Unfair Advantage -The Power of Financial Education (17 page)

Read Unfair Advantage -The Power of Financial Education Online

Authors: Robert T. Kiyosaki

Tags: #Personal Finance, #unfair advantage, #financial education, #rich dad, #robert kiyosaki

Second is the question of consistency. Standard & Poor’s has released data that show that if a person takes a handful of mutual funds that do perform well in a given year, they almost never are able to repeat that performance over periods of five to ten years. In other words, past performance really is not a solid indication of future results.

Third is the question of fees. While most fees that go to the financial system can be found somewhere in the fine print, most of the investors I talk to have no idea what those fees are and how they will affect the outcome of their investments. In my soon-to-be-released Rich Dad’s Advisor book

The ABCs of Investing in Stocks

, I dedicate nearly an entire chapter to helping investors understand the crippling ramifications that these fees bring to a person’s 401(k) plan. When those who most vigorously defend the status quo of 401(k)s filled with mutual funds bray their message, consider how much money they are making with the status quo.

Fourth is the question of beating the market. Today it’s not too hard to find financial instruments that are readily available to the individual investor that will at least mimic the market. Products like exchange-traded funds allow an investor to do pretty much everything that most mutual funds can do in terms of tracking an index market. Why should I pay huge expense ratios for a portfolio that is simply going to do whatever the market does anyway? If my 401(k) or 403(b) plan or IRA is simply going to mimic the market, what value does professional management bring? If a person examines their own IRA or 401(k), chances are they have done well when the market has done well, and they have hemorrhaged when the market has hemorrhaged. Sadly, most people find they’re talented enough all by themselves to lose money when the market falls.

There’s much more to the discussion than just these pros and cons. For many, the decisions they make will have a great impact on their financial future. In my opinion, this warrants a frank discussion with an advisor and serious consideration of a plan for financial education.

As Andy explained, mutual funds, banks, and pension companies are important because they provide the money that those in the B and I quadrants use to invest.

For the uneducated investor,

mutual funds

are an oxymoron, because they are one-sided funds, and are not mutually beneficial.

6. Diversified Portfolio

Most people are not diversified—they are

de-worsified.

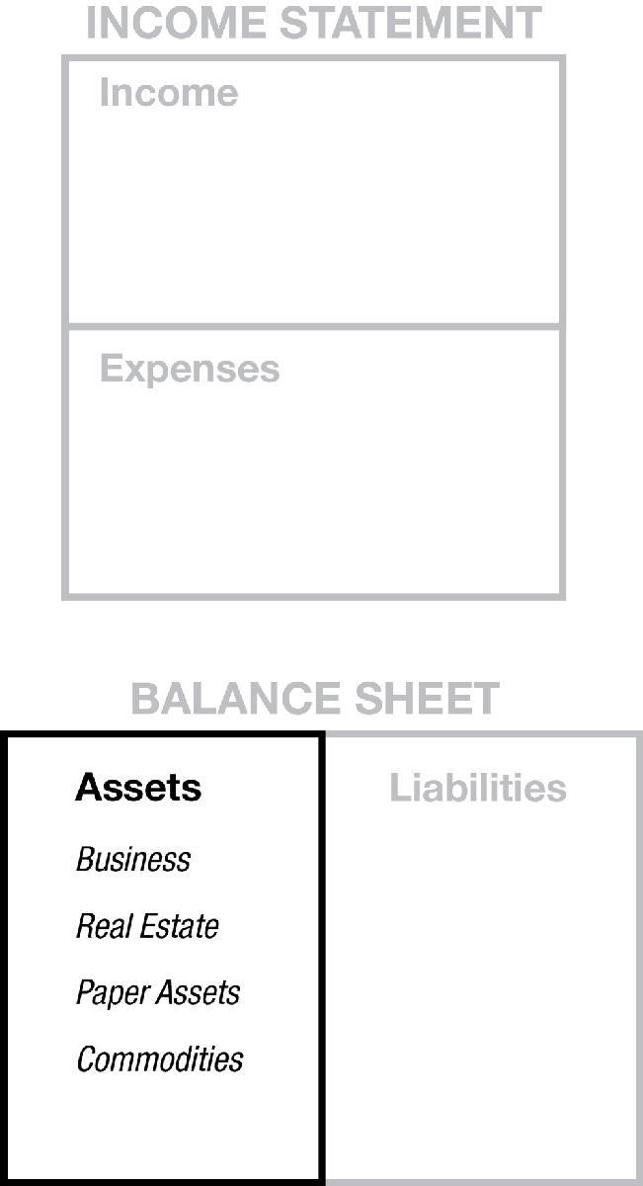

The four basic asset classes in the world of investments are shown in the asset column of the financial statement below.

Most people who believe they have a diversified portfolio are not diversified because they are primarily in only one asset class: paper assets.

Paper assets are made up of stocks, bonds, mutual funds, ETFs, insurance, annuities, and savings.

Again, they are not diversified, they are de-worsified. Even more hideous, mutual funds by definition are diversified, made up of a basket of different stocks, bonds, and paper assets. When a person has a diversified portfolio of mutual funds, he or she is beyond diversified.

When the stock market crashes as it did in 2007, most of the paper assets crash in unison. This is why even Warren Buffett’s mutual fund, Berkshire Hathaway crashed in the crash.

As Buffett himself says,

“Diversification is protection against ignorance. (It) makes very little sense for those who know what they’re doing.”

Jim Cramer, a very smart investor and an expert on the stock market, often runs a segment on his TV program called “Am I diversified?” During that segment, viewers call in and rattle off the stocks they are holding in their portfolios. For example, a

viewer may say, “I have shares of Exxon, GE, IBM, Procter and Gamble, and Bank of America. I also have an emerging market fund, money market fund, a gold ETF, a bond fund, a REIT, an S&P 500 index fund, and I just bought an index fund for large

cap dividends. Am I diversified?”

Jim Cramer then evaluates the viewer’s diversified portfolio.

In my opinion, the above portfolio is not diversified. It is de worsified. It is

less worse

, but not diversified, because it is filled with only one class of assets: paper assets. If the stock market crashes, which it will, diversification will not protect him.

If the crash is severe, as it was in 1929 and 2007, the stock market may not recover for years, again destroying the portfolios for capital-gains investors.

Today, there are more mutual-fund companies than there are publicly traded companies. This is how insane diversification has become.

In 2007 when markets began to crash, everything crashed, even real estate. Diversification did not save millions of people from their lack of financial education.

For most people, their

diversified portfolio

is an oxymoron. It is a de-worsified portfolio, a portfolio made less worse, but not less risky.

Why Are Investors Losing?

FAQ

Why are uneducated investors losing so much?

Short Answer

They invest without insurance.

Explanation

You do not drive a car without insurance. You do not buy a house without insurance. Yet when most investors invest, they invest without insurance. When the stock market crashed, they lost because they had no insurance.

When I invest in real estate I have insurance. If the building burns down, my losses are covered. Even my loss of income is insured.

The biggest losers in the last crash were investors who had their money, uninsured, in retirement plans, plans like the 401(k) in the United States. That is beyond risky. That is foolish.

We all know the markets will crash again, yet most investors invest without insurance.

FAQ

How long did the Great Depression last?

Short Answer

25 years.

Explanation

In 1929 the Dow hit an all-time high of 381. It took till 1954—25 years—for it to reach 381 again.

This is the problem for those investing for capital gains. This is why gold investors who rushed in late in 1980 to buy gold at $850 an ounce have not yet recovered. This is why baby boomers who were counting on their retirement plans filled with a diversified portfolio of paper assets and their home’s appreciation (capital gains) for their retirement are in trouble today.

On October 9, 2007, the Dow hit an all-time high of 14,164. On March 9, 2009, it had fallen to 6,547. Millions of investors lost trillions of dollars. How long will it be before capital-gains investors get their money back?

Today millions of people have their fingers crossed, hoping the Dow keeps climbing. This is not investing. This is gambling. Betting your future on the ups and downs of any market is risky, very risky.

I was taught to diversify differently. I own assets in different asset classes, not just in paper assets. For example, I do invest in oil, but I do not invest in oil company stocks. I do invest in real estate. I do not invest in REITs, Real Estate Investment Trusts, a mutual fund for real estate. I love cash flow, infinite returns, and tax advantages, which is why I generally stay out of paper assets.

Bonds are paper assets. I do not invest in bonds. Rather I borrow the money that bonds create to buy apartment houses, especially when interest rates are low.

When the Fed and central banks are printing money, I save gold and silver, not money. If the banks stop printing money, I will sell gold and silver and go back to cash.

Simply put, I diversify by owning percentages of the different asset classes, not the paper assets (shares, bonds, mutual funds, ETFs) representing the different asset classes.

As Warren Buffett says, “Diversification is protection from ignorance.”

The question is, “From whose ignorance—yours, or the stock broker and financial planners selling you the de-worsified portfolio?” Or your real estate broker who tells you your home is an asset and that real estate always goes up in value (capital gains)?

Fin Ed Definition

A mutual fund is already diversified.

Generally, a mutual fund is a diversified assortment of stocks, bonds, or other so-called assets. When a person buys a diversified portfolio of mutual funds, in many cases, they are buying the same stocks in different mutual funds. This is not diversification. This is concentration.

7. Debt-Free

I always chuckle when someone says to me, “I am debt-free. My house and car are paid for, and we pay off our credit cards the moment we use them.”

Rather than disturb their dream, I say, “Congratulations,” and move on. Let them live in their oxymoron.

What I want to say is, “Have you seen the size of the national debt? How can you be debt-free when you and I are paying the principal and interest on nearly $75 trillion in debt? How can you be so naïve?”

In 2010, every U.S. citizen’s share of the national debt was $174,000 per person or

$665,000 per family.

A Crash of People

The subprime crash of 2007 was caused by excessive debt owed by subprime borrowers.

A Crash of Nations

The next crash will be caused by excessive debt owed by subprime nations. So far, the world has supported the crash of smaller countries, such as the PIIGS (Portugal, Ireland, Italy, Greece, and Spain).

If Germany had not bailed out Greece, the crash would have spread. The first major country to go will probably be Japan.

Why is Japan in trouble? Debt. Japan has the largest percentage of debt-to-GDP ratio of the major world powers. The irony is that Japan is a highly educated, hardworking, homogenous population, with one of the highest savings rates in the world. In spite of these solid personal work and savings ethics, their government continues to mismanage their economy.

The illusion American leaders promote is that Americans can work hard and produce our way out of these rising mountains of debt, that Americans need to work harder and save more money. This is why President Obama says, “American workers are the most productive workers in the world.” It seems he wants American workers to save the U.S. economy when it is the ongoing incompetence of our political and financial leaders that is the true cause of the problem. The people that need financial education the most are our leaders.

Thinking that hard work and thrift will save the U.S. economy is equivalent to a worker earning $10 an hour, believing he can work hard and pay the mortgage of a $2 million home, a Mercedes, a Porsche, a private school for his kids, and save enough for an early secure retirement.

This is the same fantasy millions of Americans, Japanese, Brits, and Europeans and their government leaders are living in. If Japan goes down, crushed by its mountain of debt, the world will follow.

Financial Insanity

Japan is doing the same thing the United States is doing, using debt in an attempt to stimulate their economy. This is no different than a worker using credit cards to pay the interest on their credit cards. During the real estate boom, millions of people refinanced their house to pay off their credit cards and kept using their credit cards. When the entire system crashed, people started losing their homes.

The insanity is that leaders of the Western world are doing the same thing today, using debt to solve a crisis caused by debt.

If Japan does collapse, it may go under by 2015, maybe earlier. Japan would be followed by England, Europe, the United States, and China. Let’s hope it does not happen.

The Baby Boom Bust

In the United States, there are approximately 75 million baby boomers ready to start collecting Social Security and Medicare. Japan, England, France, and Germany have the same problem: baby boomers collecting on promises their countries cannot keep.

If 75 million American baby boomers collect just $1,000 a month in Social Security and Medicare benefits, that is an additional $7.5 billion in monthly payments from the government. Obviously, the printing presses will be running, cranking out checks without money in the bank.