Unfair Advantage -The Power of Financial Education (16 page)

Read Unfair Advantage -The Power of Financial Education Online

Authors: Robert T. Kiyosaki

Tags: #Personal Finance, #unfair advantage, #financial education, #rich dad, #robert kiyosaki

In my wallet I carry a fresh Zimbabwe $100 trillion note, which numerically is $100,000,000,000,000. At one time, it bought three eggs. It purchases less today.

Today, Federal Reserve Bank Chairman Ben Bernanke is printing trillions of dollars and President Obama is spending trillions of dollars.

Phony money causes wars between nations as well as wars of real money (gold, silver, food, oil, things with intrinsic value) versus pieces of paper with ink on it.

3. Safe Investments

There is no such thing as a safe investment. There are only smart investors.

As stated at the start of this chapter, when I am asked questions such as, “Is real estate a good investment?” or “Are stocks good investments?” my answer is always the same, “Are you a good investor?”

No investment is safe if you are foolish, even gold. You can lose a lot of money investing in real money, gold and silver.

Today, in 2011, gold is hitting all-time highs because fools rush in to chase fool’s gold. Gold fever is creating fools rushing in as gold prices rise, just as they did when stocks and real estate went in bubbles. As I write, gold is over $1,300 an ounce, an all-time high, but not if measured in 1980 dollars when gold hit $850 an ounce and silver hit $50 an ounce. For gold to be at an all-time high, it would need to be at $2,400 in today’s dollars.

Today, I see the frenzy in gold. Everywhere I go, I see signs, “We buy gold.” You know the buyer will pay $300 an ounce, not $1300 an ounce to the seller, desperate for cash and selling his or her mother’s jewelry.

Even when a person invests in gold coins, many new investors are fooled by fool’s gold, buying “rare gold coins,” aka numismatic coins. A friend of a friend was all excited about buying a rare gold coin from the last depression. He paid nearly $3,000 for a coin that was worth $1,200.

I believe it is possible for gold to hit $3,000 an ounce in a few years, and I don’t think $7,000 is out of the question. Does this mean you should go out and buy it? My answer is no. You still need to be educated on the gold markets, especially at these prices.

In overly simple terms and in theory, the price of gold is equal to the money supply. The more governments print money and increase the money supply, the more the price of gold goes up. Gold goes up as the purchasing power of the dollar goes down. This is why I think it’s funny that Fed Chairman Bernanke stated on June 9, 2010: “I don’t fully understand movements in the gold price.”

This is the guy who is printing the money. He graduated from MIT, taught at Stanford and Harvard, is the expert on the last depression, now heads the most powerful bank in the world, and he does not understand the movements in the price of gold?

This is disturbing, but his lack of understanding makes him the best friend of gold investors. The more confused Chairman Bernanke is, the more I buy gold, silver, and oil.

Fed Chairman Bernanke reminds me of my poor dad, a college professor, a PhD, gazing out at the world from the mind-set of the E quadrant. If Bernanke worked out of the I quadrant, he might understand why the price of gold goes up with every dollar he prints, aka quantitative easing.

It is because of Federal Reserve Bank leaders like former Chairman Greenspan and current Chairman Bernanke that I bought a gold mine in 1997. I knew they were destroying the dollar.

Kim and I also bought as much gold as possible before the year 2000, when gold was below $300 and silver was less than $3 an ounce.

For those considering saving precious metals rather than saving money, I would start with silver. In 2011, silver is a much better investment than gold. I say this because there is now more gold on planet earth than silver. Gold is also hoarded, which is why there is so much gold. Silver is used, much like oil, which is why there is much less silver than gold.

It is possible, someday in the not-too-distant future, that silver will be more expensive than gold. But please do not take my word for it. Do your own research.

For years, central banks were dumping gold and buying dollars. Today, they are dumping dollars and buying gold, increasing the price of gold, causing their currency to become worthless, and making life harder on the people of their country. Talk about the best-educated people doing stupid things.

My point is that you can lose money buying gold. If you had purchased gold in 1980, you would still be losing money today, even with gold at $1,300. The price of gold will need to hit $2,400 for you to have made your $850 in 1980 dollars back. If you can lose money buying gold, you can lose money buying anything.

This is why

safe investments

is an oxymoron.

4. Fair Share

Nothing is fair when it comes to money. God is not fair. If God were fair, I would look like Johnny Depp.

Nothing is fair in the stock market. Some people get more than their fair share for their shares. The average investor invests in the stock market buying shares of stock. But few investors know that there are different types of shares, and they are not fair. For example, there are

common

shares for the common man. The smart investors prefer to have

preferred

shares. Simply put, investors who own preferred shares receive preferential treatment over commoners who own common shares. Most mutual funds are filled with common shares.

There is another class of shares far above preferred shares.

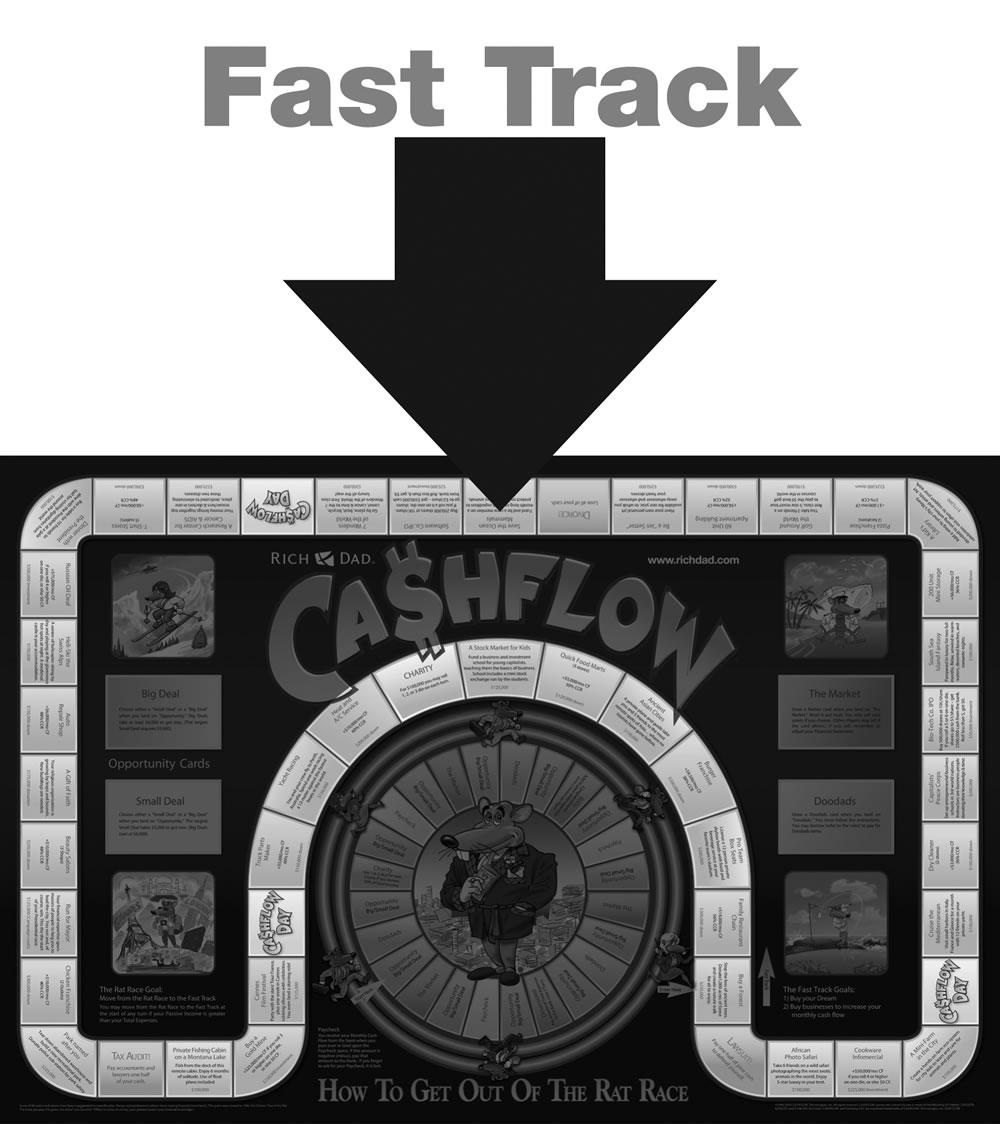

This level can be seen on the

CASHFLOW 101

game board.

Most of those in the Rat Race invest in preferred and common shares.

Investors at this level do not invest in shares. They invest in percentages. When you perform your research of a public company by looking at a prospectus of a public company, you will see a category known as “selling shareholders.” These are the shareholders who own large blocks of the stock, say 1 million to 10 million shares.

They are called “selling shareholders” because they sold only a

percentage

of their company and received a large block of shares.

Building a business and taking your company public via an IPO (initial public offering) is another form of printing money, in this case, printing shares, or stock certificates.

When I took my gold mine public, Kim and I were selling shareholders, not buying shareholders.

There are differences between selling shareholders, preferred shareholders, and common shareholders.

This is why

fair share

is an oxymoron.

The Rich Dad Company is currently working on a book written by my mentor, the man who taught me how to build businesses and sell businesses via an IPO. If you want to learn how to become a selling shareholder, watch for this book.

Stay connected to Rich Dad – via Richdad.com – for the latest updates on books and our educational program for entrepreneurs.

5. Mutual Fund

There is nothing mutual about a mutual fund. A better term would be

one-sided

fund.

This does not mean I do not like mutual funds. Personally, I love mutual funds because mutual funds provide me the money to invest.

When I took my gold mine public via the IPO, it was a group of mutual-fund companies who purchased most of the stocks we offered.

Mutual funds are designed for people who know nothing about investing and feel more comfortable having a fund manager pick their common stocks for them.

The problem is that the investor puts up 100 percent of the money, takes 100 percent of the risk and receives only 20 percent of the profits (if there are profits). The mutual-fund company takes 80 percent of the investor’s money via management fees and expenses. To me, this is a one-sided fund, not a mutual fund.

Making matters worse, taxes are not good on mutual funds.

Tom Wheelwright explains:

When you buy mutual funds, you are taxed in two separate ways. First, you are taxed on the capital gains when the fund trades (buys and sells) a stock. Second, you are taxed when you trade the mutual fund itself. The outcome of this taxing scheme is that you can pay capital gains on the mutual fund’s stock trades in a year when the mutual fund goes down in value. Imagine paying taxes when you lose money. That’s exactly what happens to a lot of people when they own mutual funds.

There are some advantages to mutual funds. Rather than have me discuss the pros and cons of mutual funds, I will let the Rich Dad advisor, Andy Tanner, explain paper assets.

Andy Tanner explains pros and cons of mutual funds:

When it comes to the pros and cons of mutual funds, I’d say that most of the pros lie in favor of the institutions that sell the mutual funds, along with the fund managers who collect fees from the fund’s investors. The investors put up the money, investors assume the risk, and institutions and fund managers get paid whether the fund performs well or whether it doesn’t. Combine that with a program of consistent dollar-cost averaging, and you have a constant flow of dollars coming into the fund at all times. As Robert says, there are always two sides to every coin, and there’s no question that the mutual-fund companies are on the more profitable side.

I suppose the appeal of mutual funds, unit trusts, and retirement plans like 401(k)s and RRSPs is that, on the surface, they appear to give an investor a way to invest without having to have a lot of financial education. In addition, they also give the investor a sense of safety because they usually diversify the money across several different sectors.

The problem is simply that appearances can be deceiving. I’m not convinced at all that investing in a 401(k) filled with mutual funds is an alternative to financial education. The type of diversification that mutual funds carry gives rise to what I think is a very dangerous false sense of safety. In reality, they give an investor no more control than investing in a single stock. Risk is related to control. Less control means more risk, which is why hope is not a strategy.

I’d say there are at least four important problems with the predominant mutual fund/401(k) system that warrant an in-depth discussion with your financial advisor:

First, this brand of diversification does very little, if anything, to protect an investor against a large stock-market crash, a long-term stagnant stock market, or even a rising stock market that fails to outpace inflation over long periods.

When a person buys large amounts of stock in a single company (like Warren Buffett who bought millions of shares of Coca-Cola), a large concern is that the share price of the company can fall, which of course is beyond the control of the investor. By the same token, when a person is diversified across the market, it is still possible (if not likely) that the entire market will fall, which also is completely beyond the control of the investor. I think most people would agree that our world markets have become more volatile and probably more fragile than ever.

From the year 2000 to 2010 we’ve observed the “decade of nothing.” Getting back to zero offers little consolation when growth—the exponential growth associated with compounding—was required to make a plan work and now retirement is staring the investor in the face. Moreover, we could easily have another decade of nothing or, even worse, a huge market slide (and there’s plenty of fundamental data to suggest the latter). If you want to add to your financial vocabulary, the next time you’re with your financial advisor, ask him to explain what “systemic risk” means. Most mutual funds and retirement plans make the dangerous assumption that the market will always go up in the long term, but there’s no guarantee that that will actually happen for this generation of investors.