes had risen for the past generation, but as this chart above shows, that story of steady growth is a bit deceptive. If you adjust home prices for inflation, they have fluctuated in a narrow band between 1970 and 2000. But mortgages don’t rise with inflation. So if you borrowed $20,000 to buy a $25,000 house in 1970, by 2000 that house would be worth around $125,000 and you’d have paid off your mortgage. But $125,000 was not much more than $25,000 in real terms. You felt richer because the numbers were higher and because you had paid off your debt, but the truth was that home ownership was not a great way to create actual gains. On the other hand, the record showed that you were not likely to lose money either, and that gave lenders confidence. If worse came to worst, they could always seize the house and sell it, thus getting their money back.

With cheap money enabling more people to buy houses, demand rose, which meant that housing prices took off like a rocket in 2001, then accelerated further after 2004. Lenders kept looking for more and more borrowers for their cheap money, which meant lending to people who were less and less likely to repay these now “subprime” loans. The climax came with the invention of the five-year variable-rate mortgage, which enabled people to buy houses for monthly payments that were frequently lower than rent on an apartment. These rates exploded after five years, but if a buyer could not meet the new payments and lost the house, at least he would have enjoyed some good years and was simply back where he started. If housing prices stayed steady, he could refinance, so all in all, he didn’t seem to be taking much of a risk.

Nor did the lenders appear to be risking much, especially given that they made their money on closing costs and other transaction fees, then sold the mortgages (and passed along the risk) to secondary investors in what became known as bundles. In packaging these loans for the secondary market, lenders emphasized the lifetime income stream, which made the subprime loans appear to be the perfect conservative investment.

Everyone was making money and no one could get hurt—it was the oldest story in the book. And most people didn’t care or didn’t want to believe that the bubble could burst.

However, reality began to intrude. New homeowners who never would have qualified for an ordinary loan in ordinary times began to default, and as properties came on the market from forced sale or foreclosure, prices that had been counted on to keep going up began to fall. During the run-up, small investors had bought multiple houses, fixed them up a bit, and resold them for a quick profit. But as boom turned to bust and speculators were unable to “flip” the houses at profit, they rushed to unload them at whatever price they could, which drove prices further down. By 2007, the mild decline that had begun in 2005 became a rout. In truth, all that happened was that prices returned to the highest level within their prior historic range; the froth was disappearing, but the basic value was still there. Nonetheless, many of the people who had put money into these houses were devastated.

With the collapse of the housing market, the mortgages that had been bundled and sold to investors no longer had a clear value. Because these investors had believed that prices would never fall, they had never looked at what was actually inside their bundles. The more aggressive investors in bundled mortgages, investment banks such as Bear Stearns and Lehman Brothers, had leveraged their positions many times over, and by the time the loan payments were due, the value of the underlying assets was so murky that no one would buy them, or even refinance the loans. Unable to cover their bets, these big players went bankrupt. And since many of the people who had bought these supposedly conservative investments, including the commercial paper issued by the banks, were in other countries, the entire global system went down.

The story of the collapse often focuses on the United States, but the damage was truly worldwide. Residents of eastern Europe—Poland, Hungary, Romania, and other countries—who in normal times had never been able to afford a house had bought in. Austrian and Italian banks in particular, backed with European and Arab money, had wanted to provide mortgages, but interest rates in eastern Europe were high. So the banks offered these new, eager, and unsophisticated buyers loans at much lower rates, only denominated in euros, Swiss francs, and even yen.

The problem was that these homeowners weren’t paid in these currencies but in zlotys or forints. A Polish homeowner essentially paid for his mortgage by first buying yen, then paying the bank. The fewer yen a zloty bought, the more zlotys the homeowner had to spend and the more expensive his monthly payment became. If these zlotys rose against the yen or the Swiss franc, there were no problems. But if the zlotys fell against the yen or the Swiss franc, there were huge problems. Every month, more and more eastern Europeans were buying Euros and other currencies. As the financial crisis deepened, there was a flight to safety; and eastern European currencies plunged. Homeowners were squeezed and broken.

Major expansions always end in financial irrationality, and this irrationality was global. If the Americans went to the limit with subprime mortgages, the Europeans went a step further by enticing homeowners to gamble on global currency markets.

There is a constant refrain that we have not seen such a catastrophic economic event since the Great Depression. That is triply untrue, because similar collapses have happened three other times since World War II. This is a crucial fact in understanding the next decade, because if the financial crisis could be compared only to the Great Depression, then my argument about American power might be difficult to make. But if this kind of crisis has been relatively common since World War II, then its significance declines, and it is more difficult to argue that the 2008 panic represents a huge blow to the United States.

The fact is that such events are common. In the 1970s, for instance, there was a significant threat to the municipal bond market. Bonds issued by states and local governments are especially attractive because they are not subject to federal tax. Such bonds are also considered all but risk-free, the assumption being that government entities will never default on their debts so long as they have the power to tax. In the 1970s, however, New York City couldn’t meet debt payments and couldn’t or wouldn’t raise taxes. If New York defaulted, the entire financing system for state and local government would devolve into chaos, so the federal government bailed out New York, making it clear that Washington was prepared to guarantee the market.

During that same period there was a surge of investment in the Third World, primarily to fund the development of natural resources such as oil and metals. Mineral prices were rising along with everything else in the 1970s, and investors assumed that because minerals are finite and irreplaceable, the prices would never fall. Investors also assumed that loans to the Third World governments that usually controlled these resources were safe, given the perception that sovereign countries never defaulted on debt.

In the mid-1980s, the belief in rising prices and stable governments, like most comfortable assumptions, turned out to be misguided. Mineral and energy prices plunged, and the extraction industries predicated on high prices collapsed. The money invested—much of it injected as loans—was lost. Third World countries, forced to choose between defaulting and raising taxes (which would further impoverish their citizens and trigger uprisings), opted to default, which threatened to swamp the global financial system. This prompted a U.S.-led multinational bailout of Third World debt. Under George Bush, Sr., Secretary of the Treasury Nicholas Brady created a system of guarantees, issuing what were called “Brady bonds” to create stability.

And then came the savings-and-loan crisis. Savings-and-loan institutions, which had been created to take consumer deposits and generate home loans—think Jimmy Stewart in

It’s a Wonderful Life

—were given the right to invest in other assets, which led them into the commercial real estate market. This appeared to be only a small step beyond their traditional residential market, and the expansion carried the same “conventional wisdom” guarantee that prices would never fall. In a growing economy, or so it was thought, the price of commercial real estate, from office buildings to malls, could only go up.

Once again, the unimaginable happened. Commercial real estate prices dropped, and many of the loans made by the S and Ls went into default. The size of the problem was vast and cut two ways. First, individual depositor money was at risk on a large scale. Second, the failure of an entire segment of the financial industry, which had resold its commercial mortgages into the broader market, was poised for catastrophe.

The federal government intervened by taking control of failed S and Ls—meaning most S and Ls—and assuming their liabilities. Mortgages in default were foreclosed, and the underlying property was taken over by a newly created institution called the Resolution Trust Corporation. Rather than try to sell all this real estate at once, thereby destroying the market for the next decade, the RTC, backed by federal guarantees that potentially could have risen to about $650 billion, took control of the real estate of failed savings-and-loans.

The crisis of 2008 was based on the same desire for low risk, and on the same assumption that a certain class of assets was indeed low-risk because its price couldn’t fall. It was met with a similar federal government intervention to bail out the system, and, just as before, everyone thought it was the end of capitalism. What is important to note is the consistent pattern, including the overstatement of the consequences. To some extent, this is a psychological phenomenon. With pain comes panic, and the management of panic is a question of leadership. Consider how it was managed in the past.