Understanding Business Accounting For Dummies, 2nd Edition (106 page)

Read Understanding Business Accounting For Dummies, 2nd Edition Online

Authors: Colin Barrow,John A. Tracy

Tags: #Finance, #Business

Book value per share and return on equity (ROE):

Shares for private businesses have no ready market price, so investors in these businesses use the ROE ratio, which is based on the value of their ownership equity reported in the balance sheet, to measure investment performance. Without a market price for the shares of a private business, the P/E ratio cannot be determined. EPS can easily be determined for a private business but does not have to be reported in its profit and loss account.

Current ratio and acid-test ratio:

These ratios indicate whether a business should have enough cash to pay its liabilities.

Return on assets (ROA):

This ratio is the first step in determining how well a business is using its capital and whether it's earning more than the interest rate on its debt, which causes financial leverage gain (or loss).

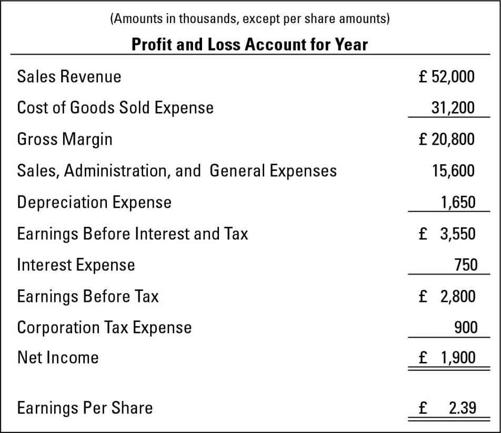

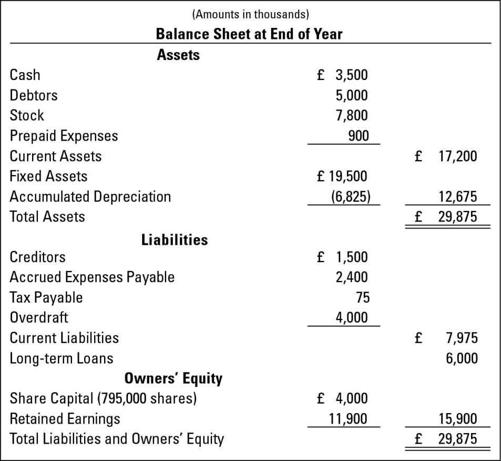

The profit and loss account and balance sheet of the business example that we first use in Chapter 8 are repeated here so that you have a financial statement for reference - see Figures 14-1 (profit and loss account) and 14-2 (balance sheet). Notice that a cash flow statement is not presented here - mainly because no ratios are calculated from data in the cash flow statement. (Refer to the sidebar ‘The temptation to compute cash flow per share: Don't give in!') The footnotes to the company's financial statements are not presented here, but the use of footnotes is discussed in the following sections.

Figure 14-1:

A sample profit and loss account.

Figure 14-2:

A sample balance sheet.

Gross margin ratio

Making bottom-line profit begins with making sales and earning enough gross margin from those sales, as explained in Chapters 5 and 9. In other words, a business must set its sales prices high enough over product costs to yield satisfactory gross margins on its products, because the business has to worry about many more expenses of making sales and running the business, plus interest expense and income tax expense. You calculate the

gross margin ratio

as follows:

Gross margin ÷ sales revenue = gross margin ratio

So a business with a £20.8 million gross margin and £52 million in sales revenue (refer to Figure 14-1) ends up with a 40 per cent gross margin ratio. Now, if the business had only been able to earn a 41 per cent gross margin, that one additional point (one point is 1 per cent) would have caused a jump in its gross margin of £520,000 (1 per cent × £52 million sales revenue) - which would have trickled down to earnings before income tax. Earnings before income tax would have been 19 per cent higher (a £520,000 bump in gross margin ÷ £2.8 million income before income tax). Never underestimate the impact of even a small improvement in the gross margin ratio!

Outside investors know only the information disclosed in the external financial report that the business releases. They can't do much more than compare the gross margin for the two- or three-yearly profit and loss accounts included in the annual financial report. Although publicly-owned businesses are required to include a management discussion and analysis (MD&A) section that should comment on any significant change in the gross margin ratio, corporate managers have wide latitude in deciding what exactly to discuss and how much detail to go into. You definitely should read the MD&A section, but it may not provide all the answers you're looking for. You have to search further in stockbroker releases, in articles in the financial press, or at the next professional business meeting you attend.

As explained in Chapter 9, managers focus on

contribution margin per unit

and

total contribution margin

to control and improve profit performance business. Contribution margin equals sales revenue minus product cost and other variable operating expenses of the business. Contribution margin is profit before the company's total fixed costs for the period are deducted. Changes in the contribution margins per unit of the products sold by a business and changes in its total fixed costs are extremely important information in managing profit.

However, businesses do not disclose contribution margin information in their

external

financial reports - they wouldn't even think of doing so. This information is considered to be proprietary in nature; it should be kept confidential and out of the hands of its competitors. In short, investors do not have access to information about the business's contribution margin. Neither GAAP nor the Stock Exchange requires that such information be disclosed. The external profit and loss account discloses gross margin and operating profit, or earnings before interest and income tax expenses. However, the expenses between these two profit lines in the profit and loss account are not separated between variable and fixed (refer to Figure 14-1).

Profit ratio

Business is motivated by profit, so the

profit ratio

is very important, to say the least. The profit ratio indicates how much net income was earned on each £100 of sales revenue:

Net income ÷ sales revenue = profit ratio

For example, the business in Figure 14-1 earned £1.9 million net income from its £52 million sales revenue, so its profit ratio is 3.65 per cent, meaning that the business earned £3.65 net income for each £100 of sales revenue.