The End of Growth: Adapting to Our New Economic Reality (28 page)

Read The End of Growth: Adapting to Our New Economic Reality Online

Authors: Richard Heinberg

Tags: #BUS072000

The view that biofuels are unlikely to fully substitute for oil anytime soon is supported by a recent University of California (Davis) study that concludes, on the basis of market trends only, that “At the current pace of research and development, global oil will run out 90 years before replacement technologies are ready.”

8

It could be objected that we are thinking of substitutes too narrowly. Why insist on maintaining current engine technology and simply switching the fuel? Why not use a different drive train altogether?

Electric cars have been around nearly as long as the automobile itself. Electricity could clearly serve as a substitute for petroleum — at least when it comes to ground transportation (aviation is another story — more on that in a moment). But the fact that electric vehicles have failed for so long to compete with gasoline- and diesel-powered vehicles suggests there may be problems.

In fact, electric cars have advantages as well as disadvantages when compared to fuel-burning cars. The main advantages of electrics are that their energy is used more efficiently (electric motors translate nearly all their energy into motive force, while internal combustion engines are much less efficient), they need less drive-train maintenance, and they are more environmentally benign (even if they’re running on coal-derived electricity, they usually entail lower carbon emissions due to their much higher energy efficiency). The drawbacks of electric vehicles are partly to do with the limited ability of batteries to store energy, as compared to conventional liquid fuels. A gallon of gasoline carries 46 megajoules of energy per kilogram, while lithium-ion batteries can store only 0.5 MJ/kg. Improvements are possible, but the ultimate practical limit of chemical energy storage is still only about 6–9 MJ/kg.

9

This is why we’ll never see battery-powered airliners: the batteries would be way too heavy to allow planes to get off the ground. This doesn’t mean research into electric aircraft should not be pursued: There have been successful experiments with ultra-light solar-powered planes, and electric planes could come in handy in a future where most transport will be by boat, rail, bicycle, or foot. But these will be special-purpose aircraft that can carry only one or two passengers.

The low energy density (by weight) of batteries tends to limit the range of electric cars. This problem can be solved with hybrid power trains — using a gasoline engine to charge the batteries, as in the Chevy Volt, or to push the car directly part of the time, as with the Toyota Prius — but that adds complexity and expense.

So substituting batteries and electricity for petroleum works in some instances, but even in those cases it offers less utility (if it offered

more

utility, we would all already be driving electric cars).

10

Increasingly, substitution is less economically efficient. But surely, in a pinch, can’t we just accept the less-efficient substitute? In emergency or niche applications, yes. But if the less-efficient substitute must replace a resource of profound economic importance (like oil), or if a large number of resources have to be replaced with less-useful substitutes, then the overall result for society is a reduction — perhaps a sharp reduction — in its capacity to achieve economic growth.

As we saw in Chapter 3, in our discussion of the global supply of minerals, when the quality of an ore drops the amount of energy required to extract the resource rises. All over the world mining companies are reporting declining ore quality.

11

So in many if not most cases it is no longer possible to substitute a rare, depleting resource with a more abundant, cheaper resource; instead, the available substitutes are themselves already rare and depleting.

Theoretically, the substitution process can go on forever — as long as we have endless energy with which to obtain the minerals we need from ores of ever-declining quality. But to produce that energy we need more resources. Even if we are using only renewable energy, we need steel for wind turbines and coatings for photovoltaic panels. And to extract

those

resources we need still more energy, which requires more resources, which requires more energy. At every step down the ladder of resource quality, more energy is needed just to keep the resource extraction process going, and less energy is available to serve human needs (which presumably is the point of the exercise).

12

The issues arising with materials synthesis are similar. In principle it is possible to synthesize oil from almost any organic material. We can make petroleum-like fuels from coal, natural gas, old tires, even garbage. However, doing so can be very costly, and the process can consume more energy than the resulting synthetic oil will deliver as a fuel, unless the material we start with is already similar to oil.

It’s not that substitution can never work. Recent years have seen the development of new catalysts in fuel cells to replace depleting, expensive platinum, and new ink-based materials for photovoltaic solar panels that use copper indium gallium diselenide (CIGS) and cadmium telluride to replace single-crystalline silicon. And of course renewable wind, solar, geothermal, and tidal energy sources are being developed and deployed as substitutes for coal.

We will be doing a lot of substituting as the resources we currently rely on deplete. In fact, materials substitution is becoming a primary focus of research and development in many industries. But in the most important cases (including oil), the substitutes will probably be inferior in terms of economic performance, and therefore will not support economic growth.

BOX 4.1

Substitution Time Lags and Economic

Consequences

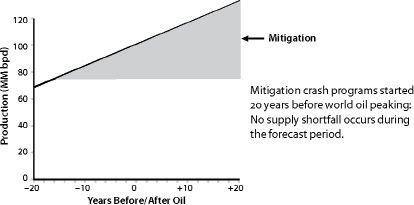

Assume that world oil production peaks this year and begins declining at a rate of two percent per year. We will then need to increase volumes of replacement fuels by this amount plus about 1.5 percent annually in order to fuel a modest rate of economic growth (that’s 3.5 percent total). We can theoretically achieve the same amount of growth by increasing transport energy efficiency by 3.5 percent per year, or by pursuing some combination of these two strategies, as long as the total effect is to adjust to declining oil availability while maintaining growth. We will probably not achieve either our substitution or efficiency goals during the first year (it takes time to develop new policies and technologies), so we will face an oil shortfall amounting to 3.5 percent of the total, minus whatever small increment we are able to offset with replacement fuels and efficiency on a short-term basis. The next year will see a similar situation. If, at the moment production started declining, we were smart enough to start investing heavily in substitutes and more efficient transport infrastructure (electric cars and trains), then those investments would start to pay off in three to four years, but it will take even longer — four to five years — for substitution and efficiency to offer significant help.

13

During these five years, unless we have plans in place to handle fuel shortfalls, adaptation will not be orderly or painless. With a reduction of two percent in oil availability, we may experience a decrease in GDP of three or four percent. Investors will become cautious and job markets will contract. There is no way to know how markets will respond during this period of high insecurity about the future energy supply. The values of currencies, the stock market, bonds, and real estate are all tied to the belief that the economy will grow in the future. With three, four, or five years of recession or depression, belief in future economic growth could wane, causing markets to fall further. The value of many of these assets could fall very significantly. And of course in a recession it may be harder to allocate resources towards innovation.

This is why it is essential to begin investing in efficiency and alternative energy as soon as possible, and choose wisely with regard to those investments.

14

FIGURE 38.

The Cost of Delaying Prepatory Response to Peak Oil.

Source: Robert L. Hirsch, Roger Bezdek, and Robert Wendling, 2005, “Peaking of World Oil Production: Impacts, Mitigation, & Risk Management.”

Energy Efficiency to the Rescue

The historic correlation between economic growth and increased energy consumption is controversial, and I promised in Chapter 3 to return to the question of whether and to what degree it is possible to de-link or decouple the two.

While it is undisputed that, during the past two centuries, both energy use and GDP have grown dramatically, some analysts argue that the causative correlation between energy consumption and growth is not tight, and that energy consumption and economic growth can be decoupled by increasing the efficiency with which energy is used. That is, economic growth can be achieved while using

less

energy.

15

This has already happened, at least to some degree. According to the US Energy Information Administration,

From the early 1950s to the early 1970s, US total primary energy consumption and real GDP increased at nearly the same annual rate. During that period, real oil prices remained virtually flat. In contrast, from the mid-1970s to 2008, the relationship between energy consumption and real GDP growth changed, with primary energy consumption growing at less than one-third the previous average rate and real GDP growth continuing to grow at its historical rate. The decoupling of real GDP growth from energy consumption growth led to a decline in energy intensity that averaged 2.8 percent per year from 1973 to 2008.

16

Translation: We’re saved! We just need to double down on whatever we’ve been doing since 1973 that led to this decline in the amount of energy it took to produce GDP growth.

17

However, several analysts have pointed out that the decoupling trend of the past 40 years conceals some explanatory factors that undercut any realistic expectation that energy use and economic growth can diverge much further.

18

One such factor is the efficiency gained through fuel switching. Not all energy is created equal, and it’s possible to derive economic benefits from changing energy sources while still using the same amount of total energy. Often energy is measured purely by its heating value, and if one considers only this metric then a British Thermal Unit (Btu) of oil is by definition equivalent to a Btu of coal, electricity, or firewood. But for practical economic purposes, every energy source has a unique profile of advantages and disadvantages based on factors like energy density, portability, and cost of production. The relative prices we pay for natural gas, coal, oil, and electricity reflect the differing economic usefulness of these sources: a Btu of coal usually costs less than a Btu of natural gas, which is cheaper than a Btu of oil, which is cheaper than a Btu of electricity.