Crimes Against Liberty (44 page)

Read Crimes Against Liberty Online

Authors: David Limbaugh

Regardless, it’s absurd to use the $1.3 trillion or $1.41 trillion figure as a baseline, since it included the extraordinary TARP bailout monies, which would hopefully be a one-time occurrence. As Brian Riedl said, “President Obama’s pledge to halve the budget deficit by 2013 is hardly ambitious.” After quadrupling the deficit in 2009, to cut it in half “would still leave deficits twice as high as under President Bush.” Furthermore, three

expected

developments—“the end of the recession, withdrawal of troops from Iraq, and phase-out of temporary stimulus spending—would halve the budget deficit by 2013.” But Obama’s deficits will more than double, possibly triple Bush’s “even after the economy recovers and the troops return home from Iraq.” Obama deceitfully used that FY2009 deficit as a baseline when he made the preposterous pledge to cut the deficit in half, a pledge that he still wouldn’t be able to fulfill and wouldn’t even really try to—because, as mentioned above, his projected annual deficits are $1 trillion for the foreseeable future.

And Obama’s budget hits just keep coming. The CBO reported that for just the first five months of FY 2010, the budget deficit was already $655 billion—$65 billion greater than the deficit at that point in the previous budget year, which was horrible enough. Even though bailout spending had decreased, the deficit continued to increase because of lower tax receipts, increased spending on unemployment benefits, interest on the public debt, and increased spending on other programs. The April deficit was $82.7 billion—the largest ever April deficit—compared to last April’s deficit of $20 billion.

22

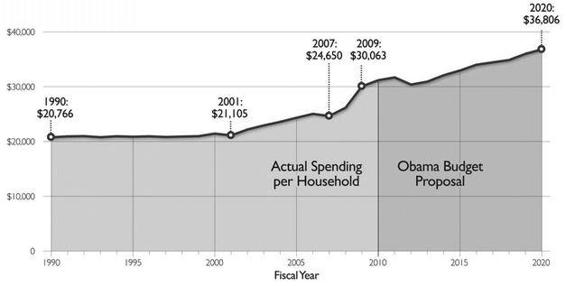

Riedl also notes before the recession started, annual federal spending totaled $24,000 per household, but under Obama’s projected budgets that figure would reach $36,000 per household by 2020—“an inflation-adjusted $12,000 per household expansion of government.” The chart on the following page illustrates these increases.

In the

American Thinker

, Steve McCann argued there is a “very high probability” that we’ll see a repeat of the financial meltdown that preceded the TARP bailouts in 2008. The current administration, however, has engulfed us in such debt that we won’t have a fallback position. Meanwhile, instead of shoring up our own financial stability to avoid Greece’s fate, we are bailing Greece out with money we don’t have and pursuing more of the reckless policies that got us into this mess in the first place. McCann remarked, “The Obama administration and its fellow travelers in Congress appear to care little for the long-term survival of this country. They are in the process of squandering the nation’s wealth and thus its well-being, in their headlong determination to ‘fundamentally change the country.’”

23

President Obama Would Push Spending $12,000 Per Household Above Pre-Recession Levels

Source:

Office of Management and Budget, HistoricalTables, Budget of the United States Government, Fiscal Yeor 20 (Washington. D.C.: U.S. Government Printing Office, 2010), p.22,Table 1-1, and U.S. Office of Management and Budget, Budget or me United States Government, FiscQJYear 2011 (Washington, D.C.: U.S. Government Printing Office, 2010 pp. 146, Table 5-L Spending totals are adjusted to include the House-passed cap-and-trade bill, which President Obama endorsed yet excluded from his budget tables. All figures are then adjusted for inflation and the number of households.

Chart I . B 2382 heritage.org

heritage.org

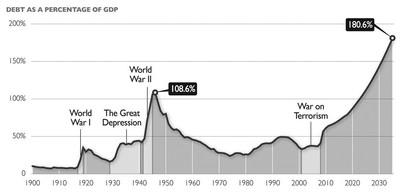

If this pattern continues and our debt-to-GDP ratio does soar into the range of 90 to 104 percent or more by 2019 or 2020, the United States would “become the next Greece,” but “unlike Greece, will not have the European Union or the IMF to turn to.... Can we expect our traditional allies, who will find themselves in a similar situation, to come to our aid? As to a dramatic economic downturn, the traditional tools used to come through a recession or depression will not be available.”

24

Yet Obama continues to fiddle as he burns our dollars.

As Obama announced his record budget for FY2011 of $3.83 trillion, he declared the federal government could not “continue to spend as if deficits don’t have consequences” and that it was unacceptable to act “as if the hard-earned tax dollars of the American people can be treated like Monopoly money.”

25

As surreal as those statements were, his excuses were even worse. He blamed the deficit on President Bush, previous Congresses, and on the unavoidable actions his administration had supposedly taken to prevent an economic collapse. He specifically blamed Bush and previous Congresses for creating a new drug program, implementing “tax cuts for the wealthy, and funding two wars.”

26

Obama’s Treasury secretary, Timothy Geithner, took the same tack when appearing before Congress—blaming Bush and having no explanation for why the administration was multiplying the spending of its predecessor. Republican congressman Paul Ryan told Geithner that all economists, including those of the administration, say “that the medium and long-run budget deficits have to get below 3% of GDP, yet this budget plan that you’re bringing to us doesn’t even get close to it.” Ryan was saying the administration knew we couldn’t afford these budgets but was presenting them anyway, without proposing meaningful reductions. Instead, it was passing off the problem to a “partisan commission, with a 2 to 1 ratio of Democrats and Republicans, that will give us a report after the election.”

Geithner responded, á la Obama, by blaming Bush and accepting no responsibility even for future budgets, saying, “We’re going to solve our part of the mess we inherited.” Ryan shot back, “Why don’t you [solve this problem] in your Budget? You guys run the government, if you are going to solve our fiscal situation, why don’t you do that? Why don’t you give us a budget that actually gets the deficits to a sustainable level?” Giethner pathetically repeated his mantra: “Congressman, we are proposing a budget that takes the huge mess we inherited and cuts the deficit dramatically.” But Ryan had the last word. “You can blame Bush only so long,” he said. “You obviously inherited a tough situation, [but] you are making it worse by your own admission.”

27

Ryan was exactly right. Obama is tied to a socialist ideology and Keynesian economic theory compelling him to continue outrageous spending in order to transfer wealth from the “rich” to the “poor” regardless of the devastating debt he accumulates. But Keynesian theory doesn’t work. The money government spends, to reiterate Brian Reidl’s point, “doesn’t fall from the sky. The only way Congress can inject spending into the economy is by first taxing or borrowing it out of the economy. No new demand is created; it’s a zero-sum transfer of existing demand.”

28

So increasing government demand decreases private sector demand.

ENTITLEMENTS

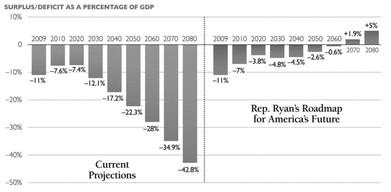

Democrats once acknowledged our entitlements would eventually bankrupt the nation, but when President Bush tried to reform Social Security, they engaged in scaremongering to downplay any problems and successfully shut down reform efforts. The problem is much more urgent now with our economic downturn and rising debt. The first chart on the opposite page shows how dire the situation is. Congressman Paul Ryan has proposed substantial entitlement reform, as shown in the second chart, which could go a long way toward restoring the nation’s fiscal solvency, though it is unlikely to gain traction as long as Democrats are in control.

ALMOST $3 TRILLION IN ADDITIONAL TAXES

As noted in chapter three, Obama flagrantly broke his no new taxes pledge on families making less than $250,000 a year. But his real tax punishment is reserved for those making $250,000 or more. He will raise the top two income tax brackets from 33 percent to 36 percent and from 35 percent to 39.6 percent, respectively. He’ll raise capital gains and dividends tax rates from 15 percent to 20 percent. He’ll phase out personal exemptions and limit itemized deductions. He’ll reduce the value of tax deductions by about one-fourth.

National Debt Set to Skyrocket

In the past, wars and the Great Depression contributed to rapid but temporary increases in the national debt. Over the next few decades, runaway spending on Social Security, Medicare, and Medicaid will drive the debt to unsustainable levels.

Source:

Heritage Foundation compilations of data from U.S. Department of the Treasury, Institute for the Measurement of Worth (Alternative Fiscal Scenario), Congressional Budget Office, and White House Office of Management and Budget.

Entitlement Reform Would Eliminate Long-Term Deficits

In January 2010, Representative Paul Ryan (R-WI) re-introduced the Roadmap for Americans Future, legislation that would improve America’s long-term budget situation by reforming entitlements. Compared to the current trajectory, the bill would eliminate long-term deficits.

Source:

Congressional Budget Office.

Collectively, these measures will amount to a $1 trillion tax increase on just 3.2 million tax filers, which is an average of $300,000 per filer over ten years on those who already pay a disproportionate share of the taxes, notwithstanding Obama’s demagogic misrepresentations to the contrary. But there’s more: businesses and wealthy individuals would pay most of the proposed $743 billion in new taxes imposed by ObamaCare; Obama will institute some $468 billion in new taxes on America’s businesses;

29

and cap and tax, if implemented, could cost $843 billion in additional taxes. The following Heritage Chart itemizes the specifics:

The President’s $2.9 Trillion Tax Increase

| Proposal | Ten-Year Revenue Impact (in Billions) |

|---|---|

| Cap-and-trade energy tax * | $843 |

| Health reform tax | $743 |

| Tax increase for upper-income families and small businesses | $968 |

| Raise income tax rates for upperincome taxpayers. | $364 |

| Raise capitol gains and dividends rates for upper-income taxpayers | $105 |

| Reinstate the personal exemption phaseout and limitation on itemized deductions for upper-income taxpayers | $208 |

| Limit itemized tax deductions to 28% value for upper-income taxpoyers | $291 |

| Tax Increases for businesses | $468 |

| Reform U.S. international tax system | $122 |

| Bank tax | $90 |

| Other business, financial and energy tax increases | $256 |

| Various tax cuts for families and busineses | -$172 |

| New stimulus tax cuts | -$61 |

| Extensions of expiring tax cuts | -$47 |

| Other proposals | $111 |

| Total Tax Increase | $2,853 |

| *Figures represent the cost of House-passed bill, which President Obama endorsed yet excluded from his budget tables. Note: Policies are net of outlay effects of proposals. | |