The Crash Course: The Unsustainable Future of Our Economy, Energy, and Environment (12 page)

Read The Crash Course: The Unsustainable Future of Our Economy, Energy, and Environment Online

Authors: Chris Martenson

Tags: #General, #Economic Conditions, #Business & Economics, #Economics, #Development, #Forecasting, #Sustainable Development, #Economic Development, #Economic Forecasting - United States, #United States, #Sustainable Development - United States, #Economic Forecasting, #United States - Economic Conditions - 2009

The question is, when?

1

Maslow was a psychologist who proposed that humans have many needs existing in a hierarchical structure in which the higher levels will not be sought and met until the lower ones are met. At the bottom of his pyramid are the physiological needs of breathing, being fed, obtaining water, sleeping, and excreting. The next layer up covers our safety and security, and self-actualization resides at the very top of the pyramid.

PART III

Economy

CHAPTER 10

Debt

If something cannot go on forever, it will stop.

—Herbert Stein, Economist (1916–1999)

1

The United States and much of the developed world suffer from a condition that I call “too much debt.” We could spend an entire book just on the subject of debt, because debt by itself has the capacity to initiate a chaotic and diminished future. But we’re only going to spend just enough time on debt to get to my main conclusion: Debt markets are making an enormous collective bet that the future economy will be exponentially larger than the present. It is a dangerous wager, and one which, if it doesn’t pan out, places the collective wealth of entire nations at risk.

When debt markets have been disappointed in the past, standards of living have suffered, governments have been tossed, currencies have been destroyed, and/or countries have fallen. We therefore care very deeply about whether our debt markets are at risk of being disappointed, and, if so, what the source of their disappointment might be.

What Is Debt?

In Chapter 7 (

Our Money System

), we learned that all money is loaned into existence. The other side of the loaned money is the loan itself. We now need to spend some time looking at the nature and quantity of those “loans,” which are also sometimes referred to as “credit” or “debt.” All three terms are interchangeable, and sometimes we’ll switch back and forth between them to follow established conventions. For example, government debt and some consumer loans trade on and are part of the credit markets. To really mix it all together, we’ll examine a data series called “total credit market debt.” If at any time you find the use of a term confusing, feel free to mentally insert whichever word you prefer—loan, credit, or debt—they’re essentially the same thing, and their minor differences aren’t relevant to our discussion.

So what exactly is a “debt” (or “loan”)? A debt is simply a legally binding, contractual financial obligation to repay a specific amount of borrowed money, at some point in the future, at a defined rate of interest—in other words, an IOU. An example would be an auto loan of $10,000 at an 8.75 percent rate of interest.

An auto loan is a debt, a credit card balance is debt, and mortgages, Treasury bonds, home equity loans, corporate bonds, and municipal bonds are all examples of debts. In every case there is a piece of paper (or its electronic equivalent) that identifies an amount borrowed, a maturity date, and a rate of interest.

Auto loans and mortgage debt are known as “secured” because there is a recoverable asset attached to those kinds of debts. Credit card debt is known as “unsecured” because no specific asset can be directly seized in the event of a default, although other remedies exist.

Because a debt is a legal obligation, if repayment fails to happen on schedule, all sorts of prescribed legal remedies exist for the lender to pursue, ranging from asset seizure, to liens, to legal judgments.

Debts are distinct from

liabilities

, and it’s important to remain acutely aware of the difference between them. A liability is a form of financial obligation, but it’s not the same thing as a debt. Someone who has a young child may think of their potential future college expenditure for that child as a liability, but it’s not a legally binding obligation, and therefore it’s not a debt. Debts represent known quantities and fixed amounts, whereas liabilities are imprecise and prone to fluctuations. Many things can change between today’s perceived liability and the actual future payout. The child in question may decide not to go to college after all, allowing the parent to evade the entire amount, or he or she may decide to go to the most expensive college in the country, drastically boosting the final cost of the liability. However, if the parent decides not to pay for college, no legal remedy exists for the child, because the obligation wasn’t a debt.

At the national level, the entitlement programs in the United States (e.g., Social Security, Medicare/Medicaid, and so on) are

liabilities

of the U.S. government. Though they may be vast, huge, enormous liabilities, they aren’t debts. At any point along the way, the U.S. government could, by way of an act of Congress, completely change the terms of the obligation, perhaps by raising the retirement age to 100 or slashing benefits by 80 percent, and no legal remedy for any of the affected recipients would be available. We might consider such actions to be a moral default on the part of Congress, but they would not be a legal default.

With regard to the nation’s debts, however, Congress could not pass an act which would reduce the principal repayment of Treasury bonds without triggering a legal default. Once a default happens, all sorts of legal machinery kicks into high gear. That’s the difference between a debt and a liability: Debts are legal obligations, while liabilities are, at best, moral obligations.

There are only two ways to settle a debt: pay it off or default on it. Until one of those two things happen, the debt remains “on the books.” Sometimes you’ll hear of debts being “restructured,” as with Greece in 2010, but that’s just a fancy way of saying that the debt has either been delayed (i.e., had its payment schedule extended) or reduced in some way, which constitutes a partial default, but a default nonetheless. In this regard, debts are simple beasts—they can either be paid off, or they can be defaulted upon. Those are the only two options for making them go away.

However, if you happen to have a printing press, as many governments do, there’s an alternative way to “pay off” a debt—simply print up the money to pay it off. Because such printing seems to work for a while and offers the least amount of immediate political pain, it has been a very common feature of economic history. A long time ago this involved physically debasing hard coinage, either by shrinking the precious metal content of each coin or by doing what was known as “clipping,” which involved making each coin slightly smaller in size so that a greater quantity could be minted from the same amount of precious metal. Later on, printing money involved actual printing presses churning out paper currency by the wagonload.

These days we have the means to create money electronically without involving paper or coins at all. A few keystrokes on a computer are all that’s required. Debasing and/or clipping coins was difficult (as you had to recall them first); paper printing was easier, but you still had to physically print and then distribute the money. Electronic printing is virtually instant and practically free, representing the easiest, fastest, and surest method of them all.

Such printing efforts have never worked for very long because the inevitable result has nearly always been ruinous inflation. In this sense, printing up money to pay off sovereign debts is nothing more than a poorly disguised form of taxation, since it forcefully removes value from all existing money and transfers that value to the debt holders, who otherwise might never have been paid at all. Some might even consider this a form of partial default, because the bondholders, too, are being paid with money that is worth less.

Of all the things that I track in my research, the variable that I follow most closely is the use of the official printing press to pay for government expenditures, past and present, that cannot otherwise be funded through legitimate means (such as current taxes).

Levels of Debt

The U.S. experience with debt is significant, but most other developed countries are in almost precisely similar straits. Feel free to mentally replace “United States” with the name of some other country, perhaps the United Kingdom or Japan, in the discussion below; the differences are few and have little impact on the final analysis.

The chart of total credit market debt seen in Chapter 7 (

Our Money System

,

Figure 7.1

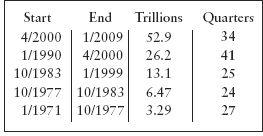

) was a beautiful example of exponential growth, and there’s quite an interesting story embedded in its data. Roughly speaking, the total amount of debt in the United States doubled over the course of the 1970s. By the early 1980s it doubled again, and by 1990 it doubled once more, and then it doubled again by 2000. Between 2000 and 2010, debt doubled yet again, from $26 trillion dollars to $52 trillion dollars. We can see this all plotted out in the table in

Figure 10.1

.

Figure 10.1

Debt Doublings

Time between complete doublings of debt in quarters.

Source:

Federal Reserve.

Do you see the pattern here? In the United States, total credit market debt has doubled five times in four decades. Everything that most people know about “how the economy works” was learned during a period of time when credit was doubling every 30 quarters on average.

In order for the decade of the twenty-teens to economically resemble any of the past four decades, we might reasonably conclude that credit market debt would have to double once more, from $52 trillion to $104 trillion, or an average of slightly more than $5 trillion per year. While the economy could certainly operate on a slower rate of debt accumulation, it will not operate in precisely the same way that it did while it was doubling so rapidly. On this basis alone we can predict that some change is in store if we conclude that another rapid doubling seems unlikely.

To put the next doubling in perspective, we might note that $5 trillion represents more than a third of 2010 GDP or that all of the mortgages on every residential house in America currently only total a bit over $10 trillion. And if somehow such a staggering amount of debt is achieved, what about the decade after that: the 2020s? Can we envision debt climbing from $104 trillion to $208 trillion for the United States? What kind of an economy is required to support $208 trillion of debt? Without getting too fancy and detailed here, such a level of borrowing doesn’t seem at all realistic (even without taking into consideration complicating issues related to energy or the environment, which we’ll be doing later on). It seems prudent to have a strategy that will work even if these next debt doublings don’t occur. The story of economic growth that has shaped the past four decades, including many of our expectations about “how the economy works,” was heavily dependent on and financed with debt. Without the explosive growth in debt seen over the past four decades, economic growth would have been a lot smaller than we experienced (and enjoyed). Our experience of “normal” economic conditions was actually an unsustainable illusion, albeit a very pleasant one.

To understand how debt distorts the picture of economic growth and health, let’s reduce the entire economy to a small island occupied by just a single family earning $50,000 per year (“Family A”). Right next to this island nation is a second island nation, also consisting of a single family earning $50,000 (“Family B”). At our first yearly “GDP snapshot” of these two families, we find that the GDP of each island is $50,000; they’re exactly equal. But the next year, using a combination of auto loans, credit card balances, student loans, and a home equity line of credit (HELOC), Family B goes out and borrows an additional $50,000, which it uses to purchase various enjoyable goods and services for itself. Family B lives it up. But Family A, representing the first island nation, prudently plunks their year’s $50,000 earnings into savings and lives a frugal life, eating homegrown food and making do with last year’s clothing, toys, and motor vehicles.

At our second “GDP snapshot” the next year, we see that Family A has not increased its earnings and is still “suffering from” a GDP of only $50,000. Therefore, despite their diligent savings, our conventional economic standards indicate that this family has suffered through a horrible year of zero percent economic growth (ugh,

no growth!

). In contrast, Family B—the family that now effectively owes every penny of last year’s income to its debtors—has seemingly undergone an exciting and dramatic 100 percent growth in their economy (yay,

growth!

) and their island is now sporting a GDP of $100,000. Investors the world over cheer the fast growth and preferentially purchase the currency and debt of Family B’s more exciting island nation, eschewing the “anemic growth” of Family A’s island nation, mired in the deplorable condition of zero percent growth.