Catastrophe (22 page)

Authors: Dick Morris

Yet when it comes to characterizing the purchase, Dodd seems to be in a dream world. In discussing his various properties and silent partners with the

Courant

, he said, “These were pretty transparent. They’ve been reported widely in the press, particularly the Irish cottage,” Dodd said. “It’s fairly routine and non-controversial in my mind.”

308

“Fairly routine and non-controversial”? Not exactly, Chris. Don’t you read the newspapers? “Pretty transparent”? Is he kidding? There was nothing transparent at all about his ownership. In his Senate disclosure forms for the years 1995 through 2002, Dodd never divulged the name of his fellow owner who held the other two-thirds interest in the Innishnee property. Nor did he ever reveal his partner’s name in any other forum. He didn’t even follow the directions on the disclosure form and list the address of the property. He simply called it “Galway cottage.” Maybe he didn’t want anyone to find out any details about it. Because the only way any information about the ownership of the Innishnee property would be somewhat transparent was if you traveled to Dublin and visited the office of the land registry. Even there the mortgage documents weren’t available to the public—but the name of his partner, William Kessinger, was. Traveling

thousands of miles to find the name but no other information is Dodd’s idea of “pretty transparent”? The purchase and sale of this property was anything but.

One thing that definitely was not transparent was the fact that the firm owned by Dodd’s partner in the Irish house, Bucky Kessinger, received federal contracts while he and Dodd owned the house together. Did Dodd check with the Ethics Committee on that, too? Because regardless of whether Dodd helped him or not—and there is no evidence that he did—it certainly doesn’t look good for a U.S. senator to partner with a man whose business received federal funds. Especially with the kind of amazing deal Dodd got on the real estate. And especially if Kessinger was also a partner of Ed Downe, as reported in the

Hartford Courant

.

Bucky Kessinger’s business, Kessinger Hunter, a Kansas real estate broker and development firm, leased federal property. According to records of the Office of Management and Budget, the firm received $1,371,343 in federal contracts from 2000–2003. (Records before 2000 are not available.) The sale of Kesinger’s share of the Irish property went through in January 2003, the last year Kessinger Hunter received money under a federal contract. But in that year the amount received almost doubled.

Contracts to KESSINGER/HUNTER & COMPANY (FY 2000–2008)

Summary

Total dollars:

$1,371,343

Total number of contractors:

1

Total number of transactions:

20

Source: OMB Watch, http://www.fedspending.org/fpds/fpds.php?parent_id=176507&sortby=u&detail=-1&datype=T&reptype=r&database=fpds&fiscal_year=&submit=GO.

But by the time Dodd bought Kessinger out, Kessinger/Hunter had begun to look at much bigger horizons—which would eventually involve more that $85 million in federal contracts and require a bill passed by Congress to make the deal happen.

As early as 2002, Kessinger/Hunter expressed interest in developing a 9000-acre piece of land, near Kansas City, Kansas, that had previously been the site of the Sunflower Army Ammunition Plant.

309

Kessinger/Hunter partnered with the International Risk Group and created a new entity, Sunflower Redevelopment, LLC, which proposed a clean-up and development of the former ammunition plant site. There were lots of complications, but eventually Sunshine worked out a deal that would give it title to the property, which it would clean up and develop into residential, retail, and university space. Sunshine sought federal funds from the Department of Defense to do the cleanup, but it turned out that it would need Congressional permission to directly transfer title to the land to a private developer.

On June 23, 2005, the Senate approved an amendment to the Defense Department Authorization bill, S. 2400. The amendment passed on a voice vote by unanimous consent. There is no evidence that Chris Dodd recused himself on the bill, which would help his old partner. Nor did Dodd recuse himself when the full authorization bill, including the special amendment for Sunshine, passed.

Dodd should, at the very least, have recused himself from both those votes. Here he was voting to help his partner in the Irish land deal to the tune of $85 million. But he evidently didn’t see anything wrong with voting for a bill that would benefit Kessinger and possibly Downe.

What are friends for?

So, Dodd’s Irish property dealing weren’t really so transparent, were they?

In 2003, when he bought out Kessinger at a bargain-basement price, Dodd’s Senate personal financial disclosure form, as posted on www.opensecrets.org, did not include the page that provides for details of all transactions, describing all sales and purchases of real property. But that year, for the first time, the “Galway cottage” is listed as a joint asset with his wife. There are no details about the 2003 sale. And the disclosure of the value of the property has stayed consistently the same for the last fifteen years—between $100,000 and $250,000.

It may be the only place in Ireland that didn’t have an increase in value.

When Dodd ran for president, his disclosure form indicated, for the first time, that the value of between $100–$250,000 was based on the value at the

time of sale. The form requires the value of the asset at the time filed, not the time reported, but Dodd has ignored that since 2002.

Once again, Dodd had made a great deal. He got someone (whoever…) to pay two-thirds of the expenses while he had full use of the property. And then he bought it for a song.

By the time he purchased the house in Ireland in 1994, he owned the apartment in D.C., with a $180,000 mortgage, as well as his waterfront home in East Haddam, on the bank of the Connecticut River, with mortgages of $148,000 (1985), $46,000 (1987), and $50,000 (1993). So once he bought his one-third interest in the Irish property, Dodd had outstanding mortgage obligations of $433,000—without counting taxes, insurance, upkeep, and so on. And this at a time when his Senate salary was $133,600.

Dodd’s account of the purchase ends on a truly bizarre note, which raises even more questions. Dodd says that he paid Kessinger $127,000 for his share. But then he says that he

voluntarily

paid even more, giving Kessinger a “gift” of more than $50,000. Why would he do that?

Dodd said he also used his own money to pay off the existing mortgage—including Kessinger’s share—which amounted to a gift to Kessinger of more than $50,000.

“Candidly, our thinking was at the time, Jackie and I: Let’s be more conservative on this in case anybody should ever raise a question about whether or not this is somehow an enrichment or taking advantage of the situation.”

Whenever a politician starts a sentence with the word “candidly,” it should raise a bright red flag. Would anyone in his right mind actually voluntarily overpay his share of a mortgage by $50,000? Not likely. Dodd now says he paid Kessinger a total of $177,000 for his two-thirds interest in a house that was appraised at $190,000. You do the math. What a generous guy he is. It sounds kind of crazy, doesn’t it? Unless there was more to the story. We’ll stay tuned.

But—hypothetically speaking—if the Ireland property was originally bought for $160,000 and Dodd owned one third of it, his share would come to about $53,000—pretty close to the extra amount he generously paid

to Kessinger. Imagine, still hypothetically, that he didn’t pay a nickel for the house but Kessinger (or Downe) put up all the money and, of course, let the senator have sole use and possession of the property. Wouldn’t it make sense—hypothetically speaking that is—for Dodd to pay back Kessinger not just his two thirds but also the original $53,000 that Dodd—hypothetically—didn’t actually pay when he bought the house?

But for once Dodd was prescient. Questions have indeed been raised about whether there was “somehow” an enrichment or taking advantage of the situation. It sure looks like it. But while questions have been raised, the answers have not been at all credible—even with the extra $50,000. Or especially with the extra $50,000.

But Dodd’s questionable housing practices didn’t end there.

COUNTRYWIDE FINANCIAL

In the summer of 2008, Portfolio.com reported that Countrywide Financial had given a “VIP” mortgage deal to Senator Chris Dodd and his wife, Jackie Clegg, on two 2003 mortgages totaling $528,000 for their Connecticut and Washington, D.C., homes. Countrywide apparently operated a program called “Friends of Angelo,” named after former Countrywide president Angelo Mozilo, which provided special benefits to celebrities who might be important to the bank in the future.

Portfolio.com

reported that the VIPs got a much better deal because Countrywide often reduced their points and gave them a better interest rate.

311

Many people blame Countrywide for starting the current global meltdown with its extensive marketing of subprime and initial low interest loans that led to hundreds of thousands of defaults. Many of the loans were then sold to Fannie Mae and Freddie Mac, which were taken over by the U.S. government last fall because of the huge number of defaulted loans that caused the agencies to fail.

Dodd immediately insisted he knew nothing about any special treatment, but later claimed that although he did know that he and his wife were part of a VIP program, he thought it was just a “courtesy.” And, obviously, such “courtesies” were normal occurrences.

But a former Countrywide loan officer disputes Dodd’s account. According to the

Wall Street Journal

:

Former Countrywide Financial loan officer Robert Feinberg says Mr. Dodd knowingly saved thousands of dollars on his refinancing of two properties in 2003 as part of a special program the California mortgage company had for the influential. He also says he has internal company documents that prove Mr. Dodd knew he was getting preferential treatment as a friend of Angelo Mozilo, Countrywide’s then-CEO.

That a “Friends of Angelo” program existed is not in dispute. It was crucial to the boom that Countrywide enjoyed before its fortunes turned. While most of the company was aggressively lending to risky borrowers and off-loading those mortgages in bulk to Fannie Mae and Freddie Mac, Mr. Feinberg’s department was charged with making sure those who could influence Fannie and Freddie’s appetite for risk were sufficiently buttered up. As a Banking Committee bigshot, Mr. Dodd was perfectly placed to be buttered….

Mr. Feinberg, who oversaw “Friends of Angelo” from 2000 to 2004,…told us that as the loan officer in charge he was supposed to make sure that the “VIP” clients knew at every step of the process that they were getting a special deal because they were “Friends of Angelo.”

“People are referred into that department as ‘very important people.’ You’re told that your loan is priced from Angelo. As the ‘Friends of Angelo department,’ [the department] has to give them a sense of importance and explain the reduction of fees and the rate as a result of being a ‘Friend of Angelo,’” he says.

As to Mr. Dodd, Mr. Feinberg says he spoke to the Senator once or twice and mostly to his wife and that like other FOAs Mr. Dodd got ‘a float down,’ which means that even after he had a preferred rate, when the prevailing rate dropped just before the closing, his rate was reduced again. Regular borrowers would pay extra for a last-minute adjustment, but not FOAs. ‘They were aware of it because they were notified and when they went to the closing they would see it,’ Mr. Feinberg says, adding that he ‘always let people in the program know that they were getting a very good deal because they were ‘Friends of Angelo.’ All of this matters because Mr. Dodd was one of those encouraging Fannie and Freddie to plunge into ‘affordable housing’ loans made by companies like Countrywide.

One indicator of his influence is the [amount] in campaign contributions—more than to any other politician—that Fan and Fred have given

him since 1989, according to the Center for Responsive Politics. These contributions are legal. But favors like those Mr. Dodd is alleged to have received may not be. Mr. Feinberg says he went public with his story because when he heard Senator Dodd on TV talking about predatory lending, he felt it was “hypocritical” and he says, “I just thought, ‘This is wrong.’”

312

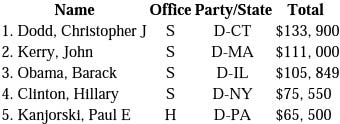

Countrywide contributed more than $100,000 in campaign contributions to Dodd, second only to then Senator Barack Obama. The company was not alone in feeling that Dodd was crucial to erecting the house of single cards of subprime mortgage deals that ultimately collapsed. Fannie Mae and Freddie Mac, who purchased the subprime mortgages and disseminated them all over Wall Street, also gave Dodd special favors, this time in the form of campaign contributions. Dodd proved useful to Fannie and Freddie, killing any attempt to rein them in. Here’s a list of the top recipients of contributions from Fannie Mae and Freddie Mac. Notice who is number one:

TOP RECIPIENTS OF FANNIE MAE AND FREDDIE MAC CAMPAIGN CONTRIBUTIONS, 1989–2008

Source:

Center For Responsive Politics