Red Capitalism (34 page)

Authors: Carl Walter,Fraser Howie

Tags: #Business & Economics, #Finance, #General

The transaction took place over a 10-year period and it was clear to the central government early on that a true privatization was in progress. In early 2003, an article in the

21st Century Business Herald

gave rise to questions about an ongoing employee buy-out at Shandong Power and led to an enquiry being made at the State Council. In August that year, SASAC, the NDRC and the MOF jointly issued an emergency notice requiring that all transfers of ownership of power-related companies come to an immediate halt; apparently the same thing was happening all over the country. This notice referenced a State Council document of October 2000 that also had clearly called for a halt to any transfers of ownership in the power sector unless approved by the State Council. Neither of these documents had the least impact on the situation at Shandong Power; it is unclear what may have happened elsewhere.

By mid-2006 the two Beijing companies had acquired a 100 percent interest in Shandong Power from entities purportedly representing the company’s employees and staff including the company’s trade union. Representatives of the new shareholder were able to produce legal opinions claiming that the transaction was perfectly legitimate. Meanwhile,

Caijing

reported a senior official at the SASAC as saying: “We did not know a thing about this. Who would have thought that such a large transaction involving state assets would not be reported to the SASAC for approval?” This comment must be seen as extremely disingenuous or entirely facetious. Throughout 2004 and 2005 the SASAC had been actively investigating management buy-outs of SOEs across the country and had released notices seeking to standardize oversight procedures.

More realistic is the assessment of a former deputy head of the State Planning Commission who commented, as follows:

SASAC had once deliberated producing a document on how to deal with management buy-outs. In this document, there was a proposal suggesting that employees holding shares in power companies choose either to stay in the company and give up their shares or leave the enterprise (and keep their shares). In the end SASAC feared that the impact would be too large and it (the document) was unable to come out officially.

4

In other words, the SASAC was afraid to create waves, even when it knew that state assets for which it was nominally responsible were actually being privatized. Was it afraid of the employees who were acquiring shares in Shandong Power? Certainly, there may have been some consideration of possible “social unrest” if staff were required to return any shares acquired. But the real fear related to the persons behind such transactions. When the sponsor of an activity is sufficiently senior in the central

nomenklatura

, there are few ways to stop them.

HOW THE NATIONAL TEAM, ITS FAMILIES AND FRIENDS BENEFIT

Even if parts of the government retain their independence of business interests, there is no doubt that the National Champions call the shots in the domestic and Hong Kong stock markets and, of course, at the CSRC. The workings of the stock markets confirm that the business of the National Champions is business in their own self-interest.

Jumbo investors in jumbo listings

Between mid-2001 and mid-2005, China experienced a severe bear market as a result of reformers tinkering with the system’s framework. By 2005, a solution acceptable to all major stakeholders—that is, all the major state shareholders—was found that enabled business to pick up where things had left off in June 2001.

5

In 18 months, the Shanghai index then miraculously surged from just below 1,000 points to 3,000 at year-end 2006. The proximate key to this boom was China’s entry into the WTO process and the certainty shared among foreign and domestic investors alike that the country was open for business. But the real key to the surge was the certainty among all domestic players that the huge overhang of non-tradable shares would not come on the market until after the Beijing Olympics in 2008. With this worry put aside, all the talk was about round-trip listings (listing on the Hong Kong exchange and then returning to list in Shanghai) of the National Champions and, especially, bank listings. Then, to add jet fuel to the fire, came the gradual appreciation of the renminbi.

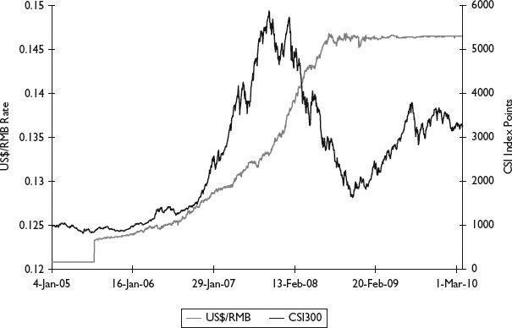

The confluence of these events made a hero of Shang Fulin, Chairman of the CSRC. Appointed in 2002, Shang had previously been the chairman of the Agricultural Bank of China and was firmly protectionist to the extent of removing nearly all overseas returnees from the CSRC on his arrival. He had been responsible for arresting and reversing the collapse of the domestic stock exchanges and the concurrent bankruptcy of China’s securities industry. In his attempts, he had employed every possible political and economic measure traditionally used to prop up the markets, and all had failed. In late 2004, he was provided with a workable solution by Zhou Xiaochuan’s reform group. After claiming full credit for this, Shang oversaw its implementation just as the RMB began its ascent against the dollar (see

Figure 7.4

). The great stock market boom of 2006 and 2007 strengthened Shang’s political position and thus put the seal to the opening of the country’s stock markets to meaningful foreign participation.

FIGURE 7.4

Shanghai Index and RMB appreciation, 2005–2010

Source: Bloomberg

At this same moment, the restructuring of the Big 3 Banks (minus ABC) was completed and their long-awaited IPOs in Hong Kong had begun. CCB listed to great fanfare in late 2005 with an H-share offering; Bank of China re-opened the domestic markets with a simultaneous Hong Kong/Shanghai IPO in June 2006; and the ICBC IPO came in October the same year with a dual Hong Kong/Shanghai listing. This period was characterized by super-large offerings; BOC’s Shanghai IPO raised RMB20 billion (US$2.4 billion) and ICBC’s offering was for a mammoth RMB46.6 billion. How did such huge amounts become available so soon after the market had tested historic lows? The friends of the family had stepped up to help out.

The prevalence of “strategic” investors in these major deals is an important factor in explaining how the market was able to get up off its knees. In similarly stagnant market conditions in 1999, the CSRC had created this third category of “strategic” IPO investors when the traditional retail and professional institutional investors failed to step up.

6

What was the incentive for this new category of “strategic” investors? Until 1999, all prospective IPO investors, retail and institutional, were required to submit an application for IPO shares in a nationwide lottery. In contrast to a similar lottery system in Hong Kong, however, the submission of an application did not guarantee receipt of even a minimum lot of shares. In China, the success ratio of the lottery is applied against the number of applications submitted.

For example, a deal that is a thousand times oversubscribed means an investor has a 0.1 percent chance of having his application selected. He can enhance his odds, however, by submitting as many separate applications as he can afford, placing a full deposit with his broker to back up each bid. This is the arrangement that has led to the market’s characteristically wild oversubscriptions. To ensure even a small allocation, it is not unusual to see investors producing enough money to subscribe for the entire offering! The system is clearly biased against the small investor and in favor of big institutions with lots of money, whether borrowed from banks or their own.

The system did not work well during the stagflation of the late 1990s, so the CSRC created this category of “real strategic” investors, which was broadly defined to include everything in the Chinese economic landscape including, most certainly, listed SOEs and their parent groups. Such “strategic” investors would agree to buy a block of shares at issue price before a deal was formally launched. Although subject to a lock-up period of, generally one year, they received a full allocation of their order. In contrast, as regular investors, whether offline or online, they were not assured of receiving any allocation, much less a full one, no matter how many forms they had submitted.

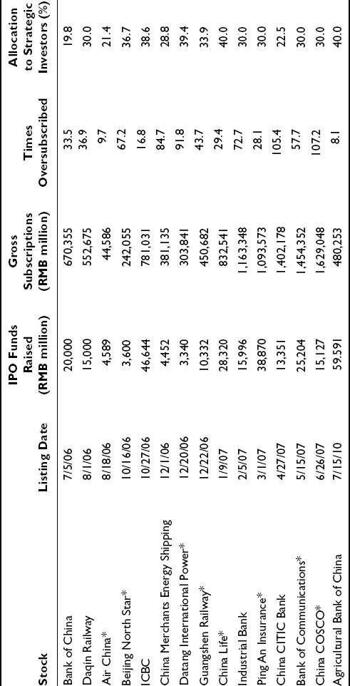

In 2006, recovering markets that had hosted no IPOs in over a year faced a potential flood of listings from the National Champions, which meant that strategic investors were once again in demand. Of the 24 Shanghai listings completed between June 2006 and June 2007, 14 benefited from the support of strategic investors, even when the amounts raised in the open lotteries were many times the IPO proceeds (see

Table 7.3

). For example, for ICBC’s massive IPO, 23 “strategic” investors (including a couple of the AMCs) contributed RMB18 billion (US$2.2 billion) to ensure the bank’s success (see

Table 7.4

). All of these investors were central government enterprises. They were given full allocations and their subscriptions represented 38 percent of total funds raised. Everyone else put in RMB781 billion for an IPO which, even though it was 17 times oversubscribed, only jumped in price by an unsatisfying five percent on the first day, showing just how weak primary markets were then and just how important, therefore, strategic investors were to completing the IPO.

TABLE 7.3

Strategic investors in Shanghai IPOs, June 2006–June 2007, July 2010

Source: Wind Information and author calculations

Note: * denotes overseas returnee listing

TABLE 7.4

Strategic investors in ICBC’s A-share IPO

Source: ICBC public notice, October 17, 2006

| Name | Value of shares allocated (RMB billion) | |

| 1 | China Life Insurance (Group) Co. | 2.0 |

| 2 | China Life Insurance Co. Ltd. | 2.0 |

| 3 | China Pacific Life Insurance Co. Ltd. | 2.0 |

| 4 | China Huarong Asset Management Co. | 1.5 |

| 5 | Ping An Life Insurance Co. Ltd. | 1.1 |

| 6 | China Huaneng Group Co. | 1.0 |

| 7 | China Guangdong Nuclear Group Co. Ltd. | 0.9 |

| 8 | COFCO Group Co. Ltd. | 0.8 |

| 9 | BaoGang Group Co. Ltd. | 0.5 |

| 10 | Dongfeng Motors Co. | 0.5 |

| 11 | State Development Investment Co. | 0.5 |

| 12 | Capital Airport Group Co. | 0.5 |

| 13 | Taikang Life Insurance Co. Ltd. | 0.5 |

| 14 | Pacific Life Insurance Co. Ltd. | 0.5 |

| 15 | Minmetals Investment Development Co. Ltd. | 0.5 |

| 16 | Xinhua Life Insurance Co. Ltd. | 0.5 |

| 17 | China Eastern Asset Management Co. | 0.5 |

| 18 | China Offshore Oil General Co. | 0.5 |

| 19 | China Re-insurance Group Co. | 0.5 |

| 20 | China Yangtze Power Co. Ltd | 0.4 |

| 21 | China Machinery Industry Group Co. | 0.4 |

| 22 | China Nuclear Industry Group Co. | 0.3 |

| 23 | Huatai Property Insurance Co. Ltd. | 0.2 |

| Total | 18.0 |