What Stays in Vegas (32 page)

Read What Stays in Vegas Online

Authors: Adam Tanner

Security guards placed their thumbs onto an electronic reader to gain access to the surveillance room. There, four guards sat side by side behind four computer screens each. A supervisor at a fifth desk watched them watching the others, as well as his own cluster of computer

monitors. They faced thirty large television screens on the wall in front of them, clustered nine at each end and twelve in the middle.

One security guard peered into the action in the count room, where women broke open one stack of $20 bills after another and ran them through bill counting machines. If anything suspicious caught her eye, the guard could zoom the ceiling camera to focus so closely that she could read the quantity of bills spitting out of the counter. Another bank of monitors focused on card tables, ready to watch the action in a few hours' time.

A steady stream of staffers arrived through the back entrance, showed ID cards, then punched in to a time clockâall the movements were captured by the casino's computer system. Some of the staff headed to an automated dry-cleaning rack. They entered in a number, and their cleanly pressed uniform appeared behind a slot large enough to pull out a suit on a hanger. Minutes later they emerged from changing roomsâmale dealers in bow ties, waitresses in sleeveless tops pressed tightly against cleavage.

Two employees punch in ahead of opening night at Horseshoe Casino Cincinnati. Source: Author photo.

A supervisor called out the evening assignments for dealers lined up in the high-limit room. Most were excited, and some were a bit nervous.

When the VIP opening hour came, the staff created a meandering gauntlet across the casino floor. As the guests arrived and made their way to a ballroom for the opening reception, the staff cheered wildly to welcome the visitors. Kanter, dressed in an orange tie to match the Total Rewards logo, wandered behind the line and applauded enthusiastically.

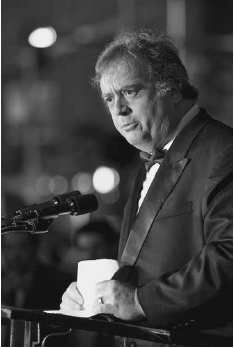

After the invited guests enjoyed some drinks, food, and live jazz in the ballroom, management tried to hush the crowd to thank city officials, investors, and staffers who had made the opening of a new casino possible. Loveman used humor to quiet down his audience. “I want to remind you that I am a casino boss. You've seen all the movies and you know what I am capable of,” he said. “There are a lot of big guys with Italian names waiting for instructions.” To each side of the stage, a showgirl, imported from Las Vegas for the event and clad scantily in feathers, smiled perfectly throughout the presentation.

A little later, I met Loveman in a small conference room off the high-limit room. For all the celebration, for all the customer data analytics Loveman had pioneered, his company continued to face tough times. A week earlier, the company had reported a 2012 loss of $1.5 billion. The year before that it had recorded a loss of nearly $700 million, and things would only get worse in the future. In both years the company paid more than $2 billion to service its debt alone. The

Wall Street Journal

dubbed Caesars “wobbly.” Even with its carefully tended client data, the heavy debt load threatened to become the storm that ravages all.

Did data analytics represent an elegant sandcastle that a rising tide of debt would wipe out? “We're not going bankrupt,” Loveman said. “We show a loss because of things like interest expense and write-downs on depreciated assets and things like that. But the operations of the company are highly profitable and very successful, so the company last year made right at $2 billion operating its casinos around the world. That's an extraordinary numberâvery healthy number.”

In 2013 that number was to stay largely the same, coming in at nearly $1.9 billion.

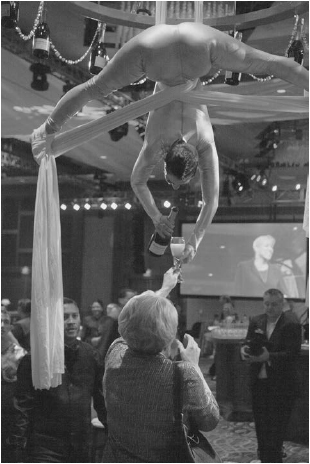

A performer tethered to the ceiling pours champagne for guests on opening night at Horseshoe Casino Cincinnati. Source: Author photo.

He noted the company had a low level of debt until it was privatized. “It was an overt decision by its new owners in 2008, and that's what the burden has been. It's a financing decision, not the operation of the business that's the problem,” he said. “The measure of Total Rewards is how it competes against its local and regional competitors

every month. What goes on the balance sheet is not indicative of that at all.”

Loveman's case was that there is a difference between the company's overall loss under rules known as generally accepted accounting principles (GAAP) and the day-to-day profit it makes from running its casinos. He said the company makes money virtually every day virtually everywhere it operates. But the expense of the debt, write-downs of old buildings in Atlantic City, and other things make the GAAP-reported number a loss.

Loveman said the company could ease its debt load by selling new shares to the public, but he did not want to do that. He said he could raise billions of dollars that way, which would lower debt and increase profits. “But the problem with that would be the existing shareholders,

including myself, would be diluted terribly by the number of shares that we would have to give to do that and none of us wants to do that,” he said.

2

Loveman does find it frustrating that the debt issue casts such a long shadow over his company and its innovations using customer data. “It's a huge challenge. We've been working on it for a long time. The company was financed in a certain way because everybody thought the world was going to be better, better, better, and almost immediately after it was financed in this way, the world got worse, worse, worse,” he said.

Gary Loveman at the opening of Horseshoe Casino in Cleveland, 2012. Source: Jason Miller, courtesy of Caesars Entertainment.

And things got even worse in 2013, a year in which the company reported a $2.9 billion loss, nearly double the loss of 2012. By then, Caesars had not recorded an annual profit since 2009, which itself followed a year in which it lost more than $5 billion. By the start of 2014, Caesars faced a total debt of $23.6 billionâmore than the annual GDP of dozens of smaller countries.

3

Randy Fine, Loveman's former Harvard Business School student, ended up working for him as the first vice president of Total Rewards. Now he is critical of his former boss. Fine expects that Caesars will one day have to declare bankruptcy. “There is no question that the company chose to take on too much leverage,” he says. “Debt can't be serviced because revenues don't support it, and revenue is driven by customer management.” Yet many investors disagreed, and the stock price of Caesars Entertainment had about doubled in the year after the opening of the new property in Cincinnati. Optimists thought that if anyone could extract themselves from such a debt, it would be Gary Loveman and his team.

Visitors saw no clues of any of this uncertainty about the future on the casino floor that night in Cincinnati. As Loveman spoke, thousands of people lined up to try their luck in the new establishment. When they finally got in, many headed first not for the gaming tables or buffet restaurant, but for the Total Rewards lines to get their loyalty cards. In the Cincinnati area, about sixty thousand people already had rewards cards from visits to other Caesars casinos. A few weeks earlier management had ordered 197,000 entry-level Gold cards to distribute to new customers ready to share their personal data in exchange for rewards. On opening night 1,825 people signed up before swarming the

casino floor. “You can get a free trip to the buffet,” said Edward Willis, sixty-six, a local who recently retired. “I'll take free food.”

Asked what he thought about sharing his personal data through the program, Calvin Daniels said he was anxious to collect his rewards and winnings. And besides, he added, “I've got nothing to hide.” By the end of the first week, 17,770 new people had volunteered to give away their data by signing up for Total Rewards.

4

The opening night was not just a flash in the pan. Within the first year of operation, nearly five million people had visited the Cincinnati casino.

5

The Path to the Sunshine Test

Tariq Shaukat inched up Las Vegas Boulevard in bumper-to-bumper traffic after leaving a meeting. As the chief marketing officer at Caesars, he worked out of a luxurious office in Caesars Palace near Gary Loveman. Yet much of his marketing team occupied space south of the airport, six miles away. He had come to know the route back to his office intimately, skirting past the airport, then the massive Mandalay Bay complex to his left, followed by the glass pyramid of Luxor. Next came the faux Big Apple skyline of New York-New York and the massive fountains in front of the Bellagio before he arrived at Caesars Palace.

In all of Gary Loveman's time there, Caesars had just once strayed from their policy of only using personal data they had collected with the customers' consent. That had been a typical Loveman experiment. The company knew that many people visited Las Vegas who were not Total Rewards members. Perhaps if Caesars could identify some of those visitors, they could convert them into long-term clients? So they bought outside data, sent out promotions, and waited to see the results. Pretty soon, it became clear the effort was a dud. The failure loomed large in the internal corporate lore. Sometimes executives would float a new thought to supplement their information on clients by buying from data brokers such as Acxiom only for the past failure to be recalled, and the idea would be discarded, both on practical and philosophical grounds.

Yet as the capture and interpretation of personal data continued to grow more sophisticated, Caesars risked falling behind as rivals gathered as much information as possible, from any possible source, often with great success. Early in Loveman's tenure at the company, using outside data had seemed unfair, something clients did not expect. Since then the practice had become commonplace across many industries, even if most clients did not know about it.

Even the way Caesars handled and processed their impressive amounts of data appeared a bit dated in the era of cloud computing. That's why Joshua Kanter, joined on the line by the company's IT director, called Shaukat that late summer day in 2012 as he was driving back from the airport-area office. They wanted to cast aside some of the past restrictions on how the company processed customer information, including a ban on storing data on external servers owned by other companies. Shaukat listened attentively. At one point he asked how the company could expand its understanding of customers by gathering information about them not provided directly to the company. When Kanter reiterated that Caesars did not allow any use of such third-party data, and did not approve of storing their own data on external or cloud-based servers, Shaukat asked simply, “Why not?”

With that, Shaukat and Kanter started plotting a data revolutionâa revolution at least by Caesars' cautious standards. They would use outside data and find more efficient ways to process and store that information. Neither man had been around in the mid-1990s when the company first embraced its “no outside personal data” policy. Nor were they present when Harrah's bought Caesars Palace and reconfirmed the restriction in the mid-2000s. But both felt it no longer made sense to embrace a blanket ban that predated even Loveman's arrival at the company. Too much had changed in marketing to customers not to take a different approach. Also, as long as the customer data could be securely stored elsewhere, it did not necessarily have to stay in Vegas.