The Price of Civilization: Reawakening American Virtue and Prosperity (12 page)

Read The Price of Civilization: Reawakening American Virtue and Prosperity Online

Authors: Jeffrey D. Sachs

Tags: #Business & Economics, #Economic Conditions, #History, #United States, #21st Century, #Social Science, #Poverty & Homelessness

There would also be many fewer disagreements if the electorate

was helped to be better informed. Many studies and surveys have found that the public often has very little knowledge of the specifics of income distribution in America, and how public policies can actually affect it. Americans greatly overestimate federal spending on “giveaway” programs such as foreign aid or “welfare” for poor families (now known as Temporary Assistance for Needy Families). They often see these programs as a dominant part of the budget, when in fact they constitute a very small fraction of spending.

One of the greatest and most interesting confusions involves the real burdens and benefits of federal taxes and transfers. The red states of the Sunbelt tend to be the great opponents of federal taxation and spending, no doubt partly the legacy of southern resentment of federal rule. The residents of these states generally don’t realize, however, that they are the leading net beneficiaries of today’s federal taxes and transfers. The millionaires and billionaires live in the blue states—California, New York, Connecticut, New Jersey—and their income taxes support the Medicaid, disability, and highway programs of red state residents.

As we can see in

Table 5.1

, precisely those states in the lead of attacking federal programs are the ones that would cut off their own livelihoods and well-being if the federal government were to shut down. The table ranks states according to the federal spending each state receives per dollar of federal taxes that the state’s residents pay to Washington. A ratio greater than 1 signifies that the state’s residents are net recipients of federal spending paid by taxes of other states, while a ratio less than 1 signifies that on net the state’s tax payments are going to the benefit of the residents of other states. Of the ten largest net-recipient states, Obama carried only two, New Mexico and Virginia, in the 2008 election. Of the ten largest net-paying states, Obama carried all. The paradox is that the states that currently lead the anti-tax revolt are actually the largest net recipients of federal spending. This is a fact that their citizens do not understand.

Table 5.1: Federal Spending per Dollar of Tax Payments, by State

Source: Data from the Tax Foundation (2005) and CNN Election Center (2008).

Toward a New Consensus

At first appearance, America is hopelessly divided. Yet, on a closer view, what unites Americans is still greater than what divides us.

Our politics feel divisive not because of a raging battle in middle America but because there is a vast gap between (1) what Americans believe; (2) what the mass media tell us Americans believe; and (3) what politicians actually decide, no matter what Americans believe. Even with their differences according to region, class, race, and ethnicity, Americans are generally moderate and mostly generous in spirit, though the media tend to emphasize and even promote the extremes. And the politicians vote along with the rich and the special interests. We thereby end up with a very biased view of our own country. America can be much better than it is today if public policies begin to follow American values, not the values that corporate-driven media pretend to be American values.

For that to happen, though, the public will have to exercise a new and higher level of political responsibility. Special interests dominate our politics not only because they have more money but also because much of the general public has disengaged itself from public deliberations. Yes, the politicians and corporate interests typically strive to keep the public in the dark, but much of the public allows this to happen by not working hard enough to stay informed.

CHAPTER 6.

The New Globalization

Globalization has been the unmet economic challenge of the past forty years. Reagan was not only wrong about blaming big government for America’s ills; he was even more mistaken in neglecting the true gathering storm of the 1970s and 1980s. Starting around 1970, the United States and the world began to be buffeted by three global changes: the technological revolution of computers, the Internet, and mobile telephony ushered in by the digital electronic age; the history-changing rise of Asia within the world economy; and the newly emerging global ecological crises. These three changes are the cause of massive and ongoing shifts of incomes, jobs, and investments all over the world, including in the United States. The changes are so vast and pervasive that active direction by the federal government is absolutely required to ensure that the burdens and benefits of globalization are shared widely among the American population and that America’s global competitiveness is maintained.

Every generation faces novel challenges to combine efficiency, fairness, and sustainability. Two hundred years ago in Western Europe and the United States, the main challenge was to promote and humanize the first industrial revolution; 150 years ago, the main challenge was to create a safe and livable urban environment as large

industrial cities began to explode in population; 75 years ago, the main challenge was to surmount the Great Depression. Our main challenge is to harness the new globalization. We must find new ways to live efficiently, fairly, and sustainably in a very crowded and tightly interconnected world.

The New Globalization

The essence of globalization is that all parts of the world are now linked through trade, investment, and production networks (wherein a final product such as a computer, mobile phone, or automobile is the result of production processes in many countries, often a dozen or more). In a way, globalization has been going on for several thousand years. Han China exported silks to the Roman Empire in return for gold and Syrian-made glass two thousand years ago. Christopher Columbus and Vasco da Gama initiated the economic linkage of all parts of the world at the end of the fifteenth century by discovering sea-based routes linking Europe with Asia and the Americas, discoveries that Adam Smith deemed to be “the two greatest and most important events recorded in the history of mankind.”

1

Still, even with this long history of global trade, there is something qualitatively different about the globalization of our day, different enough to describe our era as a new globalization.

What is new is that a combination of breakthrough technologies and changes in geopolitics has created a far more intensive set of economic interconnections than ever before. The most important technologies of the new globalization are those of information, communication, and transportation. The new globalization is the globalization of the digital age. With computers to store and process information, the Internet and mobile telephony to transmit it instantly and seamlessly around the world, and containerized ocean transport and worldwide air travel to provide low-cost global trade, the world’s economies have become more tightly interlinked than

ever before, with a global division of labor that is vastly more sophisticated and intricate than anything in the past. In the nineteenth century, and indeed up to 1950, industrial production was based on the shipments of a few raw materials from various parts of the world to a manufacturing site in Europe, the United States, or Japan. Today, production at all stages of the value chain, from raw materials to final packaging, occurs in a complex network of sites, often linking dozens of production facilities in far-flung regions of the world.

The lead protagonist of the new globalization is the multinational company (MNC), with operations straddling more than one country and sometimes a hundred or more. Among America’s MNC giants (ranked by foreign assets in 2008) are General Electric, ExxonMobil, Chevron Corporation, Ford Motor Company, ConocoPhillips, Procter & Gamble, Wal-Mart Stores, IBM, and Pfizer Inc.

2

These companies often have half or more of their global workforce outside the United States. In 2010, for example, GE employed 133,000 workers in the United States and 154,000 overseas in more than sixty countries, with more than half of its $155 billion in revenue ($83 billion) earned outside the United States.

3

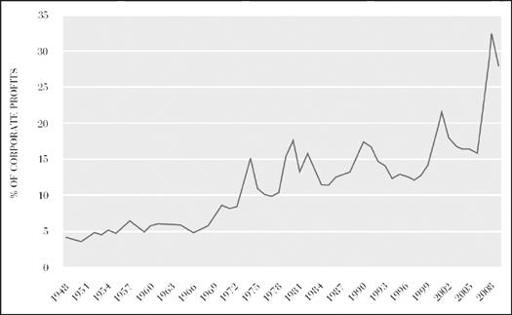

Another key indicator of the rising role of globalization in the U.S. economy is the share of corporate profits received from outside the United States, as shown in

Figure 6.1

. While the data are fraught with measurement difficulties, there is no doubt that corporate profits are increasingly internationalized. The national income accounts suggest that more than 25 percent of corporate profits have come from abroad in recent years, up from around 5 percent in the 1960s.

4

In addition to the pivotal advances in information, communications, and transport technologies, changes in geopolitics have played a key role in the emergence of globalization. The first great event was the independence of Europe’s former colonies after World War II. Independence provided the political foundations for subsequent economic development. Then, starting in the 1960s, several developing economies in Asia, most notably Hong Kong, Taiwan, and South Korea, began to join the global market-based trading system, especially by welcoming foreign investments from the United States, Europe, and Japan and hosting export-oriented production facilities in specially designated export-processing zones. Then, in 1978, the biggest change of all occurred: the People’s Republic of China, with around 1 billion people at the time (and 1.3 billion today), opened its economy to global trade, finance, and foreign investment. In 1991, India followed suit. By now virtually all of the world is linked through trade, finance, and production.

Figure 6.1: Foreign Profits as a Percentage of Total Corporate Profits, 1948–2010

Source: Data from U.S. Bureau of Economic Analysis.

The main economic implication of globalization is that a tremendous and rapidly expanding range of sophisticated economic activities that once were carried out only in the United States, Europe, and Japan can now be carried out even more profitably in China, India, Brazil, and elsewhere. Goods and services that were once produced in the United States and Europe are now produced in developing countries around the world and then exported to the high-income economies as intermediate or final products. As the production of a

widening range of goods and services is relocated to the emerging economies, U.S. employment and incomes are subjected to tremendous upheaval.

In 1985, merchandise trade between China and the United States was balanced at $3.9 billion in each direction, a level equal to 0.09 percent of U.S. GDP that year. By 2009, China’s exports to the United States had soared to $296.4 billion, equal to 2.1 percent of U.S. GDP and roughly 19 percent of the value added (output minus inputs) of U.S. manufacturing. U.S. exports had also increased substantially, to $69.5 billion. China’s merchandise exports to the United States are overwhelmingly manufactured goods (around 98 percent) and span a remarkable breadth of sectors.

5

More than half, however, are concentrated in a few key sectors: computers, telecommunications equipment, television sets, other electronics, textiles, apparel, footwear, furniture, and toys. The United States lost around 2 million jobs in those sectors between 1998 and 2009.

6

The new globalization is fundamentally changing the world economy and global politics. In 2010, China overtook Japan as the second largest economy in the world, when converting both countries’ national incomes into a common currency using market exchange rates. (If we compare national incomes according to purchasing power rather than market exchange rates, China overtook Japan as early as 2001.) Most likely, China will overtake the United States within the next two decades and perhaps by 2020 using purchasing-power-adjusted measurements. This is, of course, changing not only trade and investment patterns but geopolitical patterns as well. China is looming ever larger in global diplomacy, as more and more countries in the world see China as their major trade and financial partner. It’s fair to say that more than two hundred years of North Atlantic dominance of global politics is coming to an end as power shifts from the Atlantic to the Pacific and Indian oceans. China is also looming ever larger as a voracious importer of the world’s natural resources, such as oil, coal, copper, and soybeans,

and has also recently overtaken the United States as the largest emitter of climate-changing greenhouse gases.