Unfair Advantage -The Power of Financial Education (12 page)

Read Unfair Advantage -The Power of Financial Education Online

Authors: Robert T. Kiyosaki

Tags: #Personal Finance, #unfair advantage, #financial education, #rich dad, #robert kiyosaki

In 2002,

Rich Dad’s Prophecy

was published, predicting that the biggest stock-market crash in history was coming. You do not have to go to MIT, Stanford, or Princeton to see the future. I wrote in the introduction of

Prophecy:

“[Y]ou may have up to the year 2010 to become prepared.”

As expected,

Rich Dad’s Prophecy

was trashed by leading financial publications such as the

Wall Street Journal

and

Smart Money

magazine.

In 2007, the real estate market began to wobble as subprime borrowers could not make their mortgage payments. A global banking crisis followed, eventually bringing down the United States and Europe with it. After the United States crashed, the European PIIGS—Portugal, Ireland, Italy, Greece, and Spain—collapsed under mountains of debt. If not for Germany, Europe and the euro might have gone down. The debt crisis was solved by creating more debt. The rolling booms and busts that started after 1971 with Arab petrodollars continue. Hot money looks for people and institutions that can borrow more and more money. Ever since 1971, the world economy cannot grow unless people borrow money.

Today there are trillions of dollars (and other fiat currencies) looking for a home, which is why interest rates for borrowers are low and interest rates for savers are also low. Simply put, the financial world loves debtors and punishes savers.

Why Bankers Do Not Like Savers

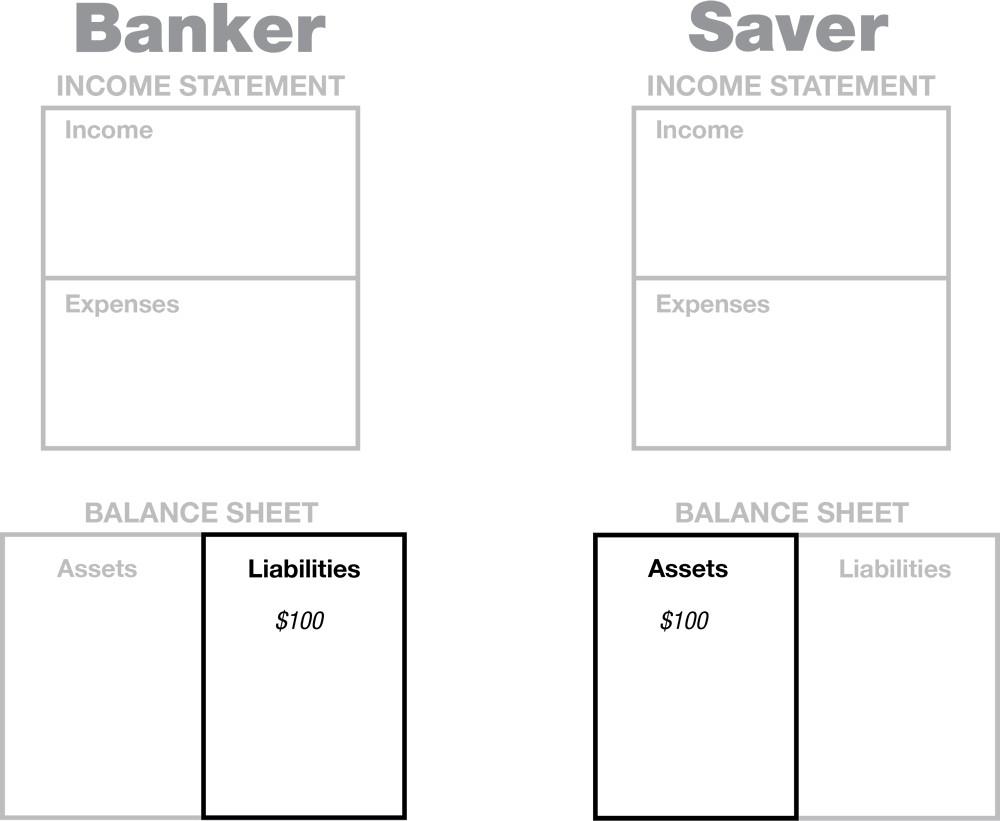

To better understand the entire global financial crisis, all one needs to do is understand the business of bankers. Pictured below are the financial statements of a banker and a saver:

Explanation

For the saver, their $100 is an asset. For the banker, the saver’s same $100 is a liability.

FAQ

Why is it a liability to the banker?

Short Answer

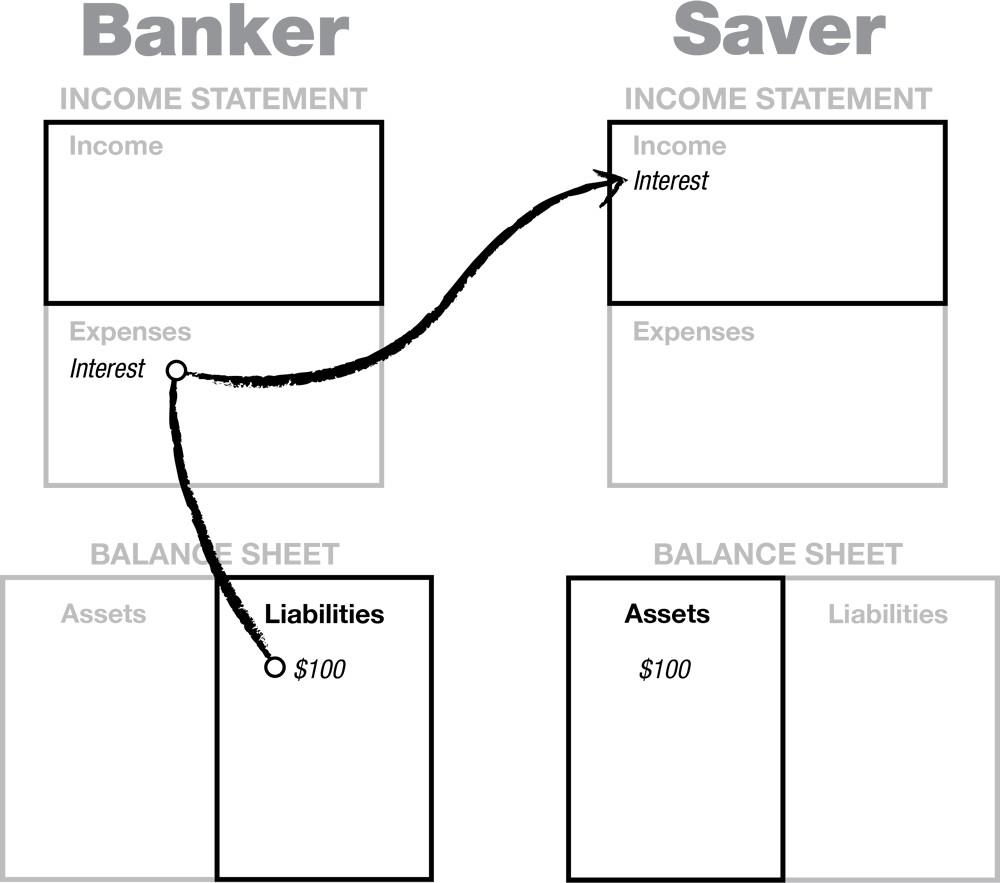

The definition of an asset is something that puts money in your pocket. The definition of a liability is something that takes money from your pocket. Since the banker must pay interest to the saver, the saver’s $100 is the saver’s asset and the banker’s liability.

Follow arrows and notice direction of cash flowing:

FAQ

How does the banker make money?

Short Answer

Debtors.

Explanation

The banking system of the world works on a system known as the fractional reserve system.

Simply put, for every dollar you save, the bank can lend out a specific multiple of your dollars. For example, let’s say you save $1 with a fractional reserve of 10. The banker can lend out $10. Like magic, your $1 becomes $10, which the banker lends out at high interest rates, especially on credit cards. This is how the banks make money from debtors and loses money from savers and why bankers love debtors—the bigger the better.

If the government wants to increase the money supply, the fractional reserve is raised to, let’s say, 40, which is what the SEC (Securities and Exchange Commission allowed the biggest five banks to do in order to save the economy in 2004. This 1:40 fractional reserve caused a massive bubble and today we are in a global crisis of debt, debt that cannot be repaid.

When debtors could not repay their loans, savers lined up outside of banks to get their money back. This is called “a run on the bank.” A run on the bank is caused primarily by the fractional-reserve system, a system that allows a bank to lend out more money than it holds in deposits.

If the government wanted to slow the economy, the U.S. Treasury and the Federal Reserve Bank would lower the fractional reserve to, let’s say, 5. That means, for every dollar you and I put in, the bank can lend out $5. With fewer dollars to borrow, interest rates go up and the economy slows.

As you may have already noticed, the fractional-reserve system of banking destroys the purchasing power of your savings by magically printing money out of thin air every time you deposit your savings. This system is the same all over the world, a system mandated by the World Bank and the IMF, the International Monetary Fund.

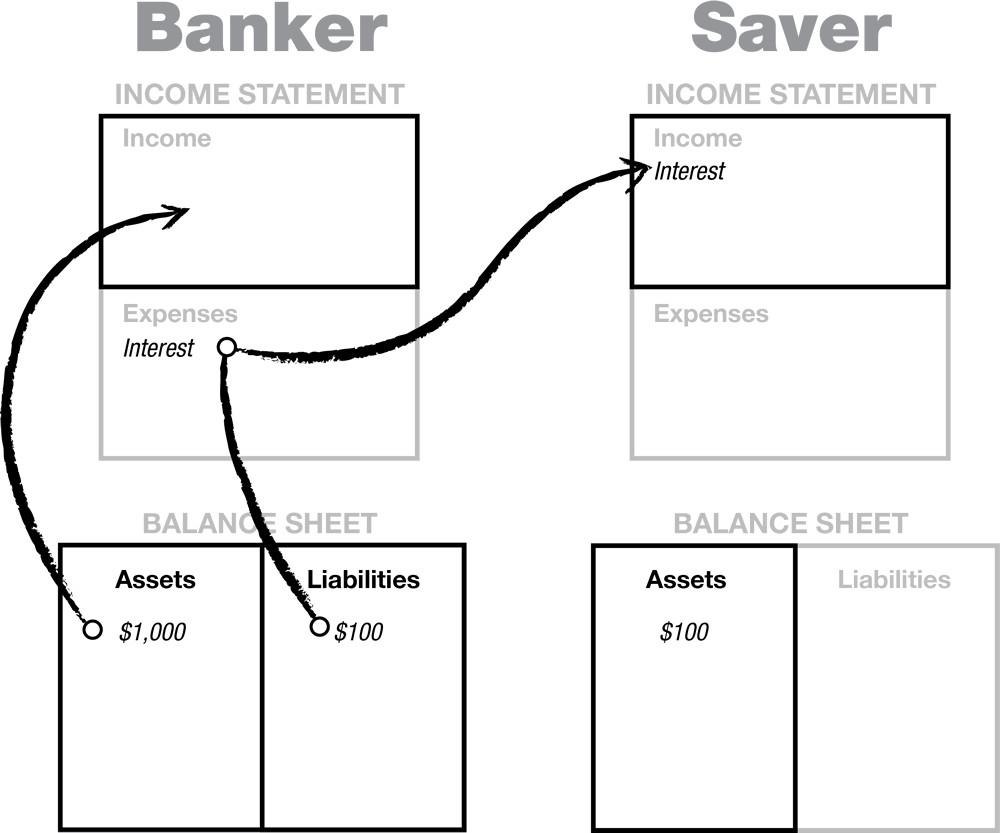

With a fractional reserve of 10, a more complete diagram is as follows:

The real magic occurs when the banker pays the saver, let’s say, 2 percent interest and lends out magic money through the fractional reserve at 5 percent to 25 percent.

Let’s be conservative:

Saver: $100 x 2 percent = $2 a year

Borrowers: $1000 x 10 percent = $100 a year.

In this example, the bank earns $100 on the saver’s deposit of $100 and pays the saver only $2 for the use of the saver’s money. This is why bankers love borrowers.

Keeping It Simple

If this is too confusing, all you need to know is that bankers need borrowers, not savers. If you and I stop borrowing, the economy stops running because today, all money is debt. In other words, “Debt makes the world go round

Taxes Reward Debtors

Now you know why the tax department rewards debtors with tax-free money and punishes savers by taxing interest on savings at the highest taxable rate as earned, or ordinary, income.

Learning to Be a Debtor

In 1973, I returned home from Vietnam. I had been away from Hawaii since 1965. I was fortunate to be assigned to Marine Corps Air Station at Kaneohe Bay, Hawaii, for my last year of service.

I had left Hawaii as a boy of 18 and returned home as a young man of 26. I had respectfully listened to adults all my life. I had gone to school after receiving a Congressional appointment to a federal military academy in New York, and graduated with a bachelor of science degree. I got a job upon graduation, sailing for Standard Oil as a third mate on their oil tankers, and earned a lot of money for a kid of 21 years of age. I was earning nearly twice as much as dad, who was nearly 50.

Rather than make a career of Standard Oil and one day become a ship’s captain, I resigned. I joined the Marine Corps, earning $200 a month as a Marine lieutenant, which was a lot less than the $4,000 a month I was earning at Standard Oil. My flight training began at Pensacola, Florida, where it took two years to graduate and receive my wings.

In 1971, I was immediately transferred to Camp Pendleton, California, for advanced training and was stationed on board an aircraft carrier in Vietnam in 1972. I crashed three times that year and was glad to return home to Hawaii in 1973, still in one piece.

Now that I was home and about to leave the military, it was time to think for myself. I was 26 years old, and I knew it was time that I decided what I wanted to do when I grew up.

The new airbase was only 15 minutes from my poor dad’s home and 30 minutes from my rich dad’s office in Waikiki. During my final year as a pilot, I visited both men and sought their advice for my future.

My poor dad thought I should fly for the airlines, as most of my fellow pilots were doing. When I told him I was done flying, he suggested I go back to Standard Oil and sail as a third mate. He told me, “The pay is great, and you’ll have five months off a year so you only have to work seven months a year.” When I shook my head to that idea, he recommended that I return to school, get my master’s degree, possibly my doctorate degree, and then get a job with the government. My response to that was, “I’d rather go back to fight in Vietnam.”

I had a problem with my dad’s advice about going back to school and working for the government. It was the same advice he had followed in his life, advice that did not work for him. At the age of 54, he was unemployed and living off his savings. His life’s plan failed when he resigned as the head of education for the State of Hawaii to run for lieutenant governor as a Republican. The Democratic ticket had his boss running for reelection. When my dad lost, he was blacklisted from government service in Hawaii.

It disturbed me, listening to him advise me to do what did not work for him. He thought I should work for the government in the E quadrant. My dad’s unemployment at the age of 54, highly educated and hardworking though he was, presented to me a glimpse of the future, the future we are in today.

I thanked my dad and drove to my rich dad’s office in Waikiki. I now knew which dad’s advice I wanted to follow. I knew that what I wanted when I grew up was to become an entrepreneur who operated out of the B and I quadrants.

Learn to Invest in Debt

In 1973, my rich dad said there were three things I needed to learn if I wanted to follow in his footsteps. They were:

Learn to sell.

The ability to sell is the most important skill of an entrepreneur. The most important job of an entrepreneur is to raise money.Learn to invest via market trends.

Today, this is called technical analysis, predicting the future of markets by tracking the past.Learn to invest in real estate.

Learn how to manage debt to achieve wealth.

Rich dad was very aware of Nixon’s change in the rules of money in 1971. That is why, in 1972 while I was in Vietnam, rich dad suggested I follow gold in the papers and take note of how the Vietnamese people responded to the changes in money. In

Conspiracy of the Rich,

I wrote about handing a Vietnamese fruit vendor a $50 bill and having her turn it down. She was my glimpse into the future and the coming crisis with the dollar, a crisis that is still coming.

When I asked my rich dad to explain why I should take classes in real estate investing, he replied, “The dollar is no longer money. The dollar is now debt. If you want to be rich, you need to learn to use debt to grow your wealth.”

When I asked if he would teach me, he replied, “No. Invest in your education first.” He did not want to waste his time with someone who knew nothing about real estate and debt. Encouraging me to learn, he said, “I will guide you after you have done your courses. I will be your mentor and your coach, but first you must seek your own education.”