How Does Aspirin Find a Headache? (31 page)

Read How Does Aspirin Find a Headache? Online

Authors: David Feldman

We’re afraid that as of now this Frustable is frustrating our readers as well as us. But we have just begun to fight.

FRUSTABLE 9:

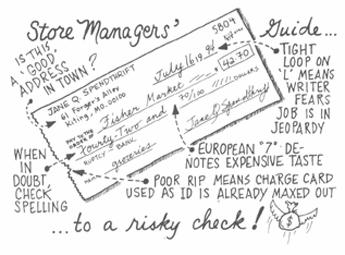

What in the world are grocery store managers looking for when they approve personal checks?

When we first posed this Frustable, we wrote:

We have been most dissatisfied with the answers we’ve received from supermarket chains on this topic, so we’re hoping that some grocery store checkers, managers, or perspicacious customers can help us with this Frustable. To us, it seems that the manager simply peeks at the check, glances at the customer, and approves the check without looking for anything in particular. In fact, we’ve never seen a check rejected.

We’ve never dealt with a question pertaining to a particular profession that has generated so much mail. If supermarket chains were reluctant to discuss this issue with us, current and former grocery store checkers and managers were not reticent at all. We received dozens of letters from readers in the trade, including a magnum opus from Stephen H. Cook of North Providence, Rhode Island, who has spent twenty-three years in the personal credit and retail computer systems business and has done research on the machines that provide electronic approval of personal checks.

Cook confirms that grocery store managers are often negligent in their duties but notes that they must be on the lookout for four types of bad checks:

1) bad checks deliberately written by persons who know it’s illegal

2) Checks written by persons who don’t know how to do a good job of using a checking account (the careless and disorganized)

3) bad checks from people without overdraft protection on their checking account, who know they can’t cover the check at the moment but are hoping that a recent or planned future deposit will clear before the check does

4) bad checks from those who have made a recent deposit but have erred in assuming when the check will clear (these folks also have no overdraft protection)

According to Cook,

Most bad checks fall into categories two and three. All checks in category four and some checks in categories two and three may be made good by being presented again to the bank. But checks in category one are totally worthless and represent the biggest risk to the retailer.

Although the store fears the bad-check artist most, some of the problem items that a manager scans a check for are just as likely to arise not only with the other three types but with customers whose checks are valid. For the protection of the store, managers may look for all of these red flags:

• Is the check signed?

• Does the written amount on the check match the numerical amount?

• Are the address and phone number of the customer printed on the check? (Many grocery stores will not accept starter checks or checks without imprinted addresses; at the very least, they will insist upon other identification, such as a driver’s license or credit card, confirming the address of the shopper. In this case, a credit card not only corroborates identification but serves as a credit check.)

• Is the customer on a bad check list published by a consumer credit clearinghouse or by the grocery store (chain) itself?

• Does the name signed match the name imprinted? Former store manager John Schaninger of Easton, Pennsylvania, reports, “I once had an assistant manager who did not check this; when I received the bad check back from the bank, the signature read, “I Beat You.”

• Is the check made out to my store?

• Has the check been tampered with? Per C. Clarke, night manager of a Hy-Vee Food Store in Spencer, Iowa, reports he recently saw a check with a “void” clearly etched but (mostly) erased.

• Is the date correct? Let’s use this seemingly innocent item as an example. Joseph S. Blake, Jr., a store manager, wrote to us about all of the potential problems inherent in an incorrectly dated check:

If a check is postdated, it is legally considered a promissory note and not a check. If it is returned, the person who wrote it merely has to say, “I asked him if he could hold it until the date on the check and he said it would be okay.” Although I would never agree to such a condition, the bank endorsements would clearly show that I deposited it before the date on the front. I would be screwed.

I note that the year is correct, particularly during the first couple of months of the new year. A check that is dated more than six months ago is considered “stale dated” and cannot be collected as a cash item.…

While I may have just thought that it was a confused little old lady that inadvertently wrote May 10 when it was really April 10, I find out later that she has done the same thing all over seven states. She has thousands of dollars of judgments against her, but no one can ever collect, since her only real asset is her checkbook for an account that never has more than five dollars in it.

All of these eight red flags are cut and dried; there is no particular reason why a checker wouldn’t be qualified to verify them. But some verifications require a little more skill to examine. Blake named the three most important:

• Is it a genuine ID? Anyone can obtain a fake ID for a nominal amount. Many of them are horribly executed, but some can fool an inexperienced checker.

• Does the photo ID or description on a driver’s license match the person trying to cash the check? As Blake puts it,

If someone were to break into your car or home, he could easily end up with your checkbook as well as several pieces of your identification. It would be less likely that the ID would match your height, weight, hair color, and other features. If the check were stolen from someone, my only recourse is against the person who wrote the check, not the person who had it stolen from him.

• Is the check writer signing the check in the manager’s presence? Some managers insist on seeing the customer sign the check in front of them (in our experience, this is not the case), and Blake offers a reason we would have never thought of, naifs that we are:

Here’s a popular scam from a few years ago that still happens from time to time. Suppose that you and I were in the business of writing bad checks together. Before I entered the store, I would have you sign my name of one of my checks. I would then go into the store with my checkbook with the check that you had signed, pick up all the big-ticket items that I could load in my cart, then proceed to the checkout counter. I would have my own identification, and my own checkbook where you had signed my name on the check, and would complete the sale.

What could be more perfect? Unless the clerk or manager noticed that the signature on my ID and the check were not the same? We could do this in a couple of dozen places, preferably on a weekend. I would then wait and call the bank on Monday morning and notify them that my checkbook and wallet had been lost or stolen, or even wait until I started to receive overdraft protection before I “realized” it.

An examination of the signatures would reveal that they were not mine—and they wouldn’t be. The checks would all be returned to wherever they came from, and the merchants would be stuck. This is the reason why many places installed cameras that take a picture of the person writing the check.

Obviously, a bright and inexperienced cashier could be trained to perform all of these check-verification functions now usually undertaken by the store manager. We understand why supermarkets might want to lay responsibility on more experienced personnel, but isn’t the practice a horrendous waste of time? Maybe there isn’t logical reason why the manager has to approve each check personally. Certainly, Russell Shaw, a journalist who writes frequently for

Supermarket News

, the largest publication covering supermarket management, has a jaundiced view of the check approval process:

There’s an insidious reason why supervisors approve checks, and this is where corporate culture fits in. Unlike some more progressive and newer industries, supermarkets have never been known as places to empower their hourly workers (read, cashiers). If you listen to a cashier paging a manager on the PA system, the manager will always be referred to by a surname (“Mr. Smith, register 8”), even though supervisor Smith’s $18,000 a year salary and high-school education might pale next to the $100,000 salary and MBA of an executive at a nearby office park where the secretaries call him by his first name.

Some of these attitudes are due to a caste system driven by low pay and low skill levels fostered by the tight profit margins of supermarkets. Many hire young and inexperienced cashiers, and management doesn’t trust seventeen-year-old cashiers.

As this feudal system affects the supervisors’ relations with cashiers, it affects relations with their supervisors as well. In many cases, supervisors approve checks because there is little else for them to do. Virtually all the product-buying decisions are made at the regional or district-manager level. In some supermarkets, supervisors have little responsibility other than scheduling of workers. This gives them something else to do.

It’s a fact, Dave, that when a line is held up while a supervisor is paged for check approval, customers get annoyed. Yet this fact seems to be ignored by the by-the-book types who write thick policy manuals yet are oblivious to customer convenience.

This inconvenience is what prompted this Frustable in the first place. If customers are going to be subjected to a long delay while the manager ambles over to the checkout line, at least the inspection of the check shouldn’t be so cursory.

Of course, the upper management of supermarket chains could argue that the identification amassed by a supervisor can be vitally important. Lawyer Jim Wright of Decatur, Georgia, informs us that the gathering of backup verification (e.g., social security number, driver’s license number) grants the grocer immunity from civil or criminal liability for false arrest or malicious prosecution if the store prosecutes someone:

In short, by obtaining verification, the manager is covering his butt should the check be bad and a warrant taken out. Quite frequently, when someone is arrested for writing a bad check, the accused claims that some other family member wrote the check without permission. The checking account holder than countersues the retailer for false arrest. If the verification of identity is written on the face of the check, the grocer is granted immunity from all liability for bringing the bad check warrant. He’s not looking to reject your check; he’s looking to protect himself.

A fascinating thesis, but one that wasn’t mentioned by a single retailer.

In fact, we must confess that we have personally approached many grocery store cashiers and managers about this topic. When we ask what they are looking for when they take a passing glimpse at ours and others’ checks, the answer is usually, “We’re looking at the check number.” Typical was the response of Fran Burns of Moneta, Virginia:

Many banks print the month and year the account was opened on the check. If that isn’t printed, we take note of the check number. Presumably, a low check number is a newly opened account. On a recently opened account, we generally will do some additional checkup on the customer.

The “low-number” theory was by far the most popular explanation from our readers, as well. We heard from some employees whose stores use 150 (or 49 checks past the usual 101 first number of checks), 300, and 500 as the demarcation line for additional security, whether it is more identification, calling the bank, or, in some cases, refusing to cash low-numbered checks or starting checks. Still, as we have discussed before, most banks allow new customers to start checking accounts with any number they want on their first checks (many business don’t want to broadcast the fact that they are starting a new enterprise, and we’d be surprised if cunning bad-check passers would either).