Hope's Edge: The Next Diet for a Small Planet (22 page)

Read Hope's Edge: The Next Diet for a Small Planet Online

Authors: Frances Moore Lappé; Anna Lappé

Tags: #Health & Fitness, #Political Science, #Vegetarian, #Nature, #Healthy Living, #General, #Globalization - Social Aspects, #Capitalism - Social Aspects, #Vegetarian Cookery, #Philosophy, #Business & Economics, #Globalization, #Cooking, #Social Aspects, #Ecology, #Capitalism, #Environmental Ethics, #Economics, #Diets, #Ethics & Moral Philosophy

The lesson is clear: the more we let the food industry create what we eat, the more we expose ourselves to risk. The more control we take over our diet, the better able we are to reduce those risks. (I am not suggesting a corporate plot to make us sick; it is simply that the logic of corporate expansion is frequently in direct conflict with our body’s logic, as we’ll see in the next chapter.)

And the word is getting out. Americans

are

starting to modify their diets, at least in part for reasons of nutrition and health. Many people nationwide have cut back on fatty meat, eggs, and oil, while eating more fruits and vegetables.

The single most important first step in rediscovering the traditional, healthy diet is

changing where you shop

. As long as you are wading through 15,000 choices in a supermarket, coming up with something healthy will seem like an incredible challenge. But if you are shopping in a community cooperative store filled with whole foods and foods from local producers, all your senses will be tantalized—but in the right direction for your health.

Part IV

lists some cooperative networks and some excellent guides to getting such a cooperative food store going in your community.

2.

Who Asked for Fruit Loops?

A

T A PARTY

not long ago I was talking with a man I hardly knew about the ideas in this edition—how I was struggling to grasp the forces

behind

these eight radical and risky changes in the American diet. “Well, don’t blame the corporations,” he told me. “If people are stupid enough to eat junk food, they deserve to get sick. Naturally corporations are going to make what sells best.”

I think he summed up pretty well how most Americans view these changes in our diet. They are seen as the more or less inevitable consequences of combining the corporate profit motive with human weakness. And since you can’t change either, why stew about it?

I’m convinced that this view is popular because while it

appears

to assign responsibility (to the gullible individual), it is really a way to evade responsibility for our economic ground rules. Once accepted, these ground rules justify such practices as feeding 145 million tons of grain to livestock. And they make the expensive, energy-consuming, life-threatening changes in our national diet inevitable.

To understand corporate logic, pretend for a few minutes that you are the chief executive of Conglomerated Foods, Inc.

From the Point of View of Conglomerated Foods, Inc.

Get off the elevator on the top floor. Enter the executive suite. Say hello to your secretary, settle down in your big leather chair, and gaze for a moment out the picture window. Think. How would

you

make Conglomerated Foods prosper? Even if you don’t have a degree from Harvard Business School, I think you’ll find that certain obvious strategies come to mind.

Ah, yes … first

expand sales

. But how?

The “Takeover” Strategy

Your most obvious step in expanding sales is to squeeze out, or buy out, smaller, often regional, producers. (As Proctor & Gamble did when they bought a small southwest coffee company called J. A. Folger about ten years ago.

1

) Then you launch an advertising blitz and a deluge of coupons and even reduce the price of your product below your cost. (You can follow International Telephone & Telegraph’s example—it sold its Wonder, Fresh Horizons, and Home Pride breads at a loss to drive smaller bakeries out of the market.

2

) Since you’re a conglomerate selling many different products, you can make up for any losses simply by raising prices in your other product lines. And why not expand your sales overseas through takeovers? (As Borden did when it bought Brazil’s biggest pasta manufacturer.

3

)

T

HE

I

MPACT OF

Y

OUR

S

TRATEGY

Walking into the supermarket, customers still see Aunt Nellie’s Pickles and Grandma’s Molasses. This illusion of diversity hides the reality that your strategy has succeeded making the food industry one of the most tightly controlled in America. In the scramble to capture national markets,

half

of American food companies have been bought out or closed down during my lifetime. Most of them were not inefficient producers; they simply could not withstand the financial muscle of the cash-laden conglomerates.

Take Beatrice Foods, for example, a company whose name is unknown to most Americans. This one company has bought out more than 400 others.

4

Names like Tropicana, Milk Duds, Rosarita, La Choy, Swiss Miss, Mother’s, and Aunt Nellie’s, and even Samsonite and Airstream—all these should really be called “Beatrice.”

As a result of the surge of takeovers, 50 of the remaining 20,000 companies have emerged at the pinnacle. These 50 corporations now own two-thirds of the industry’s assets. Based on present trends, these 50 firms—one-quarter of 1 percent of them all—will control virtually

all

the food industry’s assets in another 20 years.

5

By the 1970s the supergiants had begun to gobble up the giants. In what

Business Week

called the “great takeover binge,” Pillsbury plunked down $152 million for Green Giant (frozen vegetables). For $621 million, R. J. Reynolds seized Del Monte’s vast fruit and vegetable empire. Nabisco merged with Standard Brands (Chase & Sanborn coffee, Blue Bonnet margarine, Planter’s peanuts, etc.).

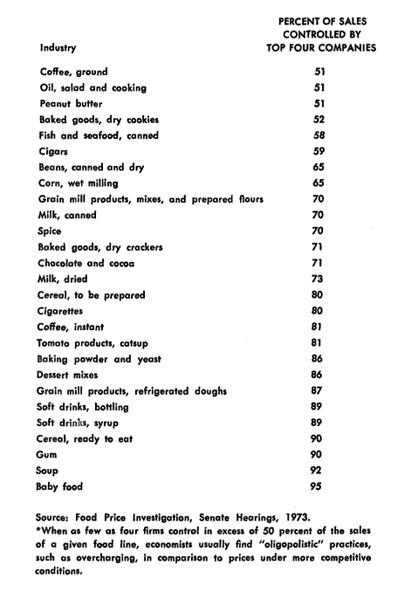

Now, in most food lines—such as breakfast cereals, soups, and frozen foods—four or fewer firms control at least half of the sales. (See

Figure 7

.) Economists call that a “shared monopoly”—and with it come monopoly prices, an estimated $20 billion in overcharges to consumers each year.

6

Anticompetitive practices cost consumers a 15-cent “monopoly overcharge” on every dollar’s worth of cereal, according to a four-year study by the Federal Trade Commission.

7

And who’s to resist? The combined budget of the antitrust divisions of the Justice Department and the Federal Trade Commission is $20 million a year, the sum that a corporate food giant can put into promoting just one “new” processed food. Spending only $20 million to counter the monopoly abuses in a trillion-dollar economy is what Ralph Nader calls a “charade.”

8

The “Grab a Bigger Market Share” Strategy

But now where are you? In most major food categories, a few giants now make over half the sales. Proctor & Gamble (Folger’s) and General Foods (Maxwell House, Sanka) together control nearly 60 percent of the ground-coffee market.

9

Kellogg’s, General Foods, and General Mills divvy up 90 percent of the dry-cereal market.

10

Campbell’s alone controls nearly 90 percent of the soup market.

11

And on it goes. Industry studies show us that at least half of the shoppers in a supermarket buy mainly the top two brands, even though they usually cost more. So you’ve got to become number one, or at least number two. You’ll have to lure some customers away from the other Big Food companies. But you can’t compete in ways that hurt your long-term profits—like offering better quality or lowering prices. Hmmm. Why not up the advertising budget? And you can come up with some eye-catching “new” products in some eye-catching new packages. If you can’t compete in price or quality, you must compete in visibility—and the more snazzy the packaging, the more visible. With more products, you can squeeze your competitors off the supermarket shelf.

Figure 7. Control of Our Food by Shared Monopolies*

To create consumer loyalty, you have to have brand names. And that’s a lot easier with processed foods. (You did stick labels on bananas, but lettuce and mushrooms were a lot more trouble.) And since you want to sell the products from your giant assembly lines all over the country, you’ll need to add such delicacies as BHT and polysorbate for indefinite “freshness.”

T

HE

I

MPACT OF

Y

OUR

S

TRATEGY

Food advertising costs shot up from about $2 billion a year in 1950 to a record $13 billion in 1978.

12

“On the average, six cents of every dollar we spend on processed foods will go directly to buy ad time on television and other promotion,” says food researcher and writer Daniel Zwerdling. “But when we buy one of industry’s hot-selling brands, we pay far, far more. In a recent year, breakfast eaters who bought Kellogg’s Country Morning, a so-called ‘natural cereal’ that better resembled crumbled cookies, paid 35 cents of every dollar merely to finance Kellogg’s ads.…”

13

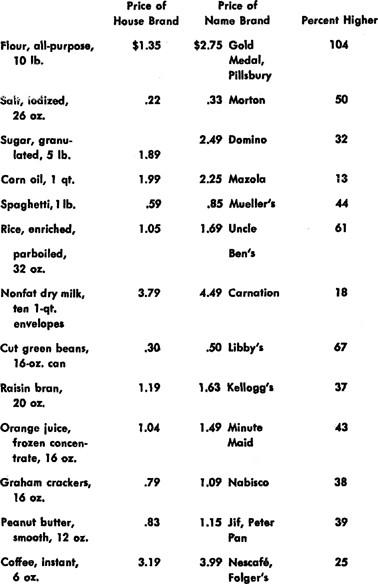

But the costs of the ads themselves are only a fraction of what the consumer ends up paying for advertising. Because advertising is power, people are willing to pay more for a highly advertised brand-name item than they would for exactly the same product sold under a less well-known or store brand name. (See

Figure 8

.)

Since launching just one new item nationwide can cost as much as $20 million, only the corporate giants can afford to play this game.

14

Because of the huge expense of advertising, Zwerdling concludes, the advertising strategy and the takeover strategy are closely tied: “Food corporations merge in part to amass the financial power they need to launch massive advertising campaigns.”

15

Other studies confirm that the more any industry relies on advertising, the faster the concentration of market power.

16

More eye-catching packaging was also part of your strategy. What has this done for us? Well, by 1980 the cost of the package exceeded the cost of the food ingredients for a fourth of the food and beverage product industry. (Soft drink containers cost two times as much as their contents; beer containers five times as much!) Over the last decade packaging costs have gone up 50 percent faster than the labor costs in our food. Today one out of every 11 dollars we spend on food and drink goes to pay for packaging.

17

And the impact of your new product strategy? “In the beginning, there was just Campbell’s chicken rice soup,” quips journalist A. Kent MacDougall. “Today, besides chicken with rice soup, Campbell Soup makes chicken gumbo, chicken noodle, chicken noodle-Os, curly noodles with chicken, cream of chicken, creamy mushroom”

18

plus five others. That’s what economists call “product proliferation.” (“To grow dramatically you have to introduce new products,” says General Foods’ Peter Rosow, general manager of the company’s dessert division.) It’s the battle of the giants for supermarket shelf space. And it works. Today, just five companies use 108 brands of cereal to control over 90 percent of cereal sales.

Such product proliferation requires more and more shelf space. Just since the early 1970s, shelf space devoted to candy and chewing gum has gone up 75 percent; that for dog and cat food, 80 percent.

19

All this means bigger stores, more clerks—costs which must mean rising prices.

Source: Center for Science in the Public Interest, 1980.

Figure 8. The Price of a Brand Name

And product proliferation, almost by definition, means more processed foods. You can’t easily proliferate new fruits. If you want endless varieties of colors, flavors, and shapes, the answer is more and more processing and ever greater use of food colorings and flavorings. Firms like International Flavors and Fragrances are delighted by your product proliferation strategy. They introduce more than 5,000 scents and 2,000 flavors each year, and estimate that three-quarters of what we buy at the supermarket contains either artificial flavors or scents.

20

The energy cost of all this processing is staggering. We use twice as much energy to process our food as to produce all of our nation’s crops, according to the Department of Agriculture.

21

And the energy our food system uses off the farm is rising much faster than that used on the farm. The energy consumed in food processing and transportation doubled between 1960 and 1973.

22