The New Empire of Debt: The Rise and Fall of an Epic Financial Bubble (49 page)

Read The New Empire of Debt: The Rise and Fall of an Epic Financial Bubble Online

Authors: Addison Wiggin,William Bonner,Agora

Tags: #Business & Money, #Economics, #Economic Conditions, #Finance, #Investing, #Professional & Technical, #Accounting & Finance

And not only had they to do something, they had to do it fast.

“Our entire economy is in danger,” said the chief executive.

“The time has come to save capitalism from the capitalists,” wrote Luigi Zingales of the University of Chicago.

13

Could any scriptwriter have come up with such a preposterous story? Could any director have found such a clownish cast of characters?

It was only a few months earlier that all the leading men and women of this drama claimed to believe in free enterprise so fervently they were willing to spend hundreds of billions of dollars forcing it on others. It was free enterprise that separated us from the barbarians and made the country rich, they said. But now, they were turning many of these free enterprises over to the bureaucrats to run, and desperately trying to make sure that the others didn’t go broke. It was a strange kind of laissez-faire—capitalism without the creative destruction. Capitalism without bankruptcy. It was like taking the alcohol out of Guinness; what was left was bitter and pointless. But an epochal shift had begun—from capitalism to state-sponsored socialism, from white collar grifters to stick-up men, from subtle swindle to naked larceny.

And then, on September 19, 2008, Ben Bernanke and Hank Paulson appeared before Congress and warned that if Congress didn’t put up $700 billion of taxpayers’ money pronto, the whole world economy could melt down.

“If we don’t take action to rescue the economy,” said Mr. Bernanke, “we may not have an economy on Monday.”

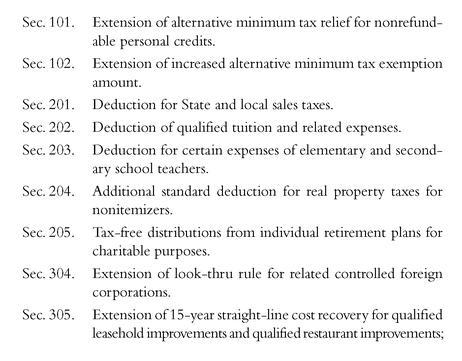

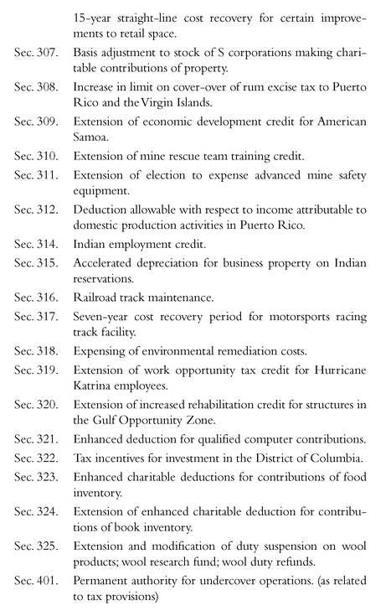

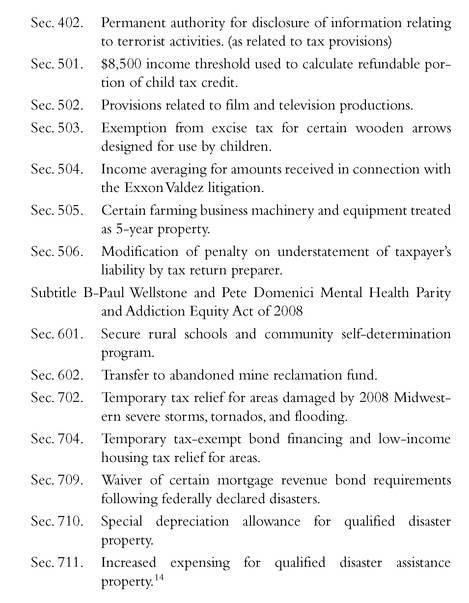

Of course, this alarm turned out to be as silly as their previous assurances. Monday came. Tuesday. Wednesday. The economy did not stop functioning. It wasn’t exactly business as usual . . . except in the U.S. Congress, where the Christmas tree decorating party continued. To the bailout bill were attached these and other baubbles:

“Bankruptcy of Neo-Capitalism,” shouted a headline in the Paris press.

Scarcely since Hitler blew his brains out has the type been bigger in France, or the contentment broader.

Meanwhile, the coordinated takeover of Wall Street, put together by George Bush’s apparatchiks, left even the hardened lefties at France’s Liberation in shock and awe:“This enormous statist intervention . . . is the work of the most ideological and extremist administration that the U.S. has ever had.”

How heartwarming it was to see the meddlers and world-improvers get a second wind. It was like driving around in a ’33 Chevy, or throwing rocks at the gendarmes. The old, gray commies felt young again! Impetuous! Brainless!

And every capitalist was behind the bailout program, too. All over the world, markets were out; state-sponsored meddling was in. Free market principles are fine—until prices start going down!

Even Russia got into the act. New to counterfeit capitalism, it was getting the hang of it fast, pledging $20 billion in the fight to keep stock prices from falling to what they are really worth.

Then, not to be left behind in the hysterical absurdity, SEC honcho Christopher Cox announced a list of 799 financial stocks on which shorting was to be banned. In Britain, the FSA’s ban on shorting financial shares lasted into 2009. But Pakistan got the King Canute Memorial Prize: By law in that benighted land, stocks couldn’t go below their August 27, 2008, close.

But all the whiners and world improvers were missing the elegant mischief of capitalism. The markets were working fine. Capitalism, in 2007-2008, was doing just what it should do: It was separating fools from their money.

In the space of six months, it scratched 10,000 Porsches, destroyed more monuments than Cromwell, and squeezed the rich harder than Mitterand. It would have taken an army of dreary Bolsheviks decades to redistribute so much wealth; and it wouldn’t have been half as much fun.

SAID THE JOKER TO THE THIEF

What a bunch of numbskulls: Greenspan, Paulson, and Bernanke! Every word they said was financial poison.This was the same Alan Greenspan who had lobbied to allow the banks to enter the securities business 20 years before. From the

New York Times

, November 19, 1987:

Mr. Greenspan said opening new business to banks would improve their profitability and long-term prospects, provided that safeguards assured that their deposits were not used to finance securities operations. He also said the proposal would draw more needed investment into the banking industry.

“Repeal of Glass-Steagall,” Mr. Greenspan said, “would respond effectively to the marked changes that have taken place in the financial marketplace here and abroad.”

By 2003, evidence was beginning to surface suggesting that the deregulation of the markets was not without risk. In particular, the derivatives market was going wild. But Mr. Greenspan seemed not to notice the danger:

“What we have found over the years in the marketplace is that derivatives have been an extraordinarily useful vehicle to transfer risk from those who shouldn’t be taking it to those who are willing to and are capable of doing so,” he told the Senate Banking Committee.

15

Then, in 2005: “Greenspan relaxed about house prices . . .,” reported the

Financial imes

.

16

“Most negatives in housing are probably behind us . . . ,” said the same sage in October 2006.

17

“We believe the effect of the troubles in the subprime sector . . . will be likely limited . . . ,” said his successor, Ben Bernanke, in March 2007.

18

Then, as more signs appeared that America’s system of imperial finance was breaking down, the more its leaders went blind.

“I don’t think we’re headed to a recession,” said George W. Bush.

19

“I don’t think I’ve seen any scenario where the American taxpayer needs to be stepping in with more taxpayer dollars,” added Henry Paulson.

20

Then, on March 11, the treasury secretary went on to explain that the fallout from subprime mortgages was “largely contained:”

21

From the report in the Wall Street Journal: “ Paulson, a former chief executive of Goldman Sachs Group, repeated his view that the U.S. economy is fundamentally on sound footing and would dodge a recession.”

The very next day, Bear Stearns CEO Alan Schwartz told the world that his firm faced no liquidity crisis. In an exclusive interview with CNBC, he said the rumors were unfounded: “We finished the year, and we reported that we had $17 billion of cash sitting at the bank’s parent company as a liquidity cushion,” he said.“As the year has gone on, that liquidity cushion has been virtually unchanged.”

22

That same week, SEC Chairman Christopher Cox added that his agency was comfortable with the “capital cushions” at the nation’s five largest investment banks.

23

Four days later, the cushions seem to have miraculously disappeared. Bear Stearns faced bankruptcy brought on by collapsing subprime prices. In a desperate measure, the firm sold itself to J.P. Morgan the next day for $2 a share—a 98 percent discount from its high of $171.

But by July, several things were clear: The subprime problem was not contained, the banks did not have enough cash, and every official—public or private—who opened his mouth was either a joker or a thief. On July 16, Fed Chairman Bernanke told Congress that troubled mortgage giants Fannie Mae and Freddie Mac were “in no danger of failing.”

24

On September 6, the U.S. government nationalized both Freddie Mac and Fannie Mac, wiping out the shareholders.

“I believe companies that make bad decisions should be allowed to go out of business,” opined George Bush.

25

But by the middle of September, the financial authorities—who neither saw no evil nor heard any—were on the case. On September 19, U.S. Treasury Secretary Paulson took aim at the problem he never saw, calling on Congress to ante up the aforementioned $700 billion.Whence cometh the $700 billion figure? “It’s not based on any particular data point, we just wanted to choose a really large number,” said a Treasury Department spokeswoman.

26

“I got to tell you,” said Paulson on November 13, “I think our major institutions have been stabilized. I believe that very strongly.”

27

Two weeks later, America’s largest bank and its largest automaker, desperate, stood on a ledge, preparing to jump.

O! BAMA! THE WHOLE WORLD TURNS ITS WEARY EYES TO YOU . . .

And so it was that the presidential campaign of ’08 was held against the backdrop of crashing imperial finances. Under pressure from the knuckleheads in his own party, Obama picked up a babbling hack as his running mate—and ran right into his own fraud. Joe Biden was to Obama what Monica Lewinsky’s blue dress was to Bill Clinton—the dumb thing that revealed the spoken lie.

Biden demolished his own presidential campaign in 1987 by pretending to be British Labor politician Neil Kinnock. Not only did he recite Kinnock’s lines about being the first in his family to go to university, he also stole his identity, claiming that his father had worked in the coal mines. His own father was actually a polo-playing car salesman from Baltimore. But if the media hadn’t stopped him, he would probably be collecting Kinnock’s pension by now.

Apparently, the better you know Biden, the less you like him. In his home state, 97 percent of voters refused to back him in the presidential primary. But that was Biden in the ’80s. In the ’00s, Biden was, supposedly, on the ticket because he knew who Saakashvili was. In truth, he was there because the old nags in the Democratic Party wanted someone they could trust on the ticket—a real go-along, get-along backslapper. They turned to Biden, in other words, not for change, but to avoid it. Americans don’t mind a liar in high office, but were suspicious of one who can’t keep his lies straight. For a few weeks, Obama’s support softened.

But then, it was McCain’s turn to stumble over his own scam. The candidate who was so concerned about national security chose a baroque woman from Alaska as his #2. Voters imagined her hands on the nuclear button and shuddered.

And so the electorate spoke. And it said “Give us Obama.”

And it came to pass that the man called Obama was given unto them. Mr. Obama became the president-elect of all the Americans. No man’s coffee tasted better on Wednesday morning than it did on Tuesday; no woman’s perfume smelled sweeter. But all over the world, people felt better about themselves, as if the human race had achieved something important.

Commentators drew all the wrong conclusions and made fools of themselves. Some thought it meant America’s redemption from the sin of slave trade. Others saw a historic transformation that they couldn’t put in words and shouldn’t have tried.