The 30 Day MBA (47 page)

Authors: Colin Barrow

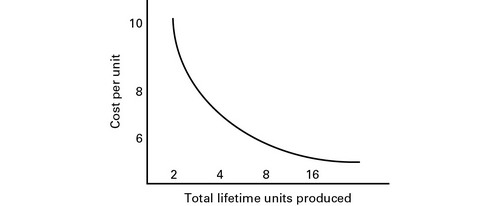

BCG itself was founded in 1963 by Bruce D Henderson, a former Bible salesman and engineering graduate from Vanderbilt University, who left the Harvard Business School 90 days before graduation to work for Westinghouse Corporation. From there he went on to head Arthur D Little's management services unit before joining the Boston Safe Deposit and Trust Company to start a consulting arm for the bank. Naming this the experience curve, it was the strategy tool that put BCG on the path to success and has served it well ever since (

Figure 12.1

).

FIGURE 12.1

Â

The experience curve

The value of the experience curve as a strategic process is that it helps a business predict future unit costs and gives a signal when costs fail to drop at the historic rate, both vital pieces of information for firms pursuing a cost leadership strategy. Every industry has a different experience curve that itself varies over time. You can find out more about how to calculate the curve for your industry on the Management And Accounting Web (

http://maaw.info/LearningCurveSummary.htm

).

The key to differentiation is a deep understanding of what customers really want and need and, more importantly, what they are prepared to pay more for. Apple's opening strategy was based around a âfun' operating system based on icons, rather than the dull MS-DOS. This belief was based on its understanding that computer users were mostly young and wanted an intuitive command system, and the âgraphical user interface' delivered just that. Apple has continued its differentiation strategy, but has added design and fashion to ease of control in order to increase the ways in which it delivers extra value. Sony and BMW are also examples of differentiators. Both have distinctive and desirable differences in their products and neither they nor Apple offers the lowest price in their respective industries; customers are willing to pay extra for the idiosyncratic and prized differences embedded in their products.

Differentiation doesn't have to be confined to just the marketing arena, nor does it always lead to success if the subject of that differentiation goes out of fashion without much warning. Northern Rock, the failed bank that had to be nationalized to stay in business, thought its strategy of raising most of the money it lent out in mortgages through the money markets was a sure winner. It allowed the bank to grow faster than its competitors, who placed more reliance on depositors for their funds. As long as interest rates were low and the money market functioned smoothly, it worked. But once the differentiators that fuelled its growth were reversed, its business model failed.

Focused strategy involves concentrating on serving a particular market or a defined geographic region. IKEA, for example, targets young, white-collar workers as its prime customer segment, selling through 235 stores in more than 30 countries. Ingvar Kamprad, an entrepreneur from the Småland province in southern Sweden, who founded the business in the late 1940s, offers home furnishing products of good function and design at prices young people can afford. He achieves this by using simple cost-cutting solutions that do not affect the quality of products.

Warren Buffett, the world's richest man, who knows a thing or two about focus, combined with Mars to buy US chewing gum manufacturer Wrigley for $23bn (£11.6bn) in May 2008. Chicago-based Wrigley, which launched its Spearmint and Juicy Fruit gums in the 1890s, has specialized in chewing gum ever since and consistently outperformed its more diversified competitors. Wrigley is the only major consumer products company to grow comfortably faster than the population in its markets and above the rate of

inflation. Over the past decade or so, for example, other consumer products companies have diversified. Gillette moved into batteries, used to drive many of its products, by acquiring Duracell. Nestlé bought Ralston Purina, Dreyer's, Ice Cream Partners and Chef America. Both have trailed Wrigley's performance.

Businesses often lose their focus over time and periodically have to rediscover their core strategic purpose. Procter & Gamble is an example of a business that had to refocus to cure weak growth. In 2000, the company was losing share in seven of its top nine categories, and had lowered earnings expectations four times in two quarters. This prompted the company to restructure and refocus on its core business: big brands, big customers and big countries. They sold off non-core businesses, establishing five global business units with a closely focused product portfolio.

First-to-market fallacy

Gaining âfirst mover advantage' are words used like a mantra to justify high expenditure and a headlong rush into new strategic areas. This concept is one of the most enduring in business theory and practice. Entrepreneurs and established giants are always in a race to be first. Research from the 1980s that shows that market pioneers have enduring advantages in distribution, product-line breadth, product quality and, especially, market share underscores this principle.

Beguiling though the theory of first mover advantage is, it is probably wrong. Gerard Tellis, of the University of Southern California, and Peter Golder, of New York University's Stern Business School, argued in their book

Will and Vision: How Latecomers Grow to Dominate Markets

(2001, McGraw-Hill Inc., United States) and subsequent research that previous studies on the subject were deeply flawed. In the first instance, earlier studies were based on surveys of surviving companies and brands, excluding all the pioneers that failed. This helps some companies to look as though they were first to market even when they were not. Procter & Gamble (P&G) boasts that it created America's disposable-nappy (diaper) business. In fact a company called Chux launched its product a quarter of a century before P&G entered the market in 1961. Also, the questions used to gather much of the data in earlier research were at best ambiguous, and perhaps dangerously so. For example, the term, âone of the pioneers in first developing such products or services,' was used as a proxy for âfirst to market'. The authors emphasize their point by listing popular misconceptions of who were the real pioneers across the 66 markets they analysed. Online book sales, Amazon (wrong), Books.com (right) â Copiers, Xerox (wrong), IBM (right) â PCs, IBM/Apple (both wrong); Micro Instrumentation Telemetry Systems (MITS) introduced its PC the Altair, a $400 kit, in 1974, followed by Tandy Corporation (Radio Shack) in 1977.

In fact the most compelling evidence from all the research was that nearly half of all firms pursuing a first-to-market strategy were fated to fail, while those following fairly close behind were three times as likely to succeed. Tellis and Golder claim that the best strategy is to enter the market 19 years after pioneers, learn from their mistakes, benefit from their product and market development and be more certain about customer preferences.

First to market: possible international advantages

According to the New Trade Theory of international business (see the elective on âIntroduction to International Global Business' on page 000) in certain cases where the world market will only support a limited number of companies, being first to market may be a source of enduring competitive advantage. Denmark took that approach with its wind turbine industry as it had few natural sources of energy. Despite being a small country, by 1999 it had captured 60 per cent of the world market for wind turbines. Today, the Danish wind turbine industry accounts for 12,000 jobs in Denmark while component supplies and installation of Danish turbines currently create another 6,000 jobs worldwide.

Companies too can, for a while at least, establish first mover advantage in overseas markets by taking their well-established expertise and systems to foreign markets, as the Volkswagen case study illustrates.

CASE STUDY

Â

Volkswagen Group China

In 2009 when the China Association of Automobile Manufacturers (CAAM) announced the list of top 10 auto manufacturers, Volkswagen's joint venture headed the pack with sales of over 1.4 million units. Shanghai General Motors Co Ltd and joint ventures from Hyundai, Nissan, Honda and Toyota, along with the BYD Co Ltd, Chery Automobile Co Ltd, and Geely Holding Group Co Ltd rounded off the top 10. Volkswagen has had the largest share of the Chinese automotive market for more than 20 years.

Volkswagen Group China, often cited as the most visible example of an international business achieving sustained first mover advantage, was earliest to market starting its connection with China in 1978. Its first joint venture there was the Shanghai Volkswagen Automotive Co, Ltd, established in October 1984, followed in February 1991 by FAW-Volkswagen Automotive Company Ltd, a second joint venture established in Changchun. At one point, Shanghai Volkswagen dominated the Chinese car market taking a 70 per cent share. The joint venture was named one of the âBest Companies to Work for in China' in 2007. In 2012 they remained market leader, albeit still holding just 20 per cent

of the market, up from 18 per cent the preceding year. Its nearest rival, GM, held 10 per cent and Toyota a little over 5. Chery, the top Chinese vehicle exporter for the nine consecutive years since it was founded in 1997, currently holds less than 3 per cent of its home market.

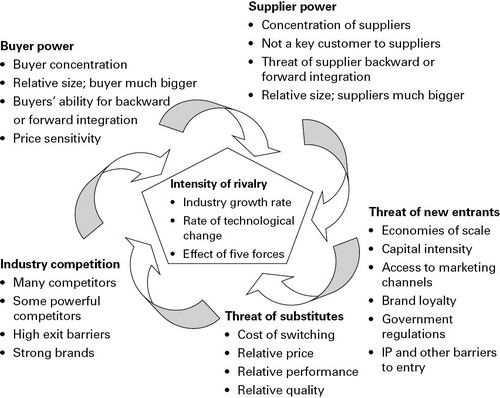

Aside from articulating the generic approach to business strategy, Porter's other major contribution to the field was what has become known as the Five Forces theory of industry structure (

Figure 12.2

). Porter postulated that the five forces that drive competition in an industry have to be understood as part of the process of choosing which of the three generic strategies to pursue. The forces he identified are:

- Threat of substitution: Can customers buy something else instead of your product? For example, Apple, and to a lesser extent Sony, have

laptop computers that are distinctive enough to make substitution difficult. Dell, on the other hand, faces intense competition from dozens of other suppliers with near-identical products competing mostly on price alone. - Threat of new entrants: If it is easy to enter your market, start-up costs are low and there are no barriers to entry such as IP (intellectual property) protection, then the threat is high.

- Supplier power: The fewer the suppliers, usually the more powerful they are. Oil is a classic example, where less than a dozen countries supply the whole market and consequently can set prices.

- Buyer power: In the food market, for example, with just a few, powerful supermarket buyers being supplied by thousands of much smaller businesses, they are often able to dictate terms.

- Industry competition: The number and capability of competitors is one determinant of a business's power. Few competitors with relatively less attractive products or services lower the intensity of rivalry in a sector. Often these sectors slip into oligopolistic (see also

Chapter 7

, Economics) behaviour, preferring to collude rather than compete.

FIGURE 12.2

Â

Five Forces theory of industry analysis (after Porter)

You can see a video clip of Professor Porter discussing the Five Forces model at

www.youtube.com/watch?v=mYF2_FBCvXw

.

Shaping strategy â tools and techniques

While Porter's Five Forces approach to strategy formulation is, as far as business schools are concerned at least, the standard starting point, there are a number of other tools that an MBA needs to be familiar with. Some pre-date Porter, some overlap, while others home in on specific issues. Like many such tools, they overlap with those used in marketing and in this book you will find SWOT (strengths, weaknesses, opportunities and threats) and perceptual mapping covered in

Chapter 3

, Marketing.

These are the main tools and techniques an MBA will be expected to know and understand.

Ansoff'

s Growth Matrix